Many businesses, especially during their growth phase, face the challenge of raising long-term capital without giving up control or risking their physical assets. Traditional funding options, like bank loans or equity financing, often require pledging valuable assets or diluting ownership, leaving companies with tough decisions.

The problem is clear: how can a business secure the capital it needs without sacrificing its assets or giving up a stake in the company? Without the right financial solution, companies may find themselves forced into costly loans or giving away ownership to raise funds.

Fortunately, there are financing options that strike a balance between these competing priorities. These alternatives provide the necessary funds while maintaining control and flexibility for business owners. In this blog, we’ll explore how businesses can raise capital without facing the usual trade-offs, offering a pathway that meets both their immediate and long-term needs.

TL;DR

- Unsecured loan stock (ULS) is a debt instrument issued by companies without collateral, offering higher returns but higher risk for investors.

- ULS provides fixed interest payments and is redeemed at the end of its term, though investors may not get their money back if the company defaults.

- Types of ULS include convertible (which can be converted into equity) and irredeemable (which pays interest indefinitely).

- Risks for investors include default risk, interest rate fluctuations, and liquidity concerns, as ULS is often not as liquid as other securities.

- For businesses, ULS raises capital without diluting ownership or using assets as security, but comes with higher interest costs.

What Is Unsecured Loan Stock?

Unsecured loan stock is a type of debt instrument issued by companies to raise funds without offering any collateral or assets as security. In simple terms, when a company needs money but doesn’t want to tie up its assets, it can issue unsecured loan stock to investors, promising to repay the loan with interest over a set period.

Unlike secured loans, which are backed by company assets like property or machinery, unsecured loan stock relies purely on the company's ability to repay from its general revenue or profits. Since there’s no collateral backing, this type of investment is considered riskier for investors, but to compensate for that risk, the company often offers a higher interest rate than secured debts.

When a company issues unsecured loan stock, the investors receive regular interest payments (also called coupons) until the debt matures, at which point the principal is repaid. However, if the company defaults, unsecured creditors (the holders of loan stock) are paid only after secured creditors like banks, but before the company's shareholders.

