Title loans have become a popular yet controversial option for those in need of quick cash, especially for individuals without access to traditional credit. However, the high-interest rates and fees associated with title loans often leave borrowers trapped in debt cycles, with some facing annual percentage rates (APRs) exceeding 300%.

Understanding how these loans work, particularly how interest rates and fees are calculated, is crucial for borrowers to make informed decisions. In this blog, we’ll break down how title loan interest rates and fees are calculated and explore the factors that affect the costs.

Key Takeaways

- Title Loans Are Costly: Interest rates can reach 300% to 400% APR, making them one of the priciest borrowing options.

- High Fees: Title loans include processing fees, late payment charges, and repossession fees, adding to the total cost.

- Debt Cycle Risks: Over 80% of title loans are rolled over, leading to mounting debt and additional fees.

- Repossession Risk: 20% of borrowers lose their vehicles due to unpaid loans, with some states having repossession rates as high as 33%.

- Explore Alternatives: Personal loans, payday alternative loans, and peer-to-peer lending offer lower rates and fewer risks.

What is a Title Loan?

A title loan is a type of secured loan where the borrower uses their vehicle's title as collateral to secure the loan. These loans are short-term and offer quick access to cash, but they come with high-interest rates and fees. If the borrower fails to repay the loan, the lender has the right to seize the vehicle to recover the outstanding amount.

Example: Suppose you own a car worth ₹100,000, and you need quick cash to cover an emergency expense. You can take out a title loan from a lender by using your car's title as collateral. The lender might offer you a loan of ₹50,000, and you would agree to pay it back in a month with a 20% interest rate. If you fail to repay the loan in time, the lender can repossess your car to recover the amount owed.

Also Read: Difference Between Secured and Unsecured Loans Explained

What are the Interest Rates and Fees of Title Loans?

Title loans are secured loans where borrowers pledge their vehicle's title as collateral, are offered by non-banking financial companies (NBFCs), and certain private lenders. These loans are often sought by individuals needing quick access to funds but lacking access to traditional credit sources.

Interest Rates

Title loan interest rates in India can vary based on the lender, loan amount, and repayment tenure. For instance, Toyota Financial Services India charges an annual interest rate of up to 24%, with a monthly late payment fee of 2% on unpaid EMIs. While this rate is relatively lower compared to some other lenders, it still translates to an APR of approximately 24%, which is notably higher than conventional loan products.

It's important to note that some lenders may impose additional fees, such as processing fees, valuation charges, and prepayment penalties, which can further increase the overall cost of the loan.

Fees

Common fees associated with title loans in India include:

- Processing Fees: Typically ranging from 0.01% to 3% of the loan amount, depending on the lender and loan type.

- Late Payment Charges: Often around 2% per month on unpaid EMIs.

- Prepayment Charges: Can range from 3% to 6% of the outstanding principal, depending on the loan tenure and lender policies.

- Valuation Charges: For used vehicles, valuation fees can be around ₹800, applicable only if a physical valuation is conducted.

If you're considering a quick loan, Pocketly offers a straightforward and transparent alternative. With minimal documentation, fast approval, and no collateral required, Pocketly provides personal loans ranging from ₹1,000 to ₹25,000 at competitive interest rates, making it a flexible solution for managing financial needs without the high costs of title loans.

