Do you ever find yourself short on cash right before payday or need extra money to cover an unexpected expense? In that case, financial tools like overdrafts and term loans can help you out. There are two types of loans that you can use when you need money, but they perform very differently.

An overdraft acts like a financial safety net, letting you withdraw more than what's in your bank account for a short period. It's handy for managing temporary cash crunches. A term loan, on the other hand, gives you a fixed amount of money upfront, which you repay over time through regular instalments.

Both options provide access to money, but they differ significantly in terms of how they work, their costs, and how they should be utilised. If you are wondering, “Is overdraft a short-term loan?” you need to understand how each one works so you can choose better loans and avoid debt that you don't need.

This blog post outlines the primary distinctions between overdrafts and term loans. It will also help you know which one is better for short-term borrowing and when and why each one makes sense.

At a Glance

- Overdrafts are short-term loans that let you withdraw more than your account balance for temporary financial needs.

- Term loans are long-term commitments where you borrow a fixed sum and repay it in regular EMIs over a set period.

- Interest rates on overdrafts are higher, while term loans typically come with lower, more stable rates.

- Collateral requirements differ. Overdrafts often require collateral, while term loans can be secured or unsecured, depending on the lender's preferences.

- Overdrafts offer flexibility, allowing you to borrow and repay funds at any time within your limit, making them suitable for irregular income or emergency needs.

What is an Overdraft?

Overdrafts are a type of short-term credit that banks offer. You can take out more cash than you have in your account. It's like a temporary cushion that helps you cover unexpected costs or fill gaps in your cash flow without needing a new loan.

When you use an overdraft, the bank sets a limit based on how much money you make, the type of account you have, or how long you've been doing business with them. You can use this limit whenever you need to, and you'll only be charged interest on the amount you withdraw, not the entire limit. Overdrafts are a flexible and easy way to get the money you need quickly.

If you take out ₹10,000 more than your account balance, your overdraft limit is ₹50,000. Until you pay back the extra ₹10,000, you will only have to pay interest on that amount. It works like a revolving credit line: once you pay off the amount, the limit becomes available to you again.

Understanding how overdrafts work is the first step. But to see why it’s such a flexible borrowing option, let’s look closely at its key features.

