Millions of Indians struggle to manage their monthly finances, especially students and self-employed individuals who live paycheck to paycheck. Early career earners show high financial obligations, such as multiple EMIs, credit commitments, and the challenges of managing various financial products. For example, a recent CRED survey reports that 97% of young professionals hold more than one financial commitment, and many struggle with spending and repayment tracking.

Without a clear understanding of how their money flows in and out, it's easy to feel overwhelmed by unexpected expenses or cash flow shortages.

Tracking personal cash flow is one of the most effective ways to gain control of one’s finances. This guide will walk you through actionable steps to improve your personal cash flow and build a stable financial foundation.

Key Takeaways

- Understanding Personal Cash Flow: Personal cash flow is the difference between your income and expenses. Positive cash flow allows you to save, invest, and cover unexpected costs without stress, while poor cash flow can lead to financial strain and debt.

- Tracking Cash Flow: Create a personal cash flow statement, track income and expenses regularly, and categorise spending into essential and discretionary. Using budgeting tools and finance apps can help automate this process.

- Improving Cash Flow: Optimise your spending by cutting non-essential expenses, reduce high-interest debt, and build an emergency cash reserve to protect against unexpected financial challenges.

- Leverage Tools & Short-Term Loans: Use digital apps to track your finances, and consider responsible short-term loans like those from Pocketly to cover urgent expenses without disrupting your financial plans.

- Pocketly as a Solution: Pocketly offers quick, short-term loans ranging from ₹1,000 to ₹25,000, with no collateral required, fast approval, flexible repayment options, and competitive rates to help manage cash shortages.

What Is Personal Cash Flow and Why It Matters

Personal cash flow is the money that comes in and goes out of your life. It’s the balance between your income (salary, freelance earnings, side income) and your expenses (rent, bills, groceries, entertainment). The key to good financial health is having a positive cash flow, meaning you have more money coming in than going out.

Why Good Cash Flow Matters

When you have a steady and positive cash flow, you have the financial flexibility to save, invest, or even cover unexpected costs without stress. Having surplus cash after expenses is crucial for financial freedom. With good cash flow, you’re setting yourself up to build an emergency fund, start investing, and work towards long-term financial goals.

On the flip side, poor cash flow can create financial strain. The constant worry of running out of funds, missing payments, or struggling to save can lead to stress and financial instability. A lack of cash flow often forces individuals to rely on high‑interest loans or credit, which can increase financial pressure in the long run.

Personal Cash Flow Components

Cash Inflows: The Money You Earn

Cash inflows represent the total income you receive from various sources. This includes your salary, freelance income, and any side gigs or business ventures you might have. The more accurately you track these inflows, the better you can plan for your monthly expenses and savings goals. For young professionals, students, and self-employed individuals, managing fluctuating incomes is important, as it helps create a stable cash flow for everyday needs and financial planning.

Cash Outflows: The Money You Spend

Cash outflows represent your expenses, aka everything you spend on a regular basis, such as rent, bills, groceries, and discretionary spending like dining out, entertainment, and shopping. Keeping track of these outflows ensures you don’t exceed your income and helps in identifying areas where you can cut back to save more. Monitoring your outflows regularly helps you prioritize essential spending and avoid unnecessary purchases.

Why Knowing Both Sides Is Crucial

Having a clear view of both inflows and outflows enables you to make informed financial decisions. By comparing how much you earn versus how much you spend, you can assess whether you're living within your means, if there’s room to save, or if adjustments are needed. Effective management of both sides also helps you achieve your financial goals, avoid debt, and plan for future investments.

