Ever found yourself struggling to cover expenses towards month end? In those moments, a quick loan might seem like the easiest fix. But even the smallest unpaid loans can lead to bigger financial trouble. And for banks, when too many borrowers stop paying, the result is what they call a Non-Performing Asset (NPA).

Even as India’s GNPA ratio dropped to a 12-year low of 2.6% in 2024, unpaid loans remain a serious risk for both borrowers and banks.

So, what does an unpaid loan really lead to? If you're borrowing or planning to, this blog breaks down the different types of NPA you need to know. Keep reading to see how staying on top of repayments can help you avoid bigger financial setbacks later.

TL;DR

- A loan unpaid for 90+ days is called a Non-Performing Asset (NPA).

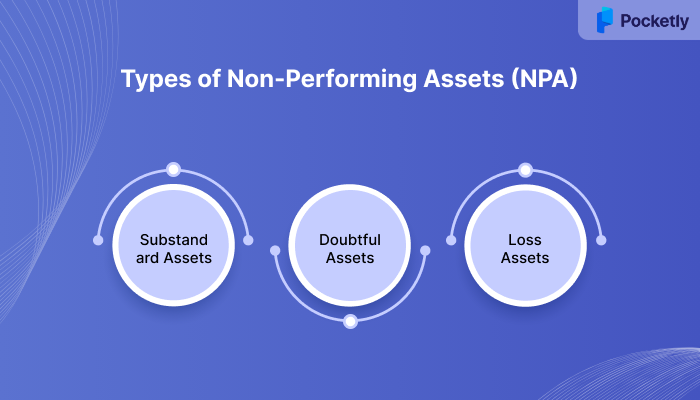

- There are three types of NPA: Substandard, Doubtful, and Loss Assets.

- Banks set aside funds (provisioning) to cover possible loan losses.

- GNPA is the total bad loans, while NNPA shows bad loans after provisions.

- NPAs can lead to stricter loans, higher interest rates, and credit issues for borrowers.

What Are Non-Performing Assets (NPAs)?

A Non-Performing Asset (NPA) is simply a loan that's no longer paying off for the bank. When you borrow money, the bank expects you to make regular repayments. But if you miss payments for 90 days or more, the loan gets classified as an NPA.

Loans are valuable assets for banks, as they earn interest over time. However, once repayments stop, the bank loses its income from the loan, and it becomes a non-performing asset. The Reserve Bank of India (RBI) sets the 90-day rule to keep everything clear and consistent across the banking system.

Once a loan is an NPA, the bank will need to take steps to recover the money, which might include legal action or writing off the debt. But how does an NPA affect not just the bank, but your finances? The impact goes deeper than you might think.

How Non-Performing Assets (NPA) Work?

When a loan becomes an NPA, it triggers a series of steps. First, the bank flags it as a non-performing loan and starts actively tracking the loan to recover the money.

If the borrower still doesn't pay, the bank might try to adjust the loan terms to make repayments easier. However, if the loan remains unpaid for too long, the bank may take legal action to recover the dues. As more loans turn into NPAs, the bank faces higher risks, which can affect its ability to lend money to others.

This brings us to the different types of NPAs and how they're classified.

Types of Non-Performing Assets (NPA)

When a loan turns into an NPA, a bank usually classifies them into different types based on how overdue the payments are and how likely the loan is to be recovered. These major types of NPA are Substandard, Doubtful, and Loss Assets. Each type indicates a different level of risk and helps the bank decide the next steps in managing the loan.

1. Substandard Assets

These are loans that have been unpaid for less than 12 months. They're still risky, but with the right actions, there's a chance they can be recovered. Banks often take measures to recover these loans before they worsen.

2. Doubtful Assets

Loans overdue for over 12 months fall into this category. At this stage, the chances of full recovery are slim, and the loan is considered high risk. The bank often takes significant provisions and may consider legal or other recovery options.

3. Loss Assets

These are loans that the bank believes are uncollectible, as there's little to no chance of recovery. Most of the time, they are written off or sold to Asset Reconstruction Companies (ARCs) at a discounted price.

What Causes NPA?

You might wonder why some loans turn into NPAs. The reasons behind them often involve a mix of personal, economic, and banking factors. Let's break down what leads to them:

- Economic slowdowns can make it harder for businesses and individuals to repay loans.

- Some borrowers take loans without planning to pay them back, leading to defaults.

- Banks sometimes approve loans without fully assessing the risk involved.

- Missed payments go unnoticed if banks aren't actively monitoring repayments.

- Interest rate hikes or falling prices can strain borrowers, making repayments tough.

By understanding these causes, you can avoid falling into the same trap and make smarter financial choices. The next step? Understanding how banks handle these risks and what it means for you.

Provisioning Of NPA

When loans go bad, banks can't just move on. They need to prepare for potential losses, and that's where provisioning comes in. This is the amount banks set aside from their profits to cover loans that might not be repaid.