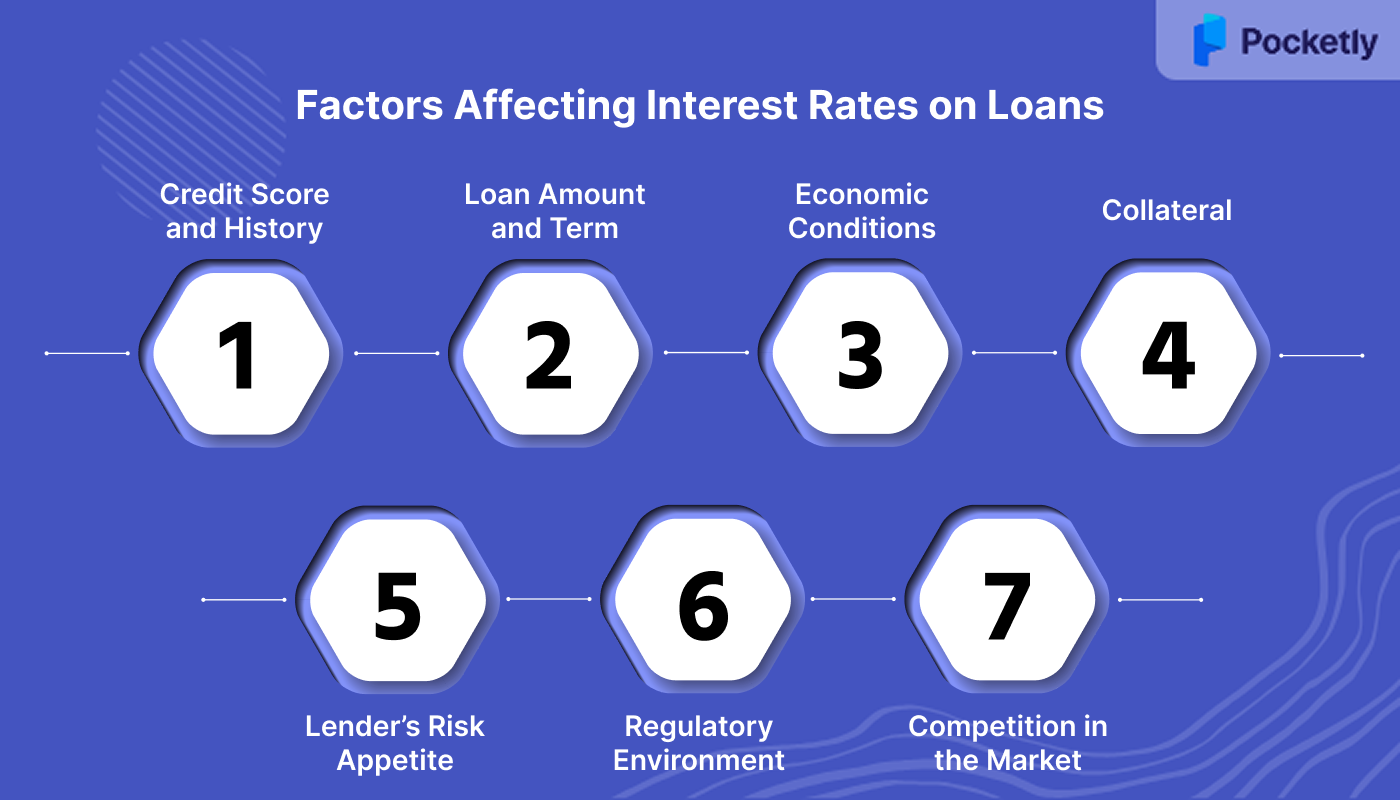

Factors Affecting Interest Rates on Loans

Interest rates on loans, including title loans, are influenced by various factors, both internal and external. Lenders consider these factors to determine how much risk they are taking on and to set rates that reflect those risks. Here's a detailed explanation of the key factors that affect interest rates:

1. Credit Score and History

A borrower’s credit score plays a crucial role in determining the interest rate. Individuals with higher credit scores (typically above 750) are considered low-risk borrowers and are often offered lower interest rates. In contrast, those with lower credit scores or no credit history are seen as high-risk borrowers, resulting in higher rates.

Example: A borrower with a credit score of 800 may secure a loan with a 5% interest rate, while someone with a score of 600 might face a 15% interest rate.

2. Loan Amount and Term

Generally, larger loans with longer repayment terms come with higher interest rates. Lenders prefer shorter loan terms as they are less risky. Longer terms, however, increase the lender’s exposure to default risk, which may be reflected in higher rates.

