If you have ever worried about money before payday or struggled to cover an unexpected bill, you are not alone. Many young professionals and students in India face the same challenge of managing expenses, rent, and daily needs.

This is where expense automation helps you stay on top of your finances. Automated tools track, record, and analyse your spending in real time, giving you a clear view of your money flow. They simplify budgeting, prevent overspending, and help you make better financial decisions.

Whether it is improving your credit score, meeting emergency expenses, or maintaining a steady cash flow, automation saves time and reduces stress. With digital lending and personal finance apps becoming common, learning how expense automation works can help you build stronger money habits and move towards financial independence.

Key Takeaways

- Expense automation uses digital tools to track, categorise, and analyse your spending automatically.

- It saves time, improves accuracy, and gives real-time insights into your money flow.

- Automated tools reduce manual errors and simplify budgeting with intelligent alerts and reports.

- While it offers strong data security, users should still check app compliance with RBI/NPCI standards.

What Is Expense Automation?

Expense automation refers to the use of digital tools to automatically record and manage your spending. Instead of manually tracking expenses or saving paper receipts, you can use apps or software that handle it for you. It makes managing money easier and keeps your finances organised with little effort.

Expense automation gives you a clear, real-time picture of your income and expenses. You can monitor where your money goes, stay within budget, and plan your finances better.

For young professionals, freelancers, and students, automating expenses helps build financial discipline. It reduces the stress of managing monthly bills, prevents overspending, and promotes smarter financial decisions.

With digital finance becoming a part of everyday life, expense automation is no longer a luxury; it’s a convenient and practical step towards better money management and long-term financial stability.