Also Read: Understanding Cash Inflow and Outflow: Definitions, Differences, and Importance

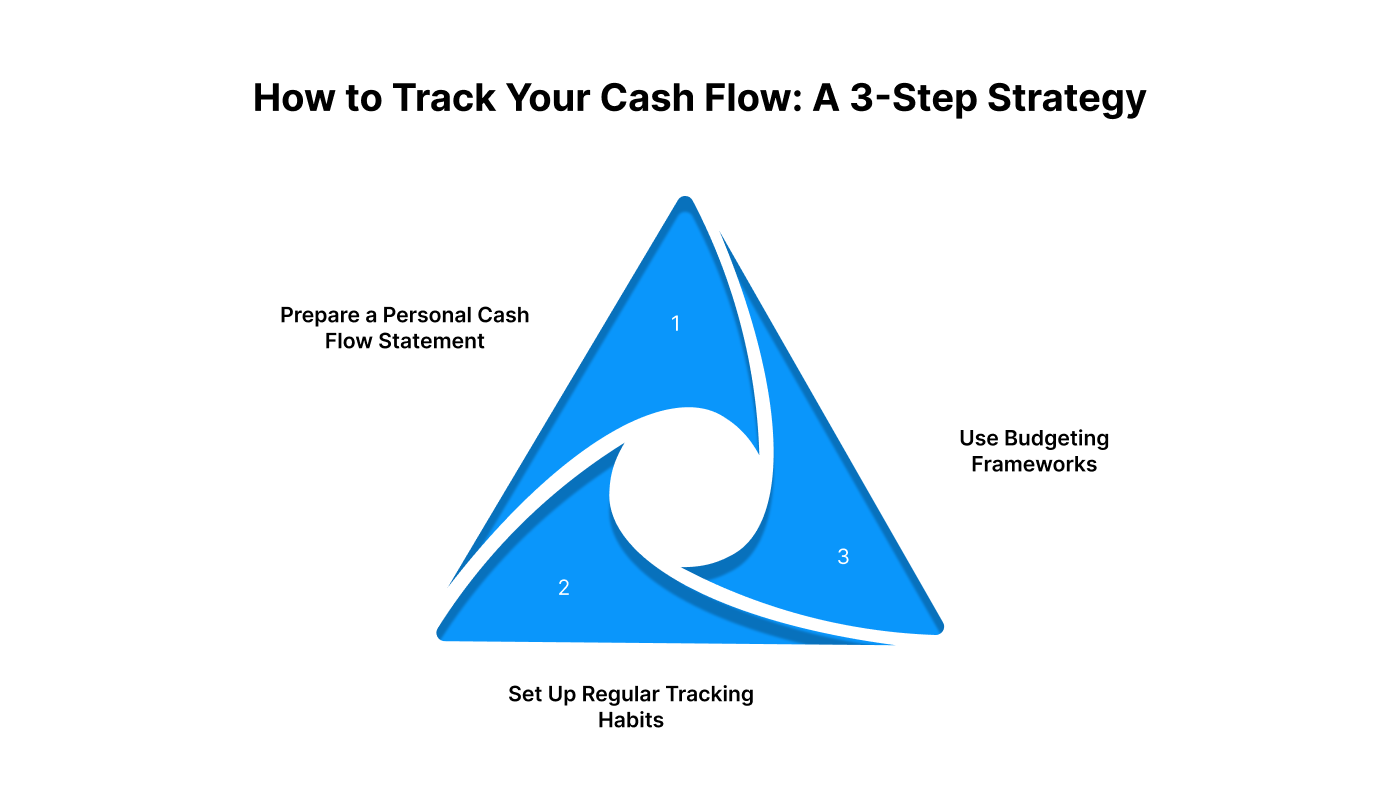

How to Track Your Cash Flow: A 3-Step Strategy

Tracking your personal cash flow is a critical part of managing your finances. Let's walk through some tools and methods you can use to track your cash flow effectively.

Prepare a Personal Cash Flow Statement

The first step in tracking your cash flow is creating a personal cash flow statement. This is a simple document or spreadsheet that helps you compare your income versus your expenses on a monthly basis.

- Record Your Cash Flow: Start by recording all your sources of income, including your salary, freelance income, and side gigs. Then, list your expenses, such as rent, utilities, groceries, and discretionary spending like entertainment and dining out.

- Categorise Spending: Break down your spending into two categories: essential (like rent, bills, and groceries) and discretionary (like entertainment, dining, and shopping). This will give you a clearer picture of where your money is going and where you can potentially cut back.

- Tracking Brings Visibility: Having a clear cash flow statement gives you visibility into your financial decisions, allowing you to spot areas where you can improve and make adjustments as needed.

