Young professionals and students in India often struggle when banks reject loan applications due to limited credit history or rigid criteria. You may need quick funds for education, medical emergencies, or month-end gaps, but formal banking processes are slow and document-heavy.

This financial exclusion can leave you stuck or pushed toward costly options. That is why understanding India’s diverse NBFC landscape can help you access faster, more flexible financial solutions. This blog will guide you through the different types of NBFCs and the best options for your short-term needs.

In short:

- NBFCs operate under a four-tier Scale-Based Regulation framework introduced by RBI in 2021, categorizing institutions from Base Layer to Top Layer based on asset size and systemic importance.

- India has multiple NBFC types serving different needs: NBFC-ICC for loans and asset financing, NBFC-MFI for microfinance, IFC for infrastructure projects, NBFC-Factors for working capital, and NBFC-P2P for peer lending

- Specialized NBFC categories such as Microfinance Institutions, Infrastructure Finance Companies, and NBFC-Factors serve distinct market segments with tailored financial products.

- RBI's 2024-25 regulations require enhanced disclosure norms, Key Fact Statements with APR details, and stricter compliance to protect borrowers from hidden charges

- Digital lending platforms like Pocketly partner with registered NBFCs to provide collateral-free personal loans from ₹1,000 to ₹25,000 with interest rates starting at 2% per month

What is an NBFC and Why Does It Matter?

A Non-Banking Financial Company provides banking-like services without holding a banking licence. These institutions offer loans, credit facilities, and investments, but cannot accept demand deposits that can be withdrawn on demand.

While banks follow rigid protocols and lengthy approval processes, NBFCs typically offer faster turnaround times and more flexible eligibility criteria. This makes them particularly valuable when you face month-end cash crunches or need immediate funds for personal emergencies.

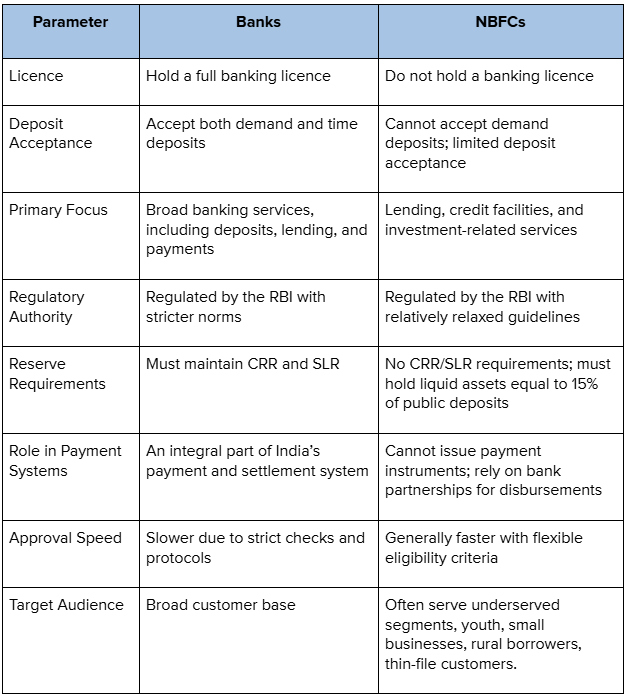

Here’s how NBFCs are different than banks:

When you need quick funds without tedious paperwork, digital lending apps backed by registered NBFCs offer a fast, reliable alternative. Pocketly, for example, partners with RBI-regulated NBFCs to provide instant personal loans from ₹1,000 to ₹25,000 with minimal documentation.

Now that you know what NBFCs are and how they differ from banks, let’s look at the regulatory system that keeps them safe, stable, and trustworthy.

Also Read: Understanding How Non-Banking Financial Companies Work

RBI’s Scale-Based Regulation (SBR) Framework for NBFCs

The Reserve Bank of India introduced the Scale-Based Regulation framework in October 2021, fundamentally transforming how NBFCs are categorized and supervised. This framework became effective on October 1, 2022.

The Four-Tier Regulatory Structure is:

- Base Layer (NBFC-BL): Covers non-deposit-taking NBFCs with assets below ₹1,000 crore. These pose minimal systemic risk, so RBI keeps regulations lighter and more flexible.

- Middle Layer (NBFC-ML): Includes all deposit-taking NBFCs and large non-deposit-taking ones with assets over ₹1,000 crore. These must follow stricter capital rules and enhanced disclosures.

