When handling taxes or managing a business in India, the Taxpayer Identification Number (TIN) is a key element you'll encounter. While it may seem like just another requirement, the TIN plays a crucial role in ensuring you meet your tax obligations, manage business transactions, and remain compliant with regulations.

The TIN is an official identifier used by businesses and professionals to ensure compliance with tax laws. It's often requested during business dealings, such as signing contracts, to verify that you're adhering to these legal requirements.

In India, understanding the full form of TIN is essential. The TIN is primarily used to identify businesses for GST purposes, and it’s often confused with other identifiers like PAN (Permanent Account Number) or Aadhaar. Each of these has a distinct role in the taxation system. Knowing when and where to use each identifier helps you stay compliant with Indian tax laws and avoid any legal issues.

In this guide, we will explore everything you need to know about TIN, its significance, how to apply for it, and how it can simplify your financial dealings. Understanding TIN is crucial for staying on top of your finances and avoiding future complications. Let's get started!

TL;DR (Key Takeaways):

- TIN (Taxpayer Identification Number) is a unique identifier for tax compliance.

- It is essential for businesses to manage sales tax, VAT, and tax filings.

- TIN helps individuals with tax reporting and ensures financial transparency.

- TIN is distinct from PAN and GSTIN, each serving different tax-related purposes.

- It's crucial for businesses and self-employed professionals to maintain a TIN for proper financial management.

What is TIN?

The Taxpayer Identification Number (TIN) is a unique identifier assigned to individuals or businesses for tax administration. It helps authorities track and manage tax payments, ensuring that taxpayers meet their obligations. In simple terms, TIN is the official number that links you to your tax records, making it easier for the government to verify your financial activity.

For businesses, a TIN is used to register for various tax-related tasks such as GST tax collection and income tax returns. For individuals, especially professionals or those with a formal business structure, a TIN helps keep track of income and tax payments, offering a transparent way to report earnings.

A TIN is required for conducting business, applying for loans, and completing official transactions. In India, this number is primarily used by businesses to comply with GST regulations. Although TIN is commonly used for tax purposes, it can also be helpful in other areas, such as opening bank accounts, entering into contracts, or applying for government benefits.

Now that we have a clear understanding of what TIN is, let's explore its key functions and how it plays a vital role in managing financial transactions for both businesses and individuals, while ensuring compliance with tax regulations.

Key Functions and How TIN Is Used by Both Businesses and Individuals

The Taxpayer Identification Number (TIN) serves several important functions, and its role extends beyond just tax filing. Whether you're running a business or managing your personal finances, TIN plays a crucial role in ensuring smooth and transparent financial transactions.

| For Businesses | Description | For Individuals | Description (Individuals) |

| Tax Compliance and Filings | Required for sales tax, VAT, or GST registration and filing returns. | Income Tax Filing | TIN helps self-employed professionals report income and deductions. |

| Invoicing and Transactions | Needed for issuing invoices, especially in inter-state or large-scale transactions. | Loan Applications and Credit Requests | Required for loan processing to verify financial status and tax compliance. |

| Business Registration and Licenses | Required for business registration, licenses, and permits in some regions. | Business Activities | Freelancers or small businesses need TIN for registration, bank accounts, and contracts. |

| Purchases and Payments | Suppliers request TIN for purchases, allowing businesses to claim tax credits/exemptions. | Claiming Benefits | Some government schemes require TIN to verify tax status for benefit claims. |

To fully appreciate its significance, it's essential to understand what TIN stands for, how it differs from similar identifiers, and why it's indispensable in official documentation and financial reporting.

To better understand how different financial obligations can impact your credit, consider checking out Loans at Work: A Simple Guide to Getting Personal Loans for Employees. This guide provides insights into managing personal loans for employees, particularly in the context of taxation and financial management.

Managing taxes with TIN is vital, but unexpected expenses can still disrupt your financial plans. If you need quick support, Pocketly offers flexible, fast loans to help you stay on track when life throws curveballs. Get the financial assistance you need today!

