In recent years, personal loans have become a popular choice for many individuals seeking quick financial relief. With high-value personal loans on the rise, lenders have become more cautious about loan approvals, making it more important than ever to ensure that once your loan is paid off, the process of closing it is seamless.

If you've just paid off your personal loan, the final step is to ensure everything is officially settled. While this may seem like a simple process, closing a loan correctly requires more than just settling the balance. Writing a personal loan closure letter is a crucial step to confirm that the loan is fully paid and that your financial record is accurate and up to date.

In this guide, we'll show you exactly how to write a Fullerton India loan closure letter, along with a format and sample to help you do it properly. Whether you're closing a loan for the first time or need a refresher, we've got you covered.

TL;DR (Key Takeaways):

- A loan closure letter is essential for officially closing your personal loan and ensuring your credit report is updated.

- Key elements of the closure letter include loan account details, confirmation of the final payment, and a request for the No Objection Certificate (NOC).

- Common mistakes to avoid include submitting the letter prematurely or forgetting to request the NOC.

- Pocketly can provide instant financial support for short-term needs, helping you manage emergencies and improve your credit score through timely repayments.

- A well-written closure letter ensures you have all the necessary documentation, making future financial dealings smoother and more efficient.

What is a Personal Loan Closure Letter?

A personal loan closure letter is a formal document submitted to your lender requesting confirmation that your loan has been fully repaid and closed. This letter serves as an official request to mark the end of the loan term and ensures that no further dues are outstanding.

It may seem like a simple formality, but it plays a crucial role in protecting your financial future. By writing a loan closure letter, you’re ensuring that the lender updates their records and removes your liability from their systems. It's not just about closing the loan; it’s about maintaining a clean credit report and avoiding potential disputes in the future.

Why is It Important?

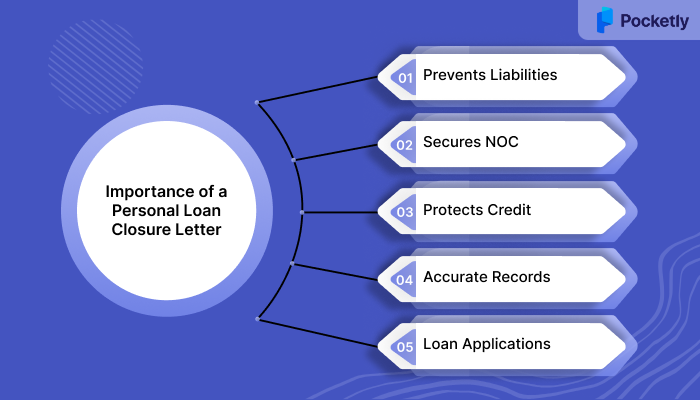

Writing a personal loan closure letter is not just a procedural step; it’s essential for protecting your financial future. This letter serves multiple purposes, from ensuring that no further payments are expected to secure important documents that can benefit you in the future. Here’s why it is important:

1. Prevents Future Liabilities: A personal loan closure letter ensures that the lender has updated their records, confirming that you no longer owe any money. This avoids situations where the lender might mistakenly claim you still have an outstanding balance or send further demands for payment.

2. Secures a No Objection Certificate (NOC): After submitting the closure letter, you are entitled to a No Objection Certificate (NOC) from your lender. The NOC is an official document that proves the loan has been paid off in full and confirms that the lender has no further claims on the loan. This certificate is vital when applying for future loans or clearing up any confusion regarding the loan's status.

3. Protects Your Credit Score: A loan closure letter helps maintain your credit health. If a loan is not officially closed, the lender might mistakenly mark it as unresolved, which can impact your credit score. By ensuring your loan is officially closed, you safeguard your credit profile for future financial transactions.

4. Ensures Accurate Financial Records: Sending a personal loan closure letter ensures that all records are accurately updated, reflecting your responsible management of debt. This is important for your personal financial history, especially when applying for other credit products in the future.

5. Facilitates Future Loan Applications: Having a loan officially closed with the correct documentation gives you a clear financial history, which is essential when applying for new loans or credit products. Lenders often check your previous loan closure status, and having a clean record will improve your chances of approval for future financial needs.

After submitting your loan closure letter, the following steps involve a few essential processes to ensure your loan is officially closed and your financial records are updated.

