Have you ever checked your CIBIL report and noticed an unfamiliar term like LSS? If you’re scratching your head, wondering what it means, you’re not alone. While most of you know the basics of a credit score, terms like LSS often slip under the radar.

LSS, despite being just a few words in your report, can influence your credit journey in more ways than one. Whether it’s for personal needs or business goals, most of us rely on loans at some point, and that's where understanding the full form of LSS becomes a must.

So, what does this seemingly small remark actually mean for your financial future? In this guide, we’ll answer all these questions and more. From decoding LSS to practical ways of managing its impact, here’s everything you need to know.

TL;DR

- The full form of LSS is Lender Settled Status, a remark seen in CIBIL reports.

- LSS appears when a borrower settles a loan by paying less than the actual amount.

- LSS can hurt your credit score and stay on your report for seven years.

- Even with a good credit score, an LSS remark can raise concerns for future lenders.

- To manage it, focus on timely repayments, low credit usage, and regular report checks.

What Does LSS Mean in CIBIL?

To begin with, many borrowers get confused when they see unfamiliar terms on their credit report. One of them is LSS.

In your CIBIL report, the full form of LSS is often understood as “Lender Settled Status.” It appears when you’ve settled a loan or credit account with your lender by paying less than the original outstanding amount.

This usually happens when someone can’t repay the full loan amount. Instead of defaulting, they negotiate with the lender to pay a partial amount as a final settlement. Once accepted, the lender marks the account as “settled.”

This status gets reported to credit bureaus like CIBIL and stays in your credit history.

How Does LSS Work?

The LSS meaning in CIBIL is not directly visible to borrowers, but it plays an essential role in how lenders assess your loan eligibility. Financial institutions use LSS as a way to evaluate your creditworthiness based on your past financial behaviour and repayment patterns.

For example, you borrowed ₹1,00,000 but were unable to repay it due to a medical emergency. You negotiate with your lender, and they agree to accept ₹70,000 as the final settlement. After this payment, the account is marked as “settled.”

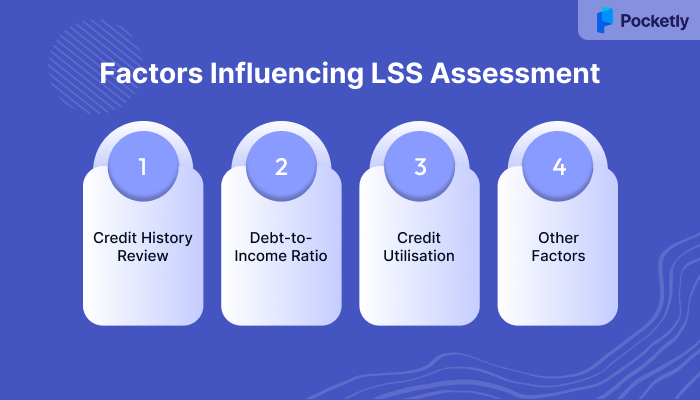

Here are the main factors that influence how LSS is assessed:

- Credit History Review: Lenders check your past loan repayments, defaults, and credit card activity. A poor track record reduces your score.

- Debt-to-Income Ratio: If most of your income goes toward EMIs, it signals poor repayment capacity.

- Credit Utilisation: If you're using too much of your credit limit, it may suggest financial stress.

- Other Factors: Employment type, income stability, and past loan types also influence internal LSS calculations.

Together, these factors help lenders assess your reliability and decide whether to approve future loans. But what does this mean for your credit profile? Let’s find out!

How Does LSS Impact Your CIBIL Report?

Even though a loan settlement can feel like a relief, it still leaves a mark that lenders take seriously.

Impact on Credit Score

Lenders view a settled status as an incomplete repayment. This can lower your CIBIL score, even if the settlement was mutually agreed upon. While the exact drop depends on your overall profile, a visible “settled” tag signals past repayment issues.

This makes lenders more cautious when evaluating your future applications. They may either decline your request or offer loans with stricter terms, such as higher interest rates or lower credit limits.

In some cases, attaching a letter of explanation to your report can help. This gives context to future lenders and shows that the situation was unavoidable, like a medical emergency or job loss.

Long-Term Implications

The effects of LSS don’t stop with a score dip. The remark typically stays on your CIBIL report for up to seven years, even if you’ve become financially stable since.

