Let’s say you run a small tailoring business in Bangalore. Orders are pouring in, but the fabric supplier wants upfront payment. Salaries are due in three days, rent is next week, and your biggest customer, who owes you ₹15,000, just asked for 30 more days to pay. Sound familiar?

This is the cash flow crunch that stalls countless Indian small businesses, not due to a lack of customers, but because money doesn’t come when it’s needed. Over 60% of small businesses in India face cash flow issues, often leading to failure.

In this blog, we’ll share practical, India-friendly strategies to manage cash flow, perfect for young entrepreneurs, student-run ventures, and self-employed professionals.

At a glance

- Cash flow is not the same as profit—businesses can be profitable yet still run out of money without proper cash management.

- Improving cash flow requires practical actions like faster invoicing, clear payment terms, inventory control, and regular forecasting.

- Offering early payment incentives, following up on overdue invoices, and negotiating supplier terms can significantly speed up collections.

- Building emergency reserves and using technology for payments, tracking, and accounting helps maintain healthy cash flow year-round.

- For short-term gaps and urgent expenses, Pocketly provides quick personal loans (₹1,000–₹25,000) to keep operations running without business disruption.

What is Profit vs. Cash Flow

Many people confuse profit with cash flow, but they're fundamentally different. You can show a profit on paper while running out of actual cash to operate your business.

Profit is what's left after you subtract all expenses from your revenue. It looks at your overall financial performance over time.

Cash flow, however, tracks the actual movement of money in and out of your business right now. It answers the critical question: Do you have enough money today to pay your bills?

Three types of cash flow activities affect your business:

- Operating activities: Day-to-day business transactions like customer payments and vendor bills

- Investing activities: Buying or selling equipment, property, or other assets

- Financing activities: Taking loans, repaying debt, or withdrawing profits

The key is synchronising these movements, so you always have enough liquidity to meet your obligations while still investing in growth.

