In 2025, choosing the right financing option could be the make-or-break decision for your business. Should you secure a loan with valuable assets like real estate, or opt for the flexibility of an unsecured loan? Both paths have distinct advantages, but also come with their own risks.

Business mortgages offer lower interest rates and longer repayment terms, but come with the potential loss of assets if repayment fails. Unsecured loans, although faster and easier to obtain, come with higher interest rates and stricter eligibility criteria. For businesses weighing these choices, understanding the nuances of each, especially how they align with growth strategies and cash flow, can make all the difference.

In fact, the unsecured business loans segment in India reached ₹9.7 trillion in FY 2025, growing at a compound annual growth rate (CAGR) of approximately 19.5%.

This blog explores the key differences between business mortgages and unsecured loans, helping you decide which option best suits your business’s needs and goals.

Key Takeaways

- Business mortgages offer lower interest rates, larger loan amounts, and longer repayment terms (up to 25 years). Requires property as collateral, but risks asset loss if repayments fail.

- Unsecured loans provide faster access to funds with no collateral required. Ideal for short-term needs, but with higher interest rates (10%-20%) and stricter eligibility criteria.

- Business mortgages are suitable for long-term investments, like property acquisition or facility expansion, and are best for businesses with stable cash flow.

- Unsecured loans are better for working capital, inventory purchases, or addressing immediate financial gaps without risking valuable assets.

- Evaluate your business’s cash flow and asset availability to choose between a business mortgage (for long-term investment) or an unsecured loan (for working capital or short-term expenses).

What is a Business Mortgage Loan?

A business mortgage loan is a type of secured loan designed for businesses to finance the purchase, improvement, or expansion of real estate. In exchange for funding, the business offers property or land as collateral, which the lender can seize if the loan is not repaid. This security makes business mortgages less risky for lenders, allowing businesses to access larger amounts of capital.

Interest rates on business mortgages are lower than those on unsecured loans due to the collateral involved, and repayment terms are often extended, ranging from 10 to 25 years. The combination of favourable rates and long repayment terms makes them an attractive option for businesses looking to invest in long-term assets.

Here are the common uses for a business mortgage loan:

- Real Estate Acquisition: Purchasing commercial property.

- Renovation: Upgrading or improving existing properties.

- Refinancing: Replacing an existing mortgage for better terms.

- Debt Consolidation: Combining high-interest debts into one loan.

- Long-Term Investment: Funding high-value, long-term assets.

Each of these uses allows businesses to invest in property while benefiting from the long-term capital available through a mortgage loan.

What is an Unsecured Business Loan?

An unsecured business loan is a type of loan that does not require any collateral, such as property or assets, to secure the borrowed amount. Instead, the lender relies on the business's creditworthiness and financial history to determine eligibility. Since there is no collateral backing the loan, the interest rates on unsecured loans are higher compared to secured loans.

These loans are ideal for businesses that need quick access to capital but don't have assets to pledge. One of the key benefits of unsecured loans is their speed and ease of approval, with many lenders offering instant personal loans for businesses in urgent need of funds.

Here are common uses of unsecured business loans:

- Working Capital: Covering day-to-day operating expenses.

- Inventory Purchase: Financing the purchase of inventory or supplies.

- Cash Flow Management: Bridging temporary gaps in cash flow.

- Emergency Expenses: Addressing unforeseen business expenses.

- Refinancing High-Interest Debt: Paying off expensive short-term debts.

With both loan types defined, the critical differences become apparent when examined side by side. These distinctions often determine which option aligns better with specific business circumstances and financial goals.

Comparing Business Mortgage vs Unsecured Business Loans

When considering financing options for business growth, it is crucial to understand the distinctions between Business Mortgage Loans and unsecured business loans. Each of these loan types is suited to different business needs.

Business Mortgage Loans are secured by real estate or other valuable assets, offering lower interest rates and longer repayment terms. In contrast, Unsecured Business Loans do not require collateral, providing quicker access to funds but often at higher interest rates and shorter terms.

