In recent news, the Delhi Cabinet approved a significant grant of Rs 17 crore to clear the pending salaries of DSFDC employees, highlighting an issue that affects many workers across India: delayed salary payments. While this grant brings relief to those employees, millions of workers across the country face the same challenge of not receiving their salaries on time.

Salary delays, whether due to company issues, cash flow problems, or administrative errors, can put employees in a tough spot, especially when it comes to meeting monthly obligations such as rent, bills, and loan repayments. If you've ever found yourself in this situation, you know how unsettling it can be.

The financial strain, stress, and uncertainty can affect not only your immediate expenses but also your long-term financial well-being. Understanding the steps you need to take when your salary is delayed is crucial for managing this challenge and ensuring you receive payment promptly. In this blog, we outline the steps you can take when your salary is not received on time and provide guidance on how to handle the situation efficiently.

TL;DR (Key Takeaways):

- If your salary is delayed, promptly review your employment contract, verify your bank details, and professionally approach your employer.

- Employees are entitled to timely payment in accordance with the Payment of Wages Act, 1936. Be aware of your legal rights to escalate the issue if necessary.

- Always keep a record of communication with your employer about the delay. This will support your case if the issue escalates to formal complaints or legal action.

- Employers who delay salaries face legal consequences, reputational damage, and potential loss of employee morale and productivity.

- If you're facing salary delays, Pocketly offers fast, no-collateral loans to help you manage financial challenges during such times.

What Constitutes Salary Delays?

Salary delays can occur for various reasons, but understanding what constitutes a salary delay is crucial for addressing the issue effectively. In general, a salary delay is defined as the non-payment or delayed payment of wages beyond the agreed-upon payment date, as outlined in your employment contract or company policy.

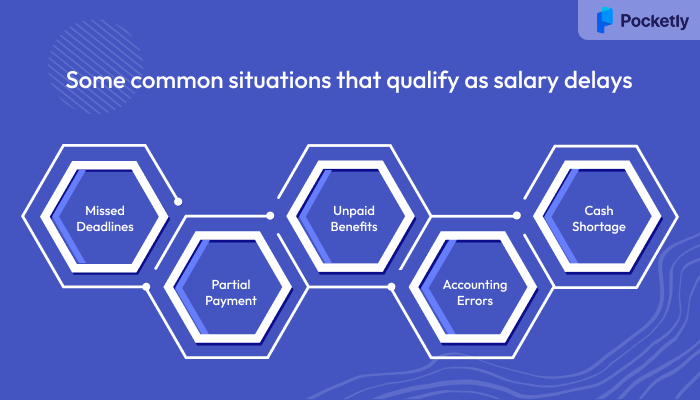

Here are some common situations that qualify as salary delays:

- Missed Payment Deadlines: When the salary payment is due on a specific date (e.g., the last working day of the month) and is not paid on time, it’s considered a salary delay.

- Partial Payment: In some cases, employees may receive only a part of their salary or the payment may be split into multiple installments, creating further complications.

- Non-payment of Benefits or Allowances: Sometimes, the basic salary may be paid on time, but additional benefits such as bonuses, overtime pay, or allowances may be delayed.

- Administrative or Accounting Errors: Salary delays may also occur due to internal issues, such as accounting errors, software glitches, or problems with payroll processing systems within the company.

- Cash Flow Problems of the Employer: Businesses experiencing financial difficulties or cash flow shortages may delay salary payments. This is common in companies struggling with late customer payments or budget issues.

Understanding the underlying reasons for salary delays enables employees to take the necessary steps to address the issue, whether through open communication, formal channels, or legal action, as needed. While initial communication with your employer is crucial, sometimes salary delays persist, requiring you to take further steps to resolve the issue.

Immediate Steps to Take

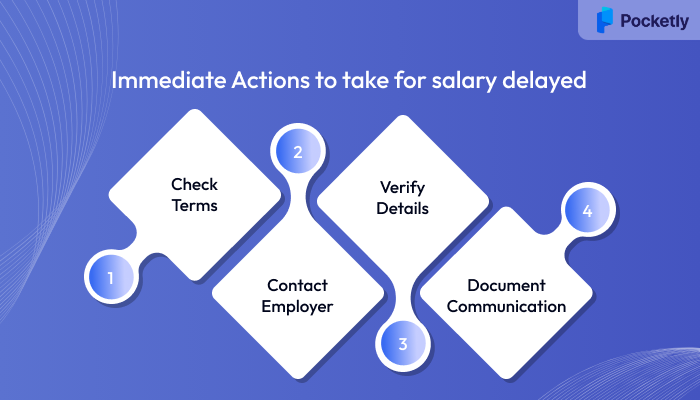

When your salary is delayed, it’s essential to act promptly and methodically to ensure the situation is addressed and resolved. Below are the actionable steps that can help you manage the situation effectively and protect your rights:

1. Check Your Salary Payment Terms

- Why it matters: Your employment contract outlines the agreed payment schedule. Understanding your employer’s commitment helps you confirm whether the delay is valid or not.

