Life can throw unexpected expenses your way, whether it's a medical emergency, a sudden home repair, or just running low on cash before payday. Traditional banks can take too long to approve loans, which is where instant loan apps come in to help.

That’s where instant personal loan apps have stepped in, making it possible to get quick, short-term loans right from your phone. While Kissht is one name you might have heard of, it’s not the only option out there, and depending on your situation, it might not even be the best fit.

In this guide, we’ll show you some of the best instant loan apps in India, compare their features, and explain how they work. Our goal is to help you pick the right app that’s easy to use, offers fair rates, and treats you transparently and responsibly.

What are Instant Personal Loans

Instant personal loans are small loans you can get quickly, usually through a mobile app or website. Traditional bank loans can take time to process. However, instant personal loans are designed to give you access to money within minutes or hours.

These loans are popular for handling emergencies, paying bills, or covering unexpected expenses when you need money fast. The loan amounts are usually flexible, starting from as low as ₹1,000 and going up to a few lakhs, with repayment periods ranging from a few months to a couple of years.

Benefits of Instant Personal Loan Apps

Instant personal loan apps are a great choice for students, young professionals, or anyone who wants to get funds urgently, without needing to visit a bank or deal with long paperwork.

Here’s what makes these apps so useful:

- Super Easy to Use: You can apply right from your smartphone in just a few minutes. The whole process is simple and straightforward.

- Super Fast Approvals: The app uses technology to check your credit and give you a decision in minutes or hours. This is perfect if you need money urgently.

- Available Anytime: You can apply for a loan anytime, day or night, not just during bank hours.

- Track Everything in Real Time: You can see your loan status, upcoming payments, and how much you owe, all from the app itself.

So, if you want a quick, hassle-free way to borrow money, instant personal loan apps are a smart option.

Key Features to Look for in Instant Personal Loan Apps

When you’re looking for an instant personal loan app, there are a few key features that can make all the difference for a smooth, safe, and easy borrowing experience. Here's what to keep an eye out for:

1. Fast Approval & Disbursal

The best loan apps are quick. Once you apply, they usually approve and send you the money in just a few minutes to a few hours. This is a big win over traditional loans, which can take days.

2. Minimal Documentation & Digital Process

Most apps are paperless. You can upload your documents, like your PAN and Aadhaar cards, and proof of income, directly in the app. No need for physical paperwork. Plus, e-signatures make everything even faster, and you can apply anytime, from anywhere.

3. Flexible Loan Amounts & Tenures

These apps offer loans of all sizes, from ₹1,000 to ₹20 Lakhs, depending on the app. You can also choose how long you want to repay, whether a few months or a few years, so it’s easier to find a plan that fits your budget.

4. Transparent Interest Rates & Fees

Good apps are upfront about their costs. They’ll show you the interest rates, processing fees, and any other charges before you commit. Some apps even have built-in calculators so you can see your monthly payments and the total cost before deciding. This way, you know exactly what you’re getting into.

5. User-Friendly Interface & Customer Support

A simple, easy-to-use app makes the process a lot less stressful. Good customer support is also key. Whether through chat, email, or phone, you should be able to quickly get answers to any questions or solve issues if they come up.

6. Data Security & RBI Compliance

Your personal and financial data needs to be protected. Trusted apps use strong security measures like multi-factor authentication to keep your information safe. They also make sure they follow all the rules set by the Reserve Bank of India (RBI) to ensure everything’s fair and transparent.

Choosing an app that follows these rules means you don’t have to worry about hidden charges or unfair practices. It gives you peace of mind knowing your information is safe and that the loan is being handled legally.

If you want to learn more about instant loan apps and how these can be beneficial for you, check out our guide on instant loans.

Now that you know what to expect from a good loan app, let's dive into some of the top apps that offer these features, starting with one that’s made for young, busy individuals.

Top Instant Personal Loan Apps Like Kissht

There are many loan apps out there, but not all are created equal. This section compares some of the loan apps like Kissht, helping you find a platform that suits your borrowing needs. By looking at features like loan amounts, interest rates, and ease of use, you can find the best fit for your financial situation.

1. Pocketly

If you’re a student, young professional, or self-employed individual looking for a quick and reliable way to manage unexpected expenses, Pocketly could be the solution you’ve been searching for. Pocketly is a digital lending platform designed specifically for young Indians who need short-term loans without the hassle of traditional paperwork or collateral.