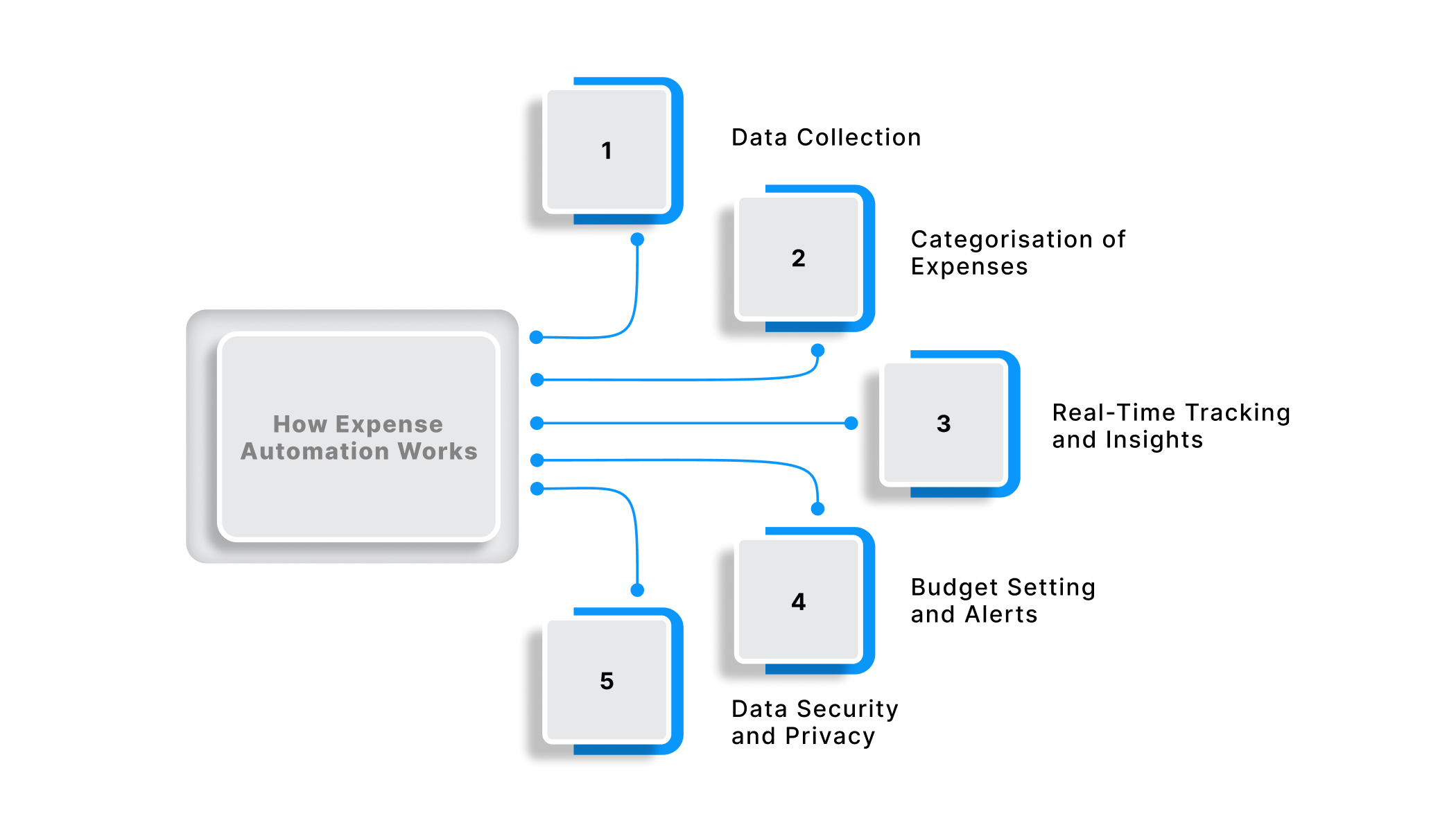

How Expense Automation Works

Expense automation works by combining secure digital technology and intelligent data processing to manage your financial transactions automatically. It eliminates the need to manually record expenses and gives you a clear picture of your spending in real time. This process allows you to maintain accuracy, stay organised, and make better financial decisions.

The working of expense automation can be understood through the following steps:

Data Collection

You begin by linking your bank accounts, UPI apps, or credit cards to the automation platform. Every transaction you make is captured securely and recorded in one place. This ensures that no expense goes unnoticed and that all your financial activities are updated instantly.

Categorisation of Expenses

Once the transactions are collected, the software automatically classifies them, such as rent, groceries, transport, or entertainment. It uses predefined rules and intelligent algorithms to recognise patterns in your spending. This helps you identify where most of your money is going and which areas require more control.

Real-Time Tracking and Insights

After categorising, the system tracks your expenses continuously and presents them in the form of reports or dashboards. You can view your monthly spending trends, identify unnecessary expenses, and compare them with your income. This real-time tracking gives you a clear sense of your financial health without having to check your accounts manually.

Budget Setting and Alerts

You can set specific budgets for different categories based on your income and needs. The system monitors your spending and notifies you when you are close to exceeding the set limit. These alerts help you adjust your spending habits before you go beyond your budget.

Data Security and Privacy

Expense automation tools follow strict data security measures to keep your financial information safe. They use encryption and authentication processes to prevent unauthorised access. You have full control over your data and can decide which accounts or cards to link.

Expense automation simplifies the entire process of managing money. It collects your data, organises it intelligently, and offers meaningful insights to guide your financial decisions. Over time, it helps you develop stronger money management habits and reduces the stress of handling multiple expenses manually.

