Do you ever feel like managing money feels simple in theory but messy in real life? You plan, you save, and still, somehow, the wallet runs dry before the month does. You’re definitely not alone.

According to a recent survey, 41% of Indians believe they’re well-informed about their finances. Yet somehow, many still struggle to stay consistent with savings or handle sudden expenses. Turns out, knowing your money and managing it smartly are two very different things.

That’s where understanding personal finance helps you, not as a boring checklist, but as a necessary skill. In this blog, we’ll break down the essentials of personal finance, why it matters and how to manage it effectively. Whether you're juggling bills or just trying to save, we’ve got practical tips to help you get right on track.

Quick Look:

- Personal finance helps you manage income, spending, savings, and investments to secure long-term stability.

- Knowing your money flow builds awareness and prevents overspending or unnecessary debt.

- Master five key areas, including income, spending, saving, investing, and protection, for long-term stability.

- Use smart money habits like budgeting, managing debt, and planning early for future goals.

- Avoid common mistakes like emotional spending and ignoring emergency funds to stay financially resilient.

What Is Personal Finance And Why Is It Important?

Let’s face it, handling money isn’t exactly taught in school, but it’s one of the most essential life skills. Personal finance is simply about how you manage your money, from your income and savings to expenses, loans, and investments.

It’s basically the art (and a bit of science) that helps you balance your current lifestyle while preparing for what’s ahead.

Why does it matter so much? Because without a plan, even a decent income can slip through your fingers. Having good financial habits helps you:

- Prepares you for surprises: You’ll never have to panic over sudden medical bills or unexpected travel costs.

- Helps you reach big goals: From buying a laptop to funding your studies abroad, every rupee counts when it’s planned.

- Reduces financial stress: A well-managed budget keeps you in control and worry-free.

- Encourages wealth building: Small, consistent habits can turn savings into investments over time.

- Improves decision-making: You’ll learn to spend on what matters and avoid impulsive traps.

Understanding the concept is just step one. To actually manage your money well, you need to know the core parts that make up personal finance.

Also Read: Understanding Personal Finance and Budgeting for Financial Needs

What Are The 5 Basics Of Personal Finance?

Every good plan starts with the basics. Think of personal finance as a five-part framework, where every piece connects to create a complete picture of your financial health. Let’s look at each one in detail:

Here’s a quick view:

| Component | Purpose | Example |

| Income | Builds your financial base | Salary, part-time jobs |

| Spending | Covers daily needs | Rent, bills, groceries |

| Saving | Keeps you ready for emergencies | Bank savings, cash reserve |

| Investing | Helps grow your wealth | SIPs, mutual funds |

| Protection | Safeguards your future | Health or term insurance |

1. Income

This is the money you earn, whether it’s your salary, stipend, freelance payment, or side hustle. Your income decides what’s possible in your financial plan. Tracking it helps you know exactly where your money comes from and how to divide it wisely.

2. Spending

Spending covers all your expenses, from rent and food to your Netflix subscription and cab rides. The key here is balance; make sure you’re spending less than you earn. Tracking expenses helps you identify small leaks that often go unnoticed.

3. Saving

Savings act as your emergency cushion. It’s money kept aside for when things don’t go as planned, like sudden medical bills or a lost phone. Even saving ₹500–₹1000 a month can make a difference over time.

4. Investing

Investing is about putting your money to work. Whether it’s a SIP, gold, or mutual fund, investments can help you earn returns that grow your wealth. Just remember: invest only after you’ve built your emergency fund.

5. Protection

Protection includes health and life insurance, which saves you from financial setbacks during tough times. It’s the shield that keeps your financial goals safe even when life throws a curveball.

You’ve got the basics down; now it’s time to bring them to life. Let’s see how you can manage your personal finances, especially when money feels tight.

