Managing money can be stressful for many young Indians today. Rising expenses, limited savings, and sudden financial needs often put pressure on monthly cash flow.

Students handling education costs, salaried professionals dealing with salary deductions, and self-employed individuals with irregular income all face similar challenges.

Tax planning adds to this uncertainty. As per government data, net direct tax collection (provisional) stood at ₹17.04 lakh crore as of 17th December 2025 for FY 2025–26, showing how significant taxes are in personal finances.

One commonly misunderstood area is the standard deduction in the new tax regime. Understanding how it works can help you budget better, manage cash flow, and make more informed financial decisions.

Key Takeaways

- Standard deduction is available under the new tax regime for salaried individuals and pensioners, reducing taxable income by ₹75,000 without any documentation.

- Understanding the standard deduction in the new tax regime helps improve monthly cash flow and makes budgeting more predictable for young earners.

- Choosing between the old and new tax regimes depends on income structure, existing deductions, and preference for simplicity, not assumptions.

- Reviewing your tax regime every financial year can prevent higher tax outgo and avoid unnecessary financial stress.

- During tax-related cash crunches or delayed refunds, Pocketly can help manage short-term needs with digital personal loans ranging from ₹1,000 to ₹25,000, offered through partner NBFCs.

What Is Standard Deduction and Why Does It Matter?

Standard deduction is a fixed amount reduced from your salary income before tax is calculated. You do not need to submit bills, proofs, or make investments to claim it.

It exists to account for basic work-related expenses such as travel, meals, and daily costs. Instead of tracking every expense, the government allows a flat deduction.

Why does it matter?

- It lowers taxable income directly

- It reduces overall tax liability

- It improves the monthly take-home salary

For young earners, this small reduction can make budgeting easier. It also helps manage EMIs, savings, and emergency expenses with less stress.

What Is the Standard Deduction in the New Tax Regime?

Under the new tax regime, salaried individuals and pensioners are allowed to claim a standard deduction of ₹75,000 per financial year. This deduction is applied directly to salary income before tax is calculated.

Earlier, the new regime offered lower tax rates but almost no deductions. This led many taxpayers to believe it was unsuitable for salaried professionals. The inclusion of the standard deduction has improved its appeal, especially for those who do not claim multiple exemptions.

Since both regimes offer the standard deduction, the real difference lies in how much flexibility you need versus how much simplicity you prefer. That’s where the comparison starts to matter.

Also Read: How to Automate Your Budgeting Process

Is Standard Deduction Mandatory in the New Tax Regime?

Standard deduction in the new tax regime is not optional for eligible taxpayers. If you are a salaried employee or pensioner, the deduction is applied automatically while calculating taxable income.

This means you do not need to choose or claim it separately. Once you opt for the new tax regime, the standard deduction is included by default in your salary computation.

Many taxpayers worry about missing out on deductions due to a lack of awareness. However, standard deduction does not depend on investments, proofs, or declarations. It simply reduces taxable income upfront.

Understanding this helps you estimate your take-home salary more accurately. It also prevents last-minute confusion during tax filing, which often affects budgeting and cash flow planning.

Who Can Claim the Standard Deduction Under the New Tax Regime?

Standard deduction under the new tax regime is available to salaried employees and pensioners. If you receive a regular salary or pension income, you are eligible to claim this deduction automatically.

Self-employed individuals, freelancers, and business owners cannot claim the standard deduction. Their income is taxed under different provisions, where expenses are claimed separately as business costs.

For example, a salaried professional earning ₹6 lakh annually can reduce taxable income to ₹5.5 lakh after standard deduction. This directly lowers the tax payable without any additional effort or documentation.

How to Claim Standard Deduction in the New Tax Regime

Claiming the standard deduction in the new tax regime is simple and automatic. If you are salaried, your employer applies the deduction while calculating tax deducted at source (TDS).

You do not need to submit bills, investment proofs, or any documents. The deduction is reflected directly in your Form 16, reducing your taxable salary by ₹75,000.

Pensioners also receive this benefit automatically while computing taxable pension income. There is no separate application or declaration process involved.

