Most people don’t struggle with money because of one big decision. It’s the recurring behaviour: ordering food instead of cooking, tapping UPI without checking balance, stacking subscriptions, buying on EMI “just because”. None of these hurt individually, but together they compress your monthly cash flow.

The pressure shows up in the last 7 to 10 days of the month: delaying rent splits, skipping bill payments, borrowing small amounts from friends, or waiting for salary credit before stepping out. It’s not a lack of income as much as a lack of structure around how money moves in and out.

Better money habits fix this by introducing simple systems that prevent cash leaks, surface priorities, and make monthly finances boring in the best way. In this piece, we will break those systems down into habits you can implement without spreadsheets, budgeting apps, or salary hikes.

TL;DR

- Month-end stress usually comes from recurring small spends, timing gaps, and unplanned dues rather than low income.

- Better money habits are simple systems that plug leaks, surface priorities, and give you control without spreadsheets or strict budgets.

- Tracking one month of spending, fixing essentials upfront, and keeping a small buffer are the fastest wins for smoother cash flow.

- Early habits create long-term advantages: lower stress, cleaner repayment history, fewer penalties, and more room to make life decisions.

- When cash flow is hit by delayed salary, sudden bills, or rent splits, short-term credit like Pocketly helps bridge timing gaps without borrowing from friends.

What Do Better Money Habits Actually Mean?

Better money habits aren’t about earning more or cutting every expense. They’re small repeatable moves that shape how you spend, plan, and keep a cushion for surprises.

They often look like:

- Knowing where your money goes instead of guessing

- Separating must-pays from nice-to-haves so rent and bills stay safe

- Keeping a tiny buffer for medical or work hiccups

- Paying dues on time to avoid penalties and credit dips

- Buying with intention instead of impulse

None of this needs financial expertise. These moves create predictability and help money support your life rather than control it.

Why does it matter?

Starting early matters because your 20s tend to be the first phase where rent, transport, food, health, social plans, and emergency expenses all land on one income stream. Expenses climb fast, income climbs slow, and without habits, the month turns reactive.

Early habits pay off through:

- Lower stress since essentials stay covered

- Cleaner payment history that helps with future credit access

- Small buffers that grow over time

- Fewer late fees are eating into income

- More room to switch jobs, travel, or move cities

The point at 22 isn’t wealth. The win is avoiding avoidable damage and letting time carry the compounding. A few steady habits now save you from expensive fixes later.

Where Does Your Money Actually Go Each Month?

Spending behaviour tends to cluster into a few repeatable categories. Understanding the pattern is the first step to fixing the cash flow problem.

1. Convenience Spending

Many young people choose convenience to save time, especially on busy work or study days. Ordering dal-chawal on Swiggy instead of cooking, choosing Dunzo for groceries, or paying a premium for faster service feels minor in the moment. The pattern becomes visible at the end of the month when delivery fees alone touch ₹600–₹1,200.

For example, a student ordering dinner three times a week at ₹200 with ₹35 delivery pays about ₹2,800 on food and roughly ₹420 just on delivery. That delivery money could have covered a week of home meals or a phone bill. Once you notice this pattern, you start choosing convenience with intention rather than by default.

2. Micro Transactions via UPI

UPI makes spending frictionless, which is great for utility but dangerous for awareness. Small spends like ₹60 chai breaks, ₹150 snacks, ₹120 autos, and ₹300 merch don’t feel like “real expenses” because they are small, quick taps. The catch is volume. If you do ten micro-spends a week, that’s forty in a month, often touching ₹3,000–₹5,000 without noticing.

A good example is office chai and snacks. Two breaks a day at ₹40 for 22 working days come to ₹1,760. Add autos and quick Zomato lunches and you quietly cross ₹4,000. Seeing these grouped makes you rethink what’s worth it and what’s just habit.

3. Subscription Stacking

Digital subscriptions renew automatically, so they rarely cross your mind. Spotify at ₹119, Netflix mobile at ₹149, Google Drive at ₹130, hotstar at ₹299, Cult at ₹1,499 quarterly, and a coding platform at ₹999 yearly, each harmless alone but draining when repeated.

Take someone with four platforms at ₹149 each. That’s around ₹600 monthly, ₹7,200 yearly. If two of those apps are barely used, that’s dead money. Reviewing subscriptions every quarter often reveals services that can be paused, downgraded, or shared.