This means that when banks face more bad loans, they have less money to lend out. The amount banks set aside depends on the risk level of the loan. The more risky the loan, the more money is set aside. So, when banks deal with a lot of NPAs, it could mean fewer loans or higher interest rates for you.

GNPA vs NNPA

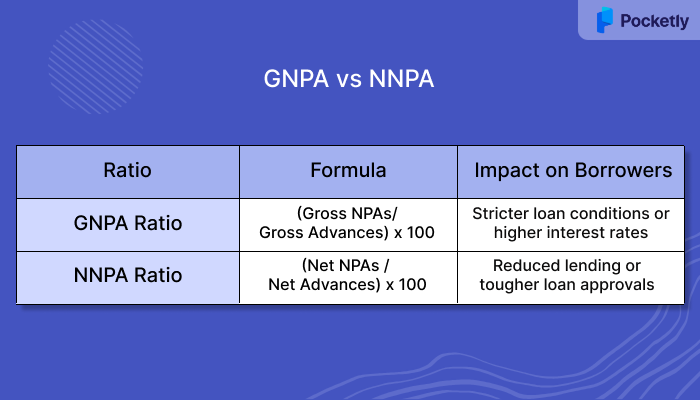

When you hear about bad loans, two terms often pop up: GNPA (Gross Non-Performing Assets) and NNPA (Net Non-Performing Assets). These two help banks, regulators, and investors assess the level of risk in a bank's loan portfolio.

- GNPA represents the total amount of bad loans in the bank, showing the full scope of the problem without factoring in any provisions made by the bank.

- NNPA, on the other hand, reflects the value of bad loans after the bank has set aside provisions to cover potential losses. This gives a more accurate view of the actual financial strain the bank is facing.

For example, let's say you borrow ₹10,00,000 from a bank. The bank sets aside ₹4,00,000 as provisions to cover potential losses. The GNPA would be ₹10,00,000, but the NNPA would only be ₹6,00,000, showing the actual loss the bank faces after provisions.

| Ratio | Formula | Impact on Borrowers |

| GNPA Ratio | (Gross NPAs / Gross Advances) × 100 | Stricter loan conditions or higher interest rates |

| NNPA Ratio | (Net NPAs / Net Advances) × 100 | Reduced lending or tougher loan approvals |

But how do these numbers affect you? They shape your borrowing experience directly.

What Is The Significance Of NPAs?

NPAs can affect you in unexpected ways, with loan defaults significantly damaging your credit rating. When NPAs pile up, banks become cautious with new lending, tightening approvals, and focusing more on risk than access.

In the long run, keeping NPAs low helps banks lend more freely, making it easier for people like you to access credit when needed.

Impact of NPAs

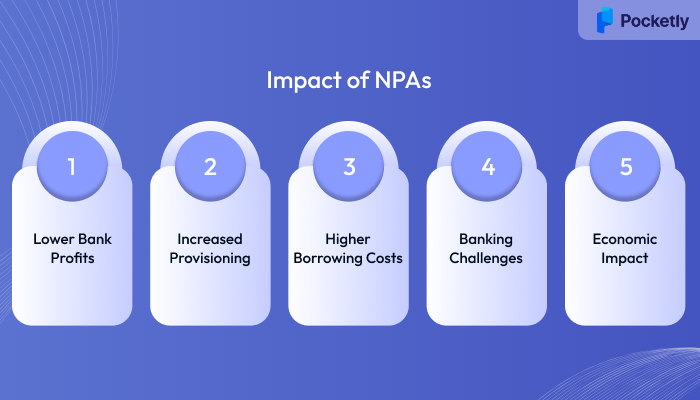

NPAs affect more than just the bank's balance sheet. They influence lending conditions, interest rates, and the overall credit environment. When banks face high NPAs, these are the key ways it impacts borrowers:

- Lower Bank Profits: When banks struggle with NPAs, they might scale back on issuing loans or increase interest rates to cover their losses.

- Increased Provisioning: With more money set aside to cover bad loans, banks may slow down lending, making it harder to secure credit.

- Higher Borrowing Costs: To recover from the risk of bad loans, banks might raise the cost of borrowing, meaning more expensive borrowing.

- Strained Banking Relationships: With more NPAs on their books, banks become more cautious, tightening loan approvals and making it harder to get credit.

- Economic Impact: A banking sector burdened with NPAs can slow down the overall economy, impacting job creation and business opportunities.

Management of NPAs

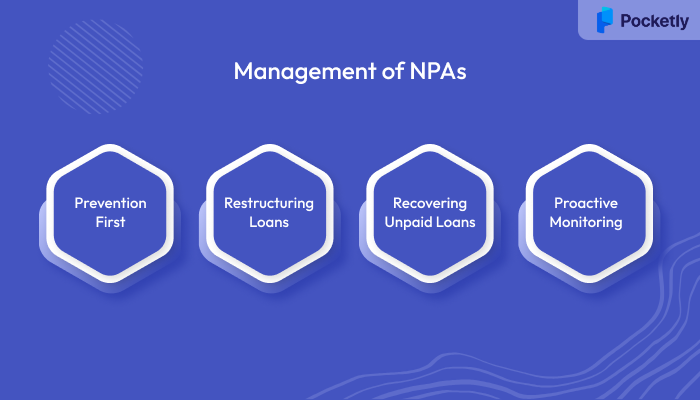

Banks constantly monitor loan performance to prevent NPAs from piling up. They use different strategies to manage and recover bad loans. As a borrower, you should stay on top of your financial health to avoid falling into similar situations.