Also read: Understanding Cash Flow: Definition, Types, and Analysis

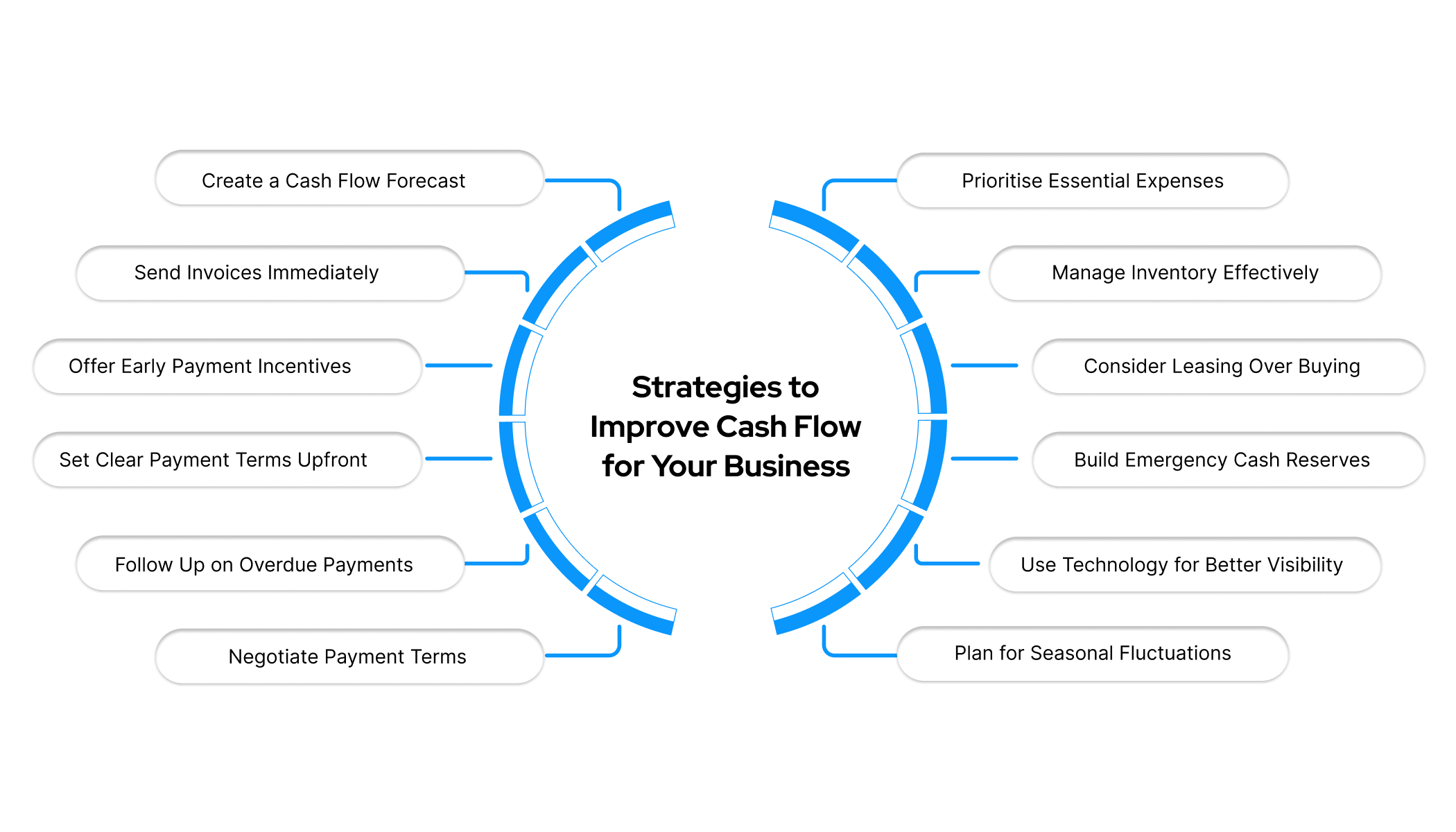

12 Strategies to Improve Cash Flow for Your Business

Managing cash flow becomes simpler when you have a clear action plan. These twelve strategies address the most common challenges young entrepreneurs face while building sustainable businesses.

1. Create a Cash Flow Forecast

A forecast is your financial GPS. List all expected inflows (actual payment timelines, not promises) and outflows like rent, salaries, and utilities. Maintain a simple weekly/monthly spreadsheet and update it regularly. Over time, you'll spot patterns of when shortages occur or when business slows.

2. Send Invoices Immediately

The faster you invoice, the faster you get paid. Send invoices the moment you deliver work or products. Make invoices clear and professional, stating exact payment terms and methods accepted.

Include your bank details, UPI information, and any other payment options you offer. The easier you make a payment, the faster the money arrives. Digital invoicing tools help speed up payments and automate reminders.

3. Offer Early Payment Incentives

A 2% discount for payment within 7 days often motivates customers to pay faster. Even if you lose a small amount on the discount, having cash in hand now is usually worth more than waiting 45 days for full payment.

Structure your discounts strategically. Offer them only for genuinely early payments, not for meeting normal terms. This rewards customers who help your cash flow while maintaining your margins on standard transactions.

4. Set Clear Payment Terms Upfront

Before starting work, discuss when and how payment will happen. Put terms in writing on quotes and invoices. Customers who understand expectations upfront are more likely to meet them.

For larger projects, consider asking for 30% to 50% upfront. This reduces your risk and improves cash flow from day one. The remaining amount can follow milestone payments or delivery completion.

Define what happens with late payments. Will you charge interest? Stop work? Clear consequences, communicated kindly but firmly, prevent many payment delays.

5. Follow Up on Overdue Payments Promptly

Don’t hesitate to ask for what you’ve earned. Send gentle reminders before the due date, and if overdue, follow up immediately. Be polite but direct, request a payment date, and escalate professionally when needed.