Also read: 6 Simple Budgeting Tips for Better Money Management

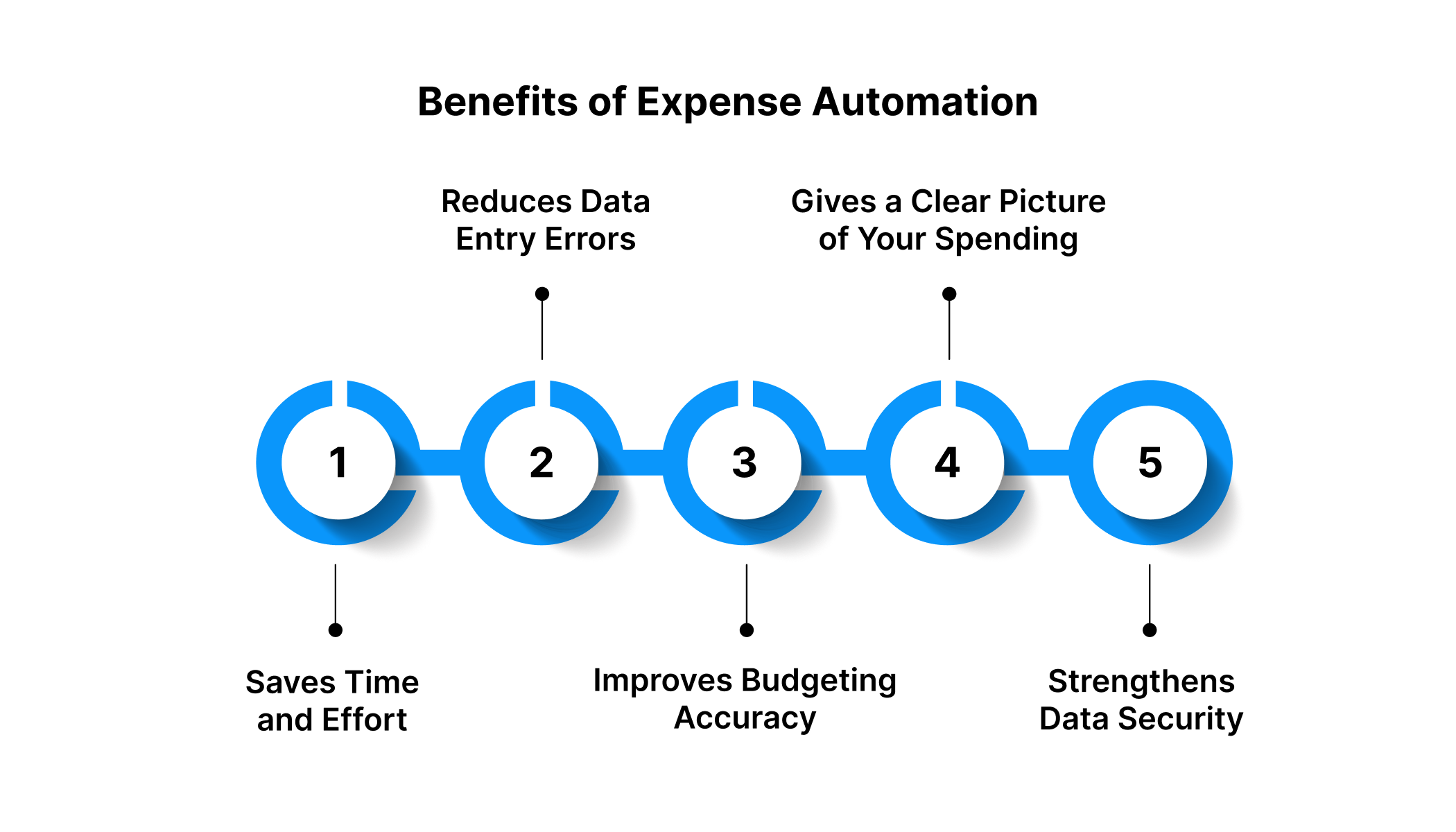

Benefits of Expense Automation

Expense automation goes beyond convenience; it’s about precision, consistency, and better control over your finances. By automating repetitive financial tasks, you save time, and gain deeper insights into your spending. Here’s how it helps you manage your money more effectively.

Saves Time and Effort

Manual tracking can be tedious, from recording expenses to reconciling receipts at the end of the month. With expense automation, all of this happens in the background.

- Every transaction is captured in real time.

- Reports and summaries are automatically generated.

- You don’t need to update or sort data manually.

This automation saves hours every month and helps you focus on actual financial decisions instead of administrative work.

Reduces Data Entry Errors

When done manually, even small entry mistakes can affect your financial accuracy. Expense automation eliminates these risks by syncing transactions directly from your accounts and digital payment platforms.

- Data is recorded and verified automatically.