Estimating net income becomes easier when it is automated. Clear tax visibility helps manage monthly expenses and reduces the risk of sudden financial strain during tax season.

How Standard Deduction Reduces Your Taxable Income

To understand the impact, start with your gross annual salary. From this amount, the standard deduction of ₹75,000 is reduced before applying tax slabs.

The calculation is straightforward.

- Start with your gross annual salary

- Subtract ₹75,000 as standard deduction

- Apply tax slabs on the reduced amount

For example:

- Annual salary: ₹8,00,000

- Standard deduction: ₹75,000

- Taxable salary: ₹7,25,000

This reduction directly affects tax payable and improves monthly cash flow. Even small changes can make a difference when managing rent, EMIs, or emergencies.

For many young professionals, even a small dip in take-home salary can affect monthly planning.

When tax deductions or refunds delay essential expenses, short-term support can help manage cash flow without long-term disruption. Platforms like Pocketly offer small, flexible loans to handle such situations responsibly.

Standard Deduction in the New Tax Regime vs the Old Tax Regime

Both tax regimes now allow a standard deduction, but they differ significantly in structure.

| Aspect | New Tax Regime | Old Tax Regime |

| Standard Deduction | Available (₹75,000 for salaried individuals and pensioners) | Available (₹75,000 for salaried individuals and pensioners) |

| Other Deductions & Exemptions | Very limited; most deductions like 80C, 80D, and HRA are not allowed | Multiple deductions and exemptions available (80C, 80D, HRA, LTA, etc.) |

| Tax Slab Rates | Lower and simplified tax slabs | Higher tax slabs compared to the new regime |

| Complexity | Simple structure with minimal compliance | More complex due to multiple deductions and proofs |

| Proof & Documentation | No need to submit investment or expense proofs | Requires documentation for deductions and exemptions |

| Best Suited For | Individuals with fewer investments or those who prefer simplicity | Individuals who actively invest in tax-saving instruments |

| Impact of Standard Deduction | Provides basic relief despite fewer deductions | Adds to overall tax savings along with other deductions |

| Flexibility in Tax Planning | Limited flexibility | High flexibility with multiple tax-saving options |

Since the standard deduction is identical in both regimes, the decision now depends entirely on tax slabs and available exemptions.

Recalculating tax under both regimes at the start of every financial year helps you make an informed decision and avoid last-minute stress.

