Can your company really optimise travel expenses just by tracking receipts? In 2026, the difference between a business that manages travel costs strategically and one that simply cuts expenses often comes down to how well it uses data to guide decisions.

Today’s finance teams are in an environment where every flight, hotel booking, and meal can directly impact the bottom line. The days of relying on instinct and manual tracking are long gone.

According to McKinsey’s Remapping Travel with Agentic AI, 59% of travel companies saw over 6% annual cost savings by adopting AI technologies in the last three years. This growing reliance on data-driven solutions marks a shift from basic expense tracking to intelligent travel spend optimisation.

In this blog, we’ll explore the key features of travel expense management software, how it can help businesses optimise their travel budgets, and why Pocketly is the solution when unexpected costs throw your financial planning off track.

TL;DR

- Travel expense management software helps businesses automate travel bookings, track expenses, and gain real‑time visibility into spend.

- The top tools in 2026 offer seamless integrations, mobile access, automated reporting, and predictive insights that modernise travel cost control.

- Leading solutions like Expensify, Brex, Payhawk, SAP Concur, and others meet the needs of companies large and small.

- If travel costs still stress your cash flow, short‑term loans can bridge gaps before reimbursements come through.

- Pocketly offers quick access to funds from ₹1,000 to ₹25,000 with fast approval and flexible repayment to help manage unexpected travel expenses without stress.

What Is Travel Expense Management Software?

At its core, travel expense management software helps businesses track, manage, and optimise travel-related spending across the organisation. It provides a seamless system to collect receipts, monitor travel bookings, and manage reimbursements, ensuring that everything aligns with company policies. It answers three essential questions:

- Where is the money going?

- Who is spending the most?

- What value is being gained from these expenses?

When these questions are answered efficiently, companies can pinpoint inefficiencies that would otherwise be missed in manual reports and spreadsheets.

Why It Matters in 2026?

Finance teams are facing growing pressure to justify every expenditure. With rising costs, supply chain disruptions, and tighter budgets, understanding travel spend is no longer a back-office task; it’s a boardroom priority.

For CFOs, finance leaders, and even business owners, real-time insights into travel expenses are critical for making smarter decisions. The ability to monitor travel spend as it happens, rather than waiting for quarterly reports, helps businesses prevent waste before it becomes a problem.

What’s New in 2026 Travel Expense Management Tools?

Earlier systems were often static and reliant on manual entries. Now, modern tools offer:

- Connected systems: Seamless integration with booking platforms, accounting software, and procurement systems.

- Live data feeds: Continuous updates flagging anomalies, overcharges, or duplicate payments.

- Predictive capabilities: Algorithms that forecast travel spend trends based on past behaviour, seasonality, and vendor performance.

These innovations shift travel expense management from mere tracking to proactive management, allowing businesses to act on data in real-time.

Pain Points Travel Expense Management Solves

Travel expense software addresses several persistent challenges that can negatively affect the bottom line:

- Unnecessary duplicate bookings that inflate costs.

- Untracked small expenses that pile up over time.

- Inconsistent reporting that only surfaces issues during audits.

- Data silos across departments make it difficult to hold anyone accountable.

By integrating data across systems, travel expense management software helps identify trends that would otherwise remain hidden, making it easier to control costs.

Also Read: Understanding TAN and Its Application

Top 7 Travel Expense Management Software in 2026

Choosing the right travel expense management software can dramatically improve how your organisation controls travel spend, enforces policies, and gains visibility into costs. Here are some of the leading options available today:

1. Expensify

Expensify is known for its ease of use and ability to streamline the entire travel and expense process. With features like receipt scanning, expense categorisation, and automated reimbursement workflows, it provides employees and finance teams with the tools they need to stay compliant and manage travel expenses effortlessly.

Website: https://www.expensify.com

Ideal for: Small to mid-sized businesses that want simplicity without compromising on functionality.

Key Strengths:

- User-friendly interface with receipt scanning and automatic categorisation

- Fast reimbursement processing and expense approvals

- Integration with accounting systems for seamless reporting

2. Brex

Brex simplifies travel and expense management for fast-growing companies by combining a corporate card with automated expense tracking. This all-in-one solution helps businesses manage travel spend while ensuring full compliance with corporate policies, providing easy reporting, and faster approvals.