Example: A short-term personal loan of ₹50,000 might have an interest rate of 10%, while a longer-term loan for ₹1,00,000 could carry a rate of 12%.

3. Economic Conditions

Interest rates are also influenced by macroeconomic factors, particularly the prevailing economic climate. The central bank's monetary policy, inflation rates, and overall economic stability play a big role in setting base rates that lenders follow.

Inflation: When inflation is high, the central bank may raise interest rates to control spending and borrowing. As a result, lenders will also increase their rates to maintain profit margins.

Example: If the RBI raises the repo rate to combat inflation, lenders may pass on the increase to consumers by charging higher interest rates.

4. Collateral

For secured loans, like title loans or home equity loans, the presence of collateral can significantly lower the interest rate. Collateral reduces the lender's risk because, if the borrower defaults, the lender can seize the asset to recover the loan amount. Loans without collateral, such as unsecured personal loans, usually have higher interest rates due to the increased risk of default.

Example: A title loan, where the borrower’s vehicle is used as collateral, may carry a lower interest rate compared to an unsecured personal loan of the same amount.

5. Lender’s Risk Appetite

Each lender has a different risk appetite and may set interest rates based on their business model. Some lenders, especially those that specialize in high-risk loans (like payday or title loan lenders), may offer loans with significantly higher interest rates to compensate for the risk involved.

Example: A traditional bank might offer personal loans at 10%, while a payday lender could charge 400% APR for a short-term loan due to the high default risk.

6. Regulatory Environment

Government regulations can also play a significant role in determining the interest rates. In some countries, governments impose caps on interest rates for certain types of loans to protect consumers from usury and predatory lending practices. In India, for example, the RBI has set guidelines for various types of lenders, including non-banking financial companies (NBFCs), to prevent exploitative interest rates on loans.

Example: The RBI may impose a cap on the interest rates that NBFCs can charge for personal loans to protect consumers from excessively high rates.

7. Competition in the Market

Interest rates are also influenced by the level of competition in the lending market. When multiple lenders offer similar products, they may lower their interest rates to attract more customers. Conversely, in markets with fewer lenders or a lack of competition, interest rates tend to be higher.

Example: If a new bank enters the market with more favorable loan terms, it could prompt existing lenders to lower their rates to stay competitive.

These factors combined determine the interest rate on a loan, so it's important to consider them when applying for credit.

What are the Cost Implications and Risks of Title Loans

Title loans are among the most expensive and high-risk forms of borrowing, particularly due to their excessive interest rates and fees, which can quickly spiral into a debt cycle. Here’s a breakdown of the cost implications and risks associated with title loans:

Cost Implications

- High Interest Rates: Title loans often have interest rates ranging from 200% to 300% annually, with some lenders charging monthly rates of 25%, resulting in APRs that can exceed 400%.

- Additional Fees: In addition to high interest, title loans can carry processing fees, late payment penalties, and repossession fees (typically around ₹25,000 to ₹30,000), further increasing the total cost.

- Real-World Examples: A borrower who takes a ₹50,000 title loan at a 25% monthly interest rate will end up paying ₹62,500 after one month. For a loan of ₹1,00,000 with an APR of 300%, the interest paid in just 30 days could be ₹30,000.