But what if follow-ups still don’t speed up payments? When clients need 45 days but suppliers need money in 7, reminders alone can’t close the gap. Short-term financing from Pocketly helps bridge it. With fast approvals and loans from ₹1,000 to ₹25,000, you can pay suppliers on time, avoid penalties, and protect your business reputation while waiting for payments.

6. Negotiate Payment Terms with Suppliers

Ask suppliers for payment terms that match your business cycle. If your customers typically pay in 45 days, request 60-day terms from suppliers. This alignment prevents the trap of paying out before money comes in.

Request extended terms or early payment discounts where possible. Many suppliers support regular and transparent clients.

7. Prioritise Essential Expenses

Not all bills are equal. Separate must-pay costs (rent, salaries, suppliers) from flexible spends (equipment upgrades, marketing). Pause non-essential expenses during tight periods and review subscriptions regularly to cut unused ones.

8. Manage Inventory Effectively

Inventory is cash on shelves. Too much inventory drains cash, while too little costs you sales. Finding the balance is critical. Track turnover, avoid overstocking, and use Just-In-Time where possible. Clear slow-moving items through discounts or bundles and free up trapped cash.

Identify slow-moving items through regular analysis. Products that don't sell quickly deserve scrutiny. Can you return them to suppliers? Offer clearance discounts? Bundle them with popular items? The goal is to convert dormant inventory back into usable cash.

9. Consider Leasing Over Buying

Leasing spreads costs over time rather than requiring large upfront payments. Your monthly lease payment might exceed the depreciation cost of buying, but it preserves cash for daily operations. This strategy works particularly well for equipment that requires frequent upgrades.

For example, leasing a laptop or vehicle means lower monthly costs compared to a purchase loan, and you can upgrade when the lease ends.

10. Build Emergency Cash Reserves

Even with perfect cash flow management, unexpected situations arise. An emergency fund protects you from these shocks without derailing your business.

Keep emergency funds separate from operating cash. Use a different savings account specifically for emergencies. This separation prevents accidentally spending your safety net on routine expenses.

Building reserves takes time, but emergencies don’t. When your laptop breaks before a deadline or your vehicle needs sudden repair, you need quick cash. Pocketly’s instant personal loans act as a temporary emergency buffer so you can handle crises, stay professional, and repay once cash flow stabilises, without turning to costly options or risking client relationships.

11. Use Technology for Better Visibility

Technology doesn’t need to be costly or complex to improve cash flow. Simple tools can make a big impact. UPI and payment apps speed up collections—share QR codes and add payment links to invoices.

Basic accounting tools or spreadsheets help monitor every rupee, giving instant clarity on your cash position. Expense tracking apps record costs in real time and let you store receipts easily, avoiding month-end surprises.

12. Plan for Seasonal Fluctuations

Many businesses experience predictable seasonal fluctuations. Planning for these patterns prevents cash flow crises during slow periods. Identify your seasonal patterns by reviewing several years of sales and expenses. Build cash reserves during peak seasons specifically for covering lean periods.

Adjust inventory and staffing to match expected demand. Reducing inventory and using temporary staff during slow periods minimises cash drain when revenue drops. Diversify income streams to smooth out seasonal variations.

Knowing what to do is important, but equally valuable is knowing what not to do. Many businesses damage their cash flow not because they lack good strategies, but because they make avoidable mistakes.

