For most beginners, managing income and expenses feels harder than it should be. You start the month with a clear plan to save more, spend wisely, and avoid impulse buys. A few weeks later, the numbers look very different from what you expected. Small transactions add up quietly, unexpected costs appear, and your balance drops faster than planned.

This is a common experience for students, first-time earners, freelancers, and young professionals. The problem is not always the amount you earn. It is usually the lack of visibility into how money moves in and out of your account.

The good news is that managing your income and expenses does not require complicated tools or financial expertise. With a simple system to track what you earn, plan what you spend, and review your progress regularly, you can build financial control at any stage of life.

This beginner-friendly guide will help you understand your money better, form reliable financial habits, and create a stable monthly flow, even if you are just getting started with budgeting.

Key Takeaways

- Understanding your income and expenses is the foundation of financial control. It helps you stay aware of how money enters and leaves your account.

- Tracking every rupee you earn and spend gives you clarity, exposes hidden costs, and prevents overspending.

- Categorising expenses into needs, wants, and savings helps you prioritise essentials and avoid unnecessary spending.

- Simple budgeting methods such as the 50 30 20 rule, zero based budgeting, or the envelope method make money management easier for beginners.

- Building good habits such as pausing before purchases, separating bank accounts, and planning for irregular expenses improves financial discipline.

- Using technology such as UPI insights, budgeting apps, reminders, and automation simplifies daily money management.

- An emergency cushion protects you from sudden financial shocks and keeps your monthly plan stable.

- When short term cash gaps occur due to delays or emergencies, Pocketly provides responsible and transparent support through small ticket personal loans.

- Regular weekly and monthly reviews help you adjust your money plan and stay consistent with your financial goals.

What Are Income and Expenses

If you want to manage money confidently, the first step is understanding what income and expenses really mean in your daily life. These two terms form the base of every budget, every financial plan, and every money-related decision you make.

Understanding Income

Income is the money you receive. It can come from different sources depending on your situation.

Common examples include:

- Salary

- Freelancing or part-time work

- Business income

- Pocket money or stipend

- Commissions or bonuses

- Side hustle earnings

Income can be of two types:

- Fixed income: The amount stays the same each month. Salary and stipends fall into this category.

- Variable income: The amount changes from month to month. Freelancing, commissions, or business profits usually vary.

Knowing your income clearly helps you plan how much you can comfortably save and spend.

Understanding Expenses

Expenses are the money you spend. Beginners often struggle here because expenses are not always obvious, especially the small ones that do not feel significant at the moment.

Expenses fall into three groups:

- Fixed expenses: Rent, EMIs, school or college fees, insurance premiums, Wi-Fi, and phone bills.

- Variable expenses: Food delivery, groceries, transport, shopping, entertainment, personal care, and daily essentials.

- Occasional expenses: Annual subscriptions, festival expenses, repairs, medical visits, and travel plans.

A simple rule to remember is this

Income brings money in. Expenses take money out.

Managing both with awareness is the key to financial balance.

Step 1: Track Your Income and Expenses Consistently

The simplest way to take control of your money is to know exactly where it goes. Most beginners struggle with budgeting not because they earn too little, but because they never see the full picture of their income and expenses. Tracking helps you understand your habits, spot leaks, and make informed decisions instead of guessing.

Why Tracking Matters

- It shows how much you actually spend in a month

- It highlights hidden or forgotten expenses

- It reveals patterns in food, travel, shopping, and entertainment

- It helps you plan a realistic budget instead of an ideal one

When you start tracking, you often realise that small, frequent payments make the biggest difference to your balance.

How to Start Tracking

Use a simple method that feels easy to follow. You can choose any of the following:

1. UPI or bank app insights: Most bank and UPI apps show category-wise spending. This helps you understand how much goes into food, travel, shopping, and bills.

2. Google Sheets or Excel: A basic sheet with two columns, income and expenses, works well for students and first-time earners.

3. Expense tracking apps: Apps like Money Manager, Walnut, and ET Money automatically read SMS alerts and record transactions.

Choose whatever makes tracking easier. The tool does not matter. The habit does.