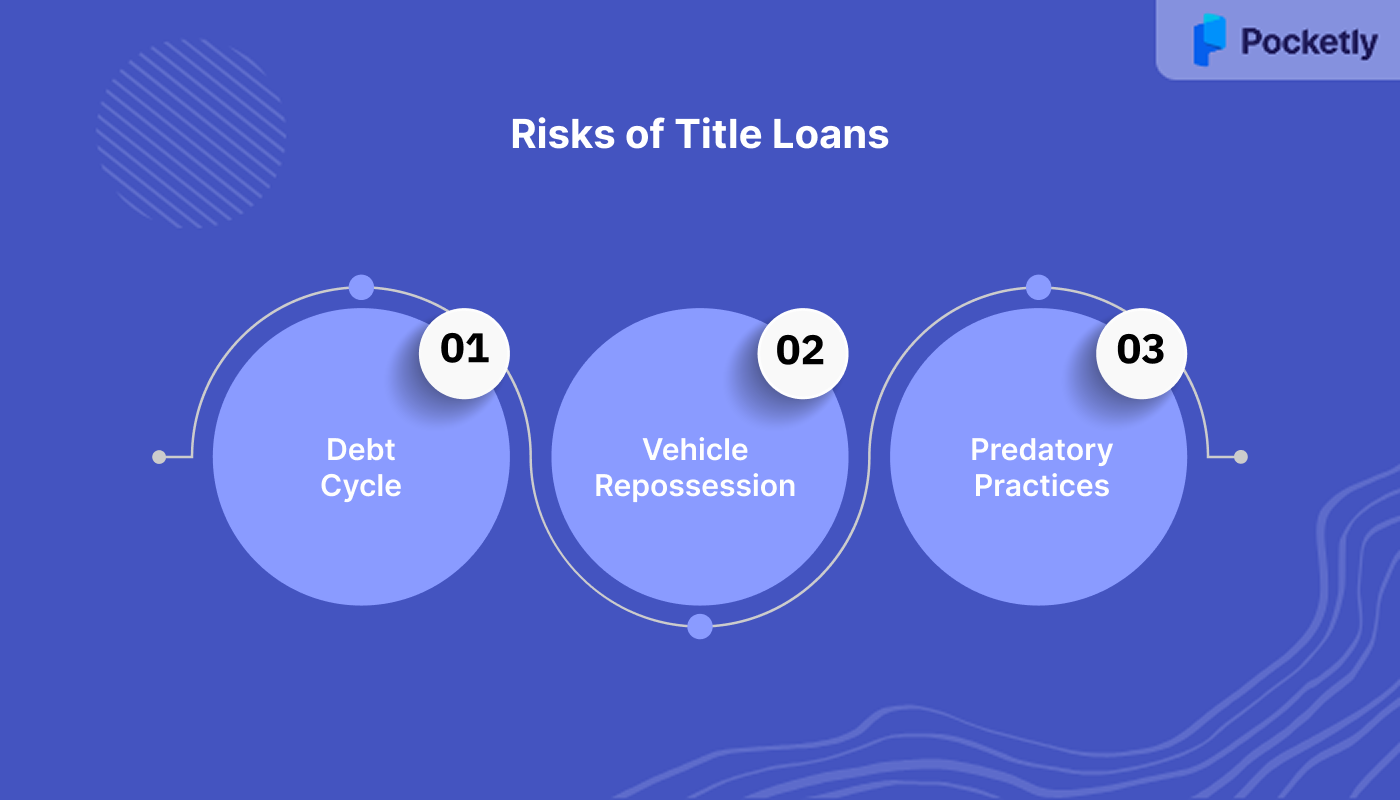

Risks of Title Loans

- Debt Cycle: One of the major risks of title loans is falling into a debt trap. Over 80% of title loans are renewed on the same day they are paid off, indicating that borrowers often cannot afford the lump-sum repayment. This leads to loan rollovers, where additional fees are incurred while the principal remains unchanged.

- Vehicle Repossession: The most severe risk of a title loan is the potential for repossession of your vehicle. Research shows that 20% of borrowers have their cars repossessed, and in states like California, 33% of title loans result in repossession.

- Predatory Practices: Title loan lenders use aggressive tactics, such as GPS tracking devices and unauthorized bank withdrawals, to ensure repayment, often at the expense of borrowers’ financial well-being. These practices can create significant stress and further financial strain.

To avoid the high costs and risks of title loans, consider alternative financing options such as instant personal loans from pocketly where it offers more favorable terms and lower interest rates starting at 2% per month.

