Introduction

Are you running out of cash at the end of the month, waiting in long bank queues, or struggling to find an ATM for urgent withdrawals? Well, you are not alone. These are common frustrations for students and young professionals. Managing money can often feel stressful when your financial needs don’t align with the slow pace of traditional banking.

This is where mobile banking changes the game. With just a smartphone, you can check your balance, pay bills, transfer money, or even set savings goals and all of this within seconds. No paperwork. No waiting. No hassle.

For young Indians learning to manage finances independently, the importance of mobile banking lies in the freedom and control it offers. It’s not just about convenience; it’s about having reliable access to your money anytime, anywhere.

In this blog, we’ll dive into why mobile banking matters and explore the key benefits that make it essential for today’s generation.

At a Glance

- Mobile banking allows you to access your accounts, transfer funds, pay bills, and track expenses at any time, from anywhere.

- Key features include 24/7 accessibility, user-friendly apps, security with OTPs/biometrics, real-time alerts, and a wide range of services.

- Benefits include convenience, instant access to money, improved expense tracking, enhanced security, financial inclusion, and cost savings.

- Challenges such as cybersecurity risks, poor internet connectivity, technical glitches, and transaction limits exist, but they can be mitigated through safe practices.

- Smart usage tips include downloading only official apps, keeping devices secure, monitoring transactions, and keeping backup options.

What is Mobile Banking?

Mobile banking refers to the use of a smartphone or tablet to access banking services and manage money digitally. Instead of visiting a physical branch or relying on cash, you can use your bank’s mobile app to handle financial transactions quickly and securely.

With mobile banking, everyday activities such as checking your balance, transferring money, paying bills, recharging your phone, or even setting up savings plans can be done in just a few taps.

In simple terms, mobile banking turns your phone into a mini bank branch that is available 24/7, no matter where you are. For students, this means paying fees or splitting expenses with friends without any hassle.

For salaried professionals, it ensures timely payment of EMIs and bills. For self-employed individuals, it streamlines business transactions and helps maintain a steady cash flow without delays.

Knowing the basics is only the first step. What makes mobile banking powerful is the diverse range of services it offers to meet everyday financial needs.

