In a world of instant UPI payments and one-click checkouts, money often slips away faster than we realise.

Many young Indian students managing allowances or professionals in their early careers start the month with saving goals, but face an unexpected cash crunch by the 20th. This pattern doesn’t just strain finances; it quietly affects mental well-being, too. Constant money stress can drain energy and focus.

Mindful spending offers a practical shift, from impulsive decisions to intentional choices, helping you regain control over your money while supporting long-term financial and emotional wellness.

Key Takeaways

- Mindful spending is about ensuring your money supports your long-term goals rather than disappearing into impulsive, short-term wants.

- Recognising triggers like FOMO or stress is the first step toward breaking the cycle of emotional spending and buyer's remorse.

- Implementing simple rules, such as the 48-hour cooling-off period, can significantly reduce unnecessary expenses and build better habits.

- Aligning your spending with your personal values reduces financial anxiety and leads to a more content and secure lifestyle.

- Maintaining a conscious spending plan, supported by a reliable safety net like Pocketly, ensures you stay resilient during unexpected financial crunches.

Understanding the Concept of Mindful Spending

Mindful spending is the practice of being fully aware of where your money is going and ensuring that every rupee spent aligns with your personal values and long-term goals. It is not about deprivation or living a life of austerity; rather, it is about making conscious choices.

Think of it as "financial meditation", you are pausing to observe your impulses before acting on them.

Traditional budgeting often feels like a restriction, but mindful spending feels like empowerment. For instance, instead of mindlessly ordering a ₹400 meal delivery because you’re bored, a mindful spender might choose to save that money for a weekend trip that brings them genuine joy.

It’s about differentiating between a "fleeting want" and a "lasting value." When your spending reflects who you are and what you want to achieve, the guilt associated with shopping disappears, replaced by a sense of control.