During this time, your ability to access loans, credit cards, or EMI options may remain limited. Some lenders may hesitate to offer you unsecured credit products, or may ask for additional guarantees.

Even if you're eligible for credit, you might have to accept less favourable terms. This can affect major milestones like buying a home, financing education, or starting a business.

But why should a single remark influence so much? The answer lies in how deeply it shapes your credit profile over time.

Why Is LSS Important to Consider?

LSS may seem like a quick way to close a loan, but its consequences go deeper than most people expect.

Risk Assessment

- When lenders review your credit report, they see LSS as a sign of past financial difficulty. This increases the risk profile attached to your name, which affects future loan approvals.

Limit Credit Access

- Even if your income is strong and your current debts are low, the LSS tag can create doubt. Lenders may hesitate to offer high-value loans or credit card upgrades.

Signals Incomplete Repayment Behaviour

- Unlike a “closed” status, which shows full repayment, LSS suggests that you didn’t meet the original loan terms. This makes it harder to build long-term credit trust.

Lingers

- An LSS remark doesn’t disappear quickly. Its presence for seven years means every future credit evaluation could be affected, unless steps are taken to rebuild your profile.

Lowers Financial Flexibility

- A single LSS remark might seem minor, but it can limit access to credit during emergencies or growth opportunities, when flexible financing options matter most.

Knowing the full form of LSS and its impact is the first step. The next? Learning how to manage it if it’s already on your credit report.