4. EMI and BNPL Commitments

EMIs and BNPL options make phones, travel, and sneakers feel more reachable. One ₹1,500 EMI seems light. The issue appears when you stack EMIs: ₹1,500 for a phone, ₹900 for headphones, ₹1,200 for a trip, and ₹700 for shoes. Now ₹4,300 leaves your account at the start of every month, reducing cash for bills and emergencies.

A common scenario: a salaried person with ₹30,000 income and ₹12,000 rent can manage expenses comfortably until EMIs enter the picture. With ₹4,300 locked in EMIs, they have less room for food, transport, and social life. The purchases were fine, the timing compressed cash flow.

5. Social and FOMO Spending

Social life carries its own financial rhythm. Dinners, coffee catch-ups, movies, concerts, birthdays, and weekend getaways are all meaningful experiences. The strain comes from frequency, not from one event. Three dinners a week at ₹800 each is ₹9,600 a month, almost equal to groceries for the same period.

A realistic example: a group trip to Goa at ₹12,000, plus birthday gifting at ₹1,500, plus two café meets at ₹400 each, plus one concert at ₹1,800. That’s roughly ₹16,000 in a single month without rent or bills. None of these were wrong choices, but without planning, they push essentials to the background.

Also read: How to Manage Monthly Expenses Smartly in 2025

5 Habits That Actually Improve Your Monthly Cash Flow

Improving finances doesn’t require complex tools or a high income. The fastest wins come from simple behaviours that remove guesswork and bring structure to how money moves each month. Here are habits that actually make a difference:

1. Track One Month of Spending

Most of us spend money without realising where it’s actually going. Tracking your spending for just one month helps you see patterns you would not notice otherwise. For example, after reviewing your UPI history, you might realise that weekday coffees, cab rides, and food delivery together cost more than your weekend outings.

When you track your expenses, you gain a clear picture of which purchases are necessary and which ones are simply habits. This awareness gives you the ability to make small adjustments, such as replacing two cab rides a week with metro travel or cooking dinner instead of ordering online.

These small changes often free up money that can go towards savings or other meaningful goals.

2. Create a Fixed List of Monthly Essentials

Money becomes unpredictable when essentials and non-essentials mix together. Making a simple list of fixed monthly essentials such as rent, groceries, transport, mobile recharge, Wi-Fi, and medicines brings order to the chaos. Once these essentials are budgeted, everything else becomes flexible rather than automatic.

For example, if you know your fixed essentials add up to ₹18,000 each month, you instantly understand how much room you have left for dining out, shopping, or entertainment. This reduces the risk of spending on wants too early in the month and then struggling to pay for needs in the last week.

3. Set Aside a Small Emergency Buffer

Emergencies are rarely huge events. More often, they are small disruptions like a phone repair, a last-minute bus ticket, or a medical appointment. Building an emergency buffer starting as low as ₹500 to ₹1,000 per month can cover these surprises without borrowing from friends or using credit.

Imagine your scooter breaks down and the repair costs ₹1,200. Without a buffer, you might delay the repair, miss work, or dip into money meant for bills. With a buffer, the problem becomes manageable and does not disturb the rest of your month. Over time, this habit builds confidence and reduces financial stress.

4. Delay Non-Essential Purchases by 72 Hours

Impulse purchases are usually driven by mood rather than need. Delaying non-essential purchases by 72 hours gives your brain time to decide if the purchase still feels worth it once the impulse fades. This works particularly well for clothing, gadgets, and novelty items.

For example, you might want a pair of sneakers after seeing a sale online. If you wait three days and still want them, buy them guilt-free. But if you forget about them within a day, you save money without feeling deprived. This simple habit protects your cash flow and makes big purchases more satisfying when you genuinely want them.

5. Use Clear Payment Rules for Credit and BNPL

Credit cards and buy-now-pay-later services are useful only when handled with structure. A simple rule like “Pay in full every cycle” or “No new EMI until one closes” can save you from hidden interest or overlapping dues that disrupt your month.

For example, a credit card bill of ₹3,200 feels manageable, but if you pay only the minimum, interest is added to the remaining amount in the next cycle. Do this across multiple platforms, and you end up paying for older purchases long after the excitement has faded. Clear rules keep these tools helpful instead of harmful.