What to Record

Record every rupee that comes in and goes out, including:

- Salary or stipend

- Freelance payments

- Rent

- Groceries

- Transport

- Subscriptions

- Eating out

- Shopping

- Cash withdrawals

- One-time or unexpected expenses

Tracking for at least one full month will give you a clear starting point.

Pro Tip

Most beginners underestimate their lifestyle spending. Tracking helps you see the real numbers so you can adjust without stress.

Step 2: Categorise Your Spending the Smart Way

Once you start tracking your income and expenses, the next step is to organise your spending into clear categories. This helps you understand where your money is going and which areas need better control. Categorising makes budgeting easier and brings structure to your financial routine.

Why Categorising Helps

- You gain clarity about what is essential and what is optional

- You stop overspending on things that do not matter

- You can adjust your habits without feeling restricted

- You create a realistic foundation for your budget

Three Simple Categories for Beginners

1. Needs

These are essential expenses that you must pay every month. They include:

- Rent or hostel fees

- Groceries

- Transport for work or college

- Electricity, Wi-Fi, and mobile bills

- Basic healthcare

- EMIs

Needs are non-negotiable and deserve priority.

2. Wants

These are lifestyle choices. They make life enjoyable but are not essential for survival.

Examples include:

- Eating out

- Streaming subscriptions

- Shopping

- Entertainment and trips

- Coffee, snacks, and impulse buys

Wants are where most overspending happens, especially for beginners.

3. Savings and Debt Repayment

This category includes money you set aside for the future, such as:

- Savings

- Investments

- Emergency fund

- Loan repayments

Even small amounts matter. A beginner can start with as little as five or ten percent and increase gradually.

A Simple Example

For someone earning ₹30,000 per month:

- Needs: ₹15,000

- Wants: ₹9,000

- Savings and debt repayment: ₹6,000

This basic breakdown helps you stay balanced and avoid end-of-month stress.

Step 3: Use Simple Budgeting Methods for Beginners

A budget is not a restriction. It is a plan that tells your money where to go instead of letting it disappear without purpose. Beginners often feel budgeting is difficult, but the truth is that a simple and flexible method is enough to stay in control of your income and expenses.

Below are easy budgeting models that work well for students, new professionals, and anyone starting their financial journey.

The 50 30 20 Rule

This rule divides your income into three major groups.

50 percent for needs: Rent, groceries, utilities, transport, and essential bills.

30 percent for wants: Dining out, shopping, entertainment, travel, and lifestyle choices.

20 percent for savings and debt repayment: Emergency fund, investments, loan repayments, or any long term goal.

Example for ₹40,000 per month

- Needs: ₹20,000

- Wants: ₹12,000

- Savings and debt repayment: ₹8,000

This rule is simple, flexible, and easy for beginners to follow.

Zero Based Budgeting

Zero based budgeting assigns a purpose to every rupee you earn. Your income minus all planned expenses equals zero. This does not mean you spend all your money. It means every rupee is given a clear role such as savings, bills, groceries, or transport.

This method is useful for people who want full clarity and want to eliminate wasteful spending.

The Envelope or Pot Method

This method works well for students and young earners. You divide your income into small pots such as food, travel, personal expenses, and savings. Each pot has a fixed amount. Once it is used up, you stop spending in that category for the month.

Digital pots can be created through UPI wallets or simple bank accounts.

Reverse Budgeting

This approach starts with savings instead of spending. Set aside a fixed amount for savings at the beginning of the month. The remaining money is then used for needs and wants.

This works well for beginners who struggle to save consistently.

Step 4: Build Better Spending Habits

Managing income and expenses is not only about tracking and budgeting. It also depends on the habits you form every day. Small behaviour changes can create a big difference in how long your money lasts and how confidently you manage it. Good spending habits help you stay in control without feeling restricted.

Pause Before You Purchase

Impulse buying is one of the biggest reasons budgets fail. A simple pause can prevent unnecessary spending.

Use the 24 hour rule

If you feel like buying something that is not essential, wait for one full day before making the decision. In many cases, the urge fades and you save that amount instantly.

Separate Your Accounts for Clarity

Using one single account for all expenses often creates confusion. Beginners benefit from separating money into different accounts.