Must Read: Understanding the Importance of Financial Education

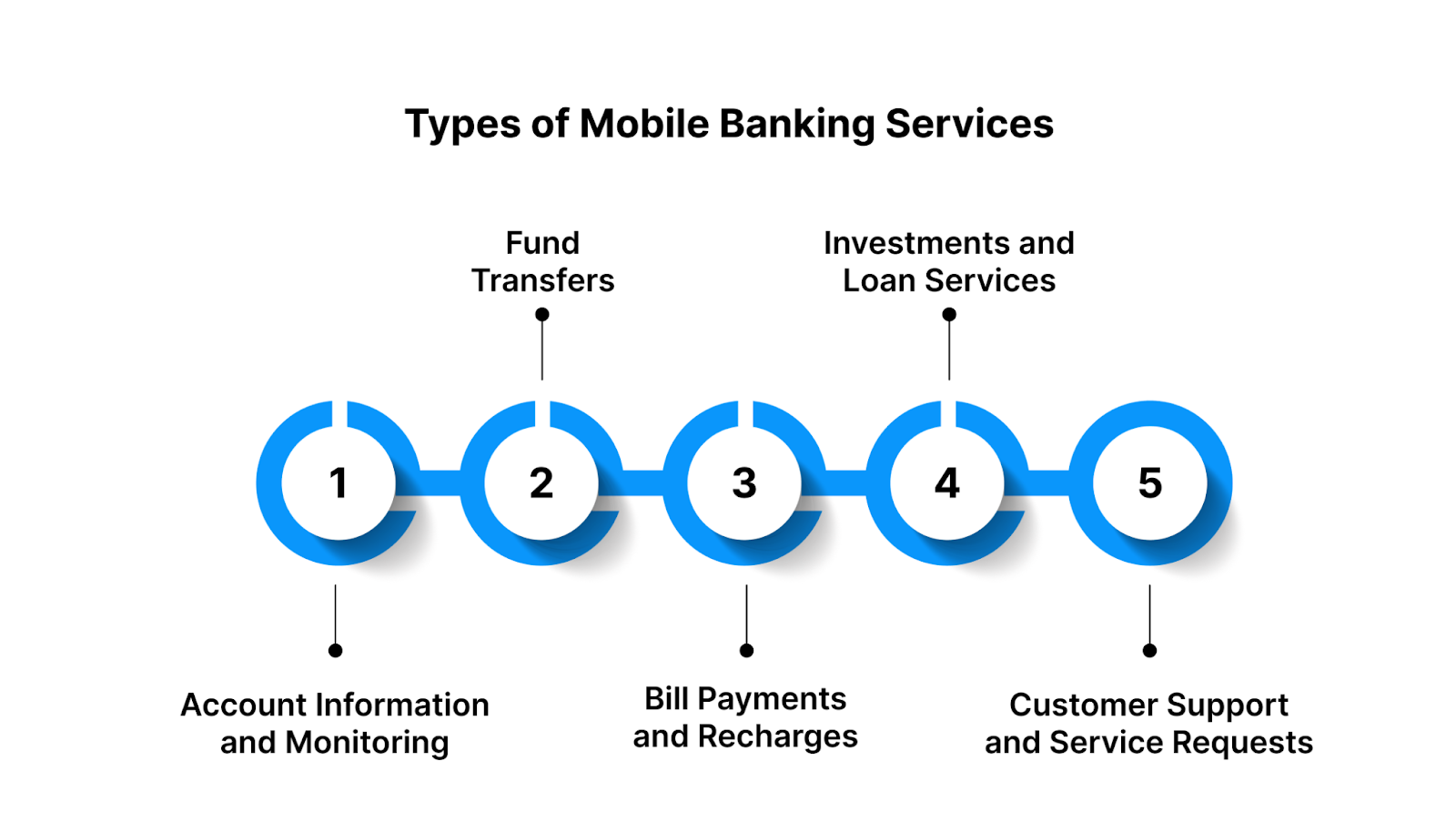

Types of Mobile Banking Services

Mobile banking provides a range of services that simplify, expedite, and enhance the handling of money.

Here are the main types:

1. Account Information and Monitoring

One of the most basic yet essential services of mobile banking is the ability to access account information at any time. Through a mobile banking app, users can check real-time balances, review recent transactions, and download mini statements.

For students or young professionals who need to track every rupee, this feature makes it easier to manage expenses, identify spending patterns, and avoid overdrawing their accounts.

2. Fund Transfers

Mobile banking has simplified the process of sending and receiving money. With options like IMPS, NEFT, RTGS, and UPI, funds can be transferred instantly between accounts, whether within the same bank or to other banks.

This convenience is beneficial when paying rent, covering shared expenses with friends, or receiving payments for freelance work. The speed and flexibility of these transfers eliminate the need to visit a branch or ATM.

3. Bill Payments and Recharges

Another popular service is the ability to pay bills and recharge accounts directly through the app. Users can pay electricity, water, internet, and other utility bills without standing in queues or visiting payment centres.

Mobile banking also supports mobile phone recharges and DTH recharges, making it easy to stay connected. For students and busy professionals, this service reduces the risk of missing due dates and incurring late payment penalties.

4. Investments and Loan Services

Beyond day-to-day transactions, mobile banking also supports long-term financial planning. Many banks allow users to open fixed deposits or recurring deposits through their mobile apps without visiting a branch.

Some platforms even provide access to mutual fund SIPs and other investment options. Mobile banking apps also enable users to apply for loans or manage their existing EMIs digitally. This feature ensures financial planning and borrowing remain simple and accessible.

5. Customer Support and Service Requests

Mobile banking also makes it easier to access customer service. Users can block or replace lost debit and credit cards instantly, request cheque books, update personal information, or raise complaints directly through the app.