Also read: 7 Best Budgeting Apps In India 2025

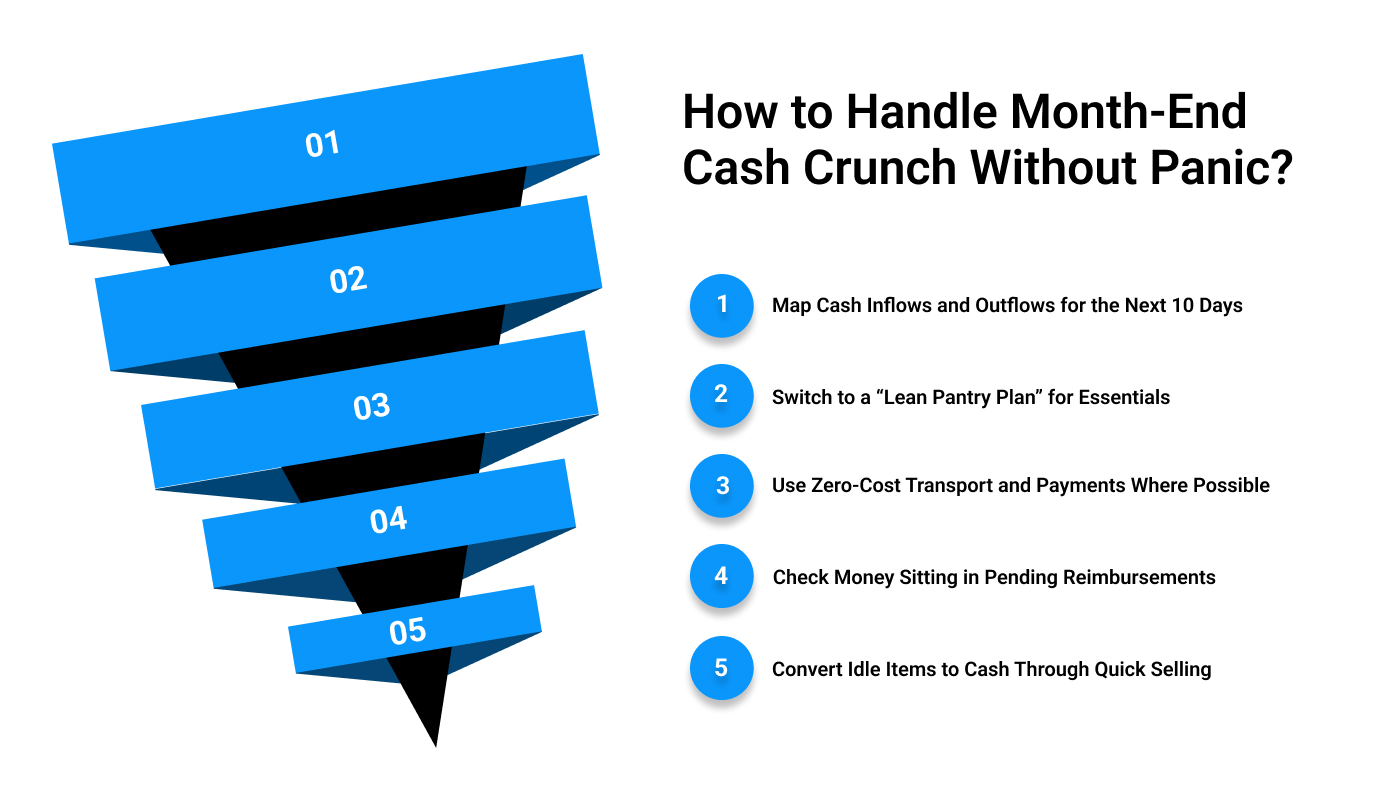

How to Handle Month-End Cash Crunch Without Panic?

Money pressure at month-end is often a timing issue, not a discipline issue. Here’s a practical way to navigate it without throwing essentials off balance:

Step 1: Map Cash Inflows and Outflows for the Next 10 Days

List the expected money coming in (salary, stipend, freelance payments, refunds, family transfers) and money going out (rent, EMIs, bills, transport, groceries).

Example: If the ₹6,000 rent share is due on the 3rd and the ₹4,500 stipend hits on the 7th, you instantly realise you need a temporary bridge of four days. Mapping gives clarity on whether the gap is big or small rather than relying on guesswork.

Step 2: Switch to a “Lean Pantry Plan” for Essentials

Instead of food delivery or outside meals, use what is already in your kitchen: rice, dal, eggs, vegetables, ready mixes, pasta. Pantry-first eating for one week easily saves ₹600–₹1,200.

Example: Replacing three ₹250 delivery meals with three ₹70 home meals saves around ₹540 in just three days.