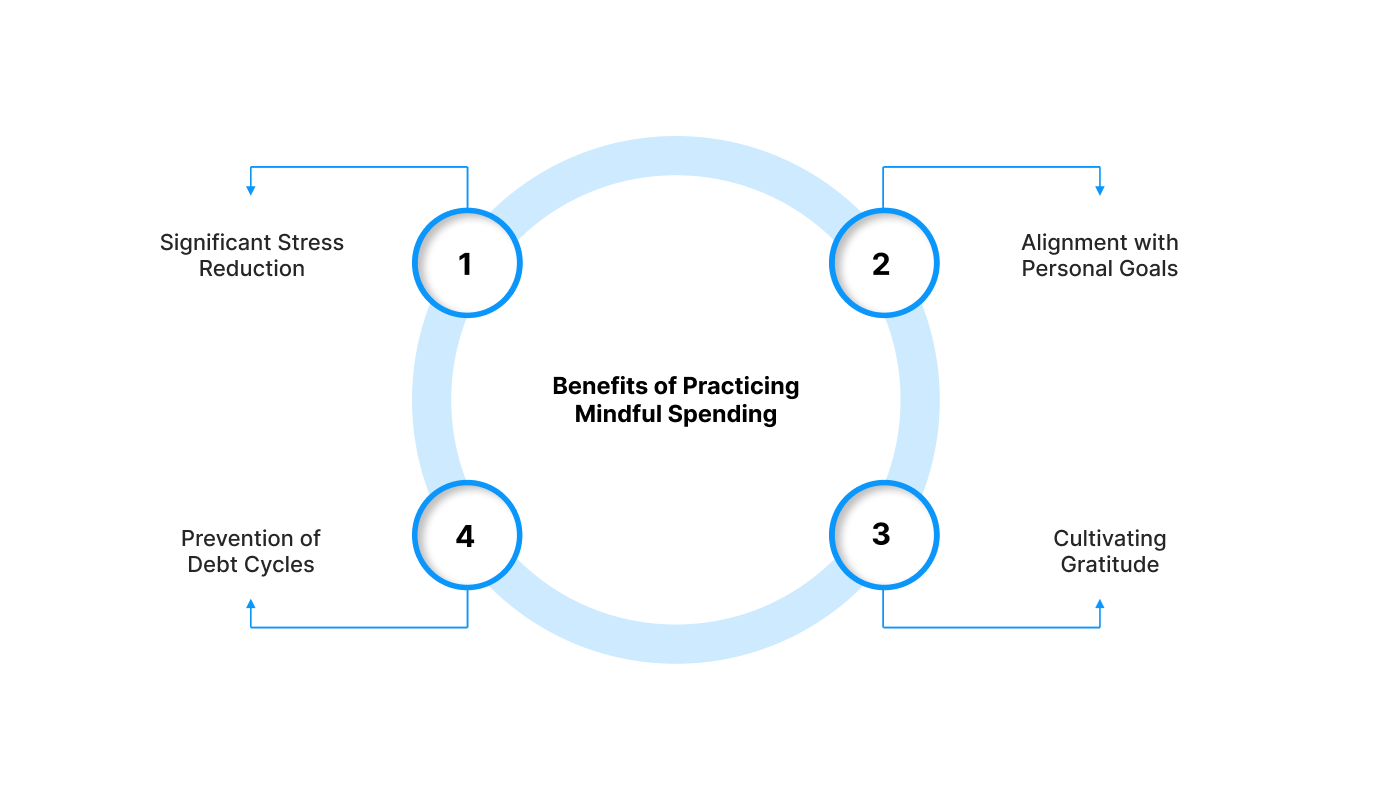

Benefits of Practicing Mindful Spending

Adopting a more intentional approach to your finances does more than just save you money; it transforms your relationship with your future. When you stop spending on autopilot, you gain a sense of clarity and peace that impacts every area of your daily life.

- Significant Stress Reduction: Financial anxiety often stems from the unknown. By knowing exactly where your money goes, you eliminate the fear of checking your bank balance at the end of the month.

- Alignment with Personal Goals: Every rupee you save by avoiding an impulse buy brings you closer to your real ambitions. Whether it is a new laptop for work or a dream holiday, mindful spending ensures your money supports your dreams.

- Prevention of Debt Cycles: For many young Indians, small impulsive purchases often lead to borrowing from friends or using high-interest credit cards. Mindfulness helps you live within your means and avoid the trap of mounting debt.

- Cultivating Gratitude: When you spend intentionally, you tend to value the things you do buy much more. This shift from quantity to quality fosters a deeper sense of contentment with your current lifestyle.

Also Read: How to Manage Monthly Expenses Smartly in 2025

Identifying Your Emotional Spending Triggers

To master mindful spending, you must first identify the "why" behind your non-essential purchases. Most impulsive spending in India today is driven by three main emotional triggers:

- FOMO (Fear Of Missing Out): Seeing a friend post a picture of a new gadget or a luxury brunch on Instagram often triggers a social comparison. You spend not because you need the item, but because you want to keep up with a perceived lifestyle.

- The "Treat Yourself" Trap: After a long day of lectures or a stressful shift at work, it’s easy to justify a splurge as a reward. While self-care is important, using spending as a primary coping mechanism for stress can lead to a dangerous cycle of debt.

- Spendception and Digital Ease: Research shows that digital payments reduce the "pain of paying." When you tap your phone or use UPI, the transaction feels less "real" than handing over physical cash. This psychological detachment makes it easier to overspend without realising the cumulative impact.