With the addition of chatbots and 24/7 live chat support, customer assistance is faster and more accessible than ever, giving users peace of mind during emergencies.

Now that you’ve seen the services available, it’s essential to explore the unique features that make mobile banking so user-friendly and reliable.

Must Read: How to Start Building Credit at The Age of 18

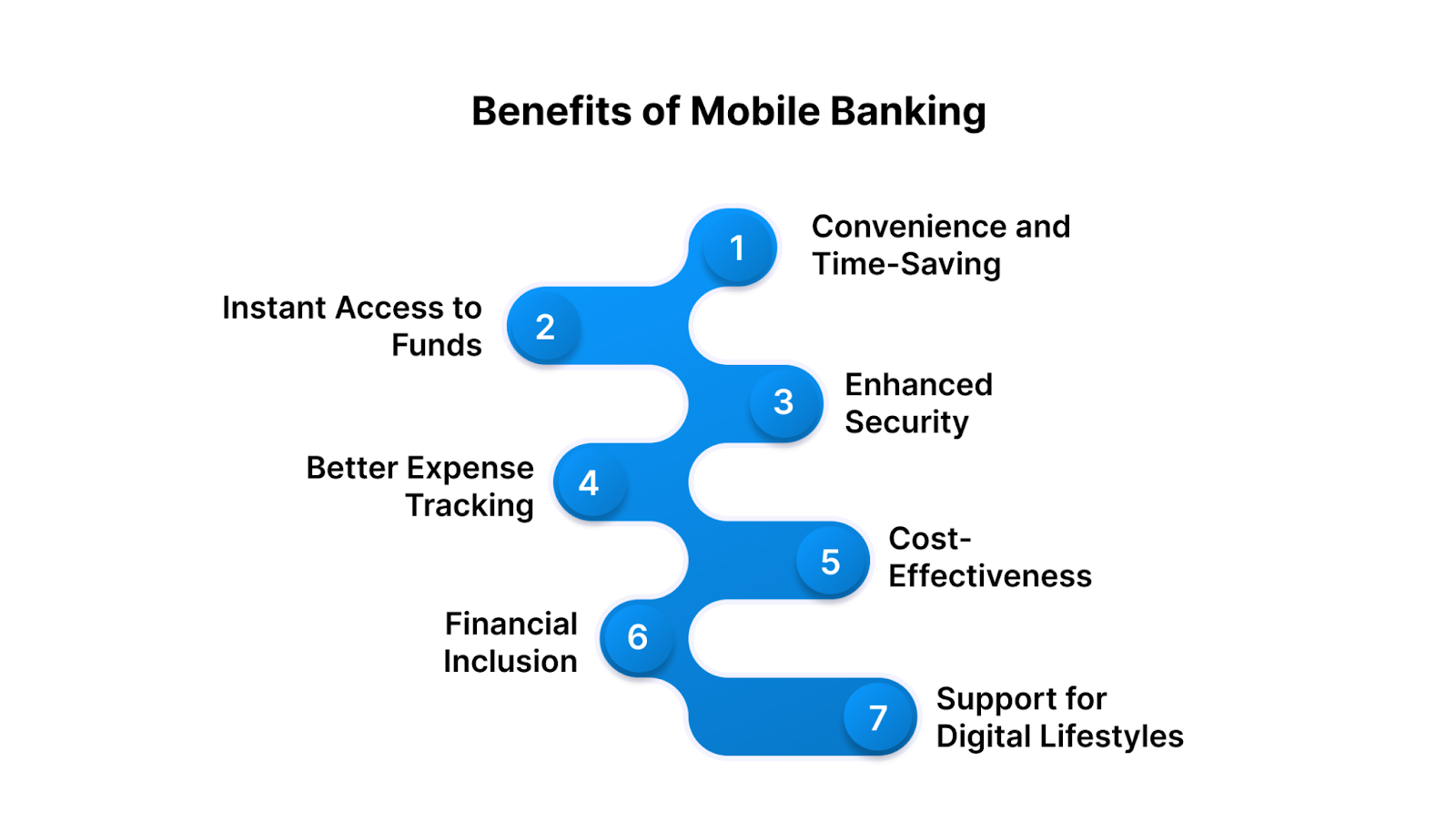

Benefits of Mobile Banking

Mobile banking can completely change the way you manage your money. From saving time to improving security, the benefits are wide-ranging and especially valuable for students, young professionals, and self-employed individuals.