Must Read: Applying for Short-Term Loans Online at Lowest Interest Rates

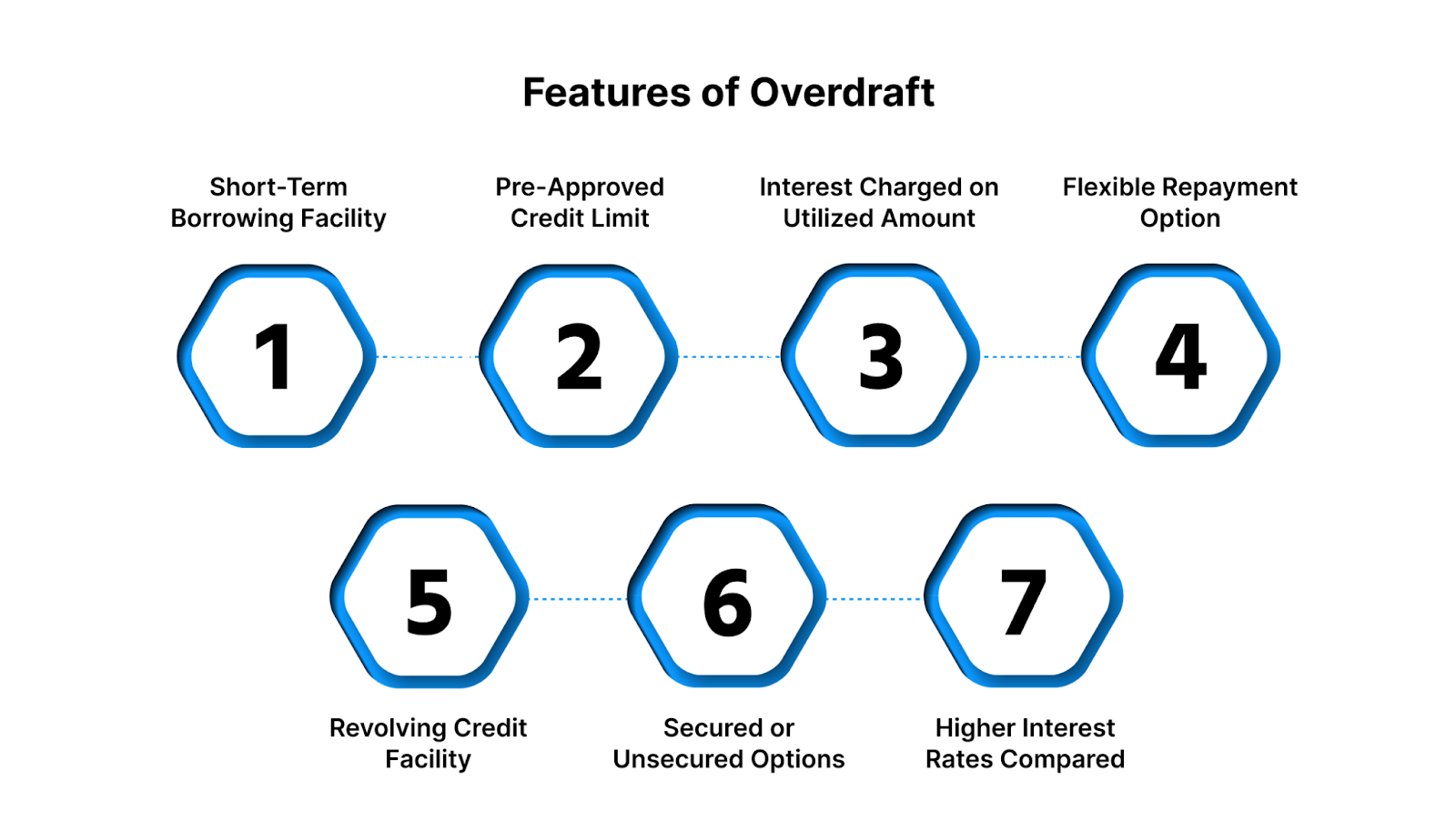

Features of Overdraft

An overdraft is a convenient way for individuals to access extra funds when their bank account balance is insufficient. For both people and businesses, it's one of the most flexible ways to get credit.

Let's take a closer look at its most essential parts:

Short-Term Borrowing Facility

Overdrafts are primarily designed to cover short-term financial needs such as paying urgent bills, managing cash flow gaps, or addressing temporary shortages. They provide a cushion for unexpected expenses without requiring a separate loan application every time.

Pre-Approved Credit Limit

The bank sets your overdraft limit based on the type of account you have, your income, your credit history, and how long you've been a customer of the bank. You can withdraw up to this amount whenever you need to, which is helpful in case of an emergency.

Interest Charged on Utilised Amount

One of the best things about an overdraft is that you only pay interest on the amount you use, not the whole amount you can borrow. If your overdraft limit is ₹1,000,000 and you borrow ₹20,000, you will only have to pay interest on that amount.

Flexible Repayment Option

For overdrafts, there are no set EMIs or due dates for repayment. You can repay the loan at any time by depositing money into your account. As soon as you pay back the loan, your available credit limit goes up again, giving you constant freedom.

Revolving Credit Facility

The overdraft is like a line of credit that you can use repeatedly, as long as you stay within your approved limit. This makes an excellent tool for managing cash flows that arrive at irregular times, especially for freelancers or business owners.

Secured or Unsecured Options

An overdraft can be backed by fixed deposits, property, or other assets, or it can be unsecured if you have a good income and credit history. It depends on the bank and your situation. Lots of different types of people can use overdrafts because they are flexible.

Higher Interest Rates Compared to Regular Loans

Overdrafts typically have slightly higher interest rates than term loans because they are designed for short-term borrowing with flexible repayment options. But because you only pay interest on what you use, they can still be cheap if you know how to use them right.

With these features in mind, it's easy to see why overdrafts are preferred for short-term needs. Next, let’s go over the significant benefits that make them such a convenient financial tool.

Must Read: Different Types of Term Loan: Features, Benefits, and Eligibility Criteria

Benefits of Overdraft

An overdraft facility gives you more than just quick cash. It also gives you control and flexibility over your money when you need it most.

