Millions of young Indians struggle with saving money, not because they do not earn enough, but because saving without clear goals and a plan can be difficult. According to a survey of Indian financial habits, around two out of five people say savings is a key financial goal, and more than 70 percent of respondents reported that they manage to save each month. However, many still find it hard to reach their savings targets consistently without structure and awareness.

Having well-defined saving goals not only gives you direction but also makes saving intentional and measurable. Whether you are saving for an emergency fund, an education course, a trip, or future plans such as buying a device or starting a business, understanding what you are saving for and why it matters can boost your motivation and discipline. This beginner-friendly guide will walk you through practical steps to set, plan and achieve your savings goals with confidence and clarity.

Key Takeaways

- Clear and realistic saving goals help you stay focused and make consistent progress.

- Categorising goals into short-term, medium-term and long-term makes the saving process structured and achievable.

- Understanding your income and expenses is essential for choosing a saving amount that fits your lifestyle.

- A savings plan works best when it matches how you earn and spend, whether you are salaried, a student or self-employed.

- Small behaviour changes, such as pausing before purchases and limiting cash leaks, strengthen your saving habits.

- Technology, including budgeting apps, reminders and automation, simplifies tracking and supports consistency.

- An emergency cushion protects your saving journey from unexpected expenses and financial stress.

- Short-term financial gaps can disrupt your progress. Pocketly offers responsible support that helps you stay on track when genuine needs arise.

- Monthly reviews and small celebrations keep you motivated and help you adjust your plan as your circumstances change.

- Avoiding common saving mistakes, such as unrealistic goals and impulse spending, increases your chances of long-term success.

What Saving Goals Are and Why They Fail

Saving goals are simply targets you set for what you want to save and by when. They give your money a purpose and help you stay focused, whether you are saving for an emergency cushion, a new phone, a short trip, or long-term plans such as education or business growth. Saving goals act like a roadmap that helps you decide how much to save, how often to save, and how to stay disciplined even when expenses vary from month to month.

Yet many beginners struggle to achieve their saving goals. This often happens for three reasons: lack of clarity, lack of tracking, and lack of consistency. When goals are vague such as “I want to save more this year,” there is no clear direction for how much to save or how to measure progress. Without tracking income and expenses, it becomes difficult to know how much can realistically be set aside. And when savings depend only on “whatever is left at the end of the month,” the goal rarely moves forward.

Understanding why you are saving, how much you need, and the timeline you want to follow creates a strong foundation. Clear saving goals make it easier to stay motivated, make conscious spending decisions, and gradually build financial confidence.

Step 1: Define Clear and Realistic Saving Goals

Before you start saving, you need clarity on what you are saving for and when you want to achieve it. Clear goals turn saving into a purposeful activity rather than a vague intention.

Short-term goals

These are goals you can achieve within a few months. They are usually smaller but highly motivating.

Examples include:

- festival shopping

- buying gadgets

- short trips

- personal accessories or hobby items

Short-term goals help you build early confidence because progress is visible quickly.

Medium-term goals

These require more planning and consistency, usually six months to two years.

Examples include:

- building an emergency cushion

- enrolling in upskilling or certification courses

- saving for a laptop upgrade

- setting aside money for personal projects

Medium-term goals strengthen discipline and prepare you for bigger financial commitments.

Long-term goals

These goals shape your future and may take several years to achieve.

Examples include:

- further education

- starting a business

- long-term investments

- significant lifestyle upgrades

Long-term goals grow best when you start early, even with small contributions.

Use the SMART method to structure each goal

A saving goal becomes actionable when it is:

- Specific: “I want to save ₹30,000 for a laptop”

- Measurable: You know the exact amount

- Achievable: Matches your income and lifestyle

- Relevant: Supports your personal or professional growth

- Time-bound: You set a realistic deadline

Using this simple framework ensures your saving goals are realistic and easy to follow.

Step 2: Understand Your Income and Expenses Before You Save

You cannot plan how much to save until you know how your money moves each month. Understanding your income and expenses gives you a clear starting point and prevents unrealistic saving targets.

List all your income sources

Include every form of money you receive:

- salary or stipend

- freelance or part-time earnings

- side hustle income

- pocket money or small transfers

Knowing your exact monthly inflow helps you decide how much you can save without strain.

Identify your monthly expenses

Break them into two groups for clarity:

- Fixed expenses: rent, utilities, EMIs, transport passes, Wi-Fi, phone bills

- Variable expenses: food delivery, personal shopping, entertainment, travel, daily essentials

This shows which parts of your spending are predictable and which need monitoring.

Organise your expenses into simple categories

To understand your spending pattern better, place each expense under:

- Needs: essential and unavoidable costs

- Wants: lifestyle choices and flexible spending

- Savings or repayments: money set aside for goals or loans

This categorisation makes it easier to see where adjustments can be made.