Also Read: Understanding the Loan Restructuring Process and Guidelines

Alternatives to Title Loans

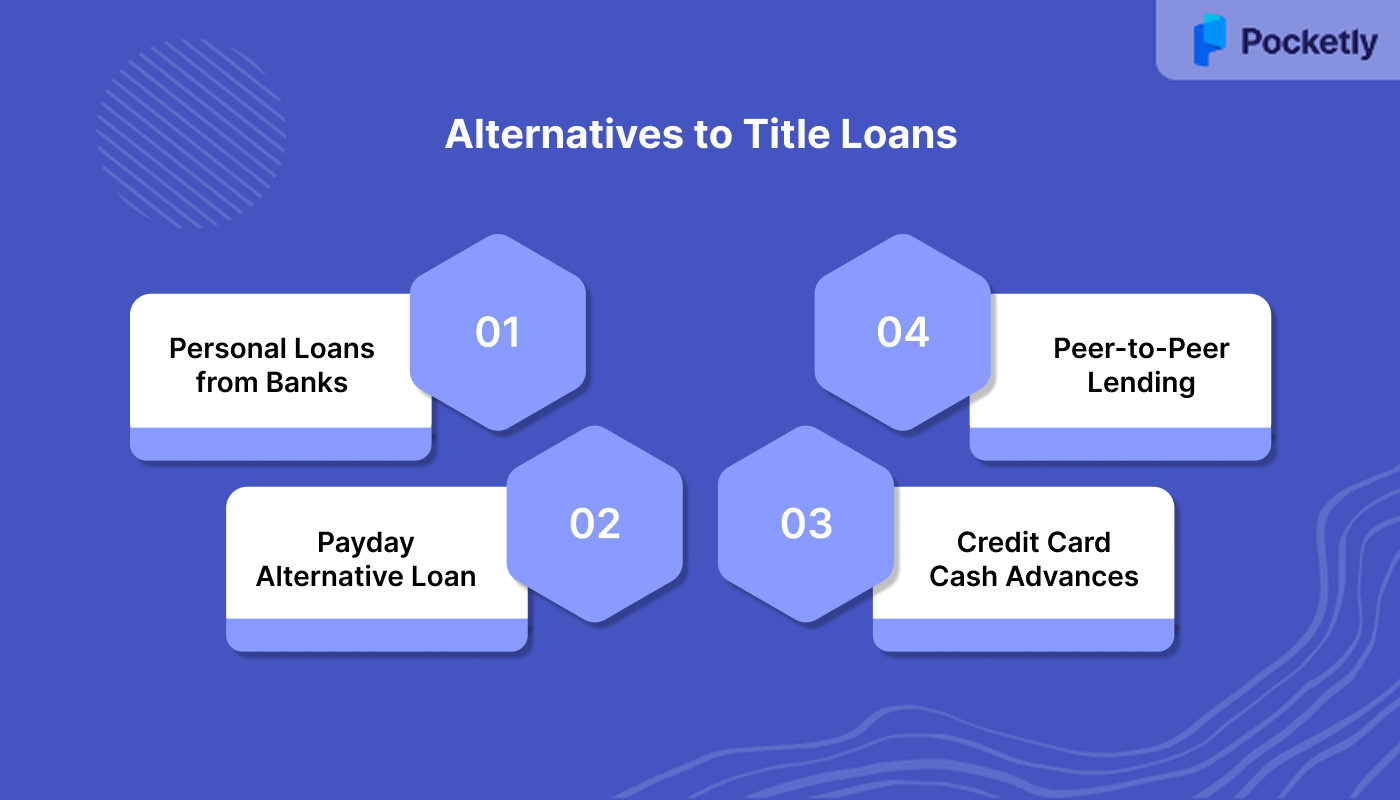

Title loans are a risky and expensive form of borrowing, and while they may offer quick cash, there are several alternatives that come with lower interest rates, more favorable terms, and less risk. Below are some viable alternatives to title loans, each with its own set of benefits and considerations:

Personal Loans from Banks or Credit Unions

Personal loans are unsecured loans offered by traditional banks or credit unions. They generally have lower interest rates compared to title loans and are typically repaid in fixed monthly installments.