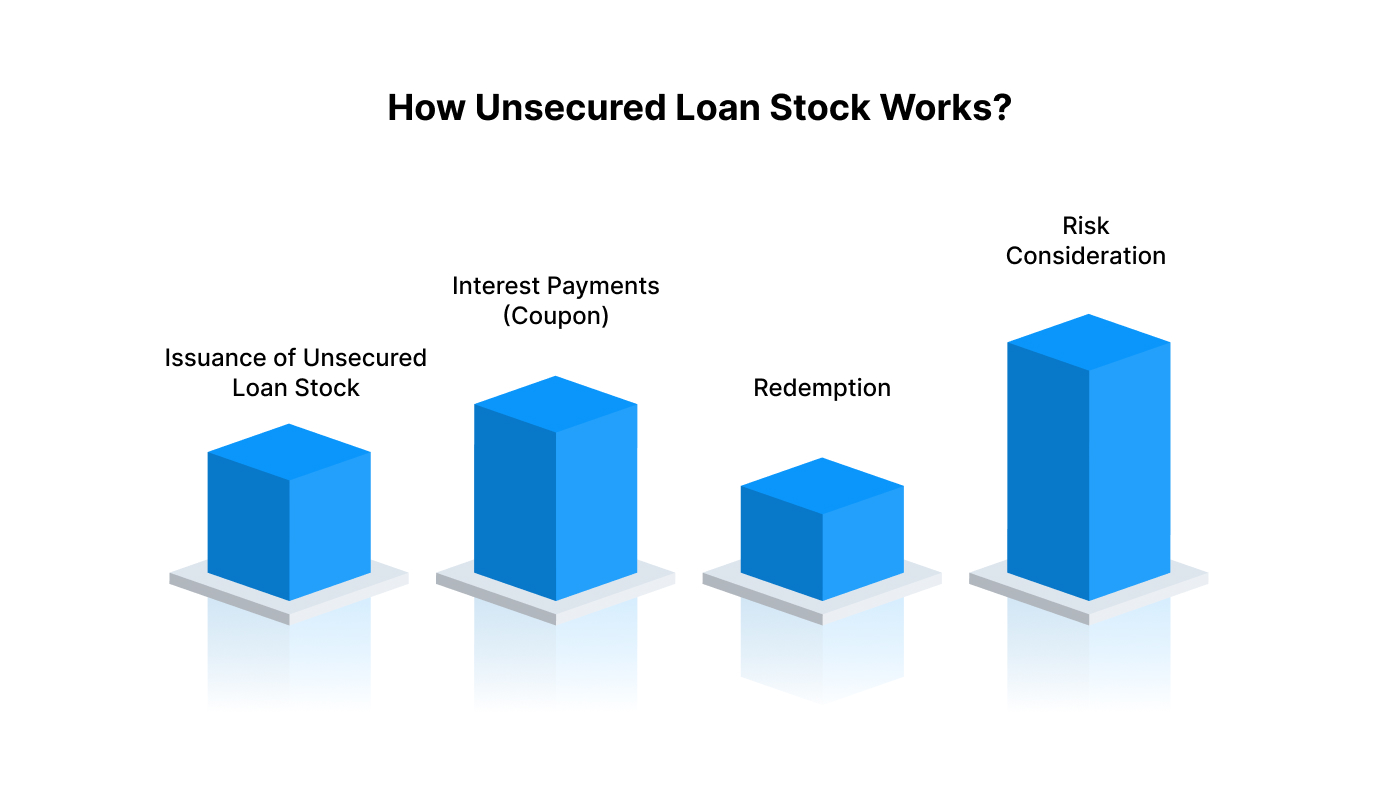

How Unsecured Loan Stock Works?

Unsecured loan stock (ULS) is an instrument that allows businesses to raise capital without using assets as collateral. Here’s a detailed breakdown of how it works, along with examples for each step:

1. Issuance of Unsecured Loan Stock

The company issues unsecured loan stock to investors in exchange for capital. Unlike traditional loans, there is no collateral backing the loan stock, which means the lender’s repayment is not secured by assets such as property, machinery, or inventory. Instead, the company’s creditworthiness and cash flow are key factors in determining whether the loan will be repaid.

Example: A growing technology startup issues unsecured loan stock worth ₹5 crore to fund its expansion into new markets. The company does not pledge any assets, but instead promises to repay the principal amount with interest over the next 5 years.

2. Interest Payments (Coupon)

Investors who purchase unsecured loan stock receive regular interest payments, commonly known as coupons. These interest payments are typically fixed and made on a predetermined schedule (e.g., annually, semi-annually). The interest rate on unsecured loan stock is generally higher than that of secured debt, as investors are taking on more risk due to the lack of collateral.

Example: The technology startup offers an interest rate of 8% per annum on its unsecured loan stock, payable every six months. Investors who hold this loan stock receive ₹40 lakh in interest payments each year (₹5 crore * 8%).

3. Redemption

At the end of the loan term, the company redeems the loan stock, which means repaying the principal amount to the investors. The redemption is made in full or in part, as per the terms of the issuance. This repayment is expected to happen once the term of the loan stock reaches maturity.

Example: After 5 years, the technology startup repays the ₹5 crore principal to investors, along with any outstanding interest. The company may redeem the loan stock earlier if it has surplus funds, but it remains obligated to pay the agreed interest during the term.

4. Risk Consideration

Since unsecured loan stock is not backed by any assets, the company’s creditworthiness and ability to generate future cash flow are critical factors for investors. If the company fails to meet its repayment obligations, investors may not receive their principal or interest. This makes unsecured loan stock riskier than secured debt, but investors are compensated for this risk with higher interest rates.

Example: If the technology startup faces a financial setback due to an economic downturn and struggles to repay the debt, the unsecured loan stock investors might not get their full repayment because there are no assets to seize. However, they might still receive partial repayments, depending on the company's financial recovery.

Also Read: Understanding Differences between Form 16, Form 16A and Form 16B

Key Features of Unsecured Loan Stock

Unsecured loan stock (ULS) offers several unique characteristics that make it an attractive, yet risky, financial instrument for both businesses and investors. Below, we explore its key features and what they mean for companies and investors.

| Feature | Description |

| Collateral | No assets are pledged; repayment depends on the company’s creditworthiness. |

| Term Length | Typically, long-term debt often has maturity periods of several years. |

| Ranking in Liquidation | Paid after secured creditors but before equity shareholders in case of default. |

| Transferability | Tradable on secondary markets, offering liquidity for investors. |

| Interest Payments (Coupon) | Fixed interest payments (coupons) at regular intervals, usually higher than secured debt. |

Types of Unsecured Loan Stock

Unsecured loan stock can take different forms depending on the terms and structure offered to investors. Here are the main types of unsecured loan stock:

1. Standard ULS

- Description: The basic form of unsecured loan stock. It pays fixed interest at regular intervals and is redeemed at par (face value) when it matures.