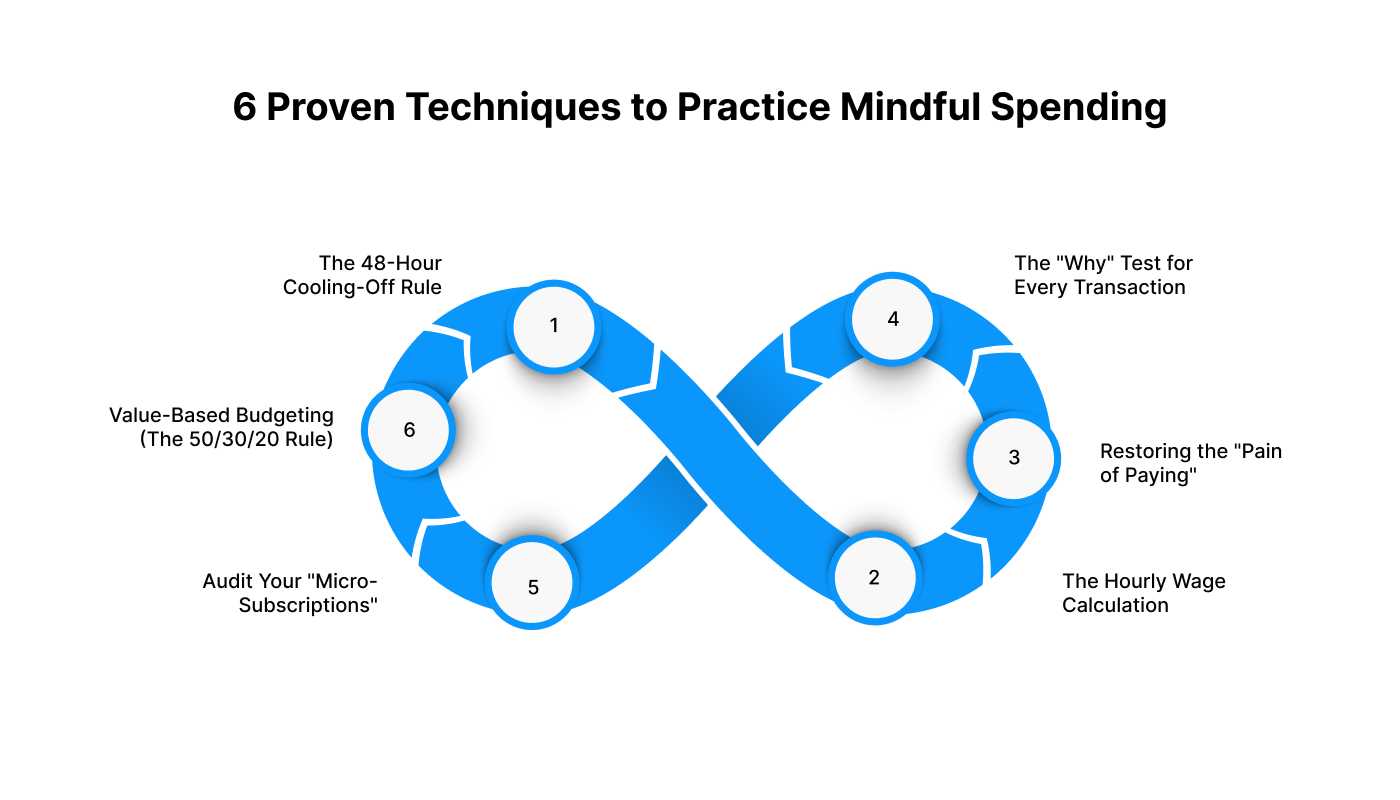

6 Proven Techniques to Practice Mindful Spending

Mastering your finances requires actionable strategies. Here are six detailed techniques to help you cultivate a mindful approach to your money:

1. The 48-Hour Cooling-Off Rule

Whenever you feel the urge to buy something that isn't a necessity (like a new pair of sneakers or an electronic accessory), wait for 48 hours. This "cooling-off" period allows the initial emotional impulse to fade. You’ll often find that after two days, the "must-have" feeling has vanished, and you can make a rational decision.

2. The Hourly Wage Calculation

Before making a purchase, convert the price into hours of work. If you earn ₹500 per hour and want a watch that costs ₹5,000, ask yourself: "Is this watch worth 10 hours of my hard work?" This simple mental shift puts the cost into a perspective that most of us find easier to understand than just a number on a screen.

3. Restoring the "Pain of Paying"

Since UPI makes spending invisible, try a "Cash-Only Week" for your discretionary expenses like dining out or shopping. Physically seeing the notes leave your wallet restores the psychological barrier to spending. For digital transactions, enable instant SMS alerts to ensure you see the deduction immediately.

4. The "Why" Test for Every Transaction

Before you scan that QR code, ask yourself three questions:

- Do I need this right now?

- Does this purchase align with my monthly goal?

- How will I feel about this purchase tomorrow morning? If the answer to any of these is negative, it’s a sign to put the item back.

5. Audit Your "Micro-Subscriptions"

In the digital age, we often suffer from "subscription leak." Small monthly deductions for OTT platforms, gaming apps, or premium tools can add up to thousands of rupees a year. Conduct a monthly audit of your bank statement and cancel anything you haven’t used in the last 30 days.

6. Value-Based Budgeting (The 50/30/20 Rule)

Adapt the classic 50/30/20 rule to the Indian context. Allocate 50% of your income to "Needs" (rent, groceries, utilities), 20% to "Savings and Debt Repayment," and 30% to "Wants." However, the mindful twist is to ensure that the 30% spent on "Wants" goes toward things that truly enhance your wellness, rather than random impulse buys.