- Classification errors are minimised.

According to a PwC India report (2023), automation can reduce financial reporting errors by up to 60%, improving both accuracy and trust in digital records.

Improves Budgeting Accuracy

Budgeting becomes simpler when your expenses are tracked and categorised automatically. You get an accurate view of how your money is distributed across essentials, subscriptions, and discretionary spending.

- You can set limits for each category.

- The system alerts you when you approach your budget threshold.

This helps you maintain financial discipline and plan your savings more strategically.

Gives a Clear Picture of Your Spending

Expense automation offers real-time visibility into your financial activity through dashboards and insights.

- You can view trends by week, month, or category.

- Spending patterns become easy to analyse.

With this level of transparency, you can identify unnecessary spending and adjust your habits before they affect your cash flow.

Strengthens Data Security

Expense automation tools follow advanced security standards to protect your information.

- They use encrypted data storage and secure authentication.

- Your financial details remain private and accessible only through authorised access.

Most fintech platforms in India comply with RBI guidelines on data protection, ensuring your transactions and records stay safe.

Expense automation transforms how you handle money. It saves time, improves accuracy, strengthens security, and gives you a clear view of your finances, helping you make smarter decisions every day.

Also Read: How to Make Money Online as a Student Without Investment.

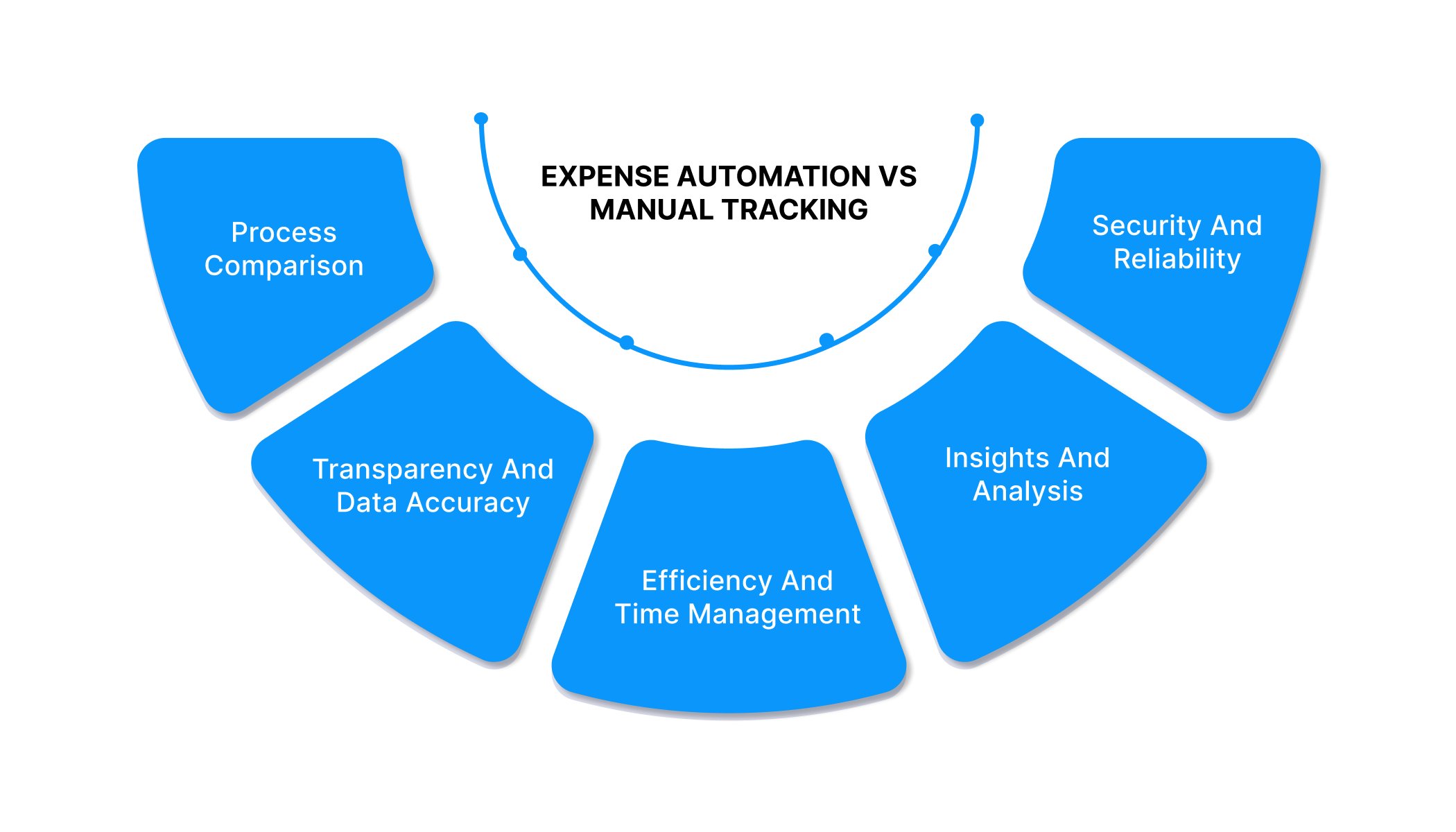

Expense Automation vs Manual Tracking

As digital finance becomes part of everyday life, managing expenses manually is becoming less practical. Spreadsheets, notes, and receipts might work for a while, but they can’t keep up with the volume and speed of today’s transactions. This is where expense automation offers a structured, efficient, and data-driven alternative.

Process Comparison

Manual Tracking:

- Involves manual entry of each transaction.

- Requires constant monitoring and updates.

- Increases the risk of human errors and missed entries.

