Balancing spending and saving has become one of the most important money decisions for young earners today. In 2025, a growing number of people are prioritising savings over unnecessary spending, and the data shows this shift clearly. A recent MarketWatch-YouGov poll found that 72% of respondents said they would be happier if they saved or invested more money rather than spending more, reflecting a widespread desire for financial security and control.

Despite this preference, many still struggle to strike the right balance. Easy digital payments, lifestyle expectations, and unpredictable expenses often make spending feel necessary, while saving can seem abstract and distant. This tension between spend and save is not just about numbers; it affects how you feel about money, your financial stress, and your confidence in achieving financial goals.

In this guide, you will learn what spend vs save really means in everyday life, why it often feels difficult to manage, and how to find a practical balance that works for your income and lifestyle without feeling restricted.

Key Takeaways

- Spend vs save balance is about intention, not choosing between present enjoyment and future security.

- Most people struggle with balance due to frictionless digital spending, irregular expenses, and inflexible budgeting assumptions.

- Overspending leads to cash stress and reliance on short-term credit, while over-saving can cause burnout and rebound spending.

- Popular frameworks like the 50/30/20 rule work best as flexible guides, not rigid rules.

- A sustainable balance starts with separating fixed expenses from flexible spending and setting savings upfront.

- Short-term expenses are a major disruptor when they are not planned for separately from monthly budgets.

- Treating temporary needs differently from lifestyle spending helps protect long-term savings progress.

- Tools like Pocketly can support responsible handling of short-term cash gaps without breaking a spend vs save system.

- Consistent habits, clear boundaries, and regular reviews matter more than perfect monthly execution.

- The most effective spend vs save systems adapt to real-life conditions instead of ideal scenarios.

What Does Spend vs Save Really Mean

Spend vs save is not a debate about choosing enjoyment today or security tomorrow. It is about how intentionally you decide where your money goes. In real life, both spending and saving happen at the same time, but problems arise when neither has a defined role.

Spending covers everything that supports your current life. This includes essentials like rent, groceries, transport, and bills, as well as lifestyle choices such as eating out, subscriptions, travel, and personal purchases. Saving, on the other hand, is about setting aside money for future needs, whether that is emergencies, planned goals, or financial stability over time.

The challenge is that spending decisions are often immediate and visible, while saving feels delayed and less tangible. Without clear boundaries, money meant for savings slowly gets absorbed into everyday spending. This is why many people feel they are earning enough but still unable to build savings consistently.

Understanding spend vs save means recognising that balance is not fixed. It changes with income, responsibilities, and life stage. A healthy approach allows you to spend without guilt and save without feeling restricted, as long as both are planned and protected. When spending has limits and saving has priority, money decisions become clearer and less stressful.