1. Convenience and Time-Saving

Mobile banking eliminates the need to visit a physical branch for basic tasks. You can transfer money, pay bills, or check balances within seconds. For busy professionals or students with packed schedules, this flexibility saves valuable time.

2. Instant Access to Funds

Whether you’re paying rent, sending money to a friend, or recharging your phone, mobile banking gives you immediate access to your funds. The ability to perform transactions in real-time ensures you’re never stuck during urgent financial needs.

3. Enhanced Security

Mobile banking apps offer multiple layers of protection, including PINs, OTPs, biometrics, and encryption. This reduces the risk of theft or fraud compared to carrying large amounts of cash. Real-time alerts also help detect suspicious activity quickly.

4. Better Expense Tracking

Every transaction made through mobile banking is recorded in your app or bank statement. This makes it easier to track where your money goes, plan monthly budgets, and avoid overspending. For young earners learning financial discipline, this is a huge advantage.

5. Cost-Effectiveness

Most mobile banking services come at little to no extra cost. You can avoid paying for demand drafts, cheque processing, or even bank transport, which makes mobile banking a cost-efficient alternative.

6. Financial Inclusion

Mobile banking has widened access to financial services, particularly in areas where physical branches are limited. With just a smartphone and internet connection, anyone can open accounts, make transfers, and access essential banking facilities.

7. Support for Digital Lifestyles

For students and professionals who prefer digital-first solutions, mobile banking integrates seamlessly with UPI, wallets, and online payment systems, providing a convenient and secure experience. It supports the shift towards a cashless economy and builds confidence in handling money digitally.

Of course, no system is perfect. Alongside the benefits, mobile banking comes with specific challenges that you should be aware of.