- Example: A company issues ULS with a 5-year term, paying a 7% annual coupon. At maturity, the principal is repaid to the investors.

- Investor Consideration: Offers predictable returns but carries default risk.

2. Convertible Unsecured Loan Stock (CULS)

- Description: This type of loan stock allows investors to convert debt into equity after a set period, usually at a predetermined price. This gives investors the opportunity to benefit from the company’s growth.

- Example: A startup issues CULS with a 5-year term, where investors can convert their loan stock into equity shares at a fixed price after 3 years.

- Investor Consideration: Potential for higher returns if the company’s share price rises, but it carries the same risks as standard ULS.

3. Irredeemable Loan Stock

- Description: This type of loan stock does not have a fixed maturity date and is considered perpetual. It pays interest indefinitely without requiring repayment of the principal unless the company chooses to redeem it.

- Example: A utility company issues irredeemable loan stock to raise capital for infrastructure, with no fixed redemption date.

- Investor Consideration: Offers a consistent income stream but carries long-term uncertainty regarding the return of principal.

4. Callable Loan Stock

- Description: The company has the option to redeem the loan stock early, often at a premium. This provides flexibility to the issuer but can introduce uncertainty for investors who may not receive the full term of interest payments.

- Example: A corporation issues callable loan stock that can be redeemed in 3 years, but the company has the option to call it earlier if interest rates decrease.

- Investor Consideration: While the potential for early repayment exists, investors may lose out on future interest payments if the company calls the loan early.

Each type of unsecured loan stock provides a different set of benefits and risks. Companies choose the type that best suits their financing needs, while investors should assess their risk tolerance and return expectations before investing in these debt instruments.

Unsecured Loan Stock vs. Other Financing Options

Understanding how unsecured loan stock compares to other financing instruments is crucial for both companies and investors. Below is a comparison of unsecured loan stock with other common forms of corporate financing:

| Feature | Unsecured Loan Stock | Secured Loan | Equity Financing |

| Collateral | None | Backed by company assets (e.g., property) | No collateral, ownership is diluted |

| Interest/Return | Fixed interest payments (higher due to risk) | Lower interest rates, as it's secured by assets | Dividends are paid if the company profits, but no fixed return |

| Repayment Priority | Paid after secured creditors but before equity | Secured creditors are repaid first | Equity holders are last in liquidation |

| Risk to Investors | Higher risk due to lack of collateral | Lower risk due to collateral backing | High risk due to market fluctuations |

| Investor Liquidity | Can be traded on secondary markets | Generally illiquid, unless refinanced | High liquidity on public stock markets |

Advantages and Disadvantages of Unsecured Loan Stock

Unsecured loan stock (ULS) offers both advantages and disadvantages for both companies and investors. Understanding these can help businesses decide whether it's the right funding option and guide investors in evaluating their risk appetite.

For the Issuing Company

Advantages:

- Retain Control Over Assets: Unlike secured loans, ULS allows the company to raise capital without pledging any physical assets, helping preserve ownership and operational flexibility.

- No Equity Dilution: ULS allows companies to raise funds without diluting ownership or giving up control to external shareholders, which is a significant advantage over equity financing.

- Access to Capital with Lower Restrictions: ULS offers companies access to capital without the need for stringent covenants that are typically found in secured loans. This means less interference from investors in day-to-day operations.

- Flexible Repayment Terms: ULS offers flexibility in repayment terms compared to traditional loans, which can be restrictive in terms of timeframes and amounts.

- Improved Balance Sheet: Issuing ULS does not involve adding secured debt to the company’s balance sheet, allowing businesses to retain more assets for future use.

Disadvantages:

- Higher Interest Rates: Because there’s no collateral backing the loan, interest rates on ULS tend to be higher than on secured loans, reflecting the increased risk for investors.

- Investor Perception: The lack of security backing might cause potential investors to perceive the company as higher risk, making it harder to attract capital if the company’s creditworthiness isn’t strong.