Some of its most important benefits are:

Immediate Access to Funds

One of the best things about an overdraft is that you can get money right away if you need it. Instead of filling out long loan applications and waiting for approvals, you can get the cash whenever you need it, right from your bank account.

Pay Interest Only on the Amount Used

Overdrafts only charge interest on the amount you take out, while fixed-term loans charge interest on the whole amount. Because of this, they are a cheap way to handle short-term cash needs.

Flexible Repayment

There aren't any set EMIs or due dates for payments. By depositing money into your account, you can repay the loan at any time. As soon as you do that, your available limit will be restored, giving you ongoing freedom.

Maintains Cash Flow Stability

Individuals and small businesses that receive irregular payments can benefit from overdrafts. They make sure that you always have access to working capital, so you don't have to wait to pay bills or other necessary costs.

No Need for Separate Loan Applications

We connect the overdraft to your bank account, so you don't have to get a new loan every time you need money. You can use and repay the pre-approved credit line as needed, without having to fill out new paperwork every time.

Useful for Managing Seasonal or Unexpected Expenses

You can use an overdraft to cover short-term cash flow problems, like sudden repairs, medical emergencies, or temporary business slowdowns, without having to dip into your savings or take on long-term debt.

Builds Financial Discipline and Credit Relationship

Responsible overdraft use, which involves only taking out what is required and making timely repayments, can enhance your credit score and your relationship with your bank, both of which may help you get bigger loans in the future.

While overdrafts provide quick access to funds, some financial goals require more structure and long-term planning. That’s where term loans come into play.

What is a Term Loan?

A term loan is a fixed amount of credit borrowed from a financial institution, to be repaid over a set period in regular instalments.

- One of the most common borrowing methods for both individuals and businesses.

- Used to achieve specific financial goals (e.g., buying a car, funding education, expanding a business, or investing in real estate/equipment).

Loan Duration Options:

- Short-term: Less than 1 year.

- Medium-term: 1 to 5 years.

- Long-term: More than 5 years.

- Borrowers repay the loan in Equated Monthly Instalments (EMIs), covering both principal and interest.

Credit History Impact:

- Term loans, when managed correctly, can help build a strong credit history.

- Early repayment or loan pre-closure may lead to penalties in some cases.

Must Read: Understanding the Meaning, Types, and Features of Collateral Loans

Features of a Term Loan

A term loan is suitable for borrowers seeking long-term, planned financial solutions because it offers several structured features.

Here is a detailed explanation of the main traits:

Fixed Loan Amount

At the beginning of the loan, the lender gives the borrower a fixed lump sum. Creditworthiness, income, and repayment ability are taken into consideration when determining this sum.

Defined Repayment Period

The payback period for term loans is set and can range from a few months to several years. This helps borrowers budget and maintain discipline through consistent payments.

Regular EMI Payments

Borrowers repay the loan through Equated Monthly Instalments (EMIs), which include both the principal and interest components. This predictable payment structure ensures easy budgeting.

Interest Rate Options

Interest rates offered by lenders can be either fixed or variable. While floating rates are subject to change based on market conditions, fixed rates maintain EMIs constant over the course of the loan.

Collateral Requirement

Term loans can be secured (requiring collateral such as real estate or equipment) or unsecured (based only on income and credit profile), depending on the loan type and amount.

Purpose-Specific Borrowing

Term loans are typically obtained for specific purposes, such as asset acquisition, business expansion, home remodelling, or education. This clarity of purpose enables borrowers to maintain focus and lenders to evaluate risk effectively.

Prepayment and Foreclosure Options

Although some lenders might impose a nominal prepayment fee, many term loans permit early repayment in whole or in part. The total interest burden is decreased by early repayment.

Credit Score Impact

Paying EMIs on time and consistently raises the borrower's credit score, which facilitates access to future loans with better terms.

Essentially, a term loan provides borrowers with financial stability through planned repayment and predictable expenses, making it the ideal choice for those preparing to undertake significant life or business objectives.

With these structured features, it's easy to see why many people choose term loans for primary goals. Let’s explore the benefits that make them stand out even more.

Benefits of a Term Loan

A term loan is one of the most popular borrowing options for both individuals and businesses, as it offers several long-term benefits.

Here are the main benefits, simply explained:

Predictable Repayments

Borrowers are aware of their monthly payment obligations because term loans are paid back with fixed monthly instalments. This facilitates financial planning and helps keep monthly budgets under control.