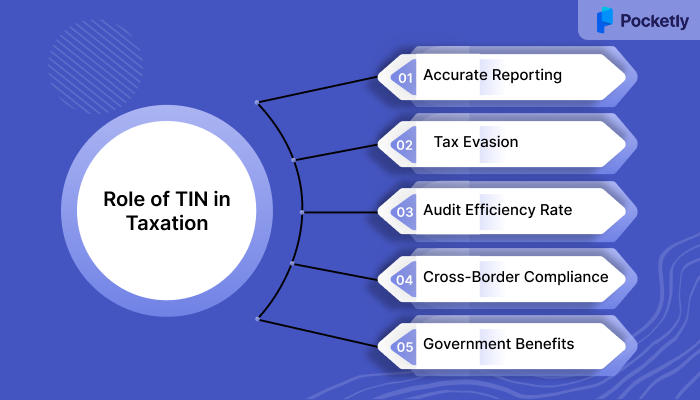

Role of TIN in Taxation

The Taxpayer Identification Number (TIN) is the backbone of how tax systems operate smoothly. While many see TIN primarily as a number to track their tax obligations, its role is much deeper in the taxation framework:

1. Facilitates Accurate Tax Reporting

One of the key functions of TIN is to ensure that tax returns are filed accurately and in a timely manner. By using a unique identifier, authorities can easily match transactions, income, and expenditures to the right individual or business. This results in precise tax filings and ensures that tax payments are accurately calculated, avoiding any confusion or errors.

2. Reduces the Risk of Tax Evasion

TIN serves as an anti-evasion measure, providing tax authorities with a means to track and verify income and tax payments effectively. By linking financial transactions to a unique TIN, the government can cross-reference data and identify discrepancies. This helps reduce fraudulent reporting and tax evasion, ensuring that everyone pays their fair share of taxes.

3. Enables Efficient Tax Audits

When a tax audit is required, having a TIN associated with all transactions makes the process much more straightforward. The authorities can easily pull up the complete tax history of an individual or business by accessing the TIN, allowing for a quicker, more efficient audit process. This streamlined approach ensures audits are accurate and minimizes delays for taxpayers.

4. Improves Cross-Border Tax Compliance

For businesses operating internationally or individuals dealing with foreign transactions, TIN helps standardize tax processes across borders. When businesses or individuals with a TIN engage in international trade or financial transactions, this number ensures that they comply with international tax laws and reporting requirements, simplifying cross-border tax management.

5. Key for Accessing Government Benefits

Beyond just tax compliance, a TIN is often required for individuals or businesses to access government schemes and benefits. Whether it’s for subsidies, loans, or other government programs, having a TIN linked to your tax records ensures that you are eligible for these benefits and allows the authorities to verify that you meet the required criteria.

Understanding its significance is the first step; now, let’s look at the process of obtaining a TIN. By following the correct procedure, you can ensure a smooth and hassle-free experience when applying for your own TIN, thereby meeting all legal requirements with ease.

Understanding the importance of TIN in tax-related activities will help you better manage your finances. For more on how different tax options work, check out Understanding the Debt Restructuring Process and Its Importance.

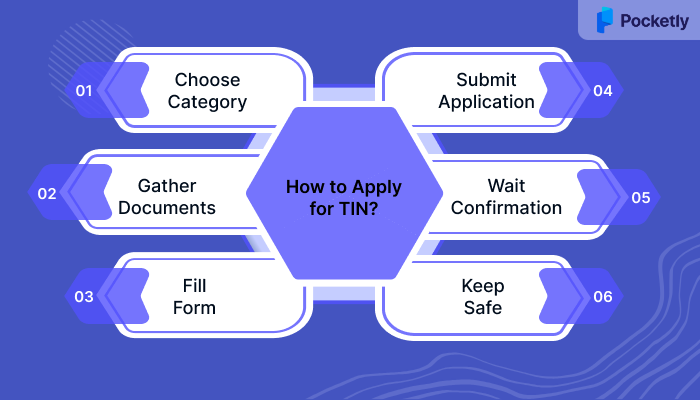

How to Apply for TIN

Applying for a Taxpayer Identification Number (TIN) is essential for anyone involved in taxable activities, whether it’s for business or personal financial purposes. The process is relatively simple but requires specific steps to ensure everything is done correctly. Before you start the application process, here are the necessary steps to ensure that you complete the application smoothly:

1. Choose the Right Category for Application

Before you begin, it’s important to determine whether you are applying as an individual or for a business. The application process differs slightly based on your status:

- For Individuals: Self-employed professionals, freelancers, or anyone reporting personal income for tax purposes will need to apply for a TIN. This helps ensure that your income is properly recorded and taxes are paid.

- For Businesses: If you’re applying for a TIN as a business entity, you will need to select the correct category based on your business type (e.g., sole proprietorship, partnership, corporation). This will link your tax activities to your business and ensure compliance with GST and VAT regulations.