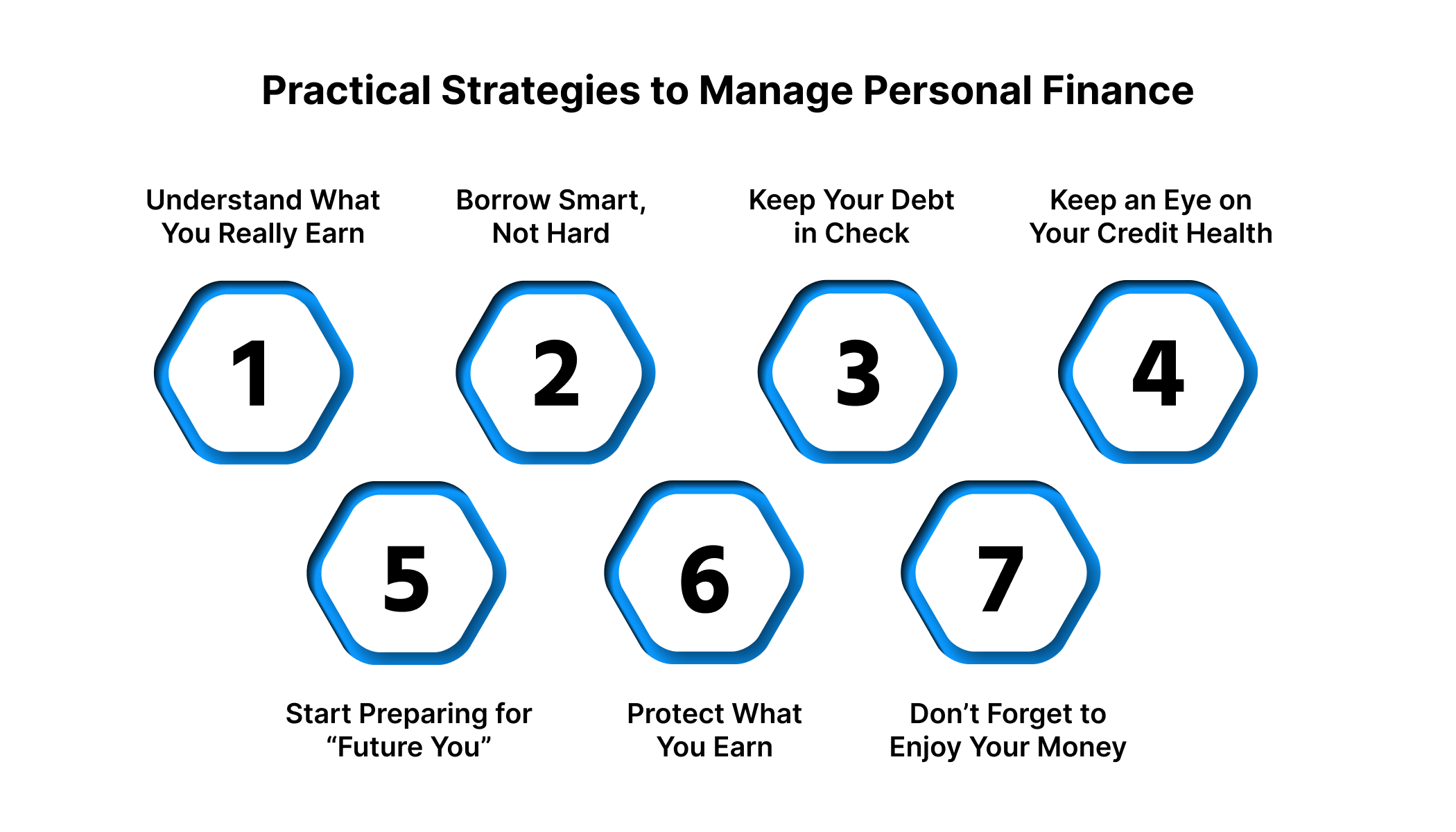

Practical Strategies to Manage Personal Finance

Personal finance isn’t about earning more, but about managing what you already have wisely. Let’s look at practical, doable strategies that actually make a difference in your day-to-day life:

1. Understand What You Really Earn

Before you plan how to spend, save, or invest, know your true income. It’s not just your salary on paper; it’s what’s left in your account after deductions and taxes.

Here’s what you can do:

- Calculate your take-home pay. Include all consistent sources like internships, side gigs, or allowances.

- Separate fixed vs. flexible income. Fixed income helps with monthly planning, while variable income (like commissions or bonuses) can go into savings or debt repayment.

- Track your inflow. Use a simple app or spreadsheet to note every rupee you earn.

When you truly understand your income, you’ll know exactly where your limits and opportunities lie.

2. Borrow Smart, Not Hard

Everyone needs to borrow at some point. Maybe your rent is due, your laptop needs repair, or you’re waiting for your salary. The trick is not to avoid borrowing altogether but to do it wisely.