Also Read: Understanding How Positive Cash Flow Works and Why It's Important

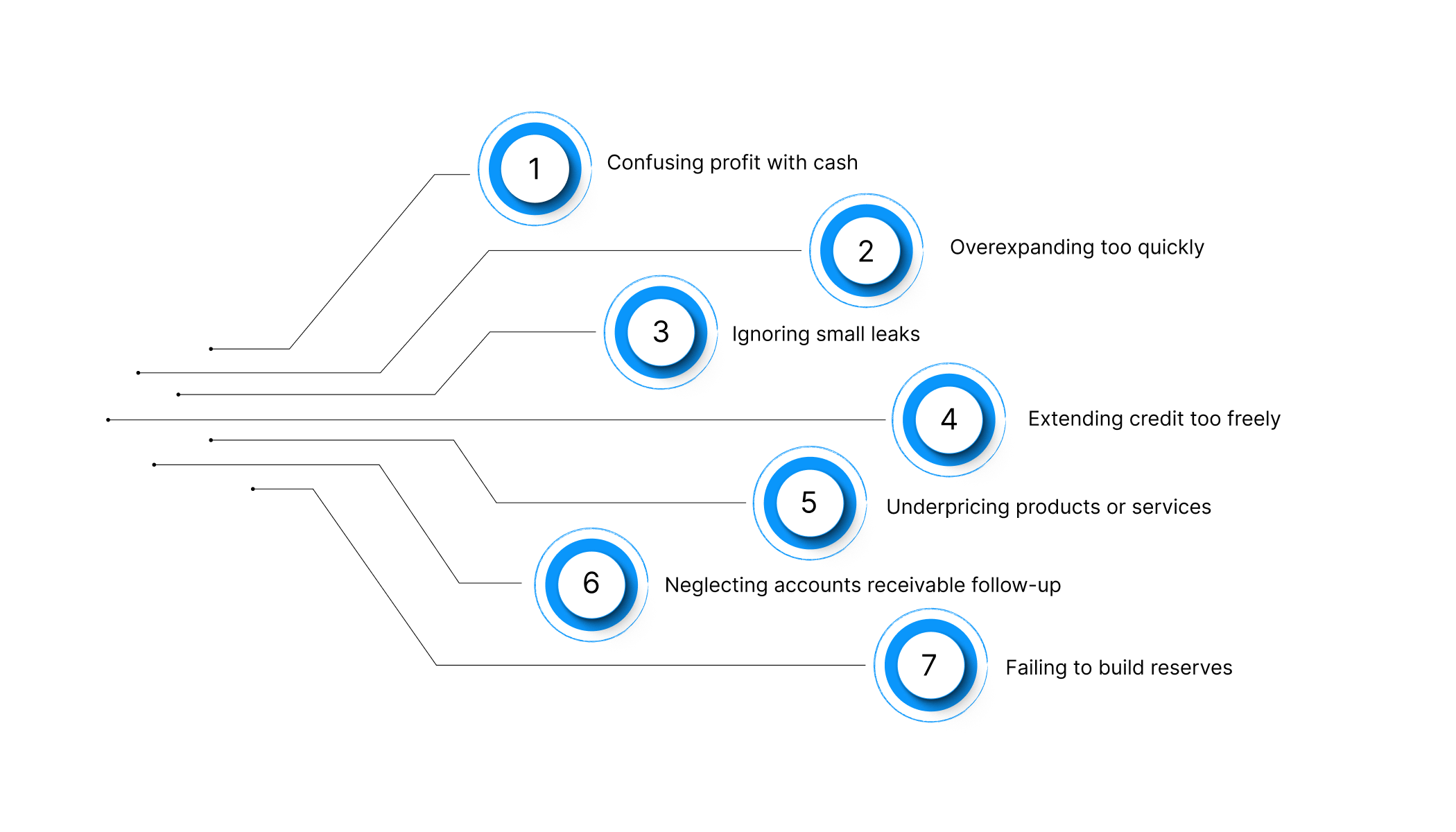

Common Cash Flow Mistakes to Avoid

Learning from others' mistakes is cheaper than making them yourself. Several common errors repeatedly damage business cash flow.

- Confusing profit with cash leads many businesses to feel successful while actually running out of money. Growing sales don't guarantee healthy cash flow if customers pay slowly or inventory consumes too much capital.

- Overexpanding too quickly strains cash resources beyond breaking point. Each new location, product line, or staff member consumes cash. Growth should match your ability to fund it without creating cash flow problems.