2. Gather Required Documentation

The application process for TIN is fairly simple, but you’ll need the right documentation to verify your identity or business. Common documents include:

- For Individuals:

- Proof of identity (e.g., Aadhar Card, PAN Card, Passport)

- Proof of address (e.g., utility bills, bank statements)

- Recent photograph (if required)

- For Businesses:

- Business registration documents (e.g., GST registration, partnership deed)

- Proof of address of business (e.g., lease agreement, utility bills)

- PAN of the business (if applicable)

3. Fill Out the Application Form

The application can be done online or in person, depending on your location. Most tax authorities allow individuals and businesses to apply for TIN online via their official portal. You'll be required to fill out an application form with details such as:

- Personal or business name

- Address and contact information

- Type of business (for businesses)

- Income details (for individuals)

Ensure that the form is filled out accurately, as any discrepancies can delay the application process.

4. Submit the Application

Once you have filled out the application form and gathered your documents, submit them online or at your nearest tax office. You may need to pay a nominal application fee, which can vary based on your location and the type of TIN you are applying for.

For businesses, the application may require additional verification steps, especially for larger corporations. If you are unsure, please check with local authorities.

5. Wait for Confirmation

After submission, your application will be processed by the relevant authorities. For businesses, the processing time can vary, but it typically takes a few weeks to receive confirmation. For individuals, the process can be quicker, with TIN being issued within a few days, depending on the jurisdiction.

Once your TIN is approved, you will receive an official confirmation, either in the form of a physical certificate or a digital document, that verifies your registration.

6. Keep Your TIN Safe

Once you receive your TIN, ensure that you keep it in a safe place, as it will be required for all tax-related activities. You'll need it for filing returns, invoicing, making payments, and more. Additionally, you may be asked to provide your TIN for various business or financial transactions, so it is always advisable to have it readily accessible.

Having understood the process of applying for TIN, it’s equally important to recognize the advantages that come with it. Beyond just being a legal requirement, TIN offers several benefits that help smooth both personal and business financial activities.

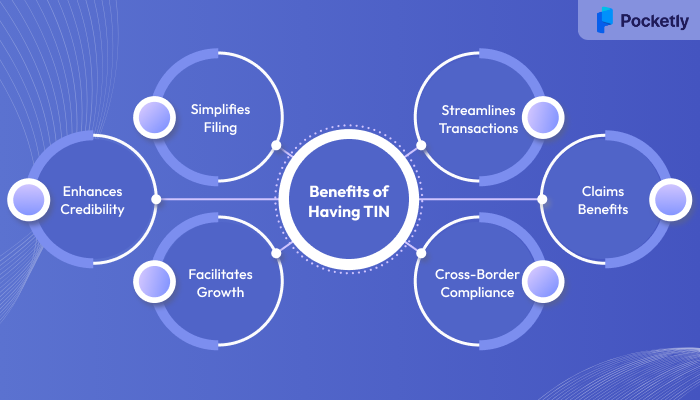

Benefits of Having TIN for Business and Individuals

A Taxpayer Identification Number (TIN) is a vital tool that provides a range of benefits for individuals and businesses alike. From simplifying tax compliance to facilitating smoother financial transactions, TIN provides a solid foundation for managing finances. Here are the key benefits of having a TIN:

- Simplifies Tax Filing and Reporting: A TIN manages the tax filing process for both businesses and individuals. It ensures accurate reporting of income and expenses, minimizing errors and reducing the risk of penalties. With TIN, your tax obligations are linked to your official records, making tax returns easier to file and track.

- Enhances Credibility with Financial Institutions: A valid TIN is necessary for applying for loans, credit, and even opening a bank account. It allows lenders and financial institutions to verify your tax status and financial reliability. Keeping your TIN updated enhances your financial credibility and may result in more favourable terms on loans and credit facilities.

- Facilitates Business Growth and Legal Compliance: Businesses rely on TIN for tasks like VAT/GST registration, issuing invoices, and filing tax returns. It ensures compliance with legal requirements, making business operations smoother and reducing the likelihood of tax-related issues. TIN is also necessary for obtaining business licenses and permits.

- Streamlines Financial Transactions: Having a TIN enables smoother and more transparent financial transactions. Businesses can track invoices, payments, and taxes effectively, while individuals can ensure their income is reported accurately. This simplifies the entire financial process, promoting clarity in both personal and business finances.

- Helps with Claiming Tax Deductions and Benefits: A TIN is crucial when applying for tax exemptions, deductions, or credits. Individuals and businesses can take advantage of tax-saving opportunities, including deductions for medical expenses and business-related costs. Without a TIN, claiming these benefits becomes more challenging.