- What to do: Go through your employment contract carefully and verify the payment terms. Ensure you are clear on the salary dates and check if the delay surpasses the agreed-upon timeline.

2. Contact Your Employer

- Why it matters: Direct communication with your employer is the first step in resolving the issue. Often, salary delays can result from administrative errors, and addressing the issue directly can lead to quicker solutions.

- What to do: Approach your manager or HR calmly and professionally. Politely inquire about the delay and request clarification on when you can expect to receive your salary. Staying composed and professional will help keep the conversation constructive.

3. Confirm Bank Details

- Why it matters: Delays can sometimes occur due to banking issues, such as incorrect account details or technical glitches. Ensuring your banking information is accurate can prevent such delays.

- What to do: Double-check your bank account details with your employer to ensure the correct account information is in place. This ensures no mistakes are causing the delay, especially if there’s an automated transfer system in place.

4. Record the Communication

- Why it matters: Having a written record of your communications is essential in case the situation escalates. This documentation serves as proof that you’ve made efforts to resolve the issue.

- What to do: Keep detailed records of any emails, messages, or letters exchanged with your employer. This will serve as a reference point should you need to take the issue further, such as filing a formal complaint or seeking legal advice.

By following these steps, you are taking the right approach to resolve the issue quickly and efficiently.

If you’re facing a delay in receiving your salary and need quick financial relief, Pocketly can help. With fast approval and flexible repayment options, Pocketly offers short-term loans to help you cover your expenses until your salary is credited.

Escalating the Issue

If you've followed the immediate steps and the situation hasn't been resolved, it’s important to escalate the issue to ensure your salary is paid. Here’s how you can take further action:

1. Approach Human Resources (HR)

- Why it matters: If direct communication with your employer or manager hasn’t resolved the issue, HR should be your next point of contact. HR typically handles employment-related matters and can intervene to resolve payment issues.

- What to do: Approach HR with a clear, polite request for them to address the issue. Ensure you outline your concern and how it affects your financial stability. HR may have insight into the delay and can initiate internal processes to resolve the matter.

2. Raise a Formal Complaint

- Why it matters: A formal complaint ensures that your concern is recorded in the company's official records, prompting a more structured response.

- What to do: If HR doesn’t take action, file a formal complaint through the appropriate channels, which may include the grievance redressal mechanism or senior management. Make sure to document all your interactions and include any supporting evidence, such as emails, messages, or previous communications with HR.

3. Legal Steps

- Why it matters: When all internal efforts fail, legal intervention may be necessary to get your salary paid. Understanding the legal framework and the steps involved will help you take appropriate action.

- What to do: If the issue persists and no resolution is provided, approach the labor department or other concerned government bodies. You can file a legal complaint under the Payment of Wages Act, 1936, or consult a labor lawyer who can guide you through the process of recovering your unpaid salary.

By escalating the issue, you are asserting your rights and pushing for a fair resolution. While this process can take time, it's essential to remain consistent and explore all available avenues to recover the wages you're owed.

After exhausting internal channels, it's important to understand the legal framework that supports your right to timely salary payments and the steps you can take to hold your employer accountable.

Understanding your credit score and its impact on your ability to access financial support, such as personal loans, is crucial when facing salary delays. Read our blog on "Explaining the Vital and Positive Role of Credit with Examples," which highlights the importance of maintaining a good credit score.

Legal Framework for Salary Delays in India

When salary delays persist despite your best efforts to resolve them, it's essential to know your rights under Indian labor laws. The legal framework provides you with avenues to seek justice and ensure timely payment. Here are some of the key legal aspects:

1. Payment of Wages Act, 1936

The Payment of Wages Act mandates that employees are entitled to receive their wages on time, as per the agreement made between the employer and employee. The law specifies the maximum period within which wages must be paid and provides employees the right to claim wages when they are delayed.

If your salary has not been paid within the stipulated time, you can file a complaint with the labor commissioner or directly approach the appropriate authority for redress.

2. Labor Commissioner's Role

The Labor Commissioner is responsible for ensuring the enforcement of labor laws, including the timely payment of wages. If your salary is delayed, the Labor Commissioner can intervene, investigate the issue, and take corrective actions against the employer.

If you've made multiple attempts to resolve the issue internally without success, you can file a complaint with the Labor Commissioner. Provide them with all the details of your case, such as the employment contract, communication with the employer, and the unpaid salary amount.