Expense Automation:

- Syncs automatically with your bank accounts and UPI apps.

- Records, classifies, and updates transactions in real time.

- Generates expense summaries and visual insights without manual effort.

Automation simplifies what would otherwise be a repetitive and error-prone task. It helps you focus on decision-making instead of recording and tallying expenses.

Transparency and Data Accuracy

Manual tracking depends on discipline and consistency. Any delay or skipped entry can distort your monthly budget. Expense automation removes this uncertainty by maintaining accurate, real-time data. Every transaction is captured automatically, ensuring your financial records are complete and reliable.

Efficiency and Time Management

Manual methods require you to spend hours every month reconciling accounts or sorting receipts. Automated systems process the same data within seconds. You save time and can review your spending trends anytime, anywhere, through dashboards and summaries.

Insights and Analysis

Manual records can tell you what you spent, but not why or how often. Automation adds a layer of intelligence by analysing your patterns. It identifies recurring payments, shows seasonal trends, and even flags areas where you could reduce costs. This makes it easier to make informed, data-backed financial choices.

Security and Reliability

Paper records and offline spreadsheets can be misplaced or accessed by others. Automated expense tools, however, follow strict data security practices such as encryption and verification. Your information stays protected and accessible only through authorised accounts.

| Aspect | Manual Tracking | Expense Automation |

| Data Entry | Manual | Automated |

| Accuracy | Depends on user input | System-verified |

| Time Spent | High | Low |

| Insights | Limited | Analytical |

| Security | Basic | Encrypted |

Expense automation gives you control, clarity, and consistency, something manual tracking rarely achieves. It’s not just about recording transactions but about building a smarter, more transparent financial system that supports better money habits.

Also Read: Understanding the Basics of Financial Planning and Its Importance.