- Simplifies Cross-Border Transactions: For businesses, TIN smooths international trade by facilitating compliance with tax requirements in various countries. It allows businesses to comply with global tax regulations, such as VAT and sales tax, ensuring smooth transactions with foreign suppliers and customers.

Having a TIN opens up many benefits, from simplifying tax compliance to ensuring smoother business transactions. However, the application process can come with its own set of challenges. Even small mistakes can lead to delays or complications in securing your TIN.

If you're curious about how maintaining a good financial profile can benefit you in other areas, consider reading Top Instant and Safe Personal Loan Apps in India to learn how a good TIN can help streamline your access to personal loans.

Common Mistakes to Avoid When Applying for a TIN

When applying for a Taxpayer Identification Number (TIN), small oversights can lead to unnecessary delays or rejections. Here are the key pitfalls to watch out for during the application:

1. Incorrect or Incomplete Documentation

One of the most common errors applicants make is submitting incomplete or incorrect documentation. For businesses, this may mean missing business registration documents, while individuals may neglect to include proof of identity or address. Always double-check the required documents before submission, as any missing paperwork will cause delays in processing your application.

Tip: Before applying, create a checklist of the required documents and ensure they are clear, legible, and up to date. This step will save you from unnecessary follow-ups or rejections.

2. Failing to Verify Business Details (For Businesses)

If you are applying for a TIN on behalf of a business, ensure that all business details, such as the legal name, address, and type of business, are accurately filled in. Incorrect or inconsistent business details can result in rejection, particularly when they do not align with official records. Ensure that your registration documents and TIN application are aligned to avoid confusion.

Tip: Review your business registration documents carefully before completing the TIN form. Cross-check the business name, address, and contact information to ensure consistency.

3. Submitting the Application Under the Wrong Category

Different categories of TIN applications exist for individuals and businesses, and submitting your application under the wrong category can result in delays. For example, self-employed individuals need to apply differently from sole proprietors or large businesses. Make sure you're applying under the right category based on your situation.

Tip: Understand the category under which you should apply whether it’s for personal use or as a business entity before starting the process.

4. Failing to Update Your Information

Over time, details such as your address, business structure, or financial status may change. Many people forget to update these details when reapplying for TIN or in subsequent filings. This can lead to mismatches in your records and cause delays in future applications or verifications.

Tip: Regularly update your details with the tax authorities to keep your TIN information current. This will ensure smooth processing for future applications or renewals.

5. Missing the Application Deadline (For Businesses)

If you're applying for TIN to register your business for GST, VAT, or sales tax, missing the application deadline can result in fines or penalties. It's important to stay ahead of deadlines, particularly when launching a new business or during tax season.

Tip: Set reminders for key dates and ensure that your TIN application is submitted well in advance, especially when registering for tax purposes.

6. Not Double-Checking Your Information

Minor typos in your name, business name, or other critical information can cause delays or rejections. Even if the mistake seems minor, such as misspelling a letter, it could affect the approval process. Double-check everything before submitting your application to avoid unnecessary setbacks.

Tip: Review your TIN application carefully before submission, checking for any minor errors that could cause problems down the line.

7. Not Following Up After Submission

After submitting your TIN application, some applicants forget to follow up or monitor the status of their request. Waiting for a response without checking your application status can lead to unexpected delays or missed opportunities to resolve any issues.

Tip: Once you’ve submitted your application, stay proactive by checking the status periodically and following up if needed.

As you work towards managing your financial and tax responsibilities, having the right tools and support in place can make all the difference. Whether you're managing the TIN application process or handling unexpected expenses, platforms like Pocketly can provide valuable assistance, especially when it comes to fulfilling emergency money needs or securing short-term loans for urgent financial requirements.

How Pocketly Can Support Your Financial Journey

When it comes to managing your finances effectively, especially during periods of transition or unexpected situations, having the right support is essential. This is where Pocketly steps in. Pocketly offers flexible, quick, and easy financial solutions that make it easier to bridge gaps, whether you’re handling tax-related paperwork, paying off existing loans, or covering emergency expenses.

Here’s how Pocketly can make your financial journey simpler:

1. Instant Loan Approvals with Minimal Documentation

Gone are the days of lengthy approval processes. Pocketly offers instant loan approvals without the burden of extensive paperwork. Whether you need funds for an unexpected medical bill, urgent travel, or an unforeseen expense, Pocketly ensures quick access to the money you need.