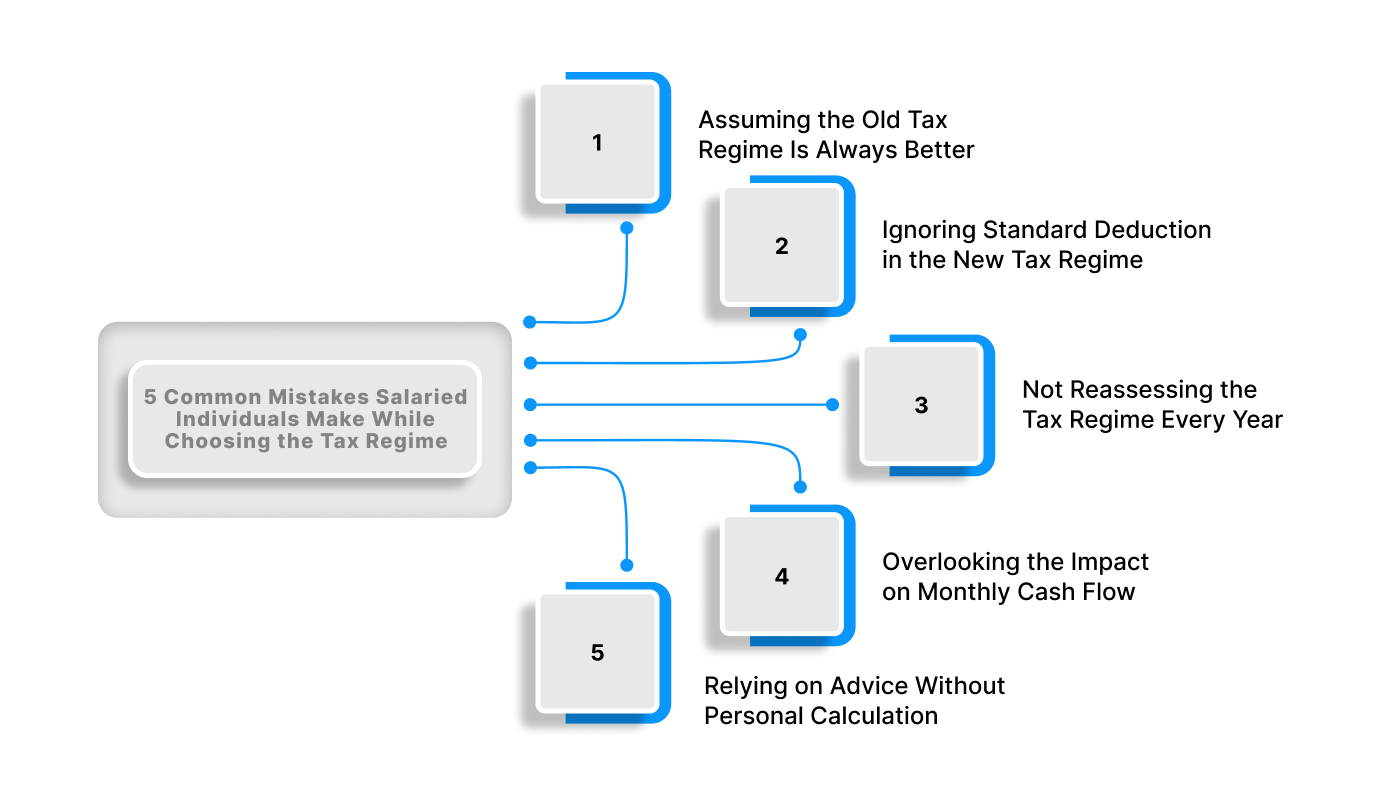

5 Common Mistakes Salaried Individuals Make While Choosing the Tax Regime

One common mistake is assuming the old tax regime is always better. Many taxpayers do not calculate their tax liability under the new regime after the recent changes.

Assuming the Old Tax Regime Is Always Better

Many salaried individuals automatically choose the old tax regime without comparing their actual tax liability. This decision is often based on habit, not calculation, and may lead to higher taxes.

Solution:

Always calculate tax under both regimes at the start of the financial year. Use your current salary details to make a data-driven choice, not an assumption.

Ignoring Standard Deduction in the New Tax Regime

A common misconception is that the new tax regime offers no deductions. As a result, many taxpayers overlook the benefit of the standard deduction available under it.

Solution:

Factor in the standard deduction while calculating taxable income in the new regime. This single deduction can make a noticeable difference to your tax outgo.

Not Reassessing the Tax Regime Every Year

Many people stick to the same tax regime year after year, even when their income or job situation changes. This can result in missed savings.

Solution:

Review your tax regime choice annually. Salary hikes, bonuses, or changes in deductions can shift which regime is more beneficial.

Overlooking the Impact on Monthly Cash Flow

Tax decisions are often viewed only from an annual perspective. This ignores how higher tax deductions can reduce the monthly take-home salary.

Solution:

Evaluate how each tax regime affects your monthly cash flow. A slightly lower annual saving may be worth it if it improves monthly financial stability.

Relying on Advice Without Personal Calculation

Following colleagues’ or friends’ tax choices without personal assessment can lead to unsuitable decisions. Financial situations differ for everyone.

Solution:

Base your tax regime choice on your own income, deductions, and financial goals. What works for someone else may not work for you.

Such tax miscalculations often lead to short-term cash shortages, especially during advance tax payments or refund delays. Planning and knowing where to seek temporary financial support can reduce unnecessary stress.

How to Decide If the New Tax Regime Is Right for You

Choosing the right tax regime depends on your income structure and financial habits. There is no universal answer that works for everyone. What matters is how much flexibility and simplicity you prefer.