Structured Borrowing for Major Goals

Large expenditures, such as purchasing a car, expanding a business, or attending college, are best suited for term loans. Borrowers can finance their objectives without compromising their savings when a lump sum payment is made available upfront.

Lower Interest Rates Compared to Credit Cards

Compared to unsecured credit options, such as credit cards or overdrafts, term loans typically have lower interest rates. They are therefore a more affordable option for long-term borrowing.

Flexible Tenure Options

Whether they require a long-term loan that lasts several years or a short-term loan that lasts less than a year, borrowers can select repayment terms that best suit their needs.

Improves Credit Score

Making regular, on-time EMI payments demonstrates sound financial management and contributes to a solid credit history. It might be simpler to get approved for later loans with lower interest rates as a result.

Option to Prepay or Foreclose

Many lenders permit loan closure or prepayment before the term is up. This results in early financial freedom and lowers the total amount of interest due.

Tax Benefits (in Certain Cases)

The Income Tax Act offers tax advantages for certain types of term loans, including those for home or school purposes. This further reduces the effective cost of borrowing.

Tailored Loan Programs

It is simpler to manage debt responsibly when lenders adjust loan amounts, interest rates, and repayment plans to the borrower's financial situation.

Term loans are a dependable option for long-term objectives and anticipated financial needs because they provide stability, affordability, and flexibility.

Both overdrafts and term loans clearly have their strengths. However, to make an informed choice, it’s essential to understand how they differ in key aspects.

Must Read: Difference and Meaning of Loan Write-Off and Waive-Off

Key Differences Between Overdraft and Term Loan

Term loans and overdrafts both give you access to borrowed money, but they are very different in terms of their structure, goal, and payback schedule. Borrowers can select the best option for their financial circumstances by being aware of these distinctions.

1. Nature of the Facility

Overdrafts function similarly to revolving credit lines. Even if your account balance is small, you can still take money out of the limit the bank sets whenever you need to. As long as the amount remains within your authorised limit, you can repay it and use it again.

A term loan, on the other hand, provides you with a one-time payment that you must pay back over a predetermined length of time in fixed monthly instalments. After you repay the loan, the loan account is closed, and you will need to reapply if you ever require additional funds.

2. Loan Tenure

Usually only available for a few months to a year, overdrafts are considered short-term credit options. Both individuals and businesses use them to cover short-term cash flow gaps or emergencies.

Conversely, term loans are long-term borrowing options. They can be used to finance significant objectives, such as home ownership, business expansion, or education, because they can last anywhere from one to several years.

3. Interest Calculation

The most significant advantage of an overdraft is that interest is charged only on the amount you actually use and for the number of days you use it. For example, if your overdraft limit is ₹1,00,000 but you withdraw ₹10,000 for 10 days, interest is calculated only on ₹10,000 for that duration.

Term loans operate differently. The entire amount borrowed is subject to interest from the time it is disbursed, and fixed EMIs are used to pay it back. Although this structure is predictable, it lacks the flexibility of an overdraft.

4. Repayment Flexibility

Repayment terms for overdrafts are entirely negotiable. Within your limit, you are free to deposit and withdraw money at any time. It is ideal for individuals who require short-term liquidity without a long-term commitment, as there is no set EMI schedule.

Term loans have a predetermined repayment schedule, typically consisting of monthly instalments. This ensures that the debt is paid off within a specified timeframe and helps borrowers stay disciplined. However, it offers less flexibility in managing payments.

5. Purpose of the Loan

The primary purposes of overdrafts are to meet short-term financial requirements, such as bill payments, seasonal cash flow management, and handling unforeseen expenses.

Term loans are used for long-term objectives, such as investing in assets, financing higher education, or purchasing real estate. They are better suited for significant, planned expenses because of the one-time lump sum.

6. Collateral Requirement

The majority of overdrafts are secured loans, which means they are backed by assets such as business accounts, savings accounts, or fixed deposits. Customers with solid credit histories can, however, apply for unsecured overdrafts from certain banks.

Depending on the loan amount, purpose, and borrower profile, term loans can be classified as either secured or unsecured. For example, personal loans are typically unsecured, whereas home loans are secured by real estate.