Here is a brief comparison:

| Feature | Business Mortgage Loan | Unsecured Business Loan |

| Collateral Requirement | Yes (e.g., real estate, equipment) | No |

| Interest Rates | Lower (typically 7%–9% per annum) | Higher (typically 10%–20% per annum) |

| Loan Amount | Larger (up to ₹5 crore or more) | Smaller (up to ₹50 lakh) |

| Repayment Term | Longer (up to 25 years) | Shorter (1–5 years) |

| Approval Time | Longer (weeks to months) | Faster (days to weeks) |

| Credit Score Impact | May have less stringent requirements | Higher credit score required |

| Risk to Borrower | Risk of asset seizure upon default | No asset risk; personal guarantee may be required |

| Uses | Real estate acquisition, facility expansion, long-term investments | Working capital, inventory purchase, and short-term expenses |

This comparison reveals the trade-offs inherent in each option, but understanding the complete picture requires examining both the advantages and potential drawbacks of secured financing.

What are the Pros and Cons of Business Mortgage Loans?

Business mortgage loans, also known as commercial mortgages, offer businesses a way to use real estate as collateral to access funding. These loans are secured by the business’s property, which offers several advantages, but also comes with risks that must be weighed before making a decision.

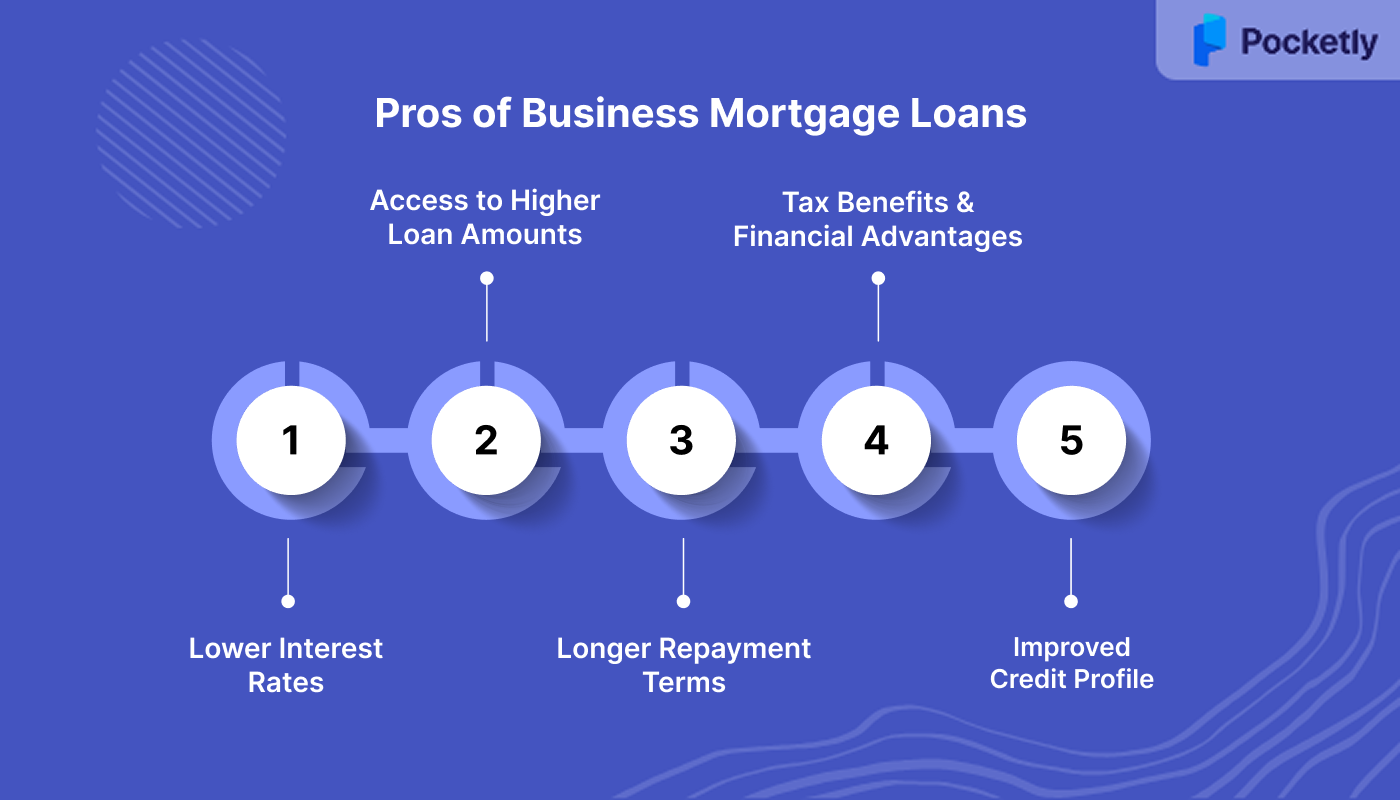

Pros of Business Mortgage Loans

1. Lower Interest Rates: Business mortgage loans offer much lower interest rates compared to unsecured business loans, ranging from 7.15% to 18% in India, depending on the lender and borrower profile.

For example, major banks like HDFC, Axis Bank, and ICICI provide commercial property loan rates starting from 8% to 12%. The lower interest rate reduces the total cost of borrowing, especially for large loans, saving businesses substantial amounts over the loan tenure.

2. Access to Higher Loan Amounts: Since business mortgage loans are secured by property, they allow businesses to access much higher loan amounts compared to unsecured alternatives. Businesses can secure loans of ₹5-25 crores, depending on the property value and their credentials.

3. Longer Repayment Terms: Business mortgage loans offer longer repayment periods ranging from 5 to 20 years. This extended tenure results in lower monthly EMI payments, easing the cash flow burden on businesses. The predictable payment structure helps with better financial planning and budgeting.

4. Tax Benefits and Financial Advantages: Interest payments on business mortgage loans are tax-deductible under Section 24 of the Income Tax Act, providing businesses with considerable tax savings. Additionally, businesses can claim depreciation on the mortgaged property, further reducing their taxable income.

5. Improved Credit Profile and Business Credibility: Regular and timely mortgage payments help businesses build a positive credit history, which can improve their creditworthiness for future financing needs. Property ownership also adds to the business’s credibility, making it more attractive to suppliers, partners, and financial institutions.