Here's how they handle them:

- Prevention First

- Banks work hard to avoid NPAs in the first place by ensuring they only lend to creditworthy individuals and businesses. By closely tracking borrowers’ financial health and offering loans responsibly, they can reduce the chances of defaults right from the start.

- Restructuring Loans

- If an account is at risk of becoming an NPA, banks often try to work with borrowers. Loan restructuring, adjusting payment terms, extending timelines, or lowering interest rates help turn troubled loans back into performing ones.

- Recovering Unpaid Loans

- If efforts to restructure fail, banks move to recovery methods. They may use legal channels like the SARFAESI Act or Debt Recovery Tribunals (DRTs) to claim what's owed. In some cases, they may sell bad loans to Asset Reconstruction Companies (ARCs), which focus on recovering money from non-performing assets.

- Proactive Monitoring

- Banks keep a close watch on loans, using early warning systems to spot any signs of stress. If problems are detected early enough, they can take steps to resolve the situation before a loan becomes an NPA.

While banks do their part to recover NPAs, platforms like Pocketly help you manage financial shortfalls.

Pocketly: Your Solution to Avoid Loan Defaults & NPAs

Unexpected expenses can be overwhelming, especially when cash flow is tight. NPAs can lead to long-term financial consequences, including poor credit scores and restricted borrowing capacity. For young individuals who are just beginning to build their financial history, avoiding non-performing assets (NPAs) is critical. That's where Pocketly comes in.

Pocketly is a digital lending platform that offers short-term personal loans to meet urgent financial needs of young indians. Unlike general financial tools, Pocketly helps users manage shortfalls without falling into repayment issues.

Here's how Pocketly can help you:

- Flexible Loan Amounts: Borrow anywhere from ₹1,000 to ₹25,000 for personal or business needs, with flexible repayment terms.

- Quick and Easy Process: Instant fund transfer with a simple KYC process, and get approval fast, with minimal documentation required.

- No Collateral Required: No need to pledge assets, reducing entry barriers for students, first-time borrowers, and young professionals.

- Transparent Interest Rates: Interest rates starting at just 2% per month, with processing fees ranging from 1-8% of the loan amount.

- Flexible Repayment Plans: Choose repayment options like partial payments and early closure without penalties that work for your budget.

By using Pocketly, you can avoid the long-term impact of loan defaults and NPAs by getting quick access to credit with full transparency and control.

Conclusion

Non-Performing Assets (NPAs) aren't just banking jargon; they reflect what happens when loans go unpaid for too long. Whether it's a substandard, doubtful, or loss asset, types of NPA signal a deeper financial issue that can impact both lenders and borrowers. Borrow only what you can repay, stay informed about your obligations, and act early when things feel tight. A little financial awareness today can help you avoid serious credit consequences tomorrow.

When facing short-term cash flow issues, Pocketly gives you a way to access funds without slipping into risky borrowing habits. With small, collateral-free loans with flexible repayment options, Pocketly helps you handle emergencies without overburdening your finances. Download Pocketly on Android or iOS to take control of your finances and avoid the pitfalls of high-risk borrowing.

FAQ's

What are the 4 R's of NPA?

The 4R strategy is an initiative developed by the Reserve Bank of India (RBI) to manage and resolve NPAs in the banking sector. The four components are:

- Recognition: Identifying bad loans transparently.

- Resolution: Recovering funds from non-performing assets.

- Recapitalization: Injecting capital into public sector banks.

- Reforms: Making changes to prevent future NPAs.

The 4 R's collectively help identify bad loans early, recover funds, and strengthen banks financially to prevent future NPAs.

What are D1, D2, D3 in NPA?

D1, D2, and D3 are categories used to classify NPAs based on the time they've been overdue. D1 indicates assets overdue for up to 1 year, D2 for 1 to 3 years, and D3 for more than 3 years. These classifications help banks assess the severity of loan defaults.

Is NPA 90 days or 180 days?

Typically, a loan becomes an NPA if it is overdue for 90 days. However, for certain loans like MSMEs or smaller loans, the overdue period can extend to 180 days. The 90-day norm is standard, but exceptions exist for specific categories.

What is an NPA example?

An example of an NPA could be a personal loan that a borrower hasn't paid for three consecutive months. Once payments are overdue for 90 days, the loan is classified as an NPA, marking it as non-performing for the bank.

What is the full form of SARFAESI?

SARFAESI refers to the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act. It allows banks to take control of properties from borrowers who default on secured loans, helping to recover outstanding dues without going to court.