- Upper Layer (NBFC-UL): Handpicked by RBI based on size and risk indicators. As of 2024–25, 15 major players like Bajaj Finance, LIC Housing Finance, Tata Capital, and Muthoot Finance fall here. They follow near-bank-level regulations.

- Top Layer (NBFC-TL): A precautionary tier that stays empty unless RBI identifies an NBFC posing exceptionally high risk. If activated, this layer would face the tightest controls.

RBI’s SBR framework ensures stronger oversight for bigger players while giving smaller NBFCs room to innovate, striking the perfect balance between safety and growth.

With these regulatory foundations in place, let's examine the specific types of NBFCs serving different market segments.

Also Read: Quick NBFC Personal Loans for People with Bad Credit Score in India

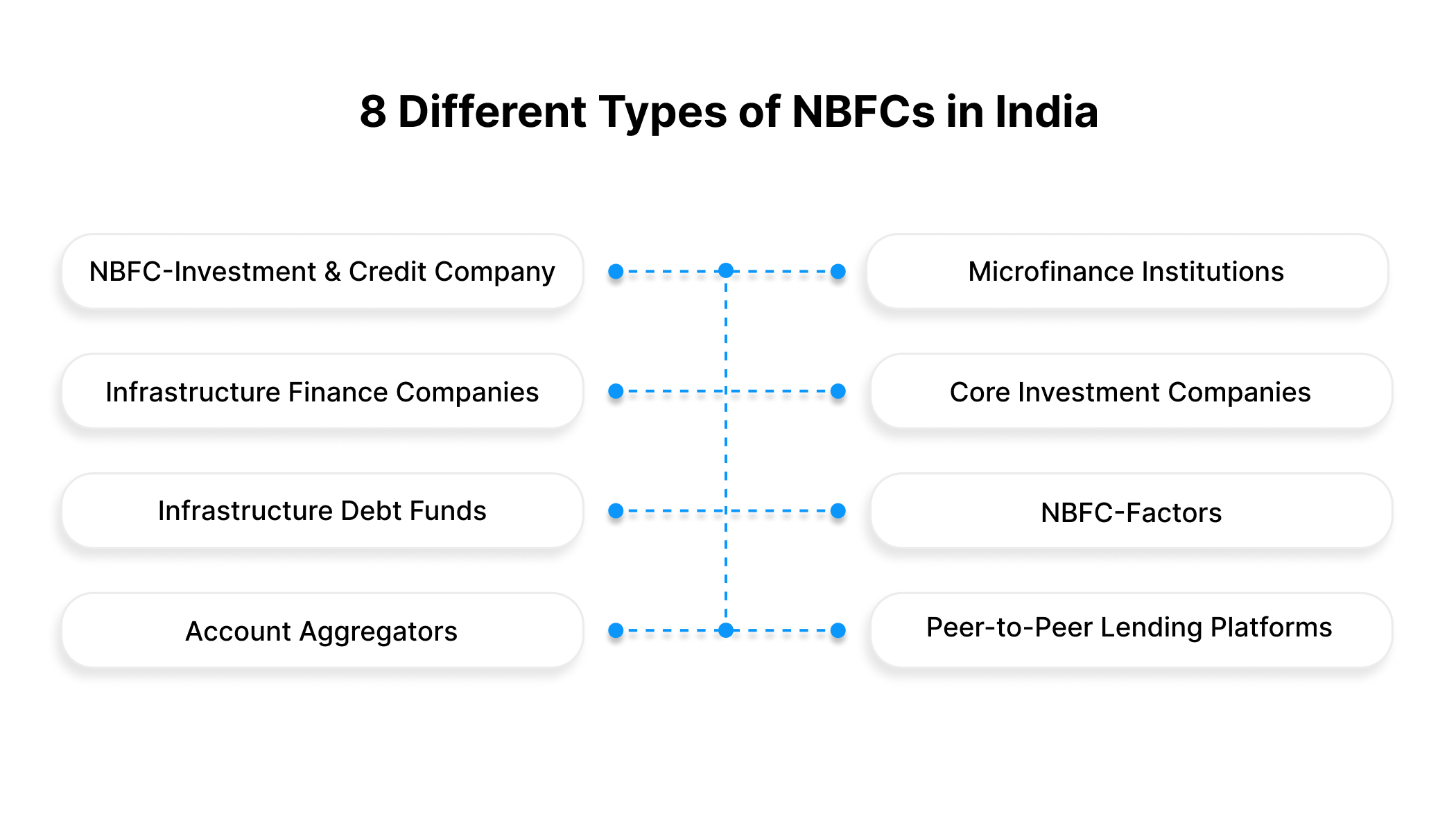

8 Different Types of NBFCs in India

India's NBFC sector comprises numerous specialized categories, each designed to serve specific financial needs.