3. Time Frame and Legal Action Options for Unpaid Salaries

Under the Payment of Wages Act, employees have the right to file a complaint within a certain time frame (usually within 12 months of the due payment). If the issue is not resolved through mediation or intervention by the Labor Commissioner, further legal action may be pursued.

Once the complaint is filed, the Labor Commissioner will investigate the matter and may give the employer a chance to explain. If the case is still unresolved, the employee has the option to escalate it to a higher court. In such cases, the employer may face fines or even imprisonment for non-compliance.

Being familiar with the legal framework equips you to take informed actions and protects your rights, ensuring that you can hold your employer accountable for unpaid wages.

While salary delays impact employees, it's important to recognize that employers also face serious consequences when they fail to meet their financial obligations.

Consequences for Employers

Employers who consistently delay salary payments face several legal, financial, and reputational risks that can negatively affect their business. It’s important to understand the impact salary delays can have on the organization as a whole:

1. Legal Repercussions

- What happens: Employers who fail to pay employees on time are violating labor laws, specifically the Payment of Wages Act, 1936. Legal action can be taken against them, resulting in penalties or even imprisonment in extreme cases.

- Risk for employers: If the issue is escalated to labor authorities or taken to court, the employer could face legal fees, fines, or damage to their reputation. This not only affects business operations but could also lead to long-term financial burdens.

2. Reputation Damage

- What happens: A business that consistently delays salary payments may develop a negative reputation, particularly in industries where word of mouth is crucial. Employees and potential candidates will be hesitant to work for companies with a history of unpaid wages.

- Risk for employers: Negative reviews from current or former employees on social media, websites, or job review platforms can damage a company’s public image, leading to difficulty in hiring talent and even loss of clients or customers.

3. Decreased Employee Morale and Productivity

- What happens: When employees don’t receive their salaries on time, morale and motivation often drop. This could lead to disengagement, decreased productivity, and increased turnover rates.

- Risk for employers: A disengaged workforce is less likely to perform well, leading to decreased productivity and higher operational costs. Additionally, high turnover rates due to salary delays incur further recruitment and training costs.

4. Legal Costs and Operational Disruption

- What happens: In some cases, if employees seek legal recourse, employers may be required to pay legal costs, back pay, and penalties. This can further disrupt daily business operations.

- Risk for employers: Prolonged legal battles over unpaid wages can significantly affect business continuity and incur substantial legal and operational expenses.

5. Regulatory Scrutiny

- What happens: If an employer is reported to regulatory bodies for non-payment of wages, they may face audits or scrutiny from labor departments. This increases the risk of further legal action and regulatory fines.

- Risk for employers: Being under investigation or facing scrutiny can slow down business operations, lead to financial penalties, and create a negative public image.

Employers should understand these consequences and the risks involved with salary delays. Prioritizing timely salary payments ensures a healthier work environment, a motivated workforce, and protection from legal consequences.

While addressing salary delays is important, it’s equally essential to focus on preventing them in the future. This proactive approach benefits both employees and employers.

For employers, missed payments can affect credit. Our blog "Impact of Personal Loan Cancellation on Your Credit Score" covers the implications of loan cancellation on your credit score, offering insights into how delayed financial obligations can affect both employees and employers.

How to Prevent Future Salary Delays

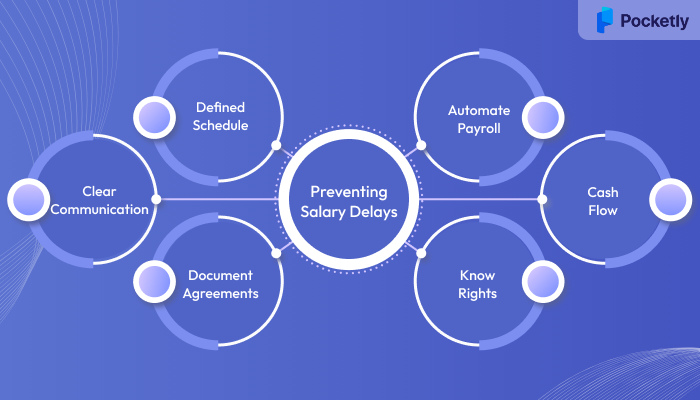

Preventing salary delays requires collaboration between both employees and employers. By setting clear expectations and following some straightforward practices, you can avoid unnecessary financial stress in the future. Here are some actionable steps:

1. Foster Clear and Open Communication

- For Employees: Ensure you are aware of your salary payment schedule and discuss any concerns promptly. Regular communication with your employer about your payment schedule will help ensure clarity.

- For Employers: Actively listen to employees' concerns and provide updates if there are any changes to the salary schedule.

2. Set a Defined Salary Payment Schedule

- For Employers: Establish a fixed, transparent payment schedule that is communicated clearly to all employees. This helps eliminate confusion about when to expect salary payments.