Set Up Regular Tracking Habits

Once you have prepared your cash flow statement, it’s important to keep track of your finances regularly.

- Check Weekly: Don’t wait until the end of the month to track your spending. Instead, review your cash flow weekly to ensure that you’re on track. This will help you catch any discrepancies early and prevent overspending.

- Use Digital Tools: Take advantage of digital tools like spreadsheets or finance apps to track your inflows and outflows easily. Apps like Mint, YNAB (You Need A Budget), or even a simple Google Sheet can automate the process, ensuring you don’t miss any transactions. Recording every rupee will keep you accountable and help you understand where your money is going.

Use Budgeting Frameworks

Tracking your cash flow is just the first step. Once you have visibility into your financial situation, applying a budgeting framework can help you control your spending and allocate money towards your financial goals.

- Apply Simple Rules: A popular method for budgeting is the 50-30-20 rule, where you allocate:

- 50% of your income to needs (e.g., rent, utilities, groceries),

- 30% to wants (e.g., entertainment, dining out),

- 20% to savings (e.g., emergency fund, retirement).

This framework is simple to follow and helps ensure you are spending wisely while still saving for the future.

- Reallocate Funds: If you find you are spending too much in discretionary areas, reallocate those funds towards savings or an emergency reserve. The goal is to consistently prioritise financial security, especially in times of uncertainty.

Once you know exactly where your money is going, you will have the tools and habits in place to improve your financial situation. Let’s explore some practical ways to enhance your cash flow and make smarter financial choices.

Also Read: Understanding Cash Flow: Definition, Types, and Analysis

3 Practical Ways to Improve Your Cash Flow

Improving your personal cash flow doesn’t have to be a complex process. By making a few positive changes, you can start seeing improvements in your financial situation right away. Here are some practical steps to help you optimise your cash flow and put yourself on the path to financial stability.

Optimise Your Spending Habits

One of the quickest ways to improve your cash flow is by controlling your spending. While it is important to enjoy life, it is also crucial to keep an eye on unnecessary expenses that add up over time.

- Cut or Reduce Non-Essential Expenses: Review your discretionary spending: dining out, subscriptions, online shopping, or premium services. Cutting back on these can significantly reduce your outgoings. For example, consider cooking at home instead of ordering takeout or cancelling subscriptions that you rarely use.

- Find Budget Alternatives for Recurring Costs: For necessary expenses, look for more affordable alternatives. You might switch to a cheaper phone plan or find budget-friendly entertainment options.

Reduce Debt and Its Cost

Debt can be a major drain on your cash flow, especially if you are carrying high-interest balances from credit cards or loans. Taking steps to reduce your debt will free up money each month that you can use for savings or investments.

- Prioritise Paying Off High-Interest Debt: If you’re juggling multiple debts, focus on paying off high-interest ones first. This will reduce the amount of interest you’re paying in the long term, thus freeing up more of your income.

- Use Consolidation or Structured Repayment Methods: Consider consolidating multiple debts into one manageable payment, especially if your debts have high-interest rates. This will not only lower your interest payments but also help streamline your monthly obligations, making it easier to track and manage your expenses.

Build an Emergency Cash Reserve

Having an emergency cash reserve is one of the most important steps you can take to improve your cash flow. Unexpected costs like medical bills, car repairs, or even sudden job loss can derail your financial stability if you’re not prepared.

- Aim for at Least Three Months of Essential Expenses Saved Up: Ideally, you should aim to save enough to cover at least three months’ worth of essential expenses (rent, utilities, groceries). This emergency fund will give you a cushion to fall back on during times of financial stress. With a solid emergency fund in place, you can avoid relying on high-interest loans or credit cards when life throws unexpected financial challenges your way.

If you need short-term support while building better money habits, explore how Pocketly can help with quick, flexible personal loans designed for urgent cash needs.

Beyond adjusting your spending habits and building your savings, there are tools and solutions available to help you manage short-term cash needs while you work on improving your long-term financial health.

Tools and Techniques to Support Better Cash Flow

Managing cash flow becomes much easier when you have the right tools at your disposal. In today's digital age, there are various tools and techniques tailored to the Indian context that can help you track and optimise your cash flow more effectively. Let’s explore some of the best options available.