Interest rates for personal loans usually range from 6% to 36%, depending on the borrower’s credit score, income, and the loan amount.

Pros:

- Lower interest rates compared to title loans.

- Longer repayment terms, making it easier to manage monthly payments.

- No collateral required, unlike title loans.

Cons:

- Approval can take longer, especially with traditional banks.

- May require a good credit score to qualify for the lowest rates.

Payday Alternative Loans (PALs)

Offered by credit unions, payday alternative loans are designed for those who need quick cash but want to avoid the predatory nature of payday loans and title loans. They offer short-term, small loans with more affordable terms.

Interest Rates of PALs have an APR of up to 28%, which is much lower than title loans.

Pros:

- Lower rates than payday loans and title loans.

- No vehicle or property needed as collateral.

- Shorter repayment periods compared to traditional loans.

Cons:

- Available only through credit unions, which may require membership.

- Smaller loan amounts compared to title loans.

Credit Cards or Credit Card Cash Advances

If you already have a credit card, using it to cover emergency expenses or even taking out a cash advance could be a viable alternative to a title loan.

Credit card come with interest rates ranging from 20% to 30%, which is high but still significantly lower than title loans.

Pros:

- No need for collateral.

- Quick access to funds if you already have a credit card.

- If repaid within the grace period, interest charges can be avoided.

Cons:

High-interest rates for cash advances.

Can lead to high credit card debt if not managed properly.

Cash advances often come with additional fees, such as transaction fees.

Peer-to-Peer Lending (P2P Lending)

Peer-to-peer lending platforms, such as LendingClub or Prosper, connect borrowers with individual lenders. These loans are often more flexible than traditional bank loans and can offer lower rates compared to title loans.

Interest rates typically range from 6% to 35%, depending on the borrower’s creditworthiness and the platform.

Pros:

- Often lower interest rates than payday or title loans.

- Faster application process compared to traditional loans.

- Potential for more flexible repayment terms.

Cons:

- Approval depends on your creditworthiness and the platform’s terms.

- Not all P2P platforms are available in every country or region.

Pocketly: Quick Loans for Salaried, Self-Employed & Young Adults

Pocketly is a fast and easy lending platform catering to loans for salaried, loans for self-employed individuals, and young adults. Whether you're managing unexpected expenses or funding personal projects, Pocketly offers flexible loan options designed to meet your needs.

Here are the key features of Pocketly:

- Loan Amount: Loans ranging from ₹1,000 to ₹25,000.

- Interest Rate: Competitive interest starting at 2% per month.

- Processing Fee: A nominal fee of 1% to 8% of the loan amount.

- Minimum KYC: Simple verification process with minimal documentation.

- No Physical Documents: Apply with ease, no need for physical paperwork.

Conclusion

Title loans offer a quick solution for those in immediate need of cash, but their high-interest rates and additional fees often lead to financial struggles for borrowers. With APRs that can exceed 400%, these loans can quickly turn into a debt trap, especially if borrowers are unable to repay in full and resort to loan rollovers. Furthermore, the risks of repossession and aggressive lending practices make title loans a dangerous option for many.

Fortunately, there are alternative options, such as personal loans, payday alternative loans, credit cards, and peer-to-peer lending, which offer lower rates and more manageable terms. Exploring these alternatives can help borrowers avoid the pitfalls of title loans and better manage their financial needs.

For a safer borrowing experience, Pocketly offers loans ranging from ₹1,000 to ₹25,000 with 2% monthly interest and minimal documentation. Download Pocketly now on iOS or Android for fast and transparent loans.