Must Read: Digital Wallet Benefits and Features Explained

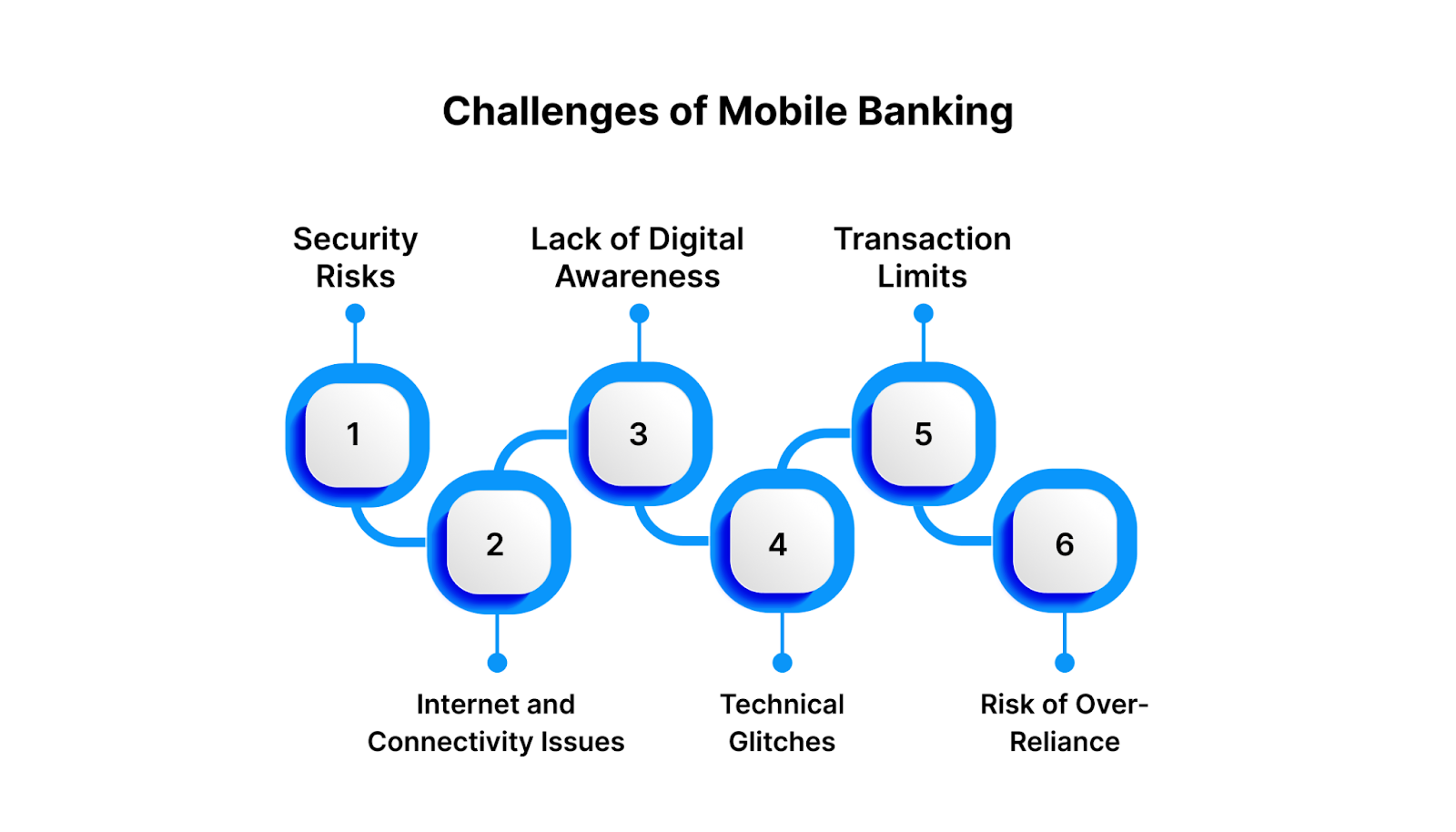

Challenges of Mobile Banking

While mobile banking offers speed, convenience, and flexibility, it also comes with its share of challenges. Being aware of these helps users take precautions and manage risks more effectively.

1. Security Risks

Even though mobile banking apps use encryption and PINs, risks such as phishing attacks, fake apps, or careless handling of passwords and OTPs can expose users to fraud. Students and first-time users are especially vulnerable if they are not cautious.

2. Internet and Connectivity Issues

Mobile banking depends on stable internet access. In rural areas or during network outages, transactions may fail or get delayed, which can be frustrating when payments are urgent.

3. Lack of Digital Awareness

Not everyone is comfortable using mobile apps for financial transactions. Limited awareness or poor digital literacy can lead to mistakes, such as sending money to the wrong account or falling for scams.

4. Technical Glitches and Failed Transactions

Sometimes payments do not go through due to server downtime or technical errors. While banks usually resolve such issues within a few days, users may feel anxious if money is deducted but not received on the other end.

5. Transaction Limits

Banks and apps often set daily transaction limits for security reasons. While this protects accounts, it can be inconvenient for users needing to transfer larger sums for emergencies or major expenses.

6. Risk of Over-Reliance

With the convenience of mobile banking, some users might neglect other aspects of money management, such as maintaining cash reserves for emergencies. Relying solely on mobile platforms can create problems when technical or connectivity issues occur.

The good news is that most of these challenges can be managed with a few innovative practices. Let’s explore some tips for using mobile banking safely and effectively.