Loan Amount, Interest Rates, and Tenure

With Pocketly, you can borrow amounts as small as ₹1,000, making it perfect for covering everything from sudden medical bills to last-minute travel plans or even a mid-month cash crunch. Repayment is flexible, with tenures ranging from 2 to 6 months, so you can choose what works best for your budget.

Eligibility Criteria: Pocketly is built for young Indians, so the eligibility requirements are straightforward:

- Age: 18 to 40 years

- Employment: Open to students, salaried professionals, and self-employed individuals

- Location: Available across India

- Documentation: Only basic KYC documents are needed (Aadhaar, PAN, and bank details)

Features

1. Flexible Loan Amount: Pocketly lets you borrow small amounts from ₹1,000 up to ₹25,000. This way, you can choose a loan size that fits your needs, whether you are a student, a salaried worker, or self-employed.

2. Fast and Easy Application: You can apply for a loan completely online without submitting any physical documents. The process is simple, with only basic ID verification, so you get quick approval.

3. Clear Pricing: Pocketly charges interest starting at 2% per month. There is also a processing fee between 1% and 8% of the loan amount.

4. Instant Transfer of Funds: Once approved, the loan money is sent straight to your bank account quickly. This helps you get the cash you need without waiting.

5. Help Available Anytime: Pocketly offers online customer support 24/7, so you can get help whenever you need it during the loan process.

6. No Collateral Needed: You don’t need to provide any security or collateral to get a loan from Pocketly. This makes it easier for young people to borrow money quickly.

Pros and Cons

| Pros | Cons |

|---|---|

| Funds transfers directly to your bank account within minutes after approval. | Processing fees of 2% plus GST make borrowing very expensive. |

| No need to worry about physical paperwork—everything is handled digitally. | 2–6 months tenures for repayment can be challenging and put financial strain on individuals. |

| Choose your repayment schedule and even make partial repayments or close your loan early without penalties. | |

| No annual or joining fees, and zero hidden charges. | |

| Access customer support anytime you need help. | |

| The interface is designed to be intuitive, so you can simply apply for a loan in just a few taps. |

2. Kissht

Kissht is a digital platform in India offering instant personal loans with flexible repayment tenure.

Loan Amount, Interest Rates, and Tenure

Loan amounts range from ₹5,000 to ₹5 Lakhs, depending on your credit profile, income, and repayment ability. Interest rates start at 6% and go up to 36% per annum, with flexible repayment terms from 3 to 72 months.

Eligibility

- Requires Indian citizenship

- Ages 21-60

- A minimum monthly income of ₹15,000

- Basic KYC documents. Even with a lower credit score, you may still qualify.

Benefits

Pros and Cons

| Pros | Cons |

|---|---|

| Quick loan application (within minutes) | High interest rates can cause financial strain. |

| Fast approval and disbursal (as fast as 5 minutes) | There are significant "bounce charges" for failed EMI payments and "penal charges" for late payments, which can substantially increase the overall cost of the loan. |

| Minimal documentation (PAN, Aadhaar, selfie) | |

| An EMI calculator for easy repayment planning. | |

| Kissht is fully digital, secure, and follows RBI guidelines. |

Kissht offers a fast and easy way to access funds with flexible terms and competitive rates.

3. Moneyview

Moneyview is a digital lending platform in India offering instant personal loans through its app.

Loan Amount, Interest Rates, and Tenure

Loans range from ₹5,000 to ₹10 Lakhs, with interest rates from 14% per annum, based on credit score and risk profile. On overdue EMIs, 2% interest is applicable. Repayment tenures are flexible, from 3 months to 5 years.

Eligibility

- Requires Indian citizenship

- Age 21 to 57 years

- A minimum monthly income of ₹13,500 for salaried individuals or ₹15,000 for self-employed individuals.

Pros and Cons

| Pros | Cons |

|---|---|

| Quick application, approval, and disbursal (often within 24 hours) | Minimum salary requirements can cause difficulties for low-salaried individuals. |

| Minimal documentation (PAN, Aadhaar, selfie, bank statements) | Short repayment tenure can cause a financial burden to borrowers. |

| An integrated EMI calculator. | |

| Moneyview's unique credit model can approve loans even for individuals with a CIBIL/Experian score as low as 650. |

Moneyview offers higher loan amounts, fast processing, and competitive rates, making it ideal for quick, flexible loans.