Why Balancing Spending and Saving Is So Difficult Today

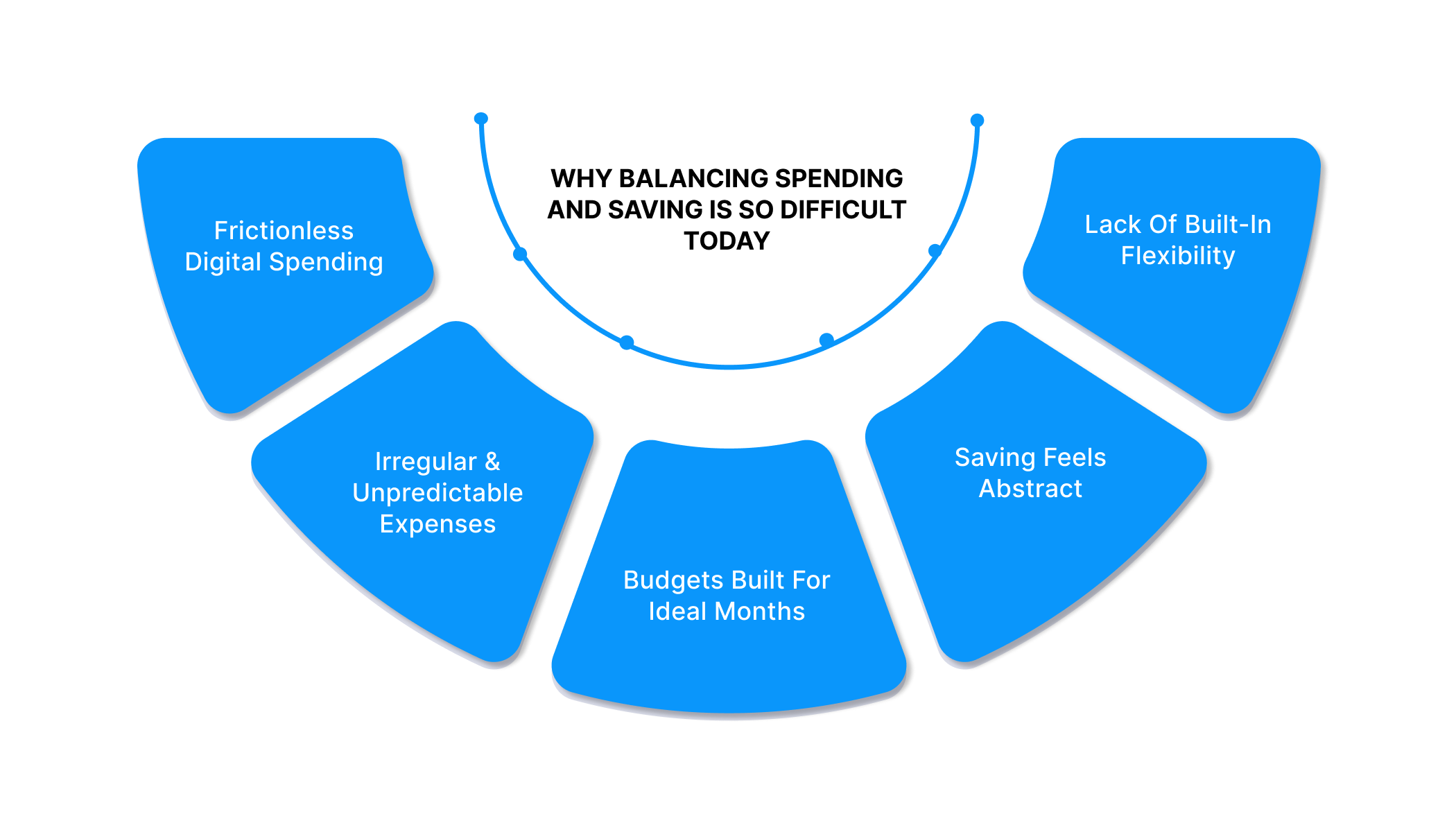

Balancing spending and saving is challenging because money decisions now happen quickly and often without reflection. Several real-life factors make it harder to maintain control, even when the intention to save is strong.

- Frictionless digital spending: UPI payments, cards, and subscriptions make spending instant. Without a pause before payment, small transactions add up before you notice their impact on savings.

- Irregular and unpredictable expenses: Monthly income may be fixed, but expenses are not. Medical costs, travel, repairs, and social commitments appear unexpectedly and disrupt saving plans.

- Budgets built for ideal months: Many budgets assume a perfect month with no surprises. When real-life expenses show up, savings are often the first thing to be compromised.

- Saving feels abstract compared to spending: Spending delivers immediate value, while saving feels distant and intangible. This makes it easier to prioritise short-term comfort over long-term security.

- Lack of built-in flexibility: Without room for adjustment, even small deviations can throw off the entire spend vs save balance.

These challenges show that difficulty in balancing spending and saving is not about lack of effort. It is about creating a system that reflects how money is actually used in daily life, not how it is expected to be used on paper.

The Real Cost of Spending Too Much or Saving Too Much

Balancing spending and saving is not about avoiding mistakes entirely. It is about understanding the consequences of leaning too far in either direction. Both overspending and over-saving come with hidden costs that affect financial stability and decision-making.

When Spending Takes Over

When spending consistently outweighs saving, financial pressure builds quietly and shows up at critical moments.

- Month-end shortages: Regular overspending reduces the buffer needed to handle basic expenses, leading to cash stress before the next income cycle.