Use Budgeting and Finance Apps

Technology has made personal finance management more accessible, especially through budgeting and finance apps. These tools allow you to automate tracking of income and expenses, ensuring you stay on top of your cash flow without any added hassle.

- Automated Tracking of Income and Expenses: Budgeting apps like Mint, Money Manager, and Expensure help you keep track of all your transactions automatically. You can sync them with your bank accounts to get real-time updates on your spending patterns. This eliminates the need for manual tracking and reduces the chance of forgetting any expenses.

- Insights into Savings Trends: Some apps even provide insights into your savings trends, helping you analyse where your money is going and how much you could potentially save if you make a few adjustments. This data is invaluable in creating an actionable savings plan, allowing you to optimise your finances and align them with your goals.

Leverage Short‑Term Finance Options

Even with the best budgeting techniques, there may be times when you experience a sudden cash crunch or need immediate funds for an emergency. In such situations, short-term finance options can be a helpful solution.

- Responsible Use of Short-Term Loans: Short-term loans from a trusted provider can help you bridge the gap between your income and expenses. When used responsibly, short-term loans can help cover urgent expenses, such as medical bills, repair costs, or even unexpected travel. They can be a practical solution to handle emergencies, allowing you to maintain your cash flow without dipping into savings or accumulating unnecessary debt.

It’s essential to opt for reliable digital lending apps like Pocketly, which provide quick access to funds with minimal documentation and quick approval processes. These apps allow you to get the financial support you need without the long waiting periods typically associated with traditional banks.

How Pocketly Helps With Your Personal Cash Flow

Improving your personal cash flow can be challenging, especially when unexpected expenses arise.

Pocketly offers a quick, reliable solution with short-term loans to help you manage cash shortages and stay on track.

Here’s how Pocketly helps you:

- Loans from ₹1,000 to ₹25,000: Pocketly offers flexible loan amounts to cover urgent financial needs, based on your eligibility.

- No Collateral Required: Enjoy the convenience of unsecured loans with no physical documents required, making the process faster and easier than traditional bank loans.

- Fast Approval & Quick Access: Get instant approval and fast disbursal of funds directly into your bank account, allowing you to address financial needs without delays.

- Flexible Repayment Options: Tailored repayment plans to suit your budget, with options to repay in instalments or with extended terms.

- Competitive Rates & Transparent Fees: Starting interest rates of 2% per month, and processing fees ranging from 1% to 8%, with no hidden charges.

Easy Loan Application Process:

- Download the app or visit the website.

- Complete quick KYC (no physical documents).

- Select your loan amount and get instant approval.

Pocketly helps you navigate urgent cash needs while you continue building your financial habits.

Conclusion

Improving your personal cash flow begins with awareness, disciplined tracking, and conscious spending. By regularly reviewing your income and outgoings, cutting unnecessary expenses, and building an emergency fund, you lay the foundation for stronger financial health. These steps will help you reduce financial stress and allow you to make smarter decisions with your money.

If you find yourself facing urgent cash needs during this journey, Pocketly can help with quick, flexible loans to keep you on track.

Try Pocketly’s short-term loan solution today. Download the Pocketly app on iOS or Android and manage your financial surprises with confidence.

FAQs

1. What does personal cash flow mean?

Personal cash flow is the difference between the money you earn and the money you spend over a specific period. It’s a key indicator of financial health and your ability to meet current expenses and save for future goals.

2. How can I quickly improve my cash flow?

To quickly improve your cash flow, track all income and spending, cut non-essential costs, and start building an emergency fund. Focus on improving your spending habits and saving where possible.

3. Should I use a loan to fix cash flow problems?

Short-term loans should be used only for urgent needs. Combine them with stronger budgeting habits to ensure long-term financial stability.

4. How often should I review my cash flow?

Review your cash flow weekly. This frequency helps you catch any issues early and adjust your spending before it becomes a bigger problem.

5. What tools help with cash flow tracking?

Budgeting apps like Mint, YNAB, or Google Sheets can help you track regular inflows and outflows. These tools automate the process, making it easier to stay on top of your finances.