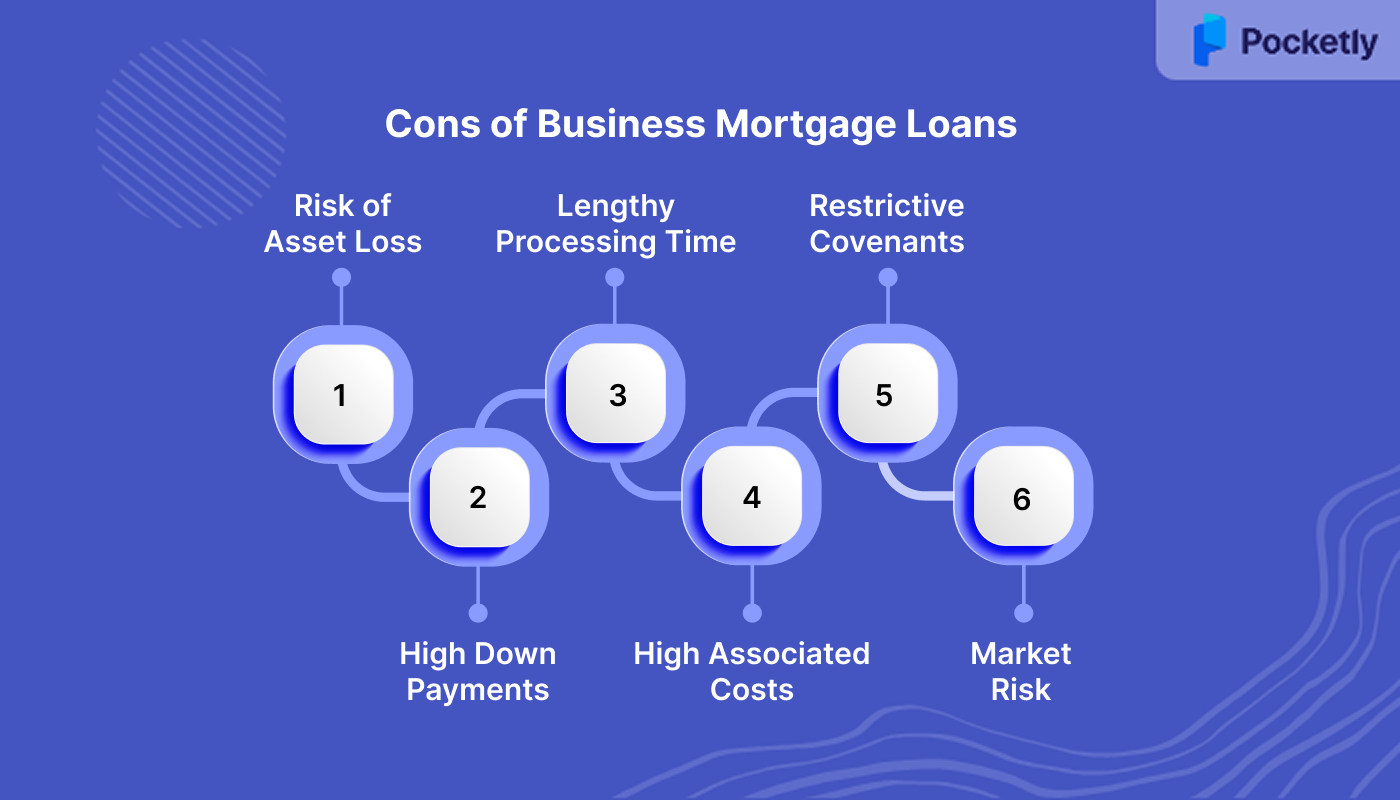

Cons of Business Mortgage Loans

1. Risk of Asset Loss: Failure to repay can result in losing the property used as collateral.

2. High Down Payments: Typically require 20-40% of the property value upfront, which can strain cash flow.

3. Lengthy Processing Time: Mortgage approval can take 15-30 days due to extensive documentation and legal checks.

4. High Associated Costs: Processing fees, legal costs, and property assessments can add up to ₹3-5 lakhs.

5. Restrictive Covenants: Agreements may impose usage restrictions on the property, limiting operational flexibility.

6. Market Risk: Fluctuations in property value can lead to negative equity, complicating refinancing options.

What are the Pros and Cons of Unsecured Business Loans?

Unsecured business loans have become a popular financing option for self-employed individuals, entrepreneurs, startups, MSMEs, and service-based businesses that lack substantial assets to pledge as collateral.