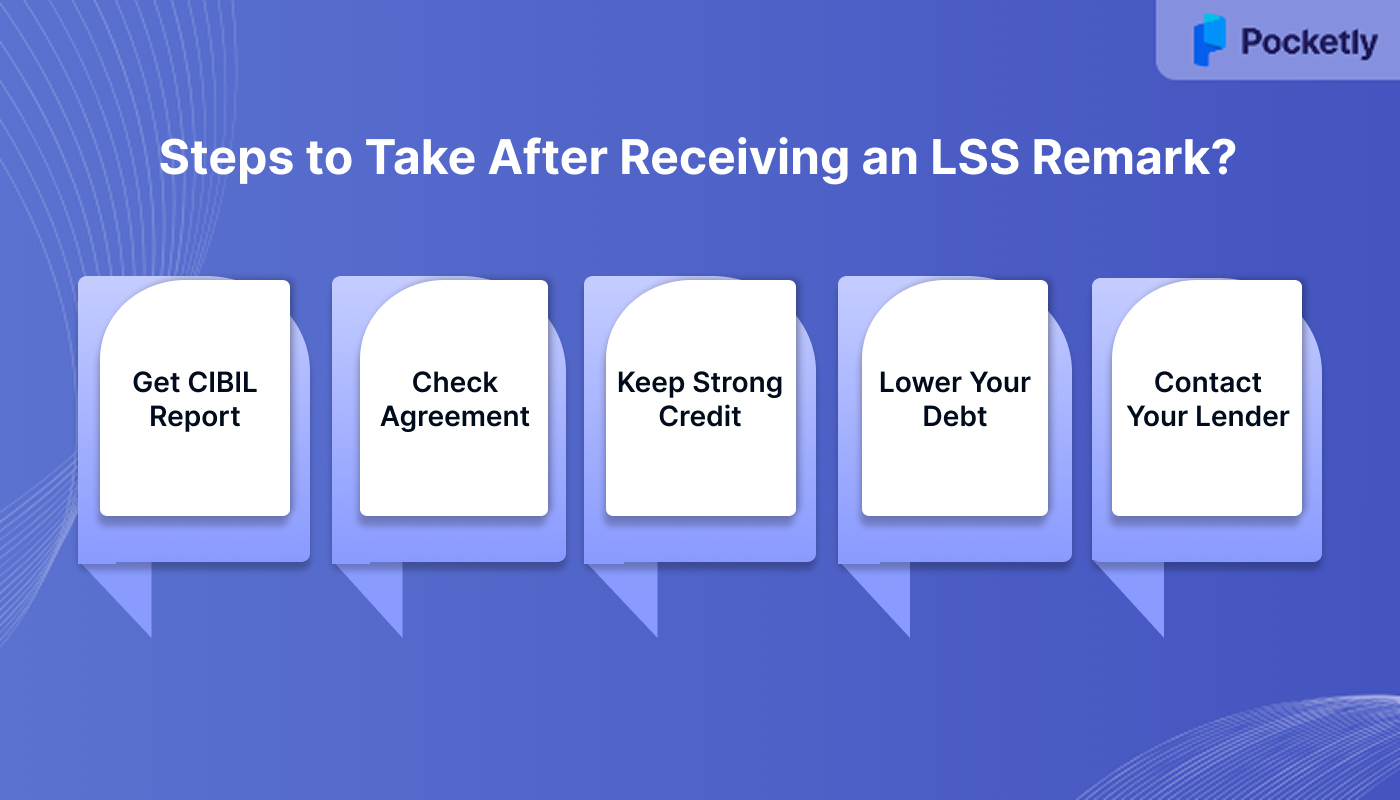

Steps to Take After Receiving an LSS Remark?

Just because you've received a Lender Settled Status (LSS) remark doesn't mean your credit future is over. While the full form of LSS may look intimidating in your report, there are steps you can take to manage its impact.

1. Obtain Your Detailed CIBIL Report

Start by downloading your CIBIL report from a trusted platform or directly through the official bureau. Look closely at the LSS remark, including the lender’s name, the date of settlement, and the exact amount paid.

These details help you track how long the remark will remain and whether it has been reported correctly. A clear understanding of your report allows you to make better decisions to rebuild your financial standing.

2. Review Your Settlement Agreement

It’s important to revisit the agreement you signed during the loan settlement process. Double-check whether the agreed terms were honoured, including repayment dates and the final settled amount.

If anything looks unclear or feels misaligned, reach out to your lender for clarification. Having a proper understanding ensures you’re not caught off guard later and helps avoid future disputes.

3. Maintain a Good Credit Profile

Even if the LSS full form on your report suggests a past financial issue, you can still show current creditworthiness through consistent financial behaviour. Make sure all ongoing EMIs, credit card bills, and dues are paid on time.

Lenders look at your full credit picture, not just one remark. Timely repayments now can help balance the impact of your past settlement and gradually rebuild your score.

4. Reduce Your Debt

Another helpful step is to lower your existing debt wherever possible. A better debt-to-income ratio makes you appear more financially stable to lenders and offsets the weight of a negative remark.

Prioritise paying off high-interest debts first, and avoid taking on any new unnecessary credit. Over time, this will improve both your score and your chances of getting better loan terms in the future.

5. Communicate with Your Lender

If you're still facing financial strain, don’t stay silent. Having an open conversation with your lender can lead to more flexible repayment options or reduced interest rates.

Sharing your current situation builds trust and may even help you negotiate terms that work better for both sides. It also shows future lenders that you took steps to responsibly manage your obligations.

How to Check Your Credit Score for Free?

To manage your financial health better, knowing your credit score is key, and luckily, checking it is quick and free. There are several reliable ways to do this, without impacting your score or paying anything.

- Online Platforms: Various trusted websites and apps offer free credit score checks. Make sure to use reliable platforms to get accurate information, as these platforms allow you to track your financial standing and monitor changes in your score over time.

- Credit Bureaus: You can directly visit major credit bureaus like CIBIL, Experian, or Equifax to access your free credit report annually. Most bureaus provide one free report per year, helping you keep track of your credit status and rectify any errors.

- Banking Apps: Several Indian banks offer free credit score checks as part of their customer service. These apps can help you monitor your score and make sure there are no discrepancies that could negatively affect your creditworthiness.

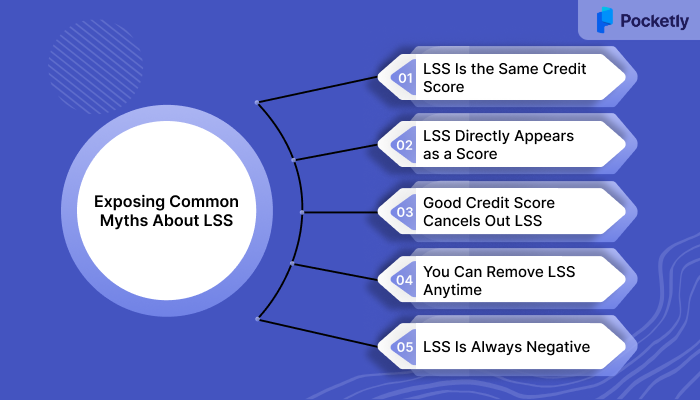

Exposing Common Myths About LSS

When it comes to LSS meaning, confusion is common, and several myths lead borrowers to make uninformed decisions. Let’s clear up a few misconceptions that tend to mislead people.