Also Read: Simple Money Management Tips for Personal Finances

Creating a Conscious Spending Plan

A conscious spending plan is not about restriction; it is about giving yourself permission to spend on what truly matters. Unlike a traditional budget that feels like a chore, this plan acts as a roadmap for your financial freedom.

- Define Your Core Values: Start by identifying the three most important areas where you want to spend your money. This could be education, travel, or perhaps supporting your family back home.

- Categorise Fixed and Variable Costs: Clearly list your non-negotiables, such as rent, utility bills, and insurance. Once these are covered, you can see exactly how much "guilt-free" money is left for your lifestyle.

- Automate Your Savings: Before you spend a single rupee on "wants," move a portion of your income into a savings or investment account. Treating savings as a mandatory bill is a hallmark of a mindful spender.

- Plan for Joy: A good plan includes money for things you love. By setting aside funds for a weekend dinner or a hobby, you prevent the feeling of deprivation that leads to massive splurges later.

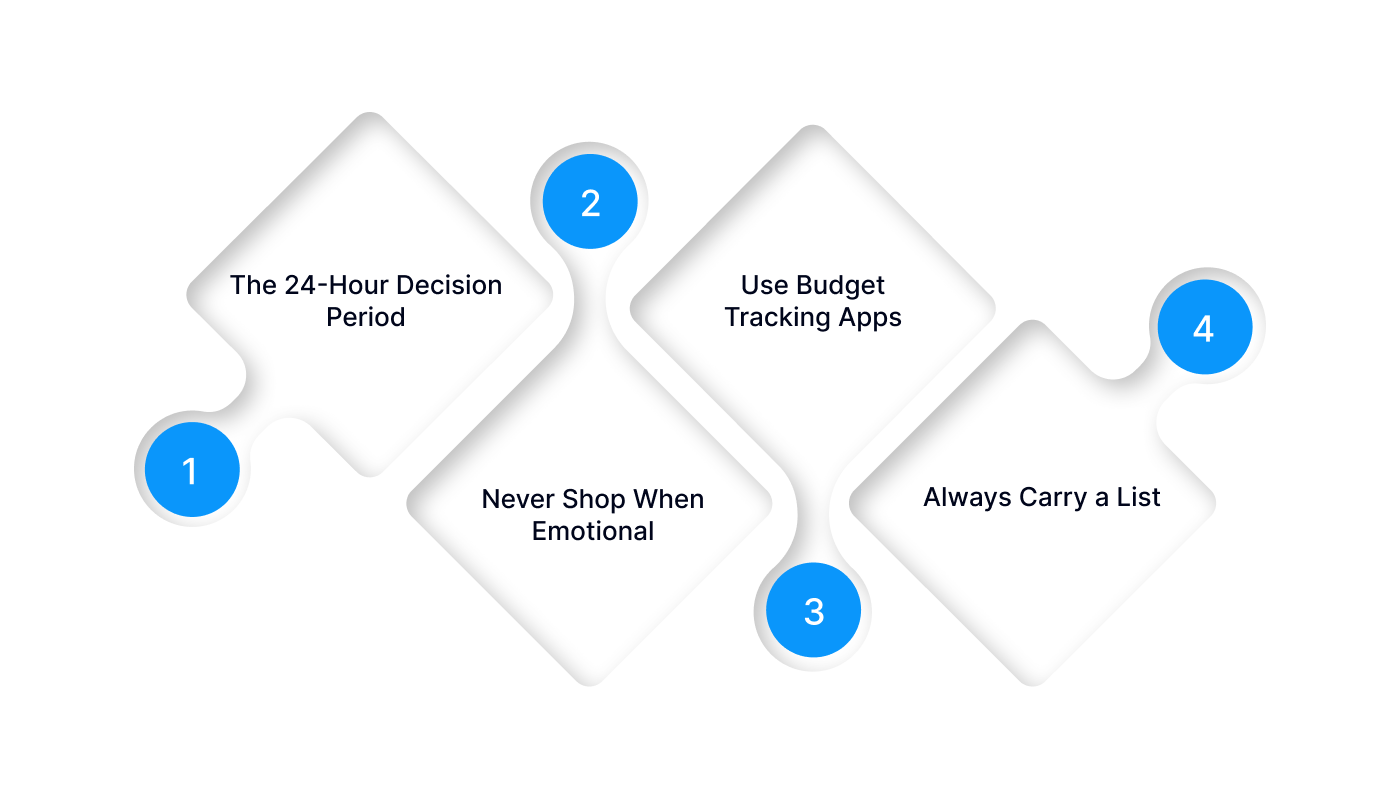

Avoiding Impulse Buys and Setting Budgets

Impulse buying is the biggest enemy of financial wellness, especially with the convenience of one-click digital payments. Setting a firm budget and using specific psychological barriers can help you stay in total control.