Use your findings to set a realistic monthly saving amount

Once you know your inflow and outflow, choose a saving amount that matches your lifestyle. Saving should feel manageable, not restrictive, so aim for consistency rather than perfection.

Step 3: Create a Savings Plan That Fits Your Lifestyle

A savings plan works best when it aligns with how you earn and spend. Instead of forcing strict methods, choose a plan that suits your income pattern and daily habits.

If you earn a fixed monthly salary

Use a “save first” approach.

- Move a fixed saving amount to a separate account as soon as your salary arrives.

- Plan the rest of your month using the remaining balance.

This ensures your savings happen before spending begins.

If you are a student or receive irregular money

Follow a flexible system.

- Set small weekly saving targets.

- Use digital pots or envelopes for different goals like travel, shopping, or emergencies.

This helps you save gradually even when income varies.

If you freelance or are self-employed

Save a percentage of every payment.

- Allocate a fixed percentage, for example 10 to 15 percent, from each project or gig.

- This creates steady progress without depending on month-end leftovers.

Choose a budgeting method that feels natural

Regardless of your income style, choose one budgeting approach that feels natural:

- Reverse budgeting: Save first, spend later. Ideal for people who struggle to save at the end of the month.

- Pot or envelope system: Assign money to specific goals like “travel savings,” “emergency fund,” or “education.” Helps avoid overspending.

- Weekly budgeting: Instead of planning for the whole month, set weekly limits. Shorter cycles make it easier to stay disciplined and adjust quickly.

The best savings plan is the one you can stick to without stress. When the plan aligns with your lifestyle, saving becomes a habit instead of an effort.

Step 4: Build Better Spending Habits

Strong saving goals need supportive daily habits. Small, intentional changes in how you spend can make a noticeable difference in how much you save each month.

Use the 24-hour pause before non-essential purchases

- Delay buying anything that is not urgent.

- This reduces impulse spending and keeps you focused on your goals.

Separate your money for clarity

- Keep different bank accounts for bills, personal spending and savings.

- This prevents accidental overspending and gives instant visibility into your limits.

Identify your personal spending triggers

- Review your last month’s expenses to find your top two “cash leaks” such as food delivery or ride-hailing.

- Reduce them gradually instead of cutting them out completely.

Plan ahead for expenses that do not occur monthly

- Set aside a small fixed amount for costs like subscriptions, festival shopping or medical visits.

- This ensures these expenses do not disrupt your savings plan.

Good habits make saving easier because they create space in your budget without feeling restrictive. Simple adjustments can support your goals more than major sacrifices.

Step 5: Use Technology to Stay Consistent

Technology can simplify your saving routine by reducing manual effort and helping you stay aware of your habits. With the right tools, saving becomes easier to track and maintain.

Use expense tracking apps or simple digital sheets

- Apps like Money Manager, Walnut or ET Money can automatically record transactions.

- If you prefer manual control, a basic Google Sheet or Excel file works well.

These tools give you a clear snapshot of where your money is going.

Set reminders and alerts for better control

- Enable notifications for bill payments, spending limits or low balances.

- Use weekly reminders to check your progress.

This keeps you accountable without feeling pressured.

Automate your savings wherever possible

- Schedule a fixed transfer to your savings account each month.

- Automate payments for essential bills to avoid last-minute expenses.

Automation removes the need for daily decisions and keeps your plan consistent.

Create digital pots for different saving goals

- Use UPI apps or separate wallets to allocate money toward specific goals.

- This helps you avoid mixing your savings with everyday spending.

With technology handling the routine tasks, you can focus on maintaining consistency, reviewing your progress and adjusting your goals as needed.

Step 6: Build an Emergency Cushion

Before working towards other saving goals, it is important to protect yourself from unexpected expenses. An emergency cushion prevents financial stress and keeps your long-term goals on track.

Understand what an emergency fund is

- It is money kept aside solely for urgent and unavoidable situations.

- Examples include medical needs, sudden repairs or a delay in income.

This fund acts as your first line of defence during unexpected events.

Start with a manageable target

- Aim for three months of essential expenses, but do not worry if this feels too high initially.

- Begin with a small monthly amount that you can maintain consistently.

Even steady contributions of a few hundred rupees build up over time.

Keep your emergency fund separate and easy to access

- Use a dedicated savings account or a liquid fund.

- Avoid mixing this money with your regular spending account.

This ensures you do not use it accidentally for non-urgent purposes.

Use it only when it is truly necessary

- The emergency cushion is meant for genuine financial shocks, not routine spending.

- Replace the amount as soon as possible if you ever use it.

A reliable emergency fund gives you confidence, helps you stay disciplined and prevents major disruptions to your saving goals.