- Missed savings goals: Money intended for emergencies or future plans gets absorbed into daily expenses, delaying or completely derailing financial goals.

- Increased reliance on short-term credit: Without savings, even small unexpected costs push people toward borrowing, which can create repeated dependency if not managed carefully.

When Saving Becomes Too Restrictive

Saving aggressively without flexibility can be just as harmful as overspending.

- Burnout and rebound spending: Extreme restrictions often lead to periods of impulsive spending, undoing months of disciplined saving.

- Guilt-driven decisions: Every purchase starts to feel wrong, making money decisions stressful rather than intentional.

- Lack of flexibility during emergencies: Over-saving without liquidity planning can leave people unprepared for short-term needs, forcing difficult choices when unexpected expenses arise.

A healthy spend vs save balance avoids these extremes. It allows for controlled spending today while protecting future stability, without creating stress or rigidity in daily financial decisions.

Popular Spend vs Save Frameworks and When They Work

Spend vs save frameworks exist to simplify decisions, not to enforce rigid rules. They work best when treated as guidelines that adapt to real-life conditions.

The 50/30/20 rule in real-life terms

The 50/30/20 rule suggests allocating income across needs, wants, and savings. In practice, this works well when income is stable and fixed expenses are predictable. It gives clarity by separating essentials from discretionary spending and ensures savings are not ignored.

However, the rule assumes uniform expenses every month, which is rarely the case. Rent hikes, medical costs, travel, or family obligations can quickly push essentials beyond the suggested limits.

Why rigid rules fail in some months

Frameworks break down when they are followed without adjustment. Treating percentages as non-negotiable can create stress during high-expense months. This often leads to abandoning the system entirely rather than adapting it.

Rigid rules fail because they do not account for:

- Irregular or seasonal expenses

- Income delays or fluctuations

- One-time financial priorities

When frameworks help and when they do not

These frameworks help when they provide structure and starting clarity. They stop working when they become inflexible targets instead of reference points. The most effective approach is to use frameworks as a base and adjust them based on current realities rather than ideal assumptions.