1. NBFC-Investment and Credit Company (NBFC-ICC)

The NBFC-ICC category represents a major consolidation that took effect in October 2022. RBI merged three previously separate categories into this single classification.

This unified category encompasses:

- Asset financing for physical assets like automobiles, tractors, and industrial machinery

- Providing loans and advances for various activities

- Acquiring securities such as stocks, bonds, and debentures

Under the revised framework, NBFC-ICCs must derive at least 50% of their total income and maintain at least 50% of their total assets in financial activities. The merger allows institutions to engage in all three activities under a single regulatory framework, adapting their business models to market opportunities.

2. Microfinance Institutions (NBFC-MFI)

NBFC-MFIs extend financial services to economically disadvantaged segments, particularly in rural and semi-urban areas.

- To qualify as an NBFC-MFI, institutions must maintain at least 85% of their assets as qualifying microfinance loans.

- These loans target households with annual income not exceeding ₹3 lakh in rural areas or ₹4 lakh in urban areas.

- Loan amounts are capped at ₹3 lakh per borrower, ensuring resources reach genuinely underserved segments.

- Regulatory norms mandate that NBFC-MFIs charge reasonable interest rates and avoid exploitative practices.

RBI has established pricing guidelines protecting vulnerable borrowers from predatory lending.

3. Infrastructure Finance Companies (IFC)

IFCs specialize in funding large-scale infrastructure projects, including roads, bridges, ports, airports, and power plants.

- To operate as an IFC, institutions must deploy at least 75% of their total assets in infrastructure loans.

- They must maintain a minimum Net Owned Fund of ₹300 crore, hold a credit rating of 'A' or higher, and maintain a Capital to Risk-Weighted Assets Ratio of 15%.

These stringent requirements reflect the long-term nature and higher risk profile of infrastructure financing.

4. Core Investment Companies (CIC-ND-SI)

Core Investment Companies function as holding companies that primarily invest in group companies' equity and debt securities.

- They must hold at least 90% of their total assets as investments in group company securities, with at least 60% in equity shares.

- To qualify as systemically important, CICs must have assets of ₹100 crore or more and accept public funds.

The regulatory framework now exempts smaller CICs from registration requirements if they don't access public funds.

5. Infrastructure Debt Funds (IDF-NBFC)

IDF-NBFCs facilitate long-term debt financing for infrastructure projects by issuing bonds with a minimum five-year maturity.

Only existing Infrastructure Finance Companies can sponsor IDF-NBFCs, ensuring promoters possess deep expertise in evaluating infrastructure risks.

6. NBFC-Factors

NBFC-Factors engage in factoring business, purchasing accounts receivable from businesses at a discount and collecting payment from debtors. This service improves working capital for suppliers who would otherwise wait 30-90 days for customer payments.

To qualify, institutions must maintain at least 50% of their total assets and gross income in factoring business with minimum net-owned funds of ₹5 crore.

7. Account Aggregators (NBFC-AA)

Account Aggregators collect and provide financial information from various sources based on explicit user authorization. This innovation particularly benefits young professionals with limited credit history by consolidating data showing regular salary credits, investment patterns, and responsible financial behavior.

8. Peer-to-Peer Lending Platforms (NBFC-P2P)

NBFC-P2P platforms connect individual lenders with borrowers through digital marketplaces. RBI regulations cap individual exposure limits, with borrowers unable to raise more than ₹10 lakh across all P2P platforms and lenders unable to deploy more than ₹50 lakh total.

Understanding NBFC categories helps you choose the right lender for fast personal loans. For example, platforms like Pocketly, owned by RBI-registered NBFCs, offer quick, compliant, collateral-free loans, often approved and disbursed within hours.

Understanding NBFC types is important, but staying updated on regulatory changes helps you make informed borrowing decisions.

Latest RBI Updates and What They Mean for Borrowers

RBI continues refining NBFC regulations to balance financial stability, consumer protection, and sectoral growth. Several recent updates directly impact your borrowing experience.

Enhanced Loan Disclosure Requirements

RBI now requires NBFCs to reveal every loan-related charge before disbursement, ensuring full transparency.

What’s changed:

- All fees, processing charges, prepayment fees, late penalties, and others must be disclosed upfront.