What to Expect After Sending the Closure Letter

Once your loan closure letter is sent, the process is far from over. Several important steps follow to ensure everything is properly documented and your loan is officially closed. Here's what you can expect after submitting the letter:

1. Lender's Review and Verification

Once the closure letter is submitted, the lender will begin reviewing your account. This process includes verifying that the final payment has been received in full and that no further outstanding balance remains. The lender will also cross-check any additional charges or fees that might apply before issuing the closure confirmation.

2. Issuance of No Objection Certificate (NOC)

After confirming that your loan is fully repaid, the lender will issue a No Objection Certificate (NOC). This certificate serves as official proof that the loan has been settled and the lender has no further claims against you. It is essential for your financial records, and you should request it if it is not automatically provided.

Why the NOC Matters: The NOC is crucial for your future financial endeavors, it serves as a clear indication that the loan has been fully closed and you've met all obligations, which is vital when applying for new loans or credit products.

3. Update of Credit Report

Once the loan is officially closed, the lender will notify the credit bureaus (such as CRIF and CIBIL) of the loan's closure. This ensures that your credit report reflects the updated status. It is essential to monitor your credit report to ensure that the loan is listed as fully settled. If you find any discrepancies, it's necessary to follow up with the lender and request corrections.

4. Timeframe for Closure Confirmation

The time it takes for the lender to process your loan closure letter and issue the NOC varies depending on the institution. Typically, it can take anywhere from a few days to a few weeks. If you haven't received confirmation within the expected timeframe, don't hesitate to follow up with the lender to ensure the process is progressing smoothly.

5. Next Steps in Your Financial Journey

Once the loan closure is confirmed, you can proceed with confidence towards your future financial goals. Whether you're planning to apply for a new loan, upgrade a credit card, or simply enjoy the relief of a debt-free status, ensuring that your loan is closed correctly will set you up for success.

Before knowing what happens after you send the closure letter, it's important first to understand the right time to write one.

Want to understand better how different interest rates affect your repayments? Read this blog on the Difference between Flat vs Reducing Interest Rates to gain more clarity on financial products.

When Should You Write a Personal Loan Closure Letter?

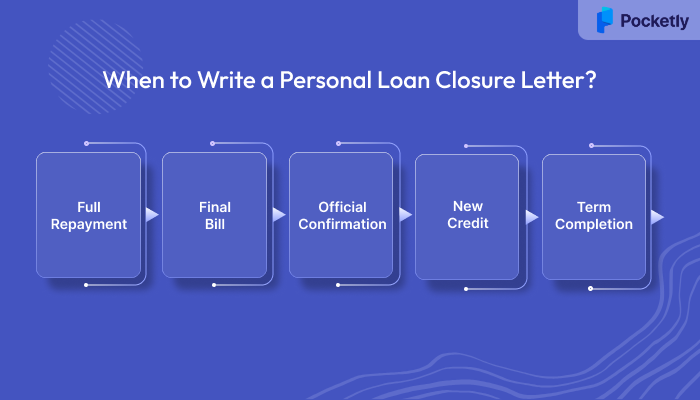

Knowing when to write a personal loan closure letter is just as important as knowing how to write it. A closure letter serves as an official confirmation that your loan has been fully repaid and closed; however, submitting it at the right time ensures a smooth and hassle-free process.

Here are the key moments when you should consider writing your personal loan closure letter:

1. After Full Repayment of the Loan

The most crucial time to write your closure letter is after you’ve paid off the entire loan amount, including the principal and any applicable interest. Before drafting the letter, double-check that there are no outstanding dues. This includes ensuring that any final payments, including fees, have been processed by the lender.

Why This Matters: Sending a closure letter prematurely, before the loan is fully paid off, can cause unnecessary delays and confusion. It’s essential to confirm that all dues are cleared to avoid any issues in obtaining the No Objection Certificate (NOC).

2. Once You Receive a Loan Statement or Final Bill

Typically, your lender will send a loan statement or final bill once the balance is paid. This statement acts as a confirmation of your final payment and will be a critical reference for your closure letter. You'll need to attach or mention this document to ensure that your request is linked to the correct account.

Why This Matters: This step ensures that there's no confusion about the payment details or outstanding balance, making the process smoother and quicker.

3. When You Want Official Confirmation of Loan Closure

If you need official confirmation that your loan is closed, whether for your records or as a requirement for future financial applications, this is the time to write the closure letter. Many lenders will issue a No Objection Certificate (NOC) upon receiving your closure request, which is crucial for future financial dealings.