Try this simple setup

- One account for bills and fixed expenses

- One account for savings

- One account for lifestyle and personal spending

This separation gives instant visibility and reduces the chances of overspending.

Identify and Limit Cash Leaks

Some expenses seem small but add up quickly. These include:

- Multiple OTT subscriptions

- Frequent food delivery

- Ride hailing costs

- Small impulse purchases

- Auto renewal apps you do not use

Review these frequently and cut what you do not need.

Plan for Irregular Expenses

Not all expenses come monthly. Some arrive without warning or only once a year. These include:

- Insurance premiums

- Annual subscriptions

- Festival shopping

- Repairs and medical expenses

Set aside a small amount each month for these. This prevents your budget from getting disrupted when such payments come up.

Step 5: Use Technology to Simplify Money Management

Technology makes it easier to manage your income and expenses, especially when you are just starting your financial journey. Many tools already exist on your phone that can help you track spending, automate important payments, and stay more organised with very little effort. Consistency becomes much easier when the system does half the work for you.

Use an Expense Tracking App or Sheet

You do not need complex software to track money. A simple app or sheet is enough.

Options you can use:

- Money Manager

- Walnut

- ET Money

- A basic Google Sheet

- A simple Excel file

Apps that read SMS alerts can auto detect payments and make tracking effortless. If you prefer privacy, a manual sheet works perfectly.

Set Reminders and Spending Limits

Most UPI and banking apps now show how much you spend in different categories such as food, travel, and utilities. These insights help you understand your habits better.

Add simple reminders such as:

- A weekly check of total spending

- A limit alert when you reach 80 percent of a category budget

- A reminder to pay bills before the due date

These small prompts prevent financial surprises later.

Automate What You Can

Automation removes stress from your money routine and prevents missed payments. You can automate:

- Rent transfers

- EMIs

- SIPs and recurring investments

- Monthly savings transfers

- Mobile or Wi Fi bills

Automation ensures you never forget important payments and keeps your financial plan consistent.

Have a Weekly Money Check In

A weekly review helps beginners stay aware of their spending. This is better than waiting for the month to end.

Spend ten to fifteen minutes reviewing:

- How much you earned

- How much you spent

- Which categories are overshooting

- Any changes you need next week

Awareness is often enough to correct overspending before it becomes a problem.

Step 6: Build an Emergency Cushion

Managing income and expenses becomes much easier when you have a financial safety net. An emergency cushion protects you from unexpected costs and prevents you from disrupting your monthly budget. Even beginners should start building this buffer with small, steady contributions.

What an Emergency Fund Is

An emergency fund is money kept aside only for urgent and unavoidable situations such as:

- Medical expenses

- Sudden repairs

- Unplanned travel

- Job loss or income delay

This fund should be separate from your regular savings.

How Much You Need

A good starting point is to save enough to cover three months of essential expenses. If that feels too high for now, begin with a smaller target such as five hundred or one thousand rupees each month.

Consistency matters more than the amount.

Where to Keep the Fund

Your emergency cushion should be easy to access. Beginners can use:

- A dedicated savings account

- A liquid mutual fund

- A separate bank account used only for emergencies

The goal is to ensure quick access when needed without touching it for non urgent spending.

Why It Helps Beginners

With an emergency fund, unexpected events do not disrupt your monthly plan. You avoid stress, stay on track with savings, and reduce the chances of taking unnecessary debt.

Step 7: When Monthly Cash Flow Feels Tight, Pocketly Can Help

Even with careful planning, financial gaps can still appear. A delayed salary, a sudden bill, or an urgent medical need can create short term pressure. In such moments, responsible and transparent credit support can prevent your budget from falling apart.

Pocketly is a digital lending app owned by Speel Finance Company Private Limited, an RBI registered NBFC. It provides access to small ticket personal loans designed to support short term financial needs in a responsible and transparent manner.

How Pocketly Supports Short Term Requirements

- Instant access to amounts between 1,000 and 25,000 rupees

- 100 percent digital KYC with no physical paperwork

- Money sent directly to your bank account

- Clear and transparent charges

- Flexible repayment options that let you pay early or close the loan when convenient

Pocketly provides support for emergencies, not daily spending. It helps you manage short term gaps while maintaining financial discipline and protecting your credit health.