4. KreditBee

KreditBee is an app in India that provides instant personal loans through RBI-approved banks and NBFCs with a quick, 100% online, paperless process.

Loan Amount, Interest, and Tenure

Loan amounts range from ₹6,000 to ₹10 Lakhs, with interest rates from 12% to 28.5% annually. The repayment tenure spans 6 to 60 months, and processing fees can be up to 5.1% plus GST.

Eligibility

- Indian citizenship

- Ages 21-60

- A minimum income of ₹10,000 for salaried individuals, and 3 months of job experience or 12 months for self-employed individuals.

- A PAN card and an Aadhaar-linked mobile number

Pros and Cons

| Pros | Cons |

|---|---|

| Fast loan disbursal (within 10-15 minutes) | High processing fees can cause financial strain to borrowers. |

| Minimal documentation | High penal charges for delayed payments (e.g., 36% per annum on principal overdue for prolonged defaults, and an EMI bounce charge of 4% of principal overdue can cause higher overdue payments. |

| 24/7 availability | |

| Full transparency with no hidden fees. |

KreditBee stands out with its customer-focused approach, flexible loan options, and no-collateral requirements. It’s a great option if you need a quick and simple loan.

5. CASHe

CASHe is a paperless lending platform in India offering quick, unsecured personal loans through its mobile app.

Loan Amount, Interest, and Tenure

Loan amounts range from ₹45,000 to ₹3,00,000 with tenures of 9, 12, or 18 months. Interest rates vary between 2.79% to 3% per month (up to 36% annually) on a reducing balance basis, with a 2.5% processing fee. A 5-day interest-free grace period is provided for EMI payments, but delays incur a 0.1% daily penalty.

Eligibility

- Indian citizenship

- Age 18-55,

- Salaried employment

- Requires documentation such as PAN card, ID proof, address proof, and bank statements.

Pros and Cons

| Pros | Cons |

|---|---|

| CASHe offers a fully digital process with minimal paperwork | Personal loans start at ₹45,000, which may not suit those needing smaller amounts for urgent expenses. |

| Provides a range of loan products, including personal, travel, education, home renovation, and more. | CASHe requires a minimum monthly salary of ₹40,000-₹50,000, limiting access for lower-income individuals. |

| Additionally, a BNPL service for online shopping is available with 0% interest. | Repayment tenures are short, up to 18 months, leading to higher monthly EMI payments. |

CASHe stands out for its fast disbursal, variety of loans, and 100% online application process.

Read More: Top Instant Loan Apps for Students in India

It can be difficult to choose a suitable app for you, with so many options available in the market. Understanding your own financial needs and comparing different options can help you make the right choice.

How to Choose the Right Apps for You

Picking the right instant loan app doesn’t have to be complicated. You can choose what works best for you by considering your personal needs and comparing different options.

- Know Your Needs: Before applying, figure out how much money you need, your repayment comfort, and the loan duration. Some apps specialize in certain needs, like medical emergencies or home repairs, so choose one that fits your purpose.

- Compare Rates and Fees: Look beyond interest rates. Check the Annual Percentage Rate (APR) to see all costs, including processing and late fees. Use the app’s calculator to estimate your monthly payments and total cost.

- Eligibility Criteria: Make sure you meet the app’s requirements—age, income, job type, and credit score. Some apps are flexible with credit history and income sources.

- Read Reviews: Check recent user reviews to learn about approval speed, fees, customer service, and security. Avoid apps with complaints about hidden fees or aggressive tactics.

- Check RBI Approval & Data Security: Choose apps regulated by the RBI or partnered with RBI-approved banks. Ensure they use strong security, like encryption and multi-factor authentication, to protect your data.

You’ll be better equipped to choose a loan app that suits your demands and keeps your finances safe if you focus on these points. But if you’re someone who values convenience and flexibility, Pocketly stands out as an excellent alternative. Pocketly offers quick, hassle-free loans ranging from ₹1,000 to ₹25,000 with only 2% interest per month and 1% to 8% processing fees. If you’re looking for a loan app that truly understands the financial needs of young people today, Pocketly might just be the right choice for you.