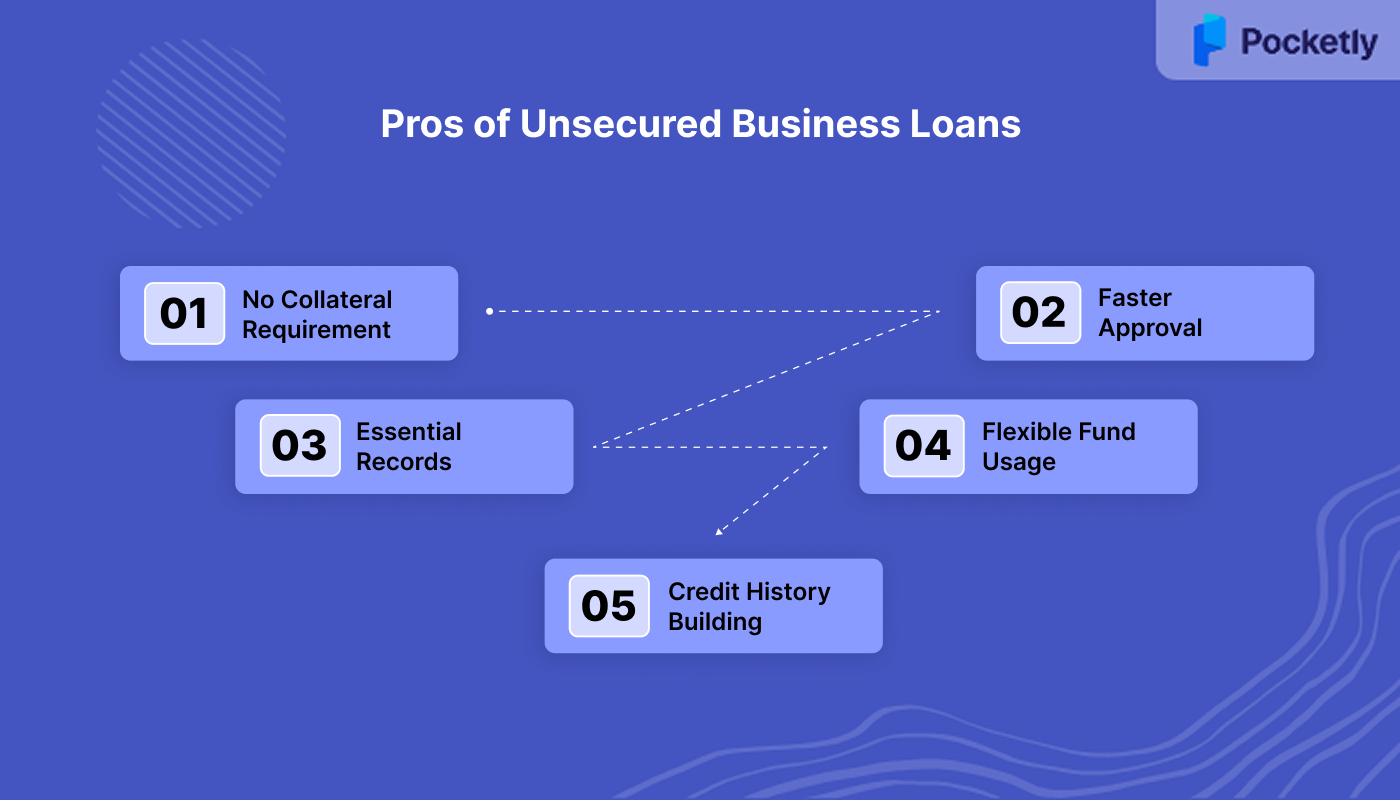

Pros of Unsecured Business Loans

- No Collateral Requirement and Asset Protection: One of the benefits of unsecured business loans is the lack of collateral requirement. This feature eliminates the risk of losing valuable assets, thus making it highly attractive for startups and service-based businesses that operate without significant physical assets.

- Faster Approval and Disbursal Process: Unsecured business loans offer much faster approval times compared to secured loans. Many lenders, including fintech platforms and NBFCs, provide loan approvals within 24-48 hours, which is crucial for businesses needing quick access to capital.

- Minimal Documentation Requirements: The documentation process for unsecured loans is far simpler, requiring basic financial statements, bank statements, and KYC documents. Unlike secured loans, which require property valuations, NOCs, and legal clearances, unsecured loans demand minimal paperwork.

- Flexible Fund Usage Without Restrictions: Unsecured loans provide complete flexibility in fund utilisation, allowing business owners to use the capital for any purpose, whether it's working capital, inventory purchases, marketing campaigns, or expansion projects.

- Credit History Building Opportunity: For new businesses or those with limited credit histories, unsecured loans offer an opportunity to build a solid credit profile. Timely repayments can help improve CIBIL scores, enhancing eligibility for future financing at better terms and larger loan amounts.

Cons of Unsecured Business Loans

- Higher Interest Rates: Interest rates range from 13% to 35%, significantly higher than secured loans, increasing the overall borrowing cost.

- Limited Loan Amounts: Typically, unsecured loans offer smaller amounts (₹5 lakh to ₹30 lakh), which may not meet the needs of businesses requiring large capital.

- Stringent Credit and Eligibility Requirements: Lenders require high credit scores (700-750) and a solid business history, limiting access for new or struggling businesses.

- Shorter Repayment Terms: Repayment terms are shorter (1-5 years), resulting in higher monthly EMIs and cash flow pressure.

- Personal Guarantee Risk: Many lenders require personal guarantees, exposing personal assets to risk in case of default.

- Severe Default Consequences: Defaulting can lead to legal actions, penalties, and damage to both business and personal credit scores.

- Risk of Over-Leveraging: Easy access to funds can lead to over-borrowing, creating an unsustainable debt burden.

- Limited Customer Service: Many lenders offer automated services with limited personal support, complicating loan adjustments or negotiations.