Must Read: Direct Payday Loans for Bad Credit with No Brokers

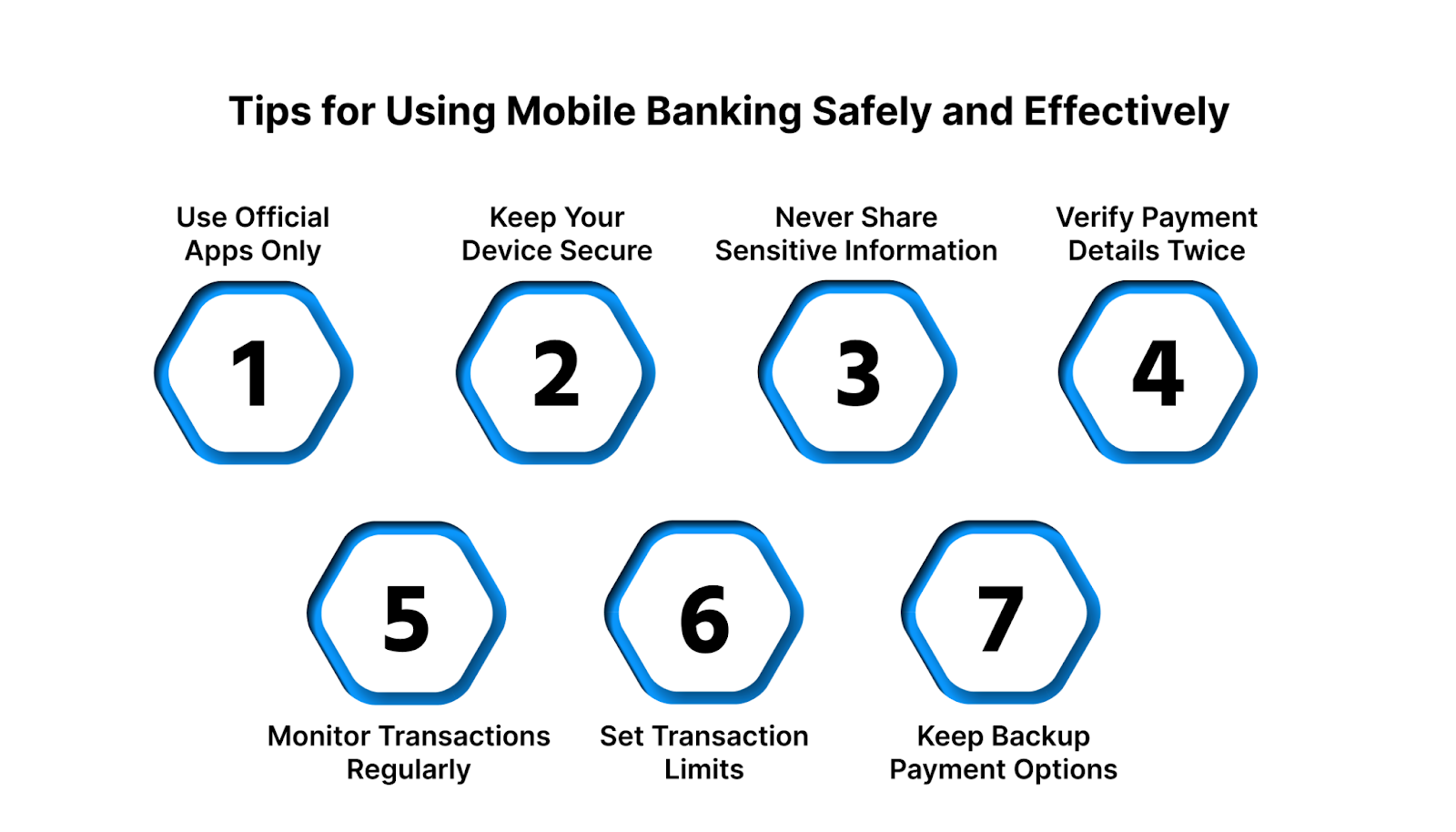

Tips for Using Mobile Banking Safely and Effectively

Mobile banking is convenient and powerful, but using it wisely ensures you stay safe and make the most of its features. Here are some practical tips to follow:

1. Use Official Apps Only

Always download banking apps from trusted sources such as the Google Play Store or the Apple App Store. Avoid third-party links or unknown websites, as fake apps are often used for fraud.

