You need a personal loan for an emergency, but banks reject your application because you have no credit history. This creates a frustrating catch-22 situation: you need credit to build a credit score, but you need a credit score to get credit.

Students, young professionals, and entrepreneurs starting their financial journeys face this exact problem across India.

Traditional credit building requires credit cards or loans that remain inaccessible without existing credit scores. However, you already make one significant financial commitment every month: your rent payment.

This guide shows you how to transform your regular rent payments into a powerful credit-building tool and practical steps to establish your credit history from scratch.

Key Takeaways

- Rent payments now improve credit scores through platforms like RentenPe that report to credit bureaus.

- Paying rent via credit cards builds payment history when you clear balances on time.

- Young Indians without credit histories can establish profiles through consistent monthly rent payments.

- Combining rent reporting with EMI management creates faster credit score improvements.

- Still concerned about the short time crunch? Pocketly offers loans from Rs. 1,000 to Rs. 25,000 for month-end gaps without disrupting credit building.

What are the Credit Score Ranges in India?

In India, credit scores range from 300 to 900 based on your borrowing and repayment behaviour.

- Scores above 750 unlock better interest rates and higher loan approvals from lenders across India.

- Banks view scores below 650 as high risk, often rejecting applications or charging premium interest rates.

- Payment history contributes 35% to your credit score, making rent payments potentially valuable for building creditworthiness.

- Credit utilisation accounts for 30 percent, whilst length of history adds 15 percent to overall scores.

Traditional systems favour those with established credit card usage and loan repayment records. Your consistent rent payments remain invisible to credit bureaus under conventional reporting methods. But know how you can make it visible.

Also Read: What Is a Credit Score: Calculation & Tips to Improve

How Rent Payments Impact Your Credit Scores

Rent payments did not affect credit scores because landlords rarely reported information to bureaus. Your Rs. 20,000 monthly payment carried no weight with lenders despite demonstrating financial responsibility.

However, recent fintech innovations have changed this situation through specialised rent reporting platforms in India.

- These platforms verify rent payments and share data with credit bureaus, creating formal records from housing expenses.

- When you pay rent through registered services, they confirm transactions and submit information to reporting agencies.

- Each on-time payment adds positive data to your profile, gradually building creditworthiness over time.

Research shows tenants who reported rent saw average score improvements up to 60 points in the first year. Individuals with no previous history experienced even more significant impacts through consistent reporting.

Some users gained 50 to 100 points over extended periods by maintaining payment discipline. So, how can you build your credit with rent payments?

Step-by-Step Process to Build Credit with Rent Payments

The improvement timeline varies based on your starting position and payment consistency. People with no credit history see visible changes within three to six months of reporting. Those rebuilding damaged credit may require nine to twelve months before significant improvements appear clearly.

Here is the step-by-step process to follow:

Step 1: Choose a Rent Reporting Platform

Selecting the right rent reporting platform determines how effectively payments improve your credit profile. Different services offer varying features, costs, and relationships with credit bureaus across India. Your choice significantly impacts credit-building success over the coming months.

- Credit bureau coverage: Platforms reporting to CIBIL, Experian, and Equifax provide broader profile development than single-bureau services.

- Fee structure: Compare setup fees, monthly charges, and historical reporting costs before committing to services.

- Verification process: Understand what landlord documents platforms require and whether they handle verification independently.

- Payment processing: Check if platforms process actual payments or simply report self-verified transactions through statements.

- Additional benefits: Some services offer rewards, cashback, or rental deposit assistance alongside credit reporting features.

Some of the popular rent reporting platforms in India are RentPe, NoBroker, and Housing.com. Pick a service based on fees, reporting coverage, and landlord cooperation.

Budget-conscious users may prefer low-cost options, while professionals aiming for faster credit growth should choose platforms with bureau reporting. If your landlord avoids paperwork, opt for services that accept self-verified payments.

Step 2: Pay Rent Through Credit Cards

Using credit cards for rent creates dual credit-building benefits when managed responsibly. The rent payment gets reported through your platform, whilst card repayment history simultaneously builds credit. This method works because credit card companies report payment behaviour to bureaus monthly.