Step 7: When Monthly Cash Flow Feels Tight, Pocketly Can Help

Even with a good saving plan, unexpected situations can create short-term pressure. A delayed salary, sudden travel, medical needs or urgent purchases can disrupt your budget and affect your saving goals. In such moments, having access to responsible short-term support can help you stay steady.

Pocketly is a digital lending app owned by Speel Finance Company Private Limited, an RBI registered NBFC, and offers small-ticket personal loans for temporary financial needs.

- Loan amounts range from ₹1,000 to ₹25,000.

- Suitable for genuine short-term gaps that you cannot plan in advance.

This prevents you from breaking your savings or dipping into your emergency fund unnecessarily.

Simple and fully digital process

- Quick KYC with no physical paperwork.

- Instant disbursal to your bank account once approved.

This ensures you get timely support when you actually need it.

Transparent and flexible repayment options

- Clear charges shown upfront with no hidden fees.

- You can repay early or close the loan whenever it is convenient.

This keeps you in control and helps you build responsible borrowing habits.

A tool for emergencies, not everyday spending

- Pocketly is designed to offer temporary relief, not long-term debt.

- When used only for genuine gaps and repaid on time, it protects your savings plan and maintains financial stability.

Pocketly acts as a short-term safety net, allowing you to continue working toward your savings goals without losing the progress you have already made.

Step 8: Review, Adjust, and Celebrate Your Saving Journey

Saving is not a one-time plan. It evolves with your income, lifestyle and priorities. A simple monthly check helps you stay aligned with your goals and remain motivated without feeling pressured.

Review your goals each month

- Compare what you planned to save with what you actually saved.

- Identify what worked and where adjustments are needed.

Regular reviews prevent surprises and strengthen consistency.

Adapt to changes in your income

- If your income increases, increase your saving amount proportionally.

- If your income decreases, adjust your goals without guilt.

Flexibility ensures you stay on track without feeling overwhelmed.

Reassess your priority goals

- Your needs can change over time.

- Shift focus towards goals that matter most right now.

This keeps your saving journey relevant and meaningful.

Celebrate your milestones

- Acknowledge progress when you reach small targets.

- Celebrating small wins keeps you motivated for bigger goals.

Positive reinforcement makes saving feel rewarding rather than restrictive.