If you have limited investments and do not actively claim deductions like HRA, 80C, or health insurance, the new tax regime may suit you better. It offers lower tax rates and a simpler filing process, along with a standard deduction.

On the other hand, if you invest regularly or claim multiple exemptions, the old tax regime may still provide higher tax savings. In such cases, deductions can outweigh the benefits of lower slab rates.

It now becomes wise to calculate tax under both regimes before the financial year begins. Reassessing annually helps you avoid surprises and manage money more confidently.

Also Read: Top Financial Awareness Concepts You Should Know in 2025

How Tax Regime Choices Affect Monthly Cash Flow

Tax regime decisions do more than affect your annual tax bill. They directly influence how much money you receive in your hand every month. A higher tax outgo often means a reduced take-home salary.

When monthly income drops, budgeting becomes harder. EMIs, rent, utility bills, and daily expenses may start competing for limited funds. This pressure is felt even more by students, young professionals, and self-employed individuals with irregular income.

For example, choosing an unsuitable tax regime may result in higher tax deductions at source. Over time, this can reduce savings capacity and delay financial goals. It can also leave little room for emergencies.

When reduced take-home pay starts affecting essentials, access to quick, short-term funds through digital lending platforms like Pocketly can help bridge the gap responsibly.

How Pocketly Can Help During Tax-Related Cash Crunches

Even with careful tax planning, financial pressure can still arise. Advance tax payments, delayed refunds, or changes in salary structure can temporarily strain monthly cash flow. For students and young professionals, these situations often coincide with other essential expenses.

Pocketly helps manage such short-term financial gaps responsibly. Pocketly is a digital lending platform owned by RBI-registered NBFC Speel Finance Company Private Limited, offering short-term personal loans for emergency needs.

Pocketly offers loan amounts ranging from ₹1,000 to ₹25,000, with interest starting at 2% per month and processing fees between 1–8% of the loan amount. The entire process is digital, with quick KYC, minimal documentation, and instant transfer of funds to your bank account. Customer support is available online to assist users throughout the application process.

To avail the services,

- Download the Pocketly app or visit the website

- Complete quick digital KYC

- Select the loan amount

- Get approval and funds transferred to your bank account

This makes it easier to handle urgent expenses without disrupting long-term financial plans or relying on informal borrowing.

Conclusion

Understanding the standard deduction in the new tax regime plays a key role in smarter financial planning. It affects your taxable income, monthly take-home salary, and how easily you manage everyday expenses.

With recent updates, the new tax regime has become more relevant for many salaried individuals. However, the right choice depends on your income structure, deductions, and cash flow priorities. Reviewing your tax position every financial year helps you stay prepared and avoid last-minute stress.

Even with careful planning, unexpected expenses can still arise. During such moments, having access to short-term financial support can make a difference. Pocketly offers a simple, digital way to manage temporary cash shortages while you stay focused on long-term financial stability.

Download the Pocketly app on iOS or Android to explore responsible borrowing options when you need them.

FAQs

1. Is the standard deduction available in the new tax regime?

Yes, standard deduction is available in the new tax regime for salaried individuals and pensioners. A fixed amount of ₹75,000 is reduced from salary income before calculating tax.

2. How much standard deduction can salaried employees claim under the new tax regime?

Salaried employees can claim a standard deduction of ₹75,000 per financial year. This deduction is applied automatically and does not require any proof or investment.

3. Can self-employed individuals claim the standard deduction in the new tax regime?

No, standard deduction is not available to self-employed individuals or freelancers. It applies only to salaried employees and pensioners under the Income Tax Act.

4. Is the new tax regime better than the old tax regime after the standard deduction?

The new tax regime may be better for individuals with fewer deductions and a preference for simplicity. Those who claim multiple exemptions may still benefit more from the old tax regime.

5. Does the standard deduction affect the monthly take-home salary?

Yes, the standard deduction reduces taxable income, which can lower tax liability. This may result in a slightly higher monthly take-home salary, improving cash flow over time.