Step 3: Use Zero-Cost Transport and Payments Where Possible

Transport is a silent budget killer at month-end. Switching from autos and cabs to metro, bus, bicycle, or walking for 7–10 days makes a visible difference.

Example: Two auto rides a day at ₹80 each for a week = ₹1,120. The equivalent metro spend could be ₹280–₹350. The savings can cover groceries or a phone recharge.

Step 4: Check Money Sitting in Pending Reimbursements

Students and professionals often have money stuck in: college reimbursements, office travel bills, medical claims, or refundable deposits.

Example: A software intern may have ₹1,800 due as travel reimbursements. A student may have a ₹2,000 refundable lab fee pending with the department office. Collecting these clears small gaps without borrowing.

Step 5: Convert Idle Items to Cash Through Quick Selling

Unused gadgets, accessories, books, and appliances have resale value. Platforms like OLX, Cashify, Quikr, or even college WhatsApp groups help you convert idle items into ₹500–₹2,000 within a day.

Example: Selling an old Bluetooth speaker for ₹700 and extra textbooks for ₹400 covers phone recharge and transport for the week without touching savings.

Short on Cash This Month? Pocketly Helps You Get Through It Smoothly

Better money habits reduce stress, but they do not eliminate unexpected costs. A delayed stipend, a sudden medical bill, a last-minute travel plan, or a rent split coming earlier than salary can break your monthly rhythm even if you budget responsibly. Pocketly exists for these exact timing gaps, small, urgent needs that cannot wait for payday.

This is especially helpful for:

- Students waiting on family transfers or stipends

- Freshers who join mid-cycle and get their first salary late

- Gig workers with uneven income schedules

- Young professionals handling unplanned expenses

Here’s what makes Pocketly practical for real month-end situations:

- Borrow small amounts based on need: Access short-term personal loans from ₹1,000 to ₹25,000 so you never borrow more than required.

- No collateral or guarantors: Skip the friction of paperwork, signatures, or asset checks.

- Fast eligibility check: Quick digital KYC and instant approval decisions through the app.

- Money goes straight to your bank: Useful for rent, groceries, transport, utilities, or fees that require immediate payment.

- Flexible repayments: Choose a repayment schedule that fits your cash flow instead of forcing a one-size-fits-all plan.

- Simple and transparent costs: Interest starts at 2 per cent per month with processing fees between 1 per cent and 8 per cent of the loan amount.

- Available anytime: Apply through the app whenever you need support, without waiting for bank hours.

Pocketly works with regulated NBFC partners to deliver secure, compliant, and transparent lending. So when timing issues disrupt your budget, Pocketly acts as a short-term bridge, helping you cover essentials without borrowing from friends or pushing dues into the next month.

Conclusion

Building better money habits takes time, and the results show up gradually. When you track where your money goes, make conscious spending choices, and build small buffers, month-end stops feeling stressful. You don’t need a high income to start; you just need consistency.

Keep reviewing your finances, adjust when you notice patterns, and prioritise essentials before anything else. If a tight month or an unexpected bill throws you off, don’t ignore it; take early action so it doesn’t become harder to manage later. Short-term lending options can help you handle timing gaps without borrowing from friends or delaying important payments.

Download Pocketly app on iOS or Android to access quick, small-ticket loans when unexpected expenses appear. It gives you flexibility during crunch weeks while you continue improving your money habits with confidence.

FAQs

1. What are money habits, and why do they matter?

Money habits are everyday behaviours around spending, saving, and managing cash. They matter because they influence whether you feel in control at month-end or constantly stressed about bills.

2. Why do young people face month-end money shortages even with decent income?

Most shortages come from timing gaps (salary cycles vs due dates), small untracked spends, and sudden expenses. It’s not always overspending; it’s often poor visibility.

3. How can I start improving my money habits without strict budgeting?

Begin by tracking expenses for one month, listing essentials, delaying non-essential purchases, and setting aside a small buffer. These small steps improve control without rigid budgets.

4. Is it normal to use short-term credit for emergencies?

Yes, many people use short-term credit for medical visits, travel needs, rent splits, or utility payments. The key is borrowing with a clear repayment plan instead of treating credit as extra income.

5. When do short-term loans make sense for money management?

They are useful when an unavoidable expense lands before cash inflow (salary, stipend, family transfer). In such cases, a short-term loan prevents late fees, service disruption, or awkward borrowing from friends.