Use this option only when truly needed and repay on time to stay financially confident.

Step 8: Review and Adjust Your Income and Expense Plan Monthly

A financial plan works best when you review it regularly. Your spending habits, income, and priorities may change over time. A monthly review helps you stay aligned with your goals and adjust your approach based on real numbers rather than assumptions.

Compare Plan vs Actual Spending

Look at what you planned to spend and what you actually spent. Identify categories that went higher or lower than expected.

Spot Patterns and Triggers

Pay attention to repeated behaviours such as:

- Mid week food delivery

- Weekend travel expenses

- Shopping spikes during stress

- Higher spending during social events

Knowing your triggers helps you plan more accurately for the next month.

Reallocate Money When Needed

If you spent less in one category, you can move the extra amount to savings. If another category needs more room next month, adjust the budget before the cycle begins.

Stay Consistent

A ten minute monthly review is enough to strengthen your money habits. Consistency builds confidence and makes long term financial management easier.

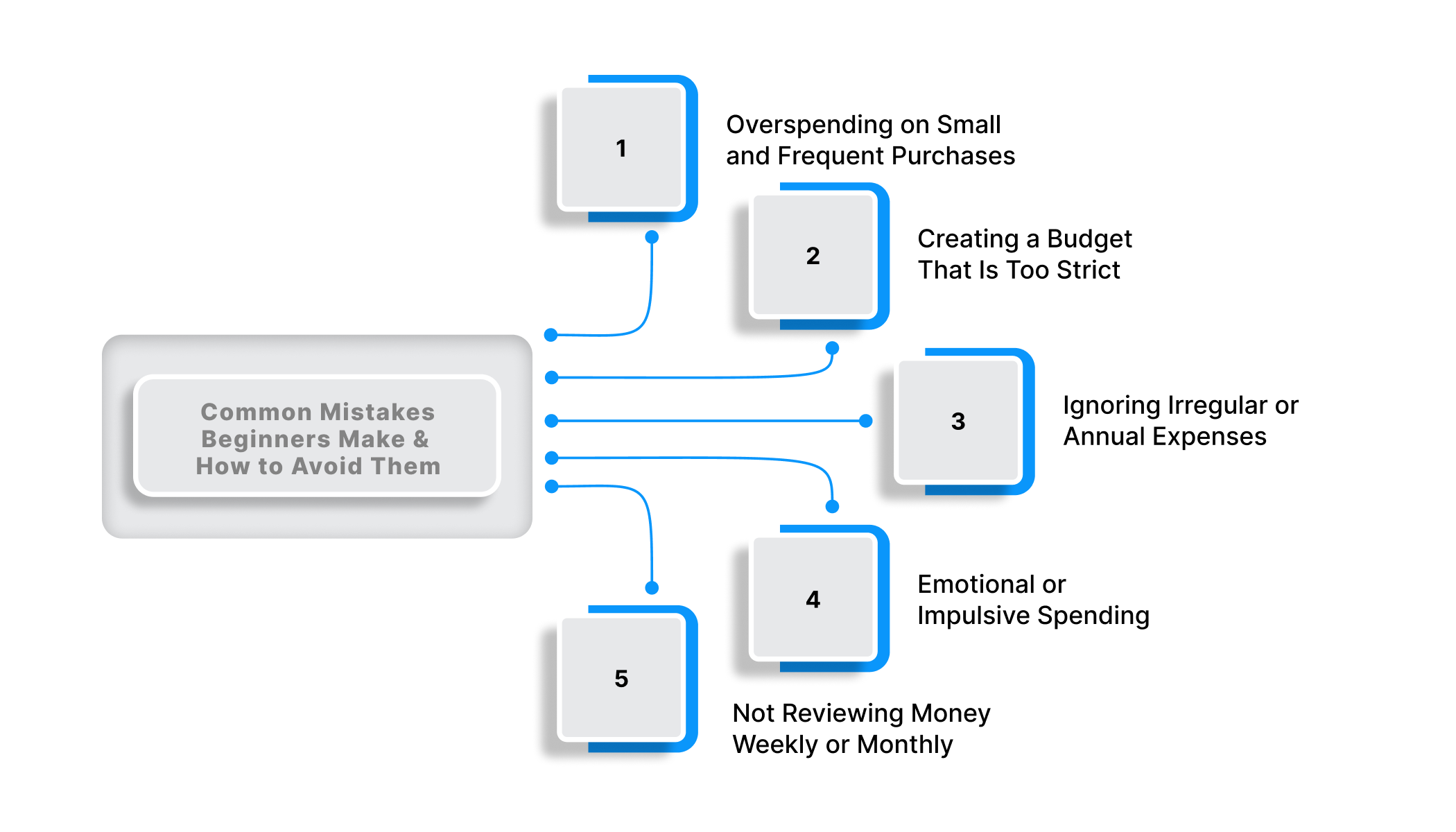

Common Mistakes Beginners Make and How to Avoid Them

Managing income and expenses becomes simpler when you understand the common mistakes that disrupt financial plans. Most beginners face similar challenges, and recognising them early helps you stay disciplined and avoid stress.

Overspending on Small and Frequent Purchases

Small transactions such as snacks, food delivery, quick rides, or monthly subscriptions may not feel important at the moment. Over time, they add up and consume a large portion of your budget.

How to avoid this: Set a weekly limit for lifestyle spending and use a separate UPI wallet for non essential purchases. When the balance runs out, stop until the next week.

Creating a Budget That Is Too Strict

Beginners often try to follow a perfect budget, but end up abandoning it within a few weeks. A budget that is too rigid does not match real life and creates frustration.

How to avoid this: Start with flexible categories and adjust based on your spending patterns. A realistic budget is easier to maintain.

Ignoring Irregular or Annual Expenses

Expenses such as insurance renewals, festival shopping, or repairs appear without warning and disrupt the monthly flow.

How to avoid this: Create a small monthly fund for irregular expenses so you are prepared when these payments come up.

Emotional or Impulsive Spending

Buying something to feel better or because of sudden excitement can reduce your savings and increase stress later.