Keep these rules in mind:

- Borrow for need, not want. Emergencies or essentials? Yes. Impulse shopping? Probably not.

- Read the fine print. Always check interest rates, processing fees, and repayment terms before committing.

- Plan repayment before borrowing. If you can’t repay comfortably within your next few pay cycles, reconsider the loan amount.

Smart Tip: For short-term financial gaps, digital lending platforms like Pocketly can be a convenient option for collateral-free loans with minimal documentation and fast approval.

3. Keep Your Debt in Check

Debt can be a useful tool, until it isn’t. The key is balance. Carrying multiple credit cards or unpaid EMIs can sneak up on you faster than you think.

Here’s how to stay in control:

- Pay more than just the minimum amount on your credit card to avoid high interest buildup.

- Pay on time. Missing even one can lower your credit rating.

- Avoid overlapping loans. One at a time keeps your budget cleaner and easier to manage.

Remember, debt should support your goals, not delay them.

4. Keep an Eye on Your Credit Health

Your credit score acts like your financial progress report, reflecting how responsibly you handle money. And whether you plan to buy a bike, rent a flat, or get a loan, this number matters.

Here’s how to maintain a healthy score:

- Pay bills and EMIs on time. Late payments can drop your score quickly.

- Keep credit utilisation low. Try to use less than 30% of your available credit limit.

- Check your report regularly. Spot errors or suspicious activity early by reviewing it every few months.

A good score means lower interest rates and smoother approvals when you need them most.

5. Start Preparing for “Future You”

Planning for the future may look far off when you’re just starting out, but time is your greatest asset. Small, consistent actions today can save you major stress later.

You can start with:

- Building an emergency fund that can cover a minimum of 3-6 months of essential expenses.

- Investing early. Even modest SIPs or savings schemes compound beautifully over time.

- Setting clear goals. Write down short-term (like a trip) and long-term (like higher studies) goals.

Every bit you save now is your future self saying “thank you.”

6. Protect What You Earn

Insurance might sound boring, but it’s actually your financial safety net. Without it, one unexpected hospital bill can undo months of careful saving.

Consider these essentials:

- Health insurance for medical emergencies.

- Term insurance if you’re a dependent earner.

- Device or travel insurance if your work or lifestyle involves risks.

Protection today saves panic tomorrow.

7. Don’t Forget to Enjoy Your Money

Saving and budgeting shouldn’t feel like punishment. Financial discipline is important, but so is balance.

Here’s how to stay happy while staying smart:

- Set a “fun fund.” Keep a small budget just for entertainment or indulgence.

- Celebrate small wins. Paid off a loan? Saved for a new gadget? That deserves recognition.

- Take breaks. It’s okay to pause and recharge, even financially.

At the end of the day, good personal finance is about balance, not perfection.

Common Financial Mistakes To Avoid

Money mistakes don’t always come from ignorance; they often come from impulse. Whether it’s a flash sale or that weekend trip, even the smartest people slip up when it comes to money. Here are some sneaky financial traps people often fall into (and how to dodge them):

Confusing Wants with Needs

It’s easy to convince yourself that a “want” is actually a “need”, especially when online offers pop up at midnight.

How to fix it:

- Before buying anything, ask: Will I still want this in 48 hours?

- Try a “cooling-off” period for big purchases; you’ll often skip them later.

- Prioritise experiences or essentials over impulse buys.

Underestimating Small Expenses

Ever checked your digital wallet after a week and wondered where it all went? Tiny, frequent spends like snacks, cabs, subscriptions silently drain your balance.

How to fix it:

- Track weekly micro-expenses using a free app.

- Cancel subscriptions you’ve “meant to use” for months.

- Give yourself a weekly limit for food delivery or shopping.

Depending Too Much on Credit Cards

Having a credit card isn’t bad, but treating it like extra income is. Paying just the minimum amount keeps you stuck in a debt loop.

How to fix it:

- Use your card for planned expenses only, not impulse buys.

- Pay the full balance before the due date.

- Keep your utilisation below 30% of your limit.

Delaying Financial Goals

Waiting for the “right time” to start saving or investing? That delay costs more than you think.

How to fix it:

- Start small; even ₹500 a month is progress.

- Automate transfers to your savings or SIP.

- Treat investing as a monthly ritual, like paying rent.

Mixing Emotions with Money

Whether it’s lending to a friend or panic-selling an investment, emotions often cloud judgment.