Your credit utilisation ratio measures how much available credit you currently use. Paying large amounts like rent temporarily increases utilisation, but clearing balances promptly demonstrates excellent management. This pattern shows lenders you handle significant expenses responsibly without carrying debt.

- Select appropriate cards: Choose cards offering reward points, cashback, or miles on large transactions to maximise benefits.

- Calculate total costs: Factor platform convenience fees (typically 1 to 3 percent) against potential rewards earned.

- Set up automation: Configure standing instructions to pay credit card bills fully before due dates.

- Monitor utilisation: Track your ratio throughout the month, ensuring rent does not push you above 30%.

- Maintain discipline: Never miss payment deadlines, as single late payments severely damage credit scores.

When unexpected pressures make bill payment difficult, having access to short-term financing from fintech platforms like Pocketly prevents missed payments. Smart financial planning includes backup solutions for managing temporary gaps without derailing credit progress.

Step 3: Maintain Perfect Payment Discipline

Consistent, on-time rent payments are the strongest driver of credit improvement. Credit scores reward reliability, not payment size. Even one missed or late rent payment can undo months of progress, so discipline is non-negotiable.

- Automate rent payments: Use standing instructions or auto-debit to remove forgetfulness and manual errors.

- Pick smart payment dates: Schedule rent 2–3 days after salary credit to avoid low-balance failures.

- Keep a rent buffer: Maintain at least one month’s rent as an emergency reserve. Treat it as untouchable except to protect on-time rent.

- Avoid last-day payments: Bank delays and technical issues are common near month-end.

- Emergency family support: Arrange short-term help strictly for rent continuity.

- Pre-approved credit access: Open a small credit line or personal loan before you need it.

- Short-term digital loans: Platforms like Pocketly offering ₹1,000–₹25,000 can bridge temporary gaps. Use only for genuine emergencies and repay quickly.

- Prioritise rent over discretion: Protect rent payments first to avoid long-term credit damage.

- Check your credit score monthly: Use free credit report services to track improvements from rent reporting.

- Maintain proof of payments: Save receipts, bank statements, and platform confirmations for dispute resolution.

- Set quarterly score goals: Track milestones (e.g., 650 → 700 → 750) to stay motivated and adjust strategy if needed.

- Act fast on errors: Early detection helps fix bureau or platform reporting issues before they hurt your score.

Perfect payment discipline turns rent into a powerful credit-building tool. Automation, buffers, and monitoring make consistency achievable.

Step 4: Combine Multiple Credit Building Methods

Diversifying your credit-building approach accelerates score improvement compared to relying solely on rent. Combining methods creates more robust credit profiles whilst demonstrating your ability to manage products.

- Secured credit cards require a refundable deposit (₹5,000–₹20,000) that becomes your credit limit. Use them for small recurring expenses and repay the full balance every month.

- Credit builder loans function like forced savings. You make monthly payments while the loan amount stays in a fixed deposit, which you receive with interest at the end, plus a positive credit history.

- Personal, gold, or loan-against-deposit products also build credit. Start with small amounts and increase gradually as income stabilises.

- Maintain a healthy credit mix. Combining rent reporting, credit cards (revolving credit), and loans (instalment credit) strengthens your profile more than relying on one product.

- Space credit applications 3–6 months apart to allow accounts to age and avoid multiple hard inquiries.

- Use utility bill reporting tools to add payment history for electricity, mobile, internet, and water bills without taking on new debt.

- Keep credit utilisation below 30% of total limits to signal financial discipline.

- Do not close old credit accounts. Account age improves your score. Keep older cards active with occasional small spends and full repayments.

- Request a credit limit increase after 6–12 months of timely payments. Higher limits improve utilisation ratios, without increasing spending.

Continue using the same monthly amount so your utilisation percentage drops naturally. Spreading costs over manageable periods maintains financial stability whilst meeting immediate obligations. But you need to avoid some common mistakes.