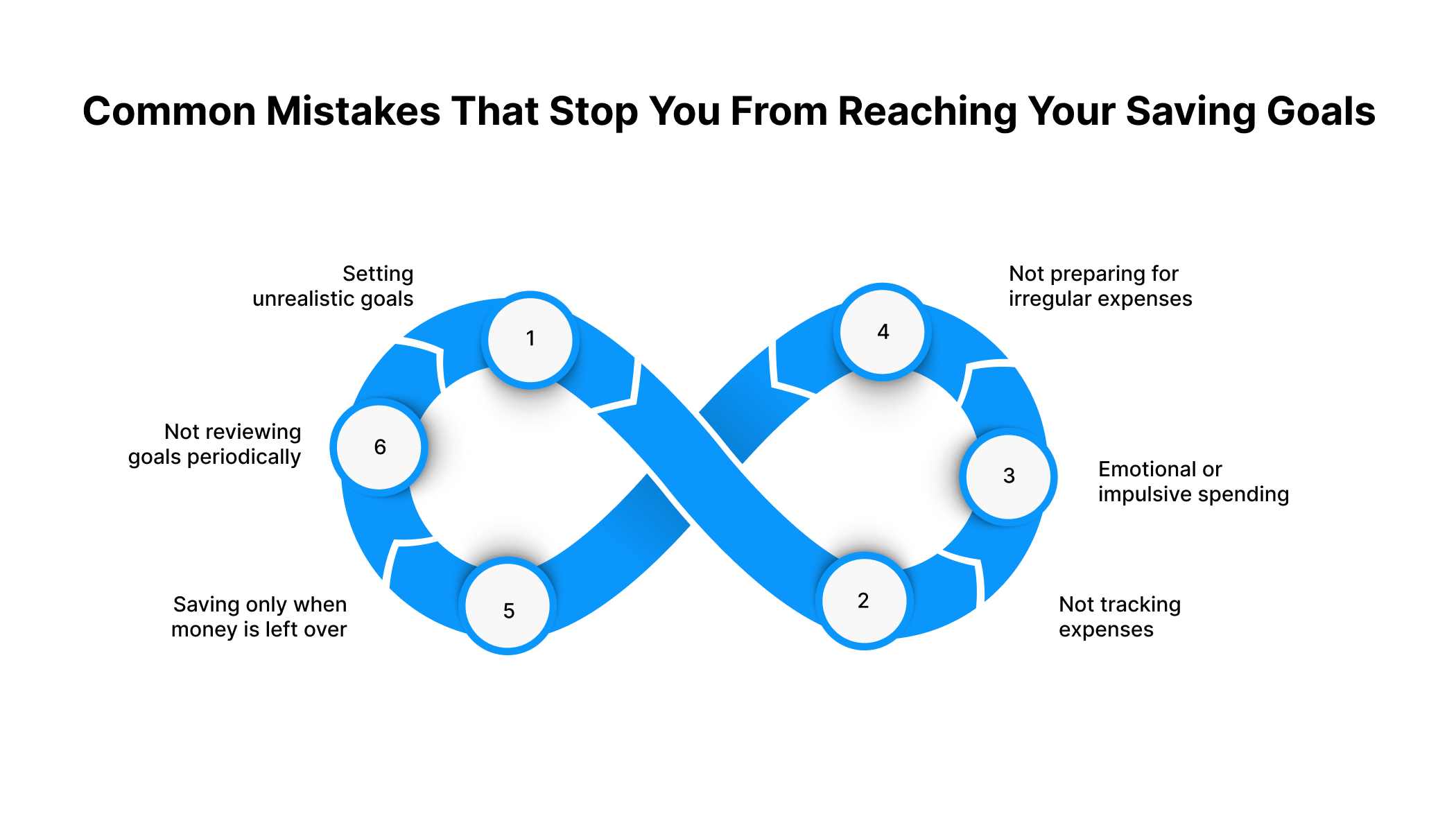

Common Mistakes That Stop You From Reaching Your Saving Goals

Many beginners face similar challenges when trying to save. Recognising these mistakes early helps you avoid them and stay on track.

Setting unrealistic goals

Overly ambitious targets create pressure.

Solution: Start small, then increase gradually as your income stabilises.

Not tracking expenses

Without visibility, saving becomes inconsistent.

Solution: Use a simple app or sheet to record your spending regularly.

Emotional or impulsive spending

Spontaneous purchases weaken long-term goals.

Solution: Follow the 24-hour pause rule for non-essential items.

Not preparing for irregular expenses

Annual or unexpected costs can break your monthly plan.

Solution: Keep a small monthly fund for non-monthly expenses.

Saving only when money is left over

This approach rarely builds progress.

Solution: Save a fixed amount first and plan your month with the remaining money.

Not reviewing goals periodically

Without reviews, habits slip and goals lose clarity.

Solution: Do a quick monthly check to adjust your plan and stay focused.

Addressing these common mistakes strengthens your saving habits and makes your financial goals easier to achieve.

Conclusion

Achieving your saving goals is not about strict rules or perfect discipline. It is about building simple, consistent habits that support your financial journey over time. When you define clear goals, understand your income, track your spending and use a savings plan that fits your lifestyle, saving becomes more achievable and far less stressful. Small steps taken consistently create long-lasting progress.

Remember that your circumstances may change, and your saving plan should change with them. Reviewing your goals, adjusting timelines and celebrating your milestones keeps you motivated and confident. Saving is a personal journey, and every bit of progress counts.

And when unexpected expenses threaten to disrupt your plan, having short-term support can help you stay steady. Pocketly offers responsible, transparent assistance for temporary cash gaps, allowing you to protect your savings while handling genuine needs. Used wisely and repaid on time, it helps you maintain your financial balance without slowing down your long-term goals.

With clarity, consistency and the right tools, you can build a saving routine that feels realistic, empowering and sustainable.

FAQs

Q: What is a saving goal?

A: A saving goal is a specific amount of money you plan to set aside for a particular purpose within a set timeline. It gives your saving efforts direction and helps you stay consistent. Clear goals make it easier to track progress and stay motivated.

Q: What is the 70 20 10 savings rule?

A: The 70 20 10 rule divides your income into three parts. Seventy percent goes to essential living expenses, twenty percent to savings or investments and ten percent to debt repayment or charity. It is a simple way to organise your money if you prefer a flexible structure.

Q: What is the 50 30 20 rule of savings?

A: The 50 30 20 rule is a budgeting method that allocates fifty percent of your income to needs, thirty percent to wants and twenty percent to savings or debt repayment. It helps balance day-to-day spending with long-term financial goals. Beginners find it easy to follow because of its clear categories.

Q: What are the 5 steps to save money?

A: The key steps include defining your saving goals, understanding your income and expenses, choosing a saving plan that fits your lifestyle, improving your spending habits and reviewing your progress regularly. These steps make saving structured and achievable. When followed consistently, they create long-term financial stability.

Q: What is the 3 saving rule?

A: The 3 saving rule encourages you to divide your savings into three parts: short-term needs, long-term goals and emergency funds. This ensures your money supports both immediate and future priorities. It also helps you stay prepared for unexpected situations without disrupting your saving journey.