Challenges to Consider in Expense Automation

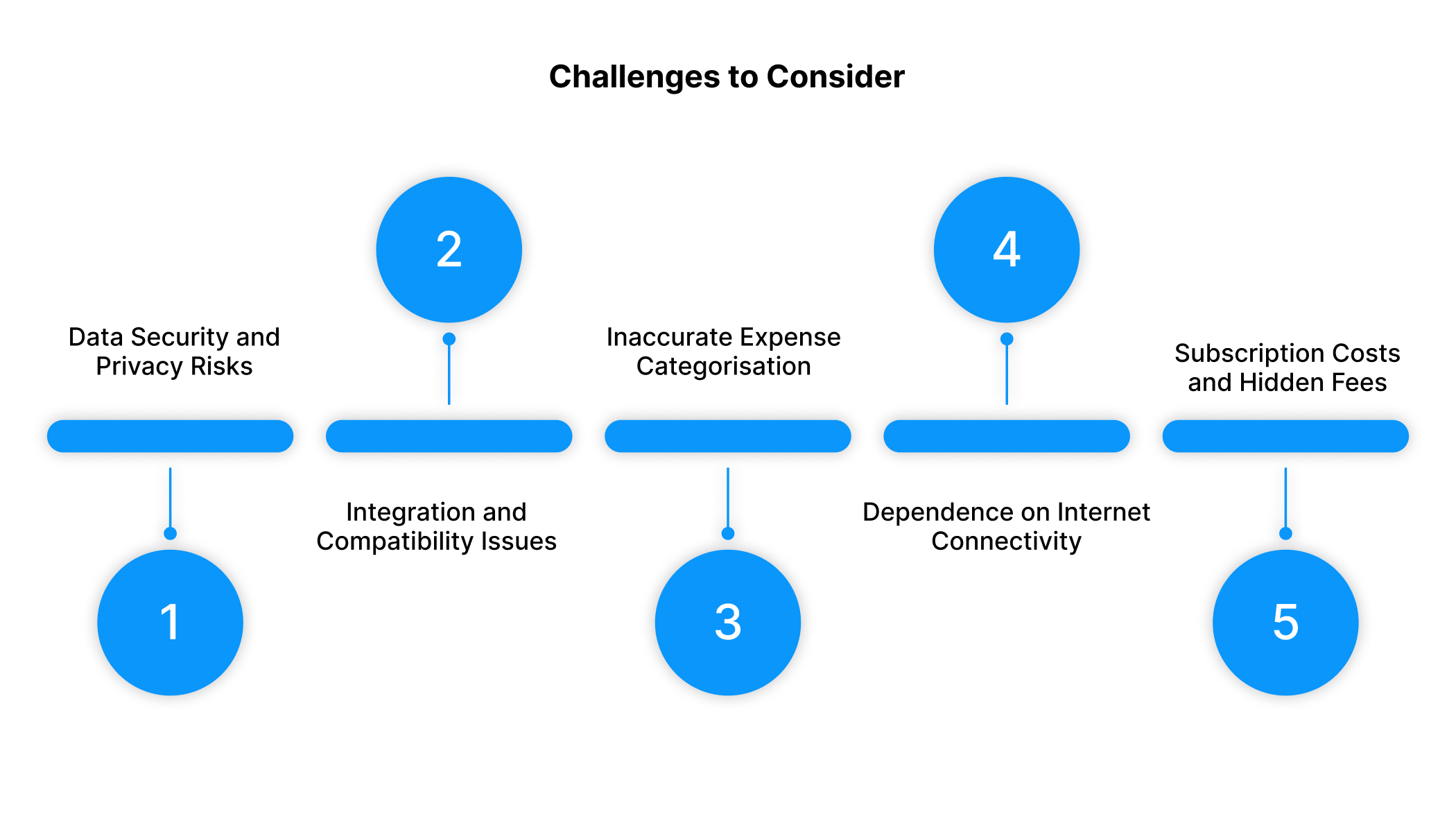

While expense automation simplifies the way you manage money, it also brings a few challenges that you should understand before fully relying on it. Knowing these limitations will help you use automation wisely and maintain control over your finances.

Data Security and Privacy Risks

When you link your bank accounts, UPI apps, or credit cards to an expense automation tool, your personal and financial data is stored digitally. If the platform does not follow strict security standards, your information may be at risk. Always check if the app uses data encryption and two-factor authentication. Choose tools that are compliant with RBI and NPCI guidelines to keep your financial information safe.

Integration and Compatibility Issues

Automation tools depend on APIs to connect with different banks and payment systems. Sometimes, these connections fail or update slowly, causing missing or duplicate entries. If you use multiple accounts or wallets, ensure that the app supports all of them. Checking compatibility before setup can help you avoid technical errors and data mismatches later.