How to avoid this: Follow the 24 hour pause rule. If you still want it the next day, buy it. If not, skip it.

Not Reviewing Money Weekly or Monthly

Without regular reviews, it becomes difficult to know where you stand financially.

How to avoid this: Do a short weekly check in and a detailed monthly review to stay aware and in control.

Conclusion

Managing income and expenses is not about restriction. It is about giving your money a clear direction. Once you understand where your money goes, choose a simple budgeting method, and build small habits, financial stability becomes much easier to achieve.

Start by tracking your expenses for one month. Create a beginner friendly budget such as the 50 30 20 rule. Review your spending regularly and adjust as needed. Over time, these small steps build confidence and help you stay prepared for both planned and unexpected situations.

When a short term gap appears, such as a medical bill, travel need, or delayed salary, you can rely on Pocketly for responsible and transparent support. Pocketly offers instant access to small ticket loans, flexible repayment options, and a fully digital process that helps you manage emergencies without disrupting your financial routine. Use this support wisely and repay on time to maintain strong financial health.

With clarity, consistency, and the right tools, you can build a smooth and stress free relationship with your money.

FAQs

Q: What is the 50 30 20 rule for managing money?

A: The 50 30 20 rule is a simple budgeting method that divides your income into three parts. Fifty percent goes to needs, thirty percent to wants, and twenty percent to savings or debt repayment. It helps you manage expenses without feeling restricted.

Q: What is the 70 20 10 rule money?

A: The 70 20 10 rule allocates seventy percent of your income to living expenses, twenty percent to savings or investments, and ten percent to debt repayment or charitable giving. It is useful for beginners who prefer a more flexible spending category. This method works well for people with higher living costs.

Q: How to control income and expenses?

A: Start by tracking every rupee you earn and spend, then organise your expenses into clear categories such as needs, wants, and savings. Create a simple budget and set weekly limits for discretionary spending. Review your money regularly to catch overspending early.

Q: What is the plan for managing income and expenses?

A: A good plan includes tracking your money, categorising your spending, choosing a budgeting method, and reviewing your progress each month. The goal is to understand your habits and make small adjustments that improve financial control. Consistency is more important than perfection.