Myth 1: LSS Is the Same as Your Credit Score

Truth: This is a common misconception. Your credit score is a three-digit number that reflects your overall credit behaviour. It considers all your loans, repayment history, credit utilisation, and the age of your credit accounts.

On the other hand, LSS refers to a specific instance where a loan was settled for less than the full amount owed. It does not represent your entire credit performance, but rather a particular loan outcome.

Myth 2: LSS Directly Appears as a Score

Truth: LSS does not appear as a separate score on your credit report. Instead, it shows up as a remark or status update on a particular loan account that was settled.

Although some financial institutions may calculate an internal Loan Sanctioning Score, this is not visible to the borrower. The LSS remark is part of the credit report's summary and helps lenders evaluate risk.

Myth 3: A Good Credit Score Cancels Out LSS

Truth: Having a high credit score does not erase the presence or effect of an LSS remark. While your score might be strong overall, the “settled” status still reflects a repayment that did not meet the original terms.

Lenders look at more than just the score. They also review each account's repayment history. A settled account may suggest past financial trouble, which can affect your chances of loan approval.

Myth 4: You Can Remove LSS Anytime

Truth: LSS cannot be removed from your credit report just because you request it. If the settlement was reported accurately, it will remain on your report for seven years from the date of update.

The only way to remove it early is if it was reported in error, in which case you can raise a dispute. Otherwise, your best option is to maintain responsible financial behaviour and gradually rebuild your credit profile.

Myth 5: LSS Is Always Negative

Truth: While LSS is not ideal, it is not necessarily the worst outcome. In fact, it can be a sign that you took proactive steps to resolve a loan, instead of defaulting completely.

Some lenders may view this effort positively, especially if you have shown improvement in other areas of your credit profile. Responsible credit use after settlement can help restore your financial credibility over time.

Pocketly: Your Quick Financial Support

If you’re dealing with a credit remark like LSS or just need urgent access to funds, the right support system can make all the difference. That’s where Pocketly steps in.

Pocketly is a digital lending platform designed for young Indians who want fast, simple, and transparent access to personal loans. You can borrow amounts ranging from ₹1,000 to ₹25,000, ideal for emergencies, education needs, or short-term gaps. Interest rates start from 2% per month, with a processing fee between 1% to 8%, depending on the loan amount.

How the Loan Process Works:

- Sign up and complete a quick KYC

- Choose your loan amount

- Submit your application digitally

- Get approval within minutes

- Receive the funds directly into your bank account

With Pocketly, you get quick bank transfers, flexible repayments, and zero hidden charges. No collateral, no paperwork hassle; just a smooth digital process. And if you ever get stuck, their 24/7 support’s got your back, making borrowing feel a lot less stressful.

Conclusion

An LSS remark might feel like a setback, but it doesn’t define your entire credit journey. By understanding the full form of LSS, its impact, and how to respond, you’re already one step closer to better financial decisions.

The key lies in building consistent, responsible habits. Whether it's staying on top of repayments or avoiding unnecessary credit, your efforts today will shape a stronger credit profile tomorrow.

And if you need a little help along the way, Pocketly is here to support you. With fast approvals, fair terms, and flexible loans, you can manage short-term needs without the stress.

Download the Pocketly app on Android or iOS and take a smarter step toward financial independence.

FAQ’s

What is the full form of LSS in finance?

The LSS full form is Lender Settled Status. It appears in your credit report when a loan is settled by paying less than the total outstanding amount after an agreement with the lender.

What is LSS asset classification?

In banking terms, LSS refers to an asset (loan) that has been settled rather than fully repaid. It’s categorised separately from standard assets due to the partial recovery involved.

Is there any way to remove LSS from my CIBIL report?

If the LSS remark is valid, it stays on your CIBIL report for seven years. You can't remove it early, but improving your credit habits can help balance its impact. Meanwhile, platforms like Pocketly can help you access short-term credit even with a limited borrowing history.

Is the LSS in the CIBIL score good or bad for my credit score?

An LSS remark is generally seen as negative since it shows incomplete repayment. It can reduce your credit score and affect your ability to get future loans.

What is the difference between STD, DPD, and LSS in the CIBIL report?

STD stands for Standard, meaning timely repayments. DPD is Days Past Due, showing how late a payment was. LSS refers to Lender Settled Status, where a loan was closed by paying less than the original due amount.