- Repayment Pressure: While ULS offers long-term capital, it does still impose an obligation to pay regular interest to investors, which could strain cash flow if the company’s earnings are unpredictable.

- Market Conditions: The cost of issuing ULS can fluctuate depending on market conditions and investor sentiment, leading to changes in interest rates or demand for the stock.

- Reputation Risk: If the company is unable to meet repayment schedules or defaults, it may affect its reputation in the financial market, making future capital raising more challenging.

For the Investor

Advantages:

- Higher Yield: Due to the risk associated with no collateral backing the debt, ULS typically offers a higher interest rate compared to secured debt instruments, providing investors with potentially higher returns.

- Diversification of Portfolio: Investing in ULS allows investors to diversify their portfolio with higher-risk, higher-reward debt instruments, balancing safer, lower-yield investments.

- Predictable Income: Investors receive fixed interest payments at regular intervals, offering a predictable income stream if the company remains solvent and generates sufficient revenue to meet its obligations.

- Capital Appreciation: In the case of convertible unsecured loan stock (CULS), investors have the potential to convert debt into equity at a later date, potentially benefiting from an increase in the company’s value.

- Secondary Market Liquidity: Unsecured loan stock can often be traded in secondary markets, providing liquidityand exit opportunities for investors who wish to sell their holdings before maturity.

- No Hidden Costs: Since ULS is typically a fixed-income investment, it is free from additional fees such as maintenance charges or performance-based commissions that might apply to other investment instruments like mutual funds.

Disadvantages:

- High Default Risk: The absence of collateral means investors face a higher risk in the event of default. ULS holders are considered unsecured creditors and may not be fully repaid if the company enters bankruptcy.

- Limited Secondary Market Liquidity: While ULS can be traded, it may not have the same level of liquidity as more commonly traded securities like bonds or stocks, especially if the issuer is a smaller company. This can make it harder for investors to sell or exit their positions in a timely manner.

- Interest Rate Risk: Fixed interest payments on ULS can become less attractive if interest rates rise in the market. Investors holding ULS with a fixed coupon rate may find that their investment offers lower returns compared to newly issued debt.

- Limited Upside Potential: Unlike equity investments, where investors can benefit from company growth through share price appreciation, ULS only offers fixed returns, limiting the capital gains potential for investors.

- Issuer's Financial Health: The financial health of the issuing company plays a major role in the success of ULS investments. Any downturns or operational challenges faced by the company may directly affect its ability to meet interest payments and redeem the stock at maturity.

Also Read: Understanding TAN and Its Application

What Are the Risks of Investing in Unsecured Loan Stock?

Unsecured loan stock (ULS) offers companies a flexible way to raise capital without pledging assets, but it also introduces various risks for investors. Below are the key risks associated with ULS, along with strategies to mitigate them:

1. Default Risk

- Since ULS is not secured by assets, investors face the risk of losing their investment if the company defaults on its obligations. ULS holders are unsecured creditors, meaning they are repaid only if there are sufficient assets remaining after the company’s secured creditors are paid.

- Mitigation Logic:

- Assess the creditworthiness of the issuing company by reviewing its financial statements, credit ratings, and past performance.

- Diversify investments across different sectors or issuers to spread the risk.

- Invest in ULS from companies with strong cash flow and low debt-to-equity ratios, as they are more likely to repay the debt.

2. Interest Rate Risk

- ULS usually offers fixed interest rates. If market interest rates rise, the fixed return on ULS may become less attractive, lowering the value of the stock on the secondary market.

- Mitigation Logic:

- Monitor interest rate trends and economic conditions to anticipate changes in market rates.

- Consider investing in floating-rate ULS, which adjusts the interest rate based on market conditions, reducing the impact of rising rates.

3. Liquidity Risk

- ULS is not always liquid, especially if it is issued by smaller or privately held companies. The lack of a secondary market or limited trading volumes can make it hard for investors to sell their holdings before maturity.

- Mitigation Logic:

- Verify liquidity options by checking whether the ULS is listed on a major exchange or if the company has an active secondary market for trading.

- If liquidity is crucial, consider short-term ULS or look for ULS that can be redeemed early.

4. Ranking in Liquidation

- In the case of a company’s bankruptcy or liquidation, ULS holders rank below secured creditors (such as banks) but above equity shareholders. If the company’s assets are insufficient, ULS holders may receive little or no repayment.