What Makes Instant Loan Apps Better than Traditional Banking Platforms

When it comes to borrowing money quickly, instant loan apps have several clear advantages over traditional banks. Here’s why more and more Indians are turning to these digital solutions:

1. Speed and Convenience

Traditional banks can take days or even weeks to process and approve a loan application, often requiring multiple branch visits and lots of paperwork. In contrast, instant loan apps are designed for speed. Most apps use automated credit checks and digital KYC, so you can get approved in minutes or hours.

2. Flexible Eligibility

Traditional banks often have strict eligibility criteria, such as high credit scores and stable, long-term employment. Instant loan apps are much more inclusive. Many apps cater to students, freelancers, and young professionals with limited credit history.

3. Better for Emergencies

When you need money urgently, for a medical emergency, urgent travel, or an unexpected bill, instant loan apps are unmatched. Funds are often credited to your bank account within minutes of approval.

4. 24/7 Accessibility

Traditional banks are limited to working hours and holidays. But with instant loan apps, you can apply for a loan anytime. Also, you can monitor your application status, loan disbursal, and repayment schedule in real time within the app.

Instant loan apps like Pocketly combine speed, flexibility, and ease of use, making them far more convenient than traditional banks.

Now that you understand why instant loan apps are often easier and more convenient than traditional banks, you might be wondering how to use them effectively. These apps are made to make borrowing simple, but getting approved isn’t always guaranteed, especially if you’re new to credit or don’t have much financial history.

How to Increase Your Chances of Getting a Loan From Instant Loan Apps

It’s important to understand what lenders look for and how you can present yourself as a reliable borrower. By taking a few proactive steps, you can significantly boost your chances of not only getting approved but also securing better terms and higher loan amounts.

Let’s explore some practical tips to help you increase your chances of getting a loan from instant loan apps:

1. Maintain a Good Credit Score

Your credit score is one of the first things lenders check. Even though some apps accept applicants with limited credit history, a higher score always helps.

- Check your credit report regularly for errors or outdated information.

- Pay your bills and EMIs on time—even a single missed payment can lower your score.

- Limit the number of loan applications you make in a short period, as too many inquiries can negatively affect your score.

2. Complete Your KYC and Profile Accurately

Most instant loan apps require KYC (Know Your Customer) verification.

- Upload clear, valid documents (Aadhaar, PAN, bank statements) as requested.

- Double-check your details for accuracy—mistakes or mismatches can delay or derail your application.

3. Show a Stable Income

Lenders want to know that you can repay the loan.

- Provide accurate proof of income, such as salary slips or bank statements.

- If self-employed or a freelancer, maintain consistent deposits in your bank account to demonstrate regular income.

4. Borrow Within Your Means

Applying for a loan amount that matches your income and repayment capacity increases your chances of approval.

- Use the app’s loan calculator to estimate a comfortable EMI.

- Start with a smaller loan if you’re a first-time borrower; successful repayment can help you qualify for larger amounts in the future.

5. Build a Positive Borrowing History

Repay your loans on time—this not only avoids penalties, but also builds trust with the lender. Some apps reward repeat customers with better rates or higher loan limits, so maintaining a good track record pays off.

6. Avoid Multiple Simultaneous Applications

Don’t apply to too many apps at once. Each application can trigger a credit inquiry, which may lower your score and signal risk to lenders.

Now, let’s go through the simple steps to apply for an instant loan with Pocketly. It’s easy and quick—here’s how.

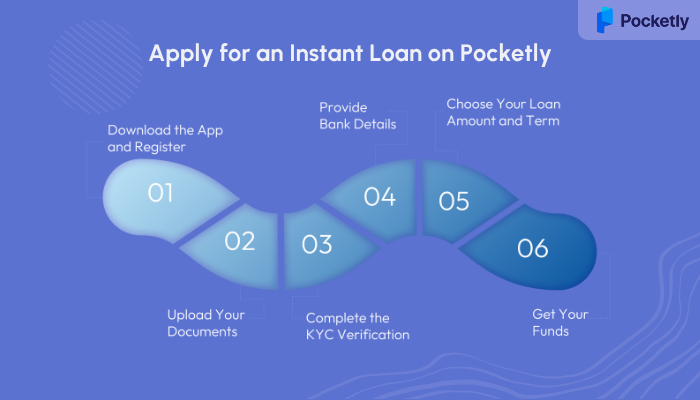

Step-by-Step Guide to Apply for an Instant Loan on Pocketly

Pocketly stands out by catering specifically to young borrowers, including students and young professionals. It offers quick, collateral-free loans with a fully digital, simple process that takes just minutes. Loan amounts are flexible, and the platform ensures data security with ISO 27001 certification. Pocketly’s mission is to empower financial independence and help users build a positive credit history.