Why This Matters: The NOC acts as proof that the loan is officially closed. It’s vital for keeping your credit record clean and for any future loan applications.

4. Before You Apply for New Credit Products

If you plan on applying for a new loan, mortgage, or credit card, it’s wise to write the closure letter once the loan is repaid and your final payment is processed. Lenders will often ask for proof of previous loan closure before approving any new credit.

Why This Matters: Without proof that your loan has been closed properly, your credit report might show a "pending" status, potentially impacting your chances of securing new credit.

5. When the Loan’s Terms Have Been Met

If you have adhered to all the terms of the loan agreement and have no remaining balance or liabilities, this is an appropriate time to submit your closure letter. You want to ensure all terms have been satisfied and no further payments are required before requesting loan closure.

Why This Matters: Ensuring that the loan is fully settled and all terms have been met reduces the chances of any disputes arising later regarding loan closure.

Knowing the right time to write a personal loan closure letter ensures that you don’t face unnecessary delays or complications. Once you've confirmed that the loan is fully paid off and the terms are met, you can proceed confidently with sending the letter.

Having established when to write your personal loan closure letter, it's now time to focus on structuring it correctly.

Knowing when to write your loan closure letter is key, but what if you need extra financial flexibility during these transitions? Pocketly can help you manage urgent expenses with fast, small loans, ensuring you stay on top of your finances. Contact us today to know how Pocketly can support you during financial transitions and apply for a quick loan when you need it the most.

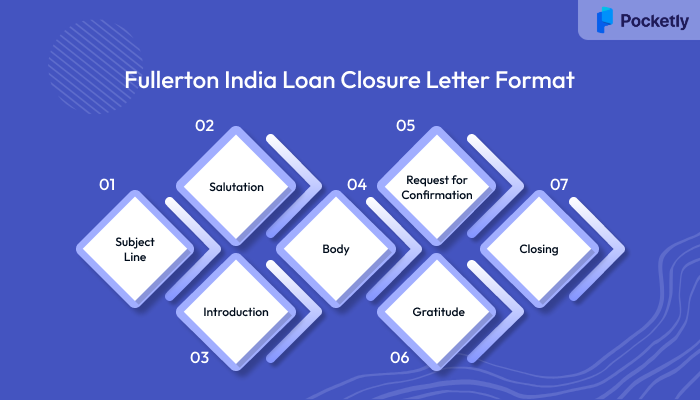

Fullerton India Loan Closure Letter Format

Writing a Fullerton India loan closure letter requires clear communication and a professional tone. This letter is essential to officially close the loan, ensuring that both you and the lender acknowledge the loan is fully repaid and there are no further obligations. By following a proper structure, you ensure that the process goes smoothly and you receive all necessary documents, such as the No Objection Certificate (NOC).

Here’s a straightforward Fullerton India loan closure letter format that you can follow to make sure your request is both clear and professional:

1. Subject Line

Make the subject line precise and to the point. A clear subject helps the lender quickly understand the purpose of your letter.

Example:

Request for Loan Closure and No Objection Certificate – Loan Account [Your Loan Number]

2. Salutation

Always address the lender formally to maintain professionalism. If you're unsure who to address, "Dear Sir/Madam" is a suitable alternative.

Example:

Dear Sir/Madam,

3. Introduction

In the opening paragraph, introduce yourself and your loan details. Be clear and concise about the purpose of your letter requesting closure of the loan after full repayment.

Example:

I hope this letter finds you well. I am writing to formally request the closure of my personal loan with Fullerton India, loan account number [Loan Number]. I have successfully completed all payments associated with this loan, and I request that the loan be officially closed and a No Objection Certificate (NOC) be issued.

4. Body (Main Request and Loan Details)

Provide specifics about your loan, including the final payment date, the loan amount, and any other relevant details. Be polite and direct in asking for the NOC or loan closure confirmation.

Example:

I have made the final payment of ₹[Amount] on [Date], and I believe the loan balance has been cleared in full. Kindly confirm the closure of this loan and issue the No Objection Certificate (NOC) at your earliest convenience.

5. Request for Confirmation

Ask for confirmation that your loan has been closed and request the NOC. Be sure to mention that the NOC is important for your financial records.

Example:

Please confirm the closure of the loan and provide the No Objection Certificate (NOC) confirming that I have fulfilled all obligations related to this loan. I would appreciate receiving this certificate at the earliest to avoid any discrepancies in my credit report.