- Mitigation Logic:

- Review the company’s capital structure to assess the seniority of ULS in the overall debt hierarchy.

- Focus on companies with a solid balance sheet and low debt to ensure that there is a higher chance of recovery in case of liquidation.

5. Risk of Early Redemption

- Some ULS are callable, meaning the company has the option to redeem the stock early, typically at a premium. This can disrupt the investor’s expected interest income if the company decides to repay the principal before maturity.

- Mitigation Logic:

- Understand the call provisions in the ULS agreement before investing.

- Look for ULS with longer maturity periods and no call options to avoid early redemption.

6. Reinvestment Risk

- If ULS is redeemed or matures, investors may face reinvestment risk, the possibility that they will not be able to reinvest their capital at the same interest rate or in equally profitable opportunities.

- Mitigation Logic:

- Keep a watchful eye on interest rate trends to plan for reinvestment opportunities.

- Invest in other fixed-income securities or diversified funds to balance reinvestment risks.

When Unsecured Loan Stock Delays Your Funding, Pocketly Can Help

If you're relying on unsecured loan stock to secure funding for your business but are facing delays in processing, it can disrupt your plans. While waiting for approval or the issuance of loan stock certificates doesn't directly affect your operations, it can cause cash flow gaps, especially if you need immediate funds for growth or expenses.

In situations like this, Pocketly offers quick, short-term loans to help you manage expenses while you wait for your unsecured loan stock to be processed. Whether you’re dealing with a delayed issuance or unforeseen cash flow issues, Pocketly provides a fast, easy solution to keep your business on track.

Here’s how the loan process works:

1. Sign Up Quickly: Register in just a few taps using your mobile number.

2. Simple KYC: Upload your Aadhaar, PAN, and complete basic KYC for quick verification.

3. Secure Bank Details: Add your bank information for a seamless transfer.

4. Select Loan Amount & Tenure: Choose a loan amount and tenure that suits your business needs.

5. Instant Transfer: Once approved, funds are transferred directly to your account within minutes.

Here’s why Pocketly makes managing expenses easy:

- Only borrow what you need: Loans from ₹1,000 to ₹25,000, so you’re never borrowing more than necessary.

- No collateral required: Skip the paperwork, no assets or guarantors needed.

- Fast approval: Complete KYC quickly and get an instant decision, so you can act fast.

- Instant transfer: Funds hit your account as soon as you're approved.

- Flexible repayment plans: Pick a repayment option that suits your budget and cash flow.

- Clear, upfront pricing: Interest starts at just 2% per month, with processing fees from 1% to 8%.

- Access anytime, anywhere: Get funds 24/7 with our easy-to-use mobile app.

With Pocketly, you get loans through regulated NBFCs, ensuring clear terms and no surprises. So, when life throws unexpected expenses your way, Pocketly gives you the flexibility to stay on top of things, stress-free.

Bottom Line

Understanding unsecured loan stock is essential for making informed investment decisions. It offers higher returns but also comes with increased risk due to the absence of collateral. By recognising the mechanics and types of ULS, you can better assess whether it fits your investment goals and risk tolerance.

For businesses, ULS provides a flexible financing option without tying up physical assets. However, even with careful planning, cash flow gaps can arise. In such situations, having a reliable solution is crucial.

If you're looking for quick financial relief, Pocketly offers easy access to small loans, ensuring you stay on track with your financial goals. Download Pocketly on iOS or Android for fast, hassle-free support when you need it most.

FAQs

1. What is unsecured loan stock (ULS)?

Unsecured loan stock is a type of debt issued by companies that is not backed by assets. Investors receive interest payments and are repaid at the end of the term, but they are higher risk compared to secured debt holders.

2. How does ULS differ from a secured loan?

Unlike secured loans, ULS is not backed by any collateral. In case of default, ULS holders are paid after secured creditors.

3. What are the advantages of investing in ULS?

ULS offers higher interest rates due to its unsecured nature, and convertible ULS provides the potential for capital gains by converting debt into equity.

4. Are there risks with investing in ULS?

Yes, default risk is higher compared to secured debt, as there’s no collateral backing the investment. Additionally, ULS can be illiquid, and interest rate fluctuations may affect its value.

5. Can ULS be converted into shares?

Yes, Convertible Unsecured Loan Stock (CULS) allows investors to convert their debt into equity shares after a certain period, depending on the terms set during issuance.