2. Keep Your Device Secure

Set up strong passwords, use fingerprint or face recognition where possible, and keep your phone’s operating system up to date. This reduces the risk of malware or unauthorised access.

3. Never Share Sensitive Information

Your bank will never ask for your PIN, OTP, or password over phone calls, emails, or messages. Treat these details like your ATM card. These should be private and non-shareable.

4. Verify Payment Details Twice

Before confirming a transaction, double-check the recipient’s name and account details. A small mistake could result in money being sent to the wrong person, and recovering it can be challenging.

5. Monitor Transactions Regularly

Check your account activity frequently through the app or SMS alerts. If you notice any suspicious activity, report it to your bank immediately.

6. Set Transaction Limits

Most mobile banking apps allow you to set daily or per-transaction limits. Keeping these limits modest reduces potential losses if your account is ever compromised.

7. Keep Backup Payment Options

While mobile banking is reliable, it’s smart to keep a debit card, small cash, or a secondary payment app handy. This ensures you’re not stranded if the system is temporarily down.

While mobile banking covers most financial needs, there are moments when expenses exceed your budget. This is where Pocketly steps in as an innovative backup solution.

Pocketly: Making Mobile Banking Even Smarter

While mobile banking makes it easy to manage money digitally, there are times when even the best-planned budget falls short, such as when unexpected expenses like exam fees, rent, or medical bills arise. This is where Pocketly steps in as an intelligent companion to your mobile banking experience.

Instant, Small-Ticket Loans

Pocketly offers short-term personal loans ranging from ₹1,000 to ₹25,000. These small, flexible amounts ensure you borrow only what you need, helping you avoid unnecessary debt.

100% Digital, No Collateral

The application process is simple, paperless, and entirely online. With a quick KYC check, approvals are fast, and there is no need to pledge property or valuables as collateral.

Quick Disbursal to Your Bank Account

Once approved, funds are transferred instantly to your bank account. You can then use UPI, debit cards, or net banking through your mobile banking app, giving you immediate access to money when it matters most.

Transparent and Fair Costs

Pocketly keeps things clear and upfront. Interest rates start at 2% per month, with processing fees ranging between 1% and 8%. There are no hidden charges, so you always know exactly what you are paying.

Helping You Build Credit Early

Timely repayments made through digital channels are reported to credit bureaus, enabling students and young professionals to establish a positive credit history from the outset of their financial journey.

With Pocketly, you gain access to funds in emergencies and build confidence in managing your money digitally and responsibly.

Conclusion

Mobile banking has transformed the way people manage their finances, offering convenience, speed, and control that traditional banking often struggles to match.

From paying bills and tracking expenses to sending money instantly, it empowers students, young professionals, and self-employed individuals to stay on top of their finances. However, it also comes with challenges such as security risks, transaction limits, and technical issues, which make using it wisely all the more crucial.

With instant, collateral-free loans starting at just ₹1,000, a fully digital process, and flexible repayments, Pocketly gives you the safety net you need while also helping you build good credit habits.

Take control of your finances today. Download the Pocketly app on iOS or Android and manage unexpected expenses with ease.

FAQs

Q1. What is mobile banking in simple words?

Mobile banking is using your smartphone to access banking services, such as checking balances, transferring money, paying bills, or applying for loans, without visiting a branch.

Q2. Why is mobile banking important for students and young professionals?

It saves time, helps track expenses, and provides instant access to funds, making it easier to manage daily finances and emergencies on the go.

Q3. Is mobile banking safe to use?

Yes, mobile banking apps use PINs, OTPs, encryption, and biometrics to secure transactions. As long as you use official apps and refrain from sharing sensitive information, it is generally safe.

Q4. What are the main benefits of mobile banking?

Convenience, instant fund transfers, better financial tracking, enhanced security, and cost-effectiveness are the most significant benefits of mobile banking.

Q5. How can Pocketly support mobile banking users?

Pocketly provides instant, collateral-free loans from ₹1,000 to ₹25,000, which are directly transferred to your bank account. This means you can use UPI, cards, or net banking for urgent expenses while also building your credit profile.