7. Interest Rates

Overdrafts usually have higher interest rates than term loans because they provide more flexibility. Rates may also differ based on credit profile and usage.

Long-term borrowing is made more affordable by term loans, particularly those that are secured, which typically have lower and more consistent interest rates.

8. Renewal and Closure

Overdrafts are renewable credit facilities. The bank must review or renew them after the validity period, which is usually one year, has passed.

Term loans have fixed tenures. Once you have repaid the entire amount, the loan account is permanently closed. If you need funds again, you will need to apply for a new loan.

9. Best Suited For

An overdraft is ideal for individuals or businesses that require quick, short-term access to cash, particularly to cover irregular expenses or income gaps.

Long-term financial objectives that require planned repayment, such as purchasing a home or vehicle, or funding a business expansion, are best served by term loans.

While term loans offer structure and predictability, enabling you to plan for significant expenses confidently, overdrafts provide flexibility, allowing you to borrow and repay as needed. The right choice depends on your borrowing habits, repayment capacity, and financial goals.

While both options have specific use cases, modern borrowers often look for faster, more flexible, and digital solutions. That’s where platforms like Pocketly step in.

Must Read: Personal Loan Application for Women Online

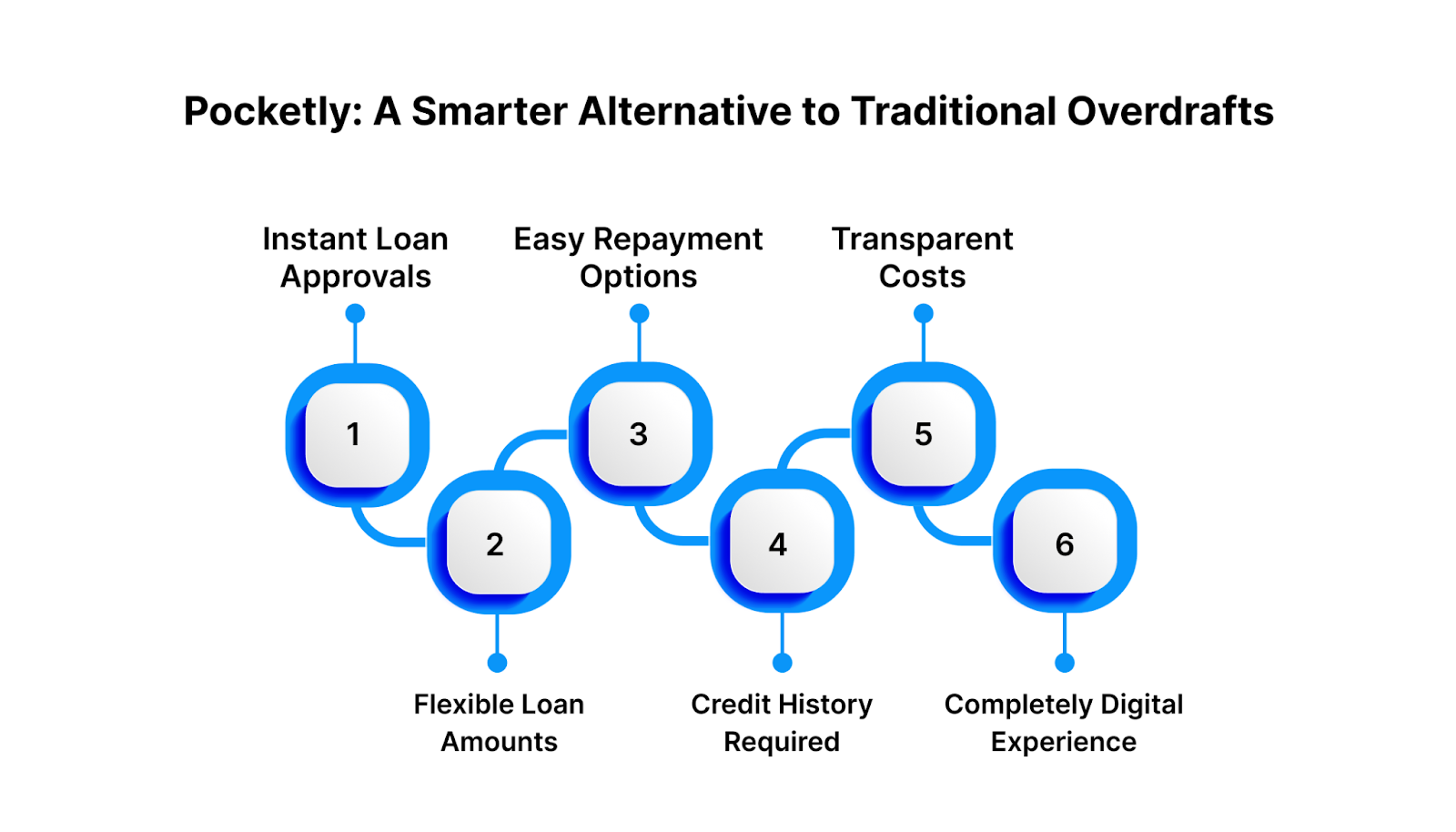

Pocketly: A Smarter Alternative to Traditional Overdrafts

Traditional overdrafts can be helpful, but they often come with challenges such as high interest rates, strict eligibility requirements, and hidden charges. It can be challenging for many young borrowers, independent contractors, and students to obtain an overdraft approval, especially if they lack collateral or a strong credit history. That’s where Pocketly steps in as a modern, simpler, and more affordable alternative.

Here’s how Pocketly stands out from traditional overdrafts:

- Instant Loan Approvals and Quick Disbursal: No lengthy paperwork or waiting for bank approvals. Pocketly processes applications within minutes and transfers funds directly to your bank account.

- Flexible Loan Amount: Depending on your actual needs, you can borrow as little as ₹1,000 or as much as ₹25,000. This flexibility helps you avoid overusing credit by ensuring that you only borrow what is required.

- Easy Repayment Options: Choose repayment tenures between 2 and 6 months, allowing you to pay in manageable EMIs. Unlike overdrafts that require lump-sum repayments, Pocketly helps you plan repayments with ease.