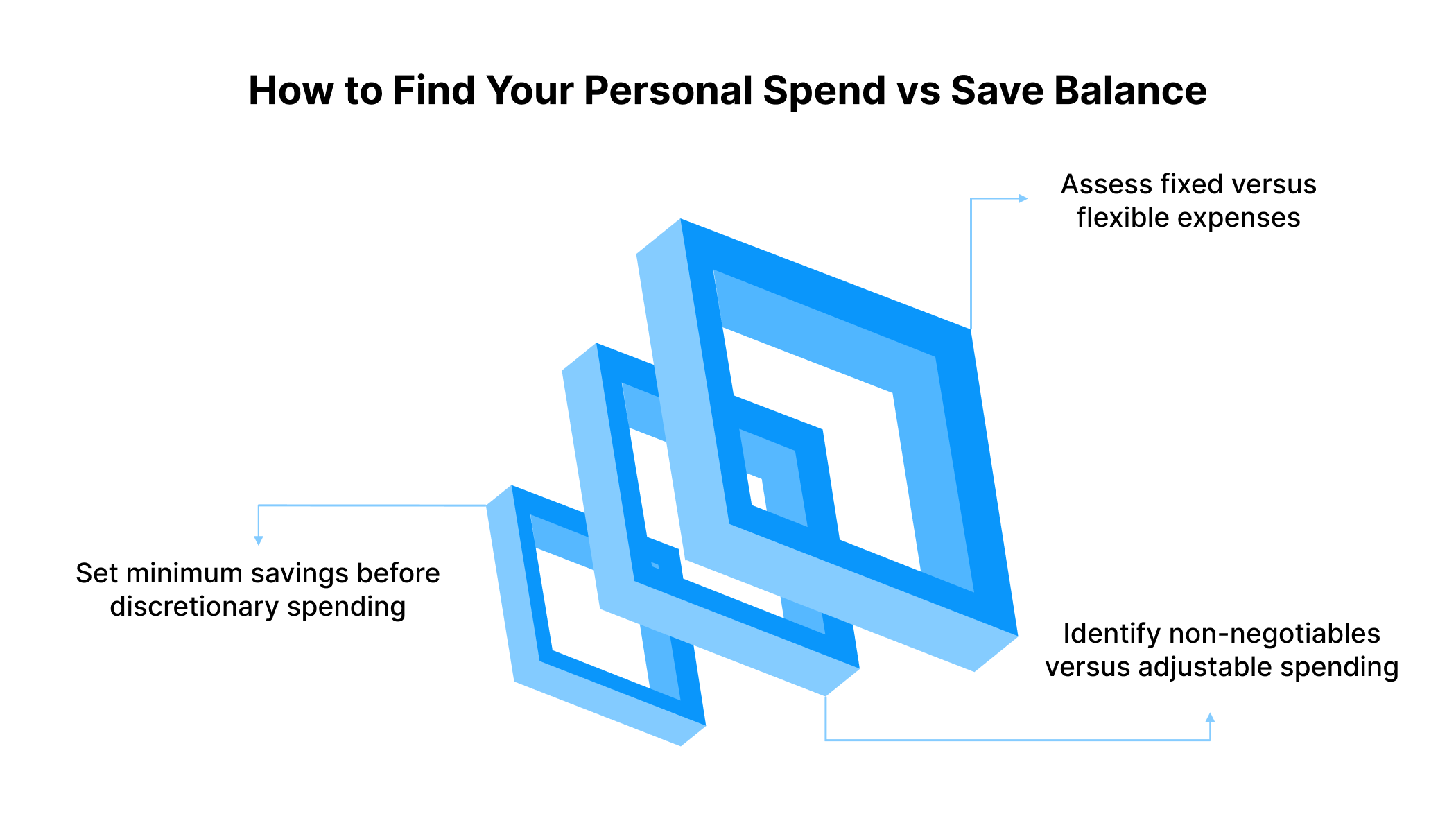

How to Find Your Personal Spend vs Save Balance

Finding the right balance is less about following rules and more about understanding how your money actually behaves month to month.

Assess fixed versus flexible expenses

Start by identifying expenses that cannot be avoided, such as rent, EMIs, utilities, and essential transport. These form the foundation of your spending. Everything else should be treated as flexible and adjustable depending on cash flow.

This distinction helps prevent lifestyle spending from quietly competing with essential commitments.

Identify non-negotiables versus adjustable spending

Not all expenses carry the same importance. Some support basic living, while others enhance comfort or convenience. Recognising this difference makes it easier to scale back without feeling deprived when adjustments are needed.

Clear prioritisation ensures that essentials and savings are protected first.

Set minimum savings before discretionary spending

Instead of saving whatever is left at the end of the month, decide on a minimum savings amount upfront. This creates a baseline that protects future needs while still allowing room for discretionary spending within defined limits.

When savings are treated as a fixed commitment rather than an afterthought, spending decisions become more intentional and easier to control.

How Short-Term Expenses Disrupt Even a Well-Planned Balance

A spend vs save plan often looks solid on paper but struggles when short-term expenses appear. These are not regular lifestyle costs or long-term goals. They are urgent, temporary needs that demand immediate attention.

Short-term expenses create friction because they:

- Do not fit neatly into monthly categories

- Require quick decisions without planning time

- Compete directly with savings or essential expenses

When these costs are handled without a predefined approach, savings are usually the first to be compromised. Over time, this creates a pattern where progress resets every few months, even when income remains stable. The issue is not poor planning but the absence of a buffer strategy for temporary gaps.

Managing short-term expenses separately from routine spending helps preserve both spending control and saving momentum.

How Pocketly Supports Short-Term Needs Without Breaking the Spend vs Save System

Pocketly is a digital lending app owned by Speel Finance Company Private Limited, an RBI registered NBFC, designed to address short-term cash gaps without replacing budgeting or funding discretionary spending. It fits into a spend vs save system by acting as a temporary bridge when timing, not income, is the problem.

Pocketly enables users to:

- Cover urgent expenses without withdrawing from savings

- Avoid rolling lifestyle spending into credit

- Keep short-term needs separate from monthly budgets

With small-ticket loan amounts and clear repayment timelines, Pocketly supports controlled borrowing instead of open-ended dependency. When used intentionally and repaid on time, it helps protect long-term financial plans while solving immediate needs.