- Loan Amounts: ₹1,000 to ₹25,000

- Approval Time: As fast as minutes

- Minimal Documentation: Only essential KYC documents required

2. Flexible Repayment Plans

One of the standout features of Pocketly is its flexible repayment options. Whether you’re managing a personal loan, dealing with an emergency, or paying off a balance, Pocketly offers repayment terms that are designed to fit within your budget. You can opt for quick repayment or spread it out over a longer term to manage monthly payments better.

- Flexible EMIs: Choose a repayment term that fits your needs

- No Prepayment Penalties: Pay off early without extra charges

- Easy Loan Management: Manage repayments via the Pocketly app

3. Transparent Fees and Competitive Interest Rates

At Pocketly, what you see is what you get. No hidden fees, no surprise charges. Pocketly keeps its fees clear and upfront, helping you plan your finances effectively.

- Interest Rate: Starting from just 2% per month

- Processing Fee: A one-time fee between 1% and 8%

- No Annual Fees or Hidden Charges: Full transparency

4. No Collateral Required

Unlike traditional loans, Pocketly doesn’t require any collateral. Whether you're dealing with small urgent expenses or need a larger amount, you can get the funds you need without pledging assets.

- Unsecured Loans: No need to put up collateral

- Quick Access to Funds: Get loans without worrying about asset-based risks

5. Credit-Friendly Practices

Even if your credit score isn’t perfect, Pocketly still provides you with a chance to access funds. Plus, as you repay your loan on time, Pocketly reports your repayments to credit bureaus, such as CRIF, which helps you build a stronger credit profile over time.

- Build Credit History: Timely repayments help boost your credit score

- Available for First-Time Borrowers: No need for a perfect credit score

6. 24/7 Access and Support

Whether it’s day or night, you can access Pocketly’s loan services whenever you need them. The app-based platform provides you with complete control over your loans and finances, with customer support readily available to assist you.

- 24/7 Availability: Apply and receive support at any time

- Mobile-Friendly: Complete your loan application through the app or website

How to Apply for a Loan with Pocketly:

1. Download the Pocketly app from the Google Play Store or Apple App Store.

2. Complete the KYC process: Simple, fully digital, and quick.

3. Choose your loan amount: Select what fits your need whether it’s ₹1,000 or ₹25,000.

4. Submit your application and get instant approval.

5. Receive your funds: The loan is directly credited to your bank account.

With Pocketly, managing finances, especially during uncertain times, becomes far less stressful. Pocketly is a reliable partner that helps you stay in control of your financial well-being.

Also Read our guide on “Personal Loan Pre-Closure: Charges and Procedure”

Conclusion

Understanding the Taxpayer Identification Number (TIN) and its role in both personal and business finances is key to maintaining compliance and ensuring smooth financial transactions. Incorporating the correct use of TIN not only manages tax-related processes but also helps you build trust with lenders and government agencies. However, mistakes in the application process can cause delays and complications, so it's essential to avoid common errors and follow the correct procedures.

Staying proactive with your TIN registration and managing your finances effectively can lead to smoother financial operations and better long-term outcomes.

Ensure you're equipped with the right tools and support to manage your finances effectively and efficiently. Keep your TIN in check, and if you need quick financial help, Pocketly is here to ensure you have access to the funds you need, when you need them most.

Download the Pocketly app today for Android or IOS easy access to quick and flexible loan solutions!

FAQs

How long does it take to receive a TIN after submitting an application?

The time it takes to receive your TIN can vary based on your location and the accuracy of the information provided. Typically, it takes around 7–10 business days for businesses to receive a TIN after submission, while individual TIN applications can take slightly less time.

Can I apply for a TIN online?

Yes, TIN can be applied for online in most cases. Many states and municipalities have online portals for both businesses and individuals to submit their applications. Ensure you have all necessary documents ready before applying to avoid any delays.

Is TIN the same as PAN?

No, TIN (Taxpayer Identification Number) is primarily used for businesses for tax reporting, while PAN (Permanent Account Number) is used for individuals to track income tax payments. PAN is essential for filing taxes as an individual, while TIN is used for business tax compliance.

Do I need a TIN to open a business account?

Yes, in most cases, you will need a TIN to open a business bank account. This helps the bank track your business's financial activities and ensures that the account is used in compliance with tax laws.

Can a low credit score affect my TIN application?

No, your credit score does not directly affect your TIN application. TIN is related to your tax and financial transactions, while a credit score typically impacts loan approvals. However, keeping both your TIN details and credit score updated can help manage your financial processes.