Here’s a step-by-step guide to applying for an instant loan on Pocketly:

Step 1: Download the App and Register

Begin by downloading the Pocketly app from either the Google Play Store or the Apple App Store. Register using your mobile number to create your account.

Step 2: Upload Your Documents

Next, upload the required KYC documents like your Aadhaar card and PAN card. Ensure the images are clear to avoid any delays during verification.

Step 3: Complete the KYC Verification

Complete the KYC process. Some users may be eligible for a video KYC, speeding up the verification process.

Step 4: Provide Bank Details

Enter your bank account information to ensure that once your loan is approved, the funds can be transferred directly and securely.

Step 5: Choose Your Loan Amount and Term

Pick the amount you wish to borrow and select a repayment period that works best for you. Pocketly offers flexible repayment terms to suit your needs.

Step 6: Get Your Funds

After approval, the funds are transferred directly to your bank account, usually within minutes, giving you immediate access to the money you need.

With Pocketly, the loan application process is fast, straightforward, and hassle-free. If your eligibility is limited, consider taking actions to enhance your likelihoods of approval and guarantee better loan terms.

Wrapping Up!

To wrap it up, instant loan apps make accessing funds easier than ever. Life can be unpredictable. Unplanned costs can pop up at any time. Instant personal loan apps like Kissht make it easy to get a quick loan when you need it. They let you access funds faster than traditional banks, without all the hassle.

But with so many options out there, it’s important to pick the right one. Look for apps that offer clear rates, flexible repayment, and a simple, secure process. It’s all about finding what works best for you.

If you’re in a pinch, Pocketly can help. It’s perfect for students or young professionals who need a loan fast. No paperwork, no collateral, just quick approval. You get the funds you need right when you need them, with easy repayment options.

Need a loan fast? Pocketly is here to help. No more waiting around for approval or worrying about hidden fees. With Pocketly, you get the money you need, right when you need it, with clear terms and easy repayment. Click here to download Pocketly and get started today

FAQs

Are these instant loan apps regulated?

Yes, the Reserve Bank of India (RBI) regulates these instant loan apps. They either are RBI-registered Non-Banking Financial Companies (NBFCs) themselves or partner with such entities or banks. It is crucial to always verify an app's RBI registration status to ensure legitimacy and consumer protection.

Can I get a loan with a low CIBIL score?

Yes, certain instant loan apps, such as Pocketly, KreditBee, RapidRupee, and PaySense, are known to cater specifically to individuals with low or even no credit history. While this offers accessibility to a broader demographic, it is important to note that such loans come with higher interest rates.

How quickly are funds disbursed?

One of the primary advantages of instant personal loan apps is their speed. Funds are typically disbursed once a loan application is approved, often within minutes to a few hours, directly into the borrower's bank account. This efficiency is a result of their streamlined digital processes.

What is the maximum loan amount I can get?

The maximum loan amount varies significantly depending on the specific app and the individual's eligibility criteria, including income and creditworthiness. Loan amounts can range from as low as ₹1,000 for micro-loans to as high as ₹20 Lakhs or even more with certain platforms.

Do I need collateral for these loans?

The vast majority of instant personal loans offered by these digital applications are unsecured loans. This means that borrowers are generally not required to feed any collateral, such as property or assets, to secure the loan.

Can self-employed individuals apply?

Yes, many instant personal loan apps cater to both salaried employees and self-employed professionals. While the core eligibility criteria remain similar, the specific income proof and other documentation requirements may differ for self-employed applicants.

What if I don't have an ITR? Am I still eligible?

Some lenders, like Fibe, offer personal loans even if an applicant does not have a formal Income Tax Return (ITR). In such cases, they may accept alternative forms of income proof, such as recent bank statements, income from investments, rental income, or, to assess the borrower's repayment capacity.