- The 24-Hour Decision Period: For any non-essential item over ₹1,000, force yourself to wait for 24 hours before completing the purchase. Most of the time, the "need" for the item will disappear once the initial excitement cools down.

- Never Shop When Emotional: Whether you are feeling extremely happy, sad, or bored, avoid browsing e-commerce apps. Your emotions can cloud your judgment and lead to "retail therapy" that you will later regret.

- Use Budget Tracking Apps: Use a simple app to log every transaction the moment it happens. This real-time feedback loop makes you much more aware of how those "small" ₹200 snacks are adding up.

- Always Carry a List: Whether you are going to the supermarket or the mall, never enter a store without a written list. Commit to buying only what is on that list to avoid being swayed by clever marketing displays.

How Pocketly Supports Your Financial Journey

Even with the best mindful spending habits, life can sometimes throw an unexpected curveball. A sudden medical bill, a mandatory college fee, or an urgent home repair can disrupt even the most carefully planned budget. In these moments, having a reliable safety net is essential for maintaining your financial wellness.

Pocketly is designed to be that bridge for young Indians. As a digital lending platform, we help you manage short-term cash flow gaps without the stress of traditional bank loans. Whether you are a student or a young professional, Pocketly offers a simple, transparent way to access funds when you need them most.

- Quick and Flexible Loans: We provide small-ticket personal loans ranging from ₹1,000 to ₹25,000, perfect for handling those minor emergencies.

- Affordable Terms: Our interest rates are competitive, starting from 2% per month, with a transparent processing fee of 1-8%.

- Fully Digital Process: There is no need for physical paperwork. Our KYC process is entirely digital, ensuring you get your funds quickly and securely.

Tailored for You: Whether you are salaried or a student, our repayment options are flexible, allowing you to close your loan or pay in EMIs based on your capacity.

How to Apply for a Pocketly Loan:

- Download: Get the Pocketly app from the Google Play Store or Apple App Store.

- KYC: Complete the quick, paperless KYC process using your basic documents.

- Select: Choose the loan amount you need (up to ₹25,000).

- Disbursal: Once approved, the funds are transferred instantly to your bank account.

Conclusion

Practicing mindful spending is one of the most effective ways to improve your overall wellness in 2026. By understanding your emotional triggers and implementing simple techniques like the 48-hour rule, you can transform your relationship with money.

Financial freedom isn't about how much you earn; it's about how wisely you manage what you have. When you align your spending with your values, you eliminate stress and build a more secure future.

For those moments when life catches you off guard, remember that help is just a tap away.

Ready to take control of your finances? Download the Pocketly app today on [Android] or [iOS] and experience a smarter way to manage your money.

Frequently Asked Questions (FAQs)

1. What is the difference between mindful spending and being stingy?

Mindful spending is about choosing to spend on things that provide genuine value and joy, whereas being stingy is a fear-based avoidance of spending altogether. Mindfulness allows for enjoyment without the subsequent financial guilt.

2. How can mindful spending help reduce my stress?

It reduces stress by eliminating the uncertainty of where your money is going and preventing the "month-end crunch." Knowing you have enough for your needs and goals creates a sense of security and calm.

3. Is it okay to use a loan for a mindful purchase?

Loans should generally be reserved for essential needs or emergencies that you cannot immediately cover. While mindful spending reduces the need for credit, a small loan from a platform like Pocketly can be a responsible way to bridge an urgent gap.

4. How long does it take to build a mindful spending habit?

Most people start seeing a change in their mindset within 30 days of tracking their expenses. However, it usually takes about three months for these practices to become an effortless part of your daily routine.

5. Can I practice mindful spending even with a low income?

Yes, mindful spending is even more crucial on a limited budget. It ensures that every rupee you earn is used effectively, helping you prioritise essentials and save for a better financial future.