Inaccurate Expense Categorisation

Automation tools classify transactions based on preset rules or algorithms. However, not all purchases are easy to identify. A payment for a work-related meal might be marked as entertainment, or a one-time transfer could be seen as recurring. Reviewing your expense categories regularly helps you correct such mistakes and keep your budget accurate.

Dependence on Internet Connectivity

Expense automation runs on real-time data sync and cloud storage. Without a stable internet connection, transactions may not update correctly, or reports may show outdated information. If you travel often or live in an area with poor connectivity, choose tools that offer offline tracking options to maintain accuracy.

Subscription Costs and Hidden Fees

Many automation platforms offer free basic versions but charge for premium features. These costs can add up if you are managing a tight monthly budget. Before subscribing, review what features you actually need and whether they justify the cost.

By understanding its technical and practical limitations, you can use it confidently and responsibly. When you choose a reliable platform and stay actively involved, automation becomes a helpful tool for achieving financial control and long-term stability.

How to Get Started with Expense Automation

Getting started with expense automation is simple when you follow a structured approach.

Assess Your Spending Habits

Begin by identifying where your money goes each month — rent, groceries, bills, or subscriptions. Review how you pay (UPI, cards, or cash) and note recurring expenses that can be tracked or reduced.

Choose the Right Automation Tool

Select a reliable platform that:

- Syncs securely with your bank or UPI accounts.

- Categorises expenses automatically.

- Offers real-time tracking and alerts.

- Complies with RBI or NPCI data protection standards.

This ensures accuracy, convenience, and financial transparency.

Link Accounts and Set Budgets

After setup, connect your accounts and:

- Create spending categories.

- Set monthly limits with alerts.

- Track reports regularly to stay within budget.

Review Weekly

Check for duplicate entries or incorrect categorisation. Adjust budgets based on spending trends to stay financially balanced.

Manage Short-Term Cash Needs with Pocketly

Even with automation, sudden expenses can arise. Pocketly is a digital lending app that helps you manage short-term cash gaps.

Pocketly features:

- Instant personal loans from ₹1,000 up to ₹25,000 (based on eligibility).

- 100% digital process with quick KYC.

- Fast disbursement and transparent interest rates (starting around 2% per month).

- No collateral required.

To apply:

- Download the Pocketly app or visit the website.

- Complete your digital KYC.

- Choose your loan amount.

- Receive approval and funds quickly.

Use Pocketly for emergency needs while relying on expense automation for long-term budgeting and control.

Conclusion

Managing your expenses wisely, tracking your spending, and setting clear budgets are all key to staying financially stable. Expense automation helps you do this effortlessly by recording your transactions, categorizing them, and giving you real-time insights into your money flow. It’s a smarter way to manage your finances, save time, and make informed financial decisions every day.

And if you ever find yourself short on cash before payday or need quick access to funds, Pocketly has you covered. With instant approvals and a 100% digital process, receiving a short-term personal loan is simple and stress-free.

Download the Pocketly app today to manage short-term needs easily while building long-term financial confidence with expense automation.

FAQs

1. Can expense automation tools help improve my credit score?

Yes. Expense automation helps you track due dates and spending patterns, making it easier to pay bills on time and avoid missed payments — two key factors that impact your credit score.

2. Are expense automation tools suitable for people with irregular income?

Absolutely. Freelancers or gig workers can benefit from automation as it helps track fluctuating earnings and irregular expenses. You can set flexible budgets and view income trends to plan better for months with lower income.

3. Do expense automation apps work with UPI and digital wallets in India?

Yes. Most modern expense automation tools integrate with UPI apps like Google Pay, PhonePe, and Paytm, along with digital wallets and net banking, allowing you to monitor all transactions in one place.

4. How often should I review my automated expense reports?

You should review your reports weekly or at least twice a month. Regular checks help identify incorrect categorisation, unusual expenses, or subscription charges you may have missed.