Also Read: How to Build Credit Without a Credit Card

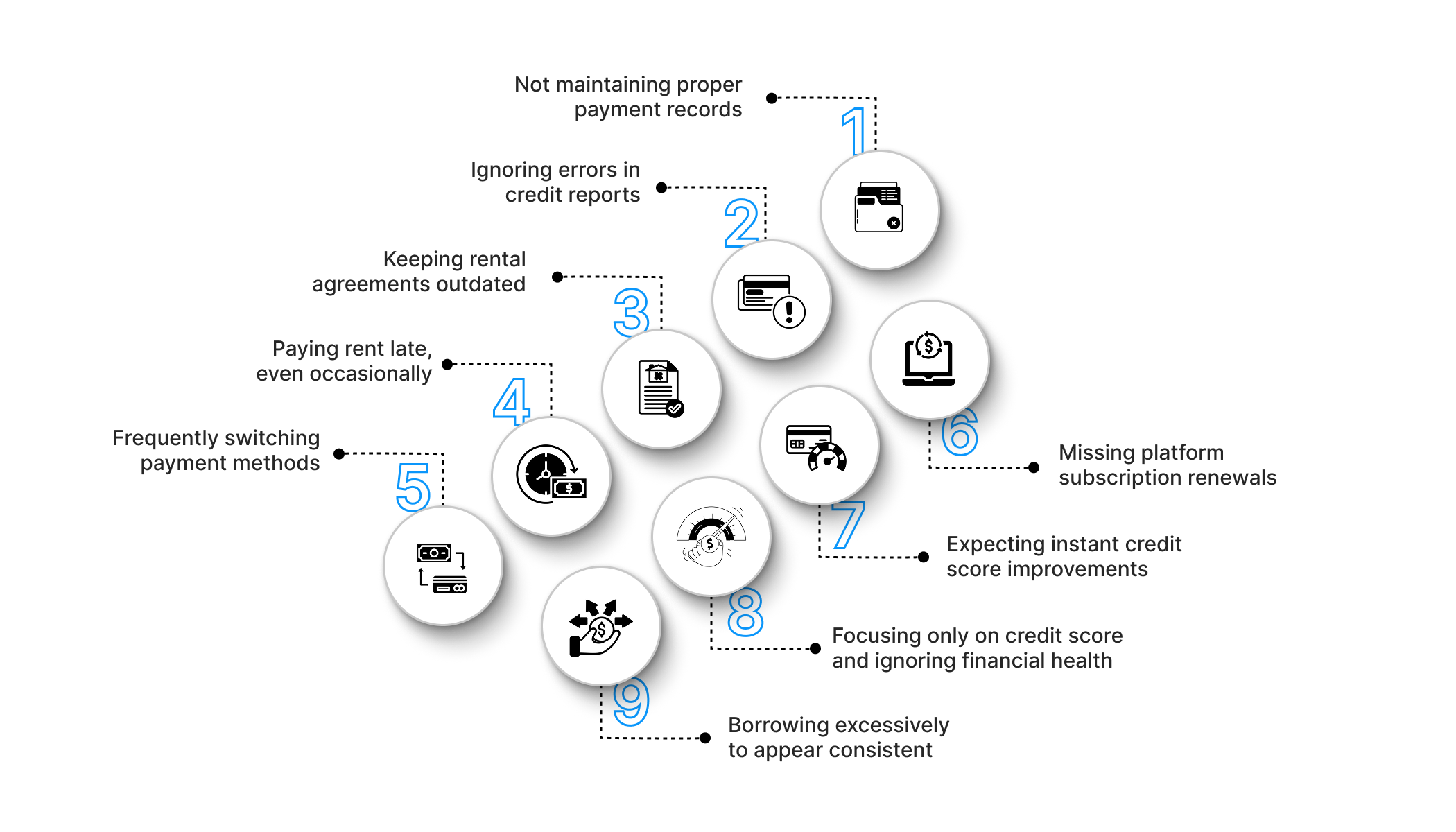

Common Mistakes to Avoid While Building Credit with Rent Payments

When you are attempting to build credit through rent payments, you can frequently encounter avoidable pitfalls. Understanding these mistakes helps you prepare better strategies from the start.