- Lenders must issue a Key Fact Statement (KFS) summarizing the loan’s total cost.

- The Annual Percentage Rate (APR) must be clearly stated, reflecting every fee beyond the interest rate.

What this means for you:

- You can compare loan offers accurately.

- No more surprises from hidden charges.

Risk Weight Changes for Consumer Credit

In November 2023, the RBI raised risk weights on unsecured consumer credit from 100% to 125%, excluding categories like home, vehicle, education, gold, and microfinance loans.

Why this matters:

- NBFCs may now assess your repayment capacity more carefully.

- A strong credit score and stable income become even more crucial for quick approval.

Upper Layer NBFC List Updated

RBI released its updated list of 15 NBFCs classified in the Upper Layer for 2024-25, including Bajaj Finance, LIC Housing Finance, Tata Capital, Aditya Birla Finance, and Muthoot Finance.

- These institutions face enhanced regulatory requirements, including stricter governance norms and higher capital adequacy standards.

- The Upper Layer classification remains in effect for at least five years, even if an institution's metrics subsequently fall below threshold criteria, ensuring regulatory stability.

When unexpected expenses arise and you need immediate access to small-ticket loans, Pocketly can leverage these regulatory developments to provide transparent, accessible financial solutions.

By partnering with RBI-regulated NBFCs, Pocketly offers loans with clear disclosure of interest rates starting at 2% per month and processing fees of 1-8% of the loan amount, eliminating surprises that often accompany traditional borrowing.

These regulatory updates shape how NBFCs serve customers, but the real value lies in how platforms apply these frameworks to solve your financial challenges.

Also Read: Can Paying Bills Help Build a Credit Score?

How Pocketly Addresses Your Short-Term Financial Needs

Managing finances as a young professional or student comes with unique challenges that traditional financial institutions often fail to address adequately.

Pocketly is built for young professionals, students, and self-employed individuals who often face unexpected expenses and cash-flow gaps that traditional lenders don’t move fast enough to solve.

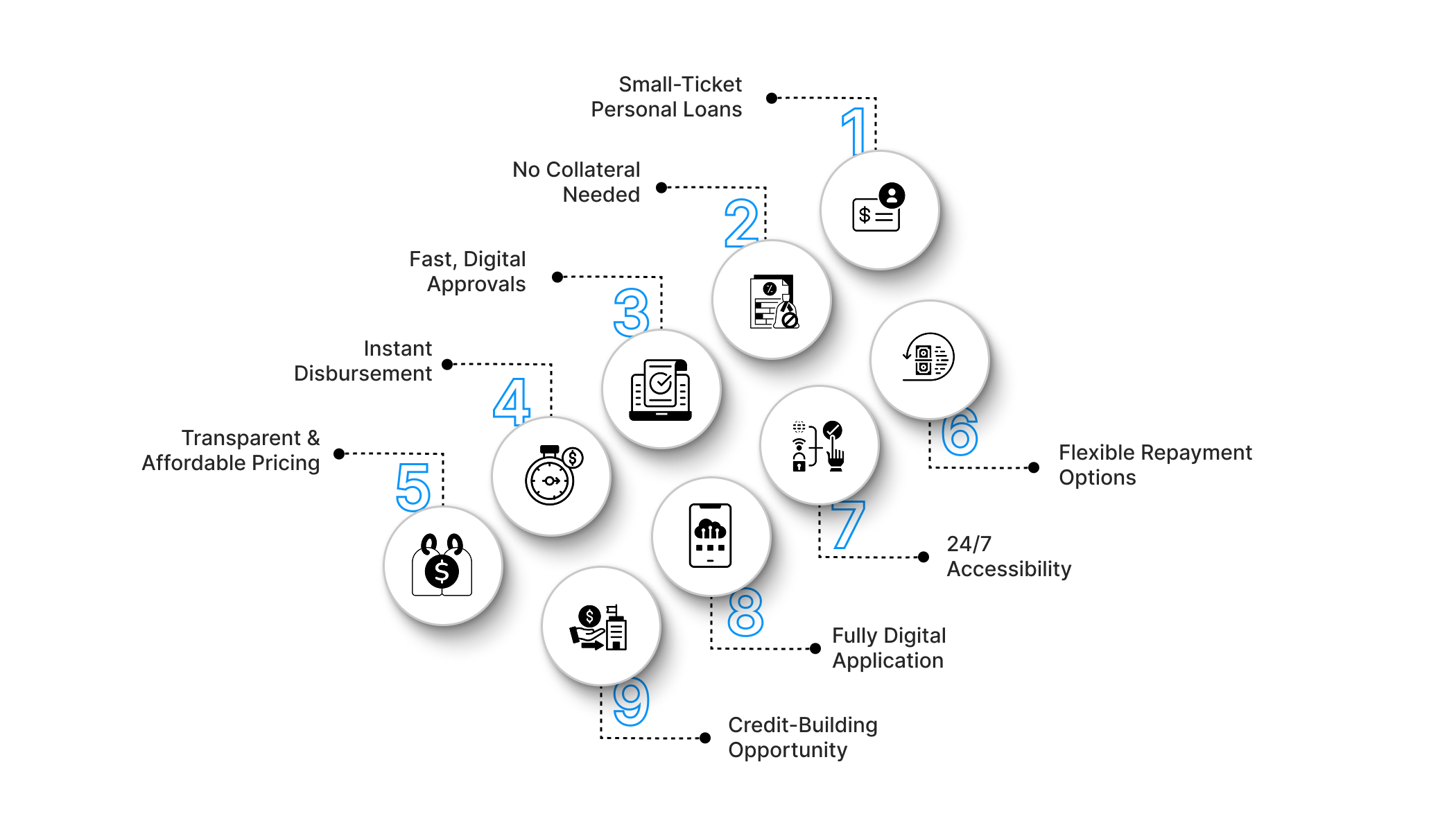

We offer:

- Small-Ticket Personal Loans (₹1,000–₹25,000): Borrow exactly what you need without getting trapped in long-term debt.

- No Collateral Needed: Access funds without pledging assets or finding guarantors.

- Fast, Digital Approvals: Automated verification and credit checks ensure quick decisions within minutes.

- Instant Disbursement: Once approved, funds are transferred directly to your bank account.

- Transparent & Affordable Pricing: Interest rates starting at 2% per month and processing fees between 1% and 8%, with no hidden charges.

- Flexible Repayment Options: Make partial prepayments or close your loan early without penalties.

- 24/7 Accessibility: Apply anytime, even during financial emergencies that don’t wait for business hours.

- Fully Digital Application: Aadhaar-based KYC, zero physical paperwork, and a frictionless process from start to finish.

- Credit-Building Opportunity: Timely repayments help young borrowers build or improve their credit score, enabling access to bigger loans in the future.

By combining the regulatory strength of RBI-registered NBFC partners with a fully digital, user-friendly platform, Pocketly offers a smarter, faster way to access short-term credit, right when you need it.

Conclusion

India’s evolving NBFC landscape, shaped by the RBI’s Scale-Based Regulation framework, offers specialized lending options when traditional banks fall short.

For young professionals and students dealing with cash crunches or sudden expenses, Pocketly bridges the gap. By partnering with RBI-registered NBFCs, this digital lending platform delivers quick, small-ticket loans with full regulatory assurance and zero traditional friction.

Ready to experience hassle-free lending designed for your needs? Download the Pocketly app now on iOS and Android and access instant personal loans from ₹1,000 to ₹25,000 with no collateral, transparent pricing, and flexible repayment options.

Frequently Asked Questions

1. Can NBFCs report my loan to credit bureaus and affect my CIBIL score?

Yes. NBFCs report all loans to bureaus like CIBIL, Experian, Equifax, and CRIF. Timely repayments improve your score, while missed EMIs hurt it—just as they would with bank loans.

2. What happens if an NBFC shuts down or surrenders its license while I still have a loan?

Your loan remains valid. The NBFC must either transfer your loan to another regulated NBFC or continue servicing it during the wind-down. You must keep paying EMIs to avoid default.

3. Are NBFC deposits covered under DICGC insurance like bank deposits?

No. DICGC does not insure NBFC deposits. This makes them riskier than bank deposits, so always check the NBFC’s credit rating and financial stability before investing.

4. Can I borrow from multiple NBFCs, and will it affect my creditworthiness?

Yes, you can. But each loan inquiry shows up on your credit report, and too many applications signal high credit risk. Multiple loans also increase your debt load, affecting future approvals.

5. How do NBFC-P2P platforms differ from traditional NBFCs, and which is better for borrowing?

P2P NBFCs match borrowers with individual lenders, while traditional NBFCs lend their own funds. P2P loans often have competitive rates but smaller limits. For small-ticket loans under ₹25,000, digital lending apps partnered with NBFCs usually offer the fastest and most reliable option.