Website: https://www.brex.com

Ideal for: Startups and growing companies needing flexible and streamlined travel expense solutions.

Key Strengths:

- Corporate card integration with automated expense tracking

- Seamless real-time reporting and policy enforcement

- Quick approval workflows with minimal manual intervention

3. Payhawk

Payhawk is an AI-driven platform that streamlines expense management, including travel costs. Its intuitive design automates receipt capture, approval workflows, and expense categorisation, offering real-time insight into spend patterns and compliance. Payhawk helps businesses stay on top of their travel budgets without sacrificing efficiency.

Website: https://payhawk.com

Ideal for: Growing companies seeking an easy-to-use, scalable expense management system.

Key Strengths:

- AI-powered receipt scanning and real-time reporting

- Integrated travel and expense solutions

- Budget allocation and policy enforcement for better control

4. SAP Concur

SAP Concur is a top-tier travel and expense management solution trusted by enterprises worldwide. It consolidates travel booking, expense reporting, and invoicing into one intuitive platform. With real-time data syncing, it ensures organisations maintain control over travel budgets while automating manual processes.

Website: https://www.concur.com

Ideal for: Mid to large enterprises needing scalable travel and expense solutions.

Key Strengths:

- Unified platform for travel booking and expense management

- Seamless ERP integration for real-time financial tracking

- Mobile app for on-the-go expense submission and approval

5. Emburse

Emburse is designed for organisations that need a flexible, easy-to-use travel and expense management tool. With its built-in receipt scanning and expense categorisation, it ensures greater financial visibility and compliance. Emburse’s AI-powered technology helps companies optimise spend while improving approval workflows and reporting accuracy.

Website: https://www.emburse.com

Ideal for: Mid-market businesses and enterprises that need customisable, efficient solutions.

Key Strengths:

- AI-driven receipt capture and automated expense categorisation

- Customisable workflows and approval processes

- Detailed spend reports with real-time tracking

6. Navan

Navan combines the power of expense management and travel booking into one centralised system. It automates travel approval processes and integrates directly with company financial systems, ensuring full visibility and seamless reimbursement workflows. Its user-friendly interface makes it effortless for employees to stay compliant with travel policies.

Website: https://navan.com

Ideal for: Companies looking for an all-in-one travel and expense solution with automated approvals.

Key Strengths:

- Single platform for booking, expenses, and reimbursements

- Enhanced policy compliance with automated rules

- Real-time spend tracking and analytics

7. Tipalti

Tipalti streamlines global accounts payable, including travel and expense management, for large enterprises with complex international operations. By automating the entire travel expense process, from bookings to reimbursements, Tipalti enhances spend compliance and supplier management while providing full visibility into global travel costs.

Website: https://tipalti.com

Ideal for: Large companies with international teams and complex global financial needs.

Key Strengths:

- Comprehensive global payment and expense management

- Strong supplier and vendor management integration

- Automation of workflows and real-time financial visibility

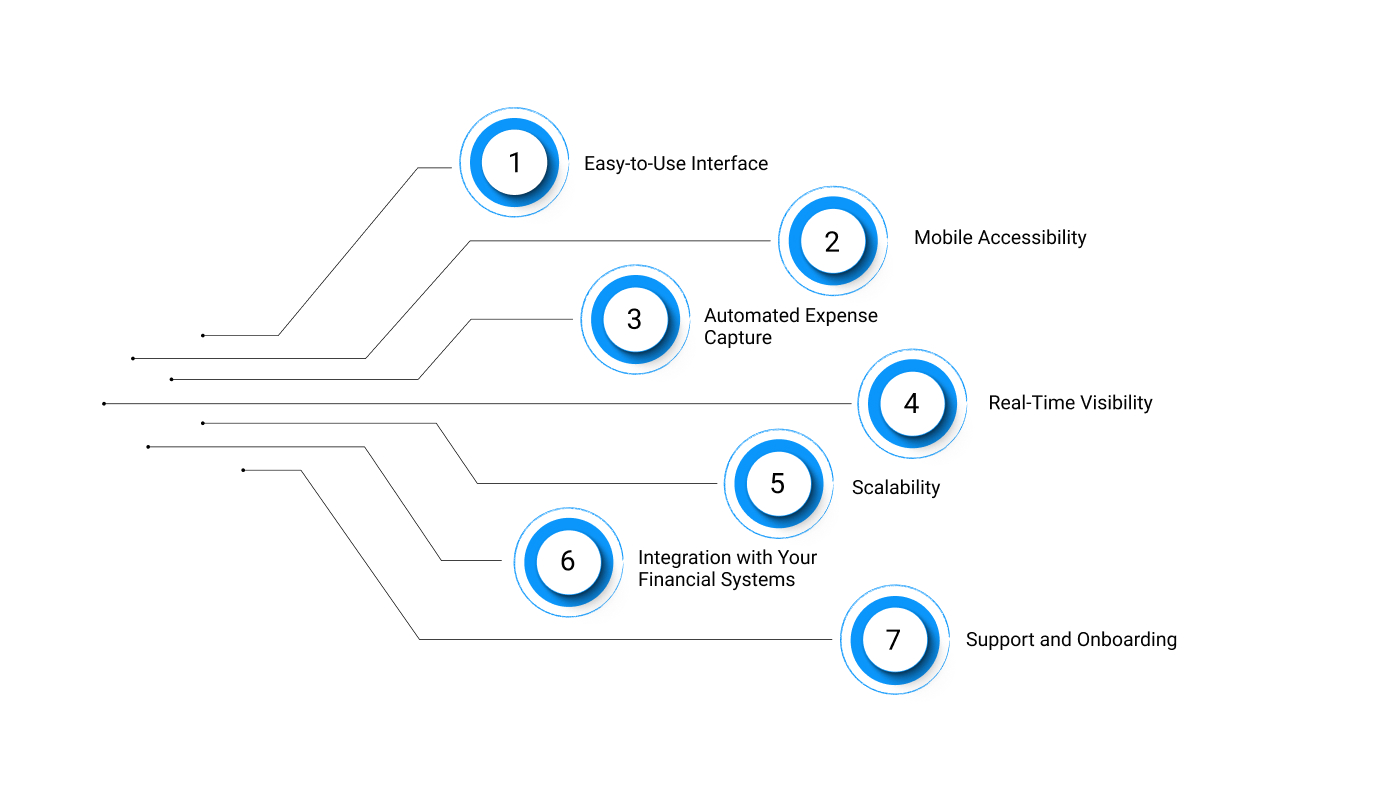

How to Choose the Right Travel Expense Management Software for Your Business?

When it comes to choosing travel expense management software, it’s not just about ticking boxes. The right platform should streamline your entire process, from booking travel to submitting expenses and getting approvals. With the right software, your finance team can gain real‑time visibility, save time, and improve policy compliance, all without making things more complicated for employees.

Here’s what you need to focus on when evaluating software:

1. Easy-to-Use Interface

Sometimes, the complexity of a tool can discourage employees from using it effectively. A travel expense management system should be simple and intuitive. When the interface is clean and user-friendly, employees can quickly submit expenses, book trips, and track spending with minimal effort.

For example, imagine your team struggling with a complicated platform where submitting an expense requires multiple steps. This could lead to delays, frustration, or even errors. A seamless, easy-to-use interface ensures the process is smooth, leading to quicker submissions and fewer mistakes.

2. Mobile Accessibility

Employees should be able to manage expenses on the go, especially those who travel frequently. Mobile access allows them to capture receipts, submit claims, and track expenses from anywhere, making it easier to stay on top of their finances.

For example, consider a scenario where an employee is on a business trip and forgets to submit a receipt for a meal. With a mobile app, they can easily snap a photo and submit it immediately, saving time and preventing missed reimbursements.

3. Automated Expense Capture and Reporting

Traditional data entry is not only tedious but also prone to mistakes. Automated expense capture using tools like OCR (Optical Character Recognition) technology can save employees time and reduce the chances of mistakes when submitting expenses.

For example, instead of manually entering the details from a paper receipt, your employees can simply take a photo of it, and the software will automatically extract the necessary information. This significantly cuts down the time spent on manual entries and ensures accuracy.

4. Real-Time Visibility

Having real-time visibility into travel expenses means that managers and finance teams can monitor and track spend as it happens, instead of waiting for reports to come in at the end of the month. This allows for better decision-making and prevents unnecessary overspending.