- Ignoring small leaks like unused subscriptions, excessive inventory, or inefficient processes. Individually minor, these collectively drain significant cash over time.

- Extending credit too freely to customers who don't deserve it. Eager to make sales, businesses often extend credit without checking payment ability, creating collection problems later.

- Underpricing products or services in hopes of attracting customers destroys cash flow. If margins don't cover costs plus working capital needs, growing sales actually worsen cash flow.

- Neglecting accounts receivable follow-up allows small payment delays to become chronic problems. The longer an invoice goes unpaid, the less likely you'll collect it.

- Failing to build reserves during good times leaves you vulnerable when challenges arise. Businesses that don't save during profitable periods struggle to survive inevitable downturns.

Awareness of these pitfalls helps you avoid them, protecting your hard-earned cash flow. However, even the best-managed businesses face timing gaps. That's not a failure of planning. It's simply how business works in the real world. This is where external support can be useful in seizing the opportunity.

Also Read: Simple Ways to Get Personal Loan Against Cash Salary

How Pocketly Assists When You Need Immediate Cash Flow Support

Even with good planning, cash flow gaps happen. A supplier demands payment today while your client pays next week. Equipment fails, transport breaks down, or invoices get delayed. Banks take weeks, ask for documents and collateral, and can’t help when money is needed now.

Pocketly is built for exactly these moments, giving young business owners instant access to small, purpose-fit funds.

What Pocketly offers:

- Quick personal loans for immediate cash needs

- Loan amounts from ₹1,000 to ₹25,000—ideal for short-term gaps

- Approval within hours, fully app-based

- Zero collateral, no branch visits, minimal documentation

- Transparent pricing

- Interest from 2% per month

- Processing fee 1%–8%

- Flexible repayment, close anytime without penalty

- Borrow only what you need, reducing cost and risk

Pocketly acts like an emergency buffer while you wait for receivables. Instead of taking big loans you don't need, you get just enough to keep operations running, pay suppliers, meet deadlines, maintain credibility, and avoid business disruption.

Conclusion

Cash flow mastery takes time, but it's completely achievable with consistent effort and smart practises. The twelve strategies above tackle common challenges like delayed payments, tight supplier terms, excess inventory, low visibility, and lack of emergency funds.

Healthy cash flow gives you freedom. You can grab growth opportunities, handle setbacks calmly, and run your business without constant money stress.

When timing gaps appear, don't let them slow you down. Pocketly offers quick, collateral-free personal loans with fast approvals and transparent terms, helping you bridge short-term needs without breaking momentum.

Download the Pocketly app now on iOS and Android and stay prepared for unexpected crunches.

Frequently Asked Questions

1. What's the difference between a cash flow statement and a forecast?

A cash flow statement shows past cash movements—what you earned and spent in a previous period. A cash flow forecast predicts future inflows and outflows. The statement is your rearview mirror; the forecast is your windshield. Use both to learn from the past and prepare for the future.

2. How can I improve cash flow without increasing sales?

Speed up collections by invoicing quickly, offering early payment discounts, and following up on overdue payments. Negotiate longer supplier terms, cut unnecessary expenses, reduce excess inventory, and lease equipment instead of buying. Digital payments and automated reminders also improve cash movement.

3. Why am I profitable on paper but still low on cash?

Profit is recorded when sales are made, not when customers pay. Cash may also be tied up in inventory, equipment purchases, or loan repayments that don’t show as expenses. This is why tracking cash flow separately from profit is crucial.

4. How much emergency cash reserve should I maintain?

Aim for 3–6 months of essential expenses like rent, salaries, and supplier payments. Start with one month if funds are tight and build gradually. Seasonal businesses should save more during peak months to cover lean periods.

5. When should I consider a short-term loan for cash flow?

Choose loans for temporary gaps—when you must pay suppliers before receiving customer payments, during urgent equipment repairs, or to leverage cost-saving bulk purchases. Avoid borrowing for ongoing losses. Borrow only with a clear repayment plan and expected revenue.