- For Employees: Understand the agreed-upon date for your salary. If any adjustments are made, ensure they’re documented.

3. Document All Agreements

- For Employees: Keep a copy of your employment contract, and any written communication regarding salary arrangements, including payment terms. This can serve as a reference in case of disputes.

- For Employers: Ensure salary agreements and any changes to payment dates are put in writing. It’s beneficial to avoid informal agreements that may lead to misunderstandings.

4. Automate Payroll Systems

- For Employers: Streamline your payroll by using automated systems to ensure that salary payments are disbursed on time without human error.

- For Employees: Understand the payment systems your employer uses. If there’s an issue, you’ll know where to look for solutions.

5. Maintain Proper Cash Flow Management

- For Employers: Ensure your business has strong cash flow management in place to avoid financial bottlenecks that may cause salary delays.

- For Employees: Understand Your Employer's Financial Stability. If your employer faces challenges, consider discussing alternative payment arrangements in advance.

6. Ensure Employees Know Their Legal Rights

- For Employees: Familiarize yourself with your rights under the Payment of Wages Act. Knowing your legal rights can help you take action if salary delays happen.

- For Employers: Educate your employees on their rights and your payment schedule to build trust and reduce the chance of legal disputes.

Taking proactive steps to prevent salary delays not only safeguards the financial well-being of employees but also strengthens the employer-employee relationship, fostering a more efficient and transparent work environment.

While understanding how to prevent salary delays is crucial, there are times when delays are inevitable. In such cases, having a quick financial solution at hand becomes essential. This is where Pocketly steps in.

Pocketly: A Quick Financial Solution During Salary Delays

When salary delays happen, it can be an incredibly stressful experience. Whether you're a salaried individual facing unexpected cash flow problems or a self-employed individual managing various financial responsibilities, dealing with delayed payments can cause significant inconvenience. Thankfully, Pocketly offers a hassle-free, quick solution to help you bridge any financial gaps during salary delays.

Here’s how Pocketly can make your financial situation easier:

- Fast Loan Approval: Pocketly offers rapid approval for small loans, enabling you to access the funds you need quickly.

- No Collateral Required: Forget about the need for collateral. With Pocketly, you can get a loan without needing to pledge any assets.

- Minimal Documentation: With minimal paperwork, Pocketly ensures a smooth and quick loan application process, saving you time and hassle.

- Flexible Loan Amounts: Whether you need ₹1,000 or ₹25,000, Pocketly gives you the flexibility to borrow the amount that suits your needs.

- Simple Repayment Terms: Pocketly offers flexible repayment options, allowing you to choose terms that match your financial capacity and preferences.

- Instant Disbursement: Once approved, your loan is transferred directly to your bank account within minutes, ensuring quick access to the funds you need.

- Interest Rate: Starting from 2% per month.

- Processing Fee: 1-8% of the loan amount, depending on the loan type and amount.

Pocketly helps you manage salary delays with ease, so you can avoid stress and maintain financial stability. It's a fast, flexible, and efficient way to manage short-term financial gaps.

Whether you're dealing with a salary delay or simply need extra financial assistance, Pocketly makes it easier than ever to get the help you need. Contact us today and experience quick, simple, and transparent lending.

No more waiting, no more stress, just financial support when you need it the most.

Conclusion

Salary delays can be frustrating and create stress, but it's important to remember that you're not powerless in these situations. By understanding your rights and taking the necessary steps, you can resolve the issue with confidence. Whether it's communicating effectively with your employer, understanding the legal framework, or seeking external help, knowing how to manage delayed payments will help you regain control.

However, during instances of salary delays, having quick access to funds is crucial to avoid added stress and prevent financial instability. Pocketly is here to provide a simple, fast, and flexible loan solution, ensuring that you never have to wait long for the money you need. With Pocketly, you can get back on track swiftly, without any complicated paperwork or long approval processes.

Don't let financial setbacks hinder your peace of mind. Download Pocketly today for Android or iOS and access funds instantly to keep your financial journey smooth.

FAQs

What should I do if my salary is delayed?

Start by communicating with your employer, checking your payment terms, and escalating the issue to HR if necessary. Understand your rights under labor laws.

How long can my employer delay my salary legally in India?

As per the Payment of Wages Act, 1936, your salary should be paid within seven days of the due date for monthly payments and within ten days for other payments.

Can I take legal action if my salary is delayed for a long time?

Yes, you can approach the Labor Commissioner, file a complaint, or even take the matter to court if your salary is unpaid for an extended period.

What are the consequences for employers who delay salary payments?

Employers may face penalties, legal action, and damage to their reputation if salary delays continue.

How can I prevent salary delays in the future?

Ensure clear communication with your employer about payment terms, and familiarize yourself with your rights to handle salary-related issues promptly.