- Not maintaining proper payment records: Failing to save rent receipts, bank confirmations, and platform transaction details can cause problems during disputes. Organise digital records by month and year for quick access.

- Ignoring errors in credit reports: Incorrect postings or missed updates can harm your score if left unchecked. Review your credit report monthly to identify and correct errors early.

- Keeping rental agreements outdated: Unupdated leases, rent revisions, or landlord changes can disrupt verification with reporting platforms and cause gaps in your credit history.

- Paying rent late, even occasionally: One late payment can undo months of positive progress. Treat rent due dates as non-negotiable and plan budgets to ensure on-time payments.

- Frequently switching payment methods: Changing banks or payment channels too often confuses reporting systems. Stick to one method whenever possible and coordinate carefully if a change is necessary.

- Missing platform subscription renewals: Lapsed subscriptions stop credit reporting, even if rent is paid on time. Set calendar reminders or opt for annual plans to avoid interruptions.

- Expecting instant credit score improvements: Credit building takes time. Visible improvements usually appear after six months, so stay consistent and patient.

- Focusing only on credit score and ignoring financial health: Building credit should not come at the cost of emergency savings or insurance. Aim for balanced, long-term financial stability.

- Borrowing excessively to appear consistent: Taking on debt just to pay rent harms long-term finances. If rent becomes unaffordable, reassess housing costs instead of accumulating debt.

But what if you're somehow out of cash?

Also Read: Can Paying Bills Help Build a Credit Score?

How Pocketly Supports Your Credit Building

Managing month-end gaps becomes simpler with access to transparent, flexible short-term financing options. Pocketly understands the challenges young Indians face while building credit and offers practical solutions.

Pocketly helps maintain payment consistency through:

- Instant loan approvals from Rs. 1,000 to Rs. 25,000 for various needs

- Quick fund transfers to bank accounts after streamlined KYC completion

- Flexible repayment options aligning with salary cycles and cash flow

- Transparent interest rates starting at 2% monthly, with clear processing fees

- No collateral requirements make financing accessible to young borrowers

- 24/7 digital access eliminates time-consuming branch visits during emergencies

You can use Pocketly strategically to bridge temporary gaps without compromising credit progress. Small loans preventing missed rent payments protect scores, whilst larger amounts help manage one-time expenses.

Final Words

Building credit through rent payments transforms your largest monthly expense into a strategic asset. Young Indians can now escape the no-credit-history trap using modern rent reporting platforms combined with disciplined financial habits. The journey from zero credit to a 750-plus score typically takes 12 to 18 months with consistent effort.

However, financial challenges will arise during this journey, from unexpected expenses to month-end cash shortages. Pocketly offers transparent short-term loans from Rs. 1,000 to Rs. 25,000, helping you maintain payment consistency without derailing progress.

Start building your credit today by setting up rent reporting and maintaining perfect payment discipline. Download the Pocketly app on iOS and Android to support your credit-building journey.

Frequently Asked Questions

1. How long does rent payment reporting take to reflect on credit reports?

Rent payments usually appear within 30–45 days after submission. First-time verification may take longer, so most users see their first update within 60–90 days. Future updates will post faster.

2. Can landlords refuse participation in rent reporting services?

Landlords can refuse platforms that require their verification. However, they cannot stop self-reported rent submitted via bank statements. Choose platforms that don’t require landlord involvement if needed.

3. What happens if I miss a rent payment?

Missed payments hurt your credit like missed EMIs. A 30-day delay can drop scores by 50–100 points. Defaults cause more serious damage and take years to recover.

4. Do all Indian credit bureaus accept rent payment data?

No. Acceptance varies by bureau and platform. Some report only to CIBIL, while others may include Experian or Equifax. Always check before signing up.

5. Can international students build Indian credit through rent reporting?

Yes, if they have valid visas, Indian bank accounts, and completed KYC. Indian credit history does not transfer abroad but is valuable for students planning to stay and work in India.