For example, if an employee goes over their allocated travel budget, a manager can spot it immediately and take corrective action before costs spiral. This transparency helps maintain financial control across the organisation.

5. Scalability

As your company expands, your software should grow with it. A scalable solution can handle more users, higher transaction volumes, and new financial processes without needing a complete system overhaul. This ensures that the software stays efficient as the business evolves.

For example, if your team expands to new regions or hires more employees, the software should adapt without requiring significant changes. This flexibility helps your company manage costs efficiently at every stage of growth.

6. Integration with Your Financial Systems

Integrating travel expense management software with existing financial systems is crucial for smooth operations. The software should sync seamlessly with your ERP, accounting, or payroll systems to automate data entry and ensure consistency across platforms.

For example, imagine an employee submitting an expense report that automatically syncs with the company’s accounting system. This eliminates double entries, reducing administrative workload and ensuring accurate financial reporting.

7. Support and Onboarding

Adopting a new software tool can be daunting, but proper onboarding and customer support can make a huge difference. A good travel expense management platform should offer clear, efficient onboarding processes and responsive customer service to address any issues promptly.

For example, during the onboarding process, if employees face difficulties with submitting their first expense report, a responsive support team should be available to guide them through the steps, ensuring smooth adoption and preventing frustration.

When Travel Costs Catch You Off Guard, How Pocketly Can Help

While travel expense management software can help you track, manage, and optimise your travel spend, it doesn't solve the problem of tight cash flow before reimbursements come through. That’s where Pocketly steps in.

Even with the best tools in place, there are times when travel costs, whether for last-minute bookings, unexpected expenses, or delayed reimbursements, can leave you scrambling. Pocketly offers quick, short-term loans to bridge that gap, so you never have to worry about missing out on a booking or falling behind on payments.

Here’s why Pocketly makes managing expenses easy:

- Only borrow what you need: Loans from ₹1,000 to ₹25,000, so you’re never borrowing more than necessary.

- No collateral required: Skip the paperwork, no assets or guarantors needed.

- Fast approval: Complete KYC quickly and get an instant decision, so you can act fast.

- Instant transfer: Funds hit your account as soon as you're approved.

- Flexible repayment plans: Pick a repayment option that suits your budget and cash flow.

- Clear, upfront pricing: Interest starts at just 2% per month, with processing fees from 1% to 8%.

- Access anytime, anywhere: Get funds 24/7 with our easy-to-use mobile app.

With Pocketly, you get loans through regulated NBFCs, ensuring clear terms and no surprises. So, when life throws unexpected expenses your way, Pocketly gives you the flexibility to stay on top of things, stress-free.

Conclusion

Travel expenses can quickly add up and disrupt your financial balance, but they don’t have to throw you off course. By using travel expense management software, you can keep track of your spending, ensure compliance, and stay on top of your budget.

Take control by using these tools to monitor travel costs, set clear policies, and manage your reimbursements effectively. When unexpected travel expenses arise, don’t let them impact your finances. Short-term loans can give the flexibility you need to cover costs without added stress.

Download Pocketly app today on iOS or Android to access quick funds whenever travel costs exceed your budget, offering you the financial freedom to manage your expenses with ease.

FAQs

1. What is travel expense management software?

Travel expense management software is a tool that automates and streamlines the process of booking, tracking, and reimbursing travel expenses for businesses, ensuring compliance and financial visibility.

2. Why do businesses need travel expense management software?

It helps businesses reduce manual effort, maintain policy compliance, and gain real‑time insights into travel costs, improving budgeting and overall spend management.

3. Can travel expense management software be accessed via mobile?

Yes, most modern travel expense management platforms offer mobile apps that let users capture receipts, submit expenses, and approve or review travel costs on the go.

4. How does Pocketly help with travel expenses?

Pocketly offers quick personal loans to help cover travel expenses when cash flow is tight. This ensures you can manage immediate costs, like last‑minute bookings or delays in reimbursements, without financial stress.

5. What features should I look for when choosing travel expense management software?

Prioritise automation, mobile accessibility, seamless integration with accounting systems, real‑time reporting, and compliance controls when selecting software to manage travel expenses.