These pros and cons highlight the complexity of business financing decisions. However, it is important for successful entrepreneurs to evaluate how different loan types align with their specific circumstances and business objectives.

Choose the Right Loan for Your Business

Selecting the right loan is crucial for your business’s growth and stability. Understanding whether an unsecured loan or a business mortgage is more appropriate for your needs can make all the difference in terms of financial flexibility and long-term success.

Here’s why the choice matters with examples:

- Unsecured Business Loans: An unsecured business loan allows a business to borrow without collateral. For example, a business owner could secure a ₹10 lakh loan based on strong cash flow and creditworthiness, with an interest rate of 12% and a 3-year repayment term. This type of loan is ideal for short-term needs, like working capital or equipment purchases, without the risk of losing assets.

- Business Mortgage Loan: A business mortgage loan covers up to 80% of a property’s value. For example, if a commercial property is valued at ₹5 crore, the business can secure a ₹4 crore loan. The loan might come with an interest rate of 9% and a 15-year repayment term. This option is perfect for businesses looking to purchase property, providing long-term stability and the opportunity to build equity as property values rise.

Also Read: What is an Unsecured Installment Loan and How It Works

These examples highlight how important it is to match loan types with specific business needs and circumstances. For entrepreneurs seeking quick, collateral-free financing solutions, modern digital platforms have emerged to bridge this gap efficiently.

Pocketly: Your Trusted Partner for Quick and Easy Unsecured Loans

Pocketly is a leading digital lending platform designed to provide quick, hassle-free unsecured loans for self-employed individuals and businesses. Whether you're dealing with an emergency or planning for a business expansion, Pocketly offers fast access to funds without the need for collateral. Through a simple, user-friendly app, you can apply for a personal loan, get approval within minutes, and have the funds transferred directly to your account.

Key Features:

- Loan Amounts: Access flexible loans ranging from ₹1,000 to ₹25,000 based on your needs.

- Interest Rate: Competitive interest rate of just 2% per month.

- Processing Fee: Transparent processing fee ranging from 1% to 8%, based on loan amount and tenure.

- Fast Approval and Disbursal: Get loan approval within 24–48 hours and have funds transferred directly to your bank account.

- No Collateral Required: Apply without the need for collateral, keeping your assets safe.

- Minimal Documentation: Simple KYC process with minimal paperwork for a hassle-free experience.

- Flexible Repayment Terms: Choose a loan repayment mode and plan that best fits your financial situation.

Conclusion

Choosing the right loan for your business is crucial to aligning with your growth strategy and financial goals. Business mortgage loans are ideal for long-term investments, particularly when significant capital is required for property acquisition or large-scale expansion, and businesses can leverage valuable assets as collateral.

On the other hand, unsecured business loans offer quick access to funds with no collateral requirement, making them a suitable option for short-term needs, working capital, and businesses with limited assets. By understanding the key differences and carefully evaluating your business’s specific needs, you can make an informed decision on the loan type that best suits your objectives.

Pocketly offers quick, collateral-free loans for immediate financial needs with flexible repayment terms. Download now on iOS or Android to access fast, hassle-free funding.

FAQs

1. How many types of unsecured loans are there?

Unsecured loans come in various forms, including personal loans, business loans, credit cards, and payday loans. These loans do not require collateral and are typically offered based on the borrower's creditworthiness and financial history.

2. Can I pay off an unsecured loan early?

Yes, most unsecured loans allow early repayment without penalties. Paying off a loan early can help reduce the overall interest paid, but it's important to check the loan terms for any prepayment clauses.

3. What is a good interest rate on a business loan?

A good interest rate on a business loan typically ranges from 7% to 10% for secured loans, and 10% to 20% for unsecured loans. The rate will depend on the loan type, the business's credit profile, and the lender's terms.

4. What does APR mean?

APR stands for Annual Percentage Rate and represents the total cost of borrowing on a yearly basis, including both the interest rate and any associated fees. It provides a clearer picture of the loan’s true cost.

What is the difference between the interest rate and the mortgage rate?

The interest rate is the percentage charged by a lender for borrowing money, while the mortgage rate specifically refers to the interest rate applied to loans secured by real estate. The mortgage rate can vary based on the type of property and loan term.