- No Collateral or Credit History Required: Pocketly doesn’t require a security deposit or a perfect credit score. This makes it ideal for students, first-time borrowers, and young professionals seeking to establish their credit history.

- Transparent Costs: Pocketly offers complete clarity on interest rates and processing fees upfront. There are no hidden charges, so you always know what you’re paying.

- Completely Digital Experience: Simple borrowing is at your fingertips with the Pocketly app, which allows you to apply and repay online at any time and from any location. No paperwork or bank visits are required.

Pocketly combines the convenience of modern technology with responsible lending practices. By offering accessible and flexible short-term credit, it empowers users to handle financial needs confidently without falling into a long-term debt cycle.

Conclusion

Both overdrafts and term loans have their advantages, but choosing the right one depends on your financial goals and repayment capacity. Overdrafts offer short-term flexibility, while term loans are better suited for long-term financial planning. Understanding these differences helps you make informed, confident borrowing decisions.

For young borrowers seeking a simpler, digital alternative, Pocketly provides instant access to small-ticket loans with flexible repayment options and transparent terms. It’s a simple way to manage short-term cash needs without the hassle of traditional banking.

Download the Pocketly app today on iOS or Android and enjoy quick, stress-free borrowing designed to fit your lifestyle, budget, and financial goals.

FAQs

1. Is an overdraft a short-term loan?

Yes. An overdraft is considered a short-term loan that allows you to withdraw more money than you have in your bank account, usually to cover temporary cash shortages.

2. What is the main difference between an overdraft and a term loan?

An overdraft offers flexible borrowing up to a limit that you can use anytime, while a term loan provides a fixed lump sum that you repay in set EMIs over a period of time.

3. Which is better: overdraft or term loan?

It depends on your needs. Choose an overdraft for short-term, recurring expenses and a term loan for long-term, planned financial goals, such as education or business expansion.

4. Does an overdraft affect my credit score?

Yes. Like any credit facility, failing to repay the overdraft on time or exceeding the limit can negatively impact your credit score.

5. Can individuals apply for overdraft facilities?

Yes, individuals with a steady income and a good banking history can apply for overdraft facilities, although they are more commonly offered to businesses.

6. Are overdrafts more expensive than term loans?

Usually, yes. Overdrafts often have higher interest rates because they are short-term and more flexible, whereas term loans come with fixed rates and structured repayment terms.