How to fix it:

- Set clear boundaries when lending. Only give what you can afford to lose.

- For investing, stick to facts, not fear.

- Create a financial checklist before any big money decision.

Also Read: Simple Money Management Tips for Personal Finances

Digital Tools For Smarter Money Decisions

Managing your money no longer needs spreadsheets or calculators. Your phone is now your entire financial toolkit. From tracking expenses to saving smartly, digital tools make money management simple and a little more fun.

Let’s explore how these tools can help you take charge of your finances:

Expense Trackers

You’d be surprised how those “just ₹200” moments add up by month-end. Expense trackers help you visualise where your money actually goes.

They categorise spends, alert you when limits are crossed, and highlight patterns that might need fixing. A quick weekly review of your spending is often all it takes to stay in control.

Savings Planners

Saving feels easier when you can actually see your progress. Savings planner apps let you create goals like “Emergency Fund” or “New Laptop,” automate transfers, and track how close you are to your targets.

It turns saving from a chore into a challenge, and you’ll find yourself more motivated to stay consistent.

Investment Apps

Investing used to sound complicated, but now, it’s as simple as setting up a SIP on your phone. These apps guide you through risk levels, track your returns, and even offer bite-sized lessons to build confidence.

Start small, stay consistent, and you’ll soon see how investing grows your wealth over time.

Digital Lending Platforms

When an unexpected expense hits, borrowing smartly matters. Digital lending platforms let you access small, short-term loans without paperwork or long waiting times.

You can repay flexibly, track dues, and even build your credit history responsibly. With transparent options like Pocketly, you can handle cash flow gaps without the stress or surprise fees.

Also Read: Difference Between Private Finance and Personal Finance

How Pocketly Makes Personal Financing Stress-Free

Managing personal finances can get tricky, especially when an unexpected expense pops up right before payday. That’s when Pocketly steps in with a quick, reliable fix. Designed for young Indians, Pocketly helps you handle short-term financial needs with instant, collateral-free loans ranging from ₹1,000 to ₹25,000.

As a digital lending platform (not an NBFC), Pocketly partners with trusted NBFCs to ensure safe, fast, and compliant lending. With interest rates starting from 2% per month and a processing fee between 1–8%, you get a transparent borrowing experience with no hidden charges.

Here’s how simple it is to apply:

- Two-Click Signup: Register instantly through the Pocketly app.

- Hassle-Free KYC: Upload Aadhaar and PAN for quick, paperless verification.

- Add Bank Details: Securely link your account for instant transfers.

- Choose Loan Amount & Tenure: Select what fits your needs.

- Get Funds in Minutes: Loan amount is credited directly to your account.

Pocketly’s fully digital process, minimum KYC, and 24/7 customer support make borrowing simple and stress-free. So, the next time an unexpected expense catches you off guard, choose Pocketly to ensure your personal finance plan stays steady.

Concluding Thoughts

Managing personal finance isn’t about complicated formulas; it’s about making thoughtful, consistent choices every day. From understanding your income and expenses to setting realistic goals, each step helps you take charge of your money and shape a secure future.

The most effective strategy is to start small, stay steady, and review your progress regularly. Over time, these small efforts build confidence and financial stability, no matter where you are in life.

And if a sudden expense disrupts your plans, having a reliable backup like Pocketly can make all the difference. Whether it’s an emergency, a short-term cash gap, or just an unexpected expense, you’ll always have support just a few taps away.

Download Pocketly today on iOS or Android to get collateral-free personal loans for your everyday needs and keep your financial goals on track.

FAQ’s

What are the most important things to know about personal finance?

Understanding where your money goes is key. Learn to balance spending, saving, and borrowing wisely so you can stay prepared for both planned and unexpected expenses.

How to learn about personal finance?

You can learn about personal finance by reading finance blogs or watching simple explainer videos online. The more you apply what you learn in real life, the faster it starts making sense.

What’s the best way to manage personal finances?

It really depends on your lifestyle and goals. Some people prefer budgeting methods like 50/30/20, while others focus on debt-free living or automated savings. In short, the “best” way is the one you can actually stick to.

What are the most effective personal finance and investment strategies everyone should know?

Focus on consistent saving, diversify your investments, and avoid impulsive spending. Building an emergency fund and setting realistic financial goals help your money grow safely over time.