The role of Pocketly is not to increase spending capacity but to stabilise cash flow during short-term disruptions.

Habits That Help Maintain a Sustainable Spend vs Save Balance

A balanced system depends less on strict rules and more on repeatable habits that hold up during unpredictable months.

- Define spending limits by purpose, not emotion: Decide in advance what types of spending are flexible and what must remain protected. This reduces impulsive decisions during high-pressure moments.

- Separate routine spending from exception spending: Treat short-term or one-off costs differently from daily expenses. This prevents temporary needs from becoming permanent budget leaks.

- Review alignment, not perfection: Instead of aiming for perfect balance every month, check whether spending and saving still reflect your priorities. Small course corrections are more effective than resets.

- Build decisions into the system: The fewer choices you have to make in the moment, the easier balance becomes. Clear rules reduce decision fatigue and stress.

Spend vs save balance is maintained through consistency, not restriction. When habits support clarity and flexibility, financial decisions stay intentional even when circumstances change.

Common Mistakes That Disrupt Spend vs Save Balance

Most spend vs save problems do not come from poor income or lack of discipline. They come from small, repeated mistakes that quietly weaken an otherwise workable system.

- Treating savings as optional: Saving only when money feels surplus makes it the first thing to disappear during busy or expensive months. Without a fixed baseline, savings remain inconsistent.

- Mixing short-term needs with lifestyle spending: Urgent expenses get absorbed into everyday spending categories, making it hard to understand where money actually went or why savings were impacted.

- Overcorrecting after one bad month:A high-spend month often triggers extreme restrictions the next month. This cycle creates frustration and increases the risk of rebound spending.

- Relying on rules without reviewing reality: Frameworks are followed mechanically even when income, responsibilities, or expenses change. This leads to guilt instead of adjustment.

- Ignoring spending patterns between reviews: When spending is only reviewed at month-end, behaviour remains unchanged during the month. Missed checkpoints reduce control.

Avoiding these mistakes does not require stricter control. It requires clearer boundaries and regular feedback that reflect how money is actually used.

Conclusion

Spend vs save balance is not about choosing between enjoyment and security. It is about building a system where both can exist without stress or guilt. When spending has clear limits and saving has priority, financial decisions feel more intentional and easier to manage.

No framework works perfectly every month. What matters is having enough structure to guide daily choices and enough flexibility to handle real-life disruptions. Separating short-term needs from regular spending and reviewing habits consistently helps maintain balance over time.

There will be moments when unexpected expenses disrupt even a well-planned system. In such cases, having a responsible short-term support option matters. Used thoughtfully, platforms like Pocketly can help manage temporary cash gaps without forcing you to dip into savings or compromise long-term goals. When paired with planned repayment, Pocketly supports financial balance rather than breaking it.

With practical habits and the right tools, spend vs save decisions become less stressful and more empowering, helping you stay in control of both today’s needs and tomorrow’s plans.

FAQs

Q: Which is better, spending or saving?

A: Neither spending nor saving is better on its own. A healthy financial approach balances both by covering current needs while protecting future security. The goal is intentional spending with consistent saving, not choosing one over the other.

Q: What does spend and save mean?

A: Spend and save refers to how you divide your income between current expenses and future needs. Spending supports daily living and lifestyle choices, while saving builds financial stability, emergency support, and long-term goals.

Q: Should you save first or spend first?

A: Saving first is generally more effective because it ensures future goals are protected before discretionary spending begins. Treating savings as a fixed commitment reduces the risk of saving only what is left at the end of the month.

Q: What is the 3 6 9 rule of money?

A: The 3 6 9 rule typically refers to keeping 3 months of expenses in liquid savings, 6 months in stable investments, and 9 months allocated toward long-term financial goals. It helps balance liquidity, safety, and growth based on risk tolerance.

Q: What is the 70/20/10 rule of money?

A: The 70/20/10 rule suggests spending 70 percent of income on expenses, saving 20 percent, and using 10 percent for investments or debt repayment. It works best as a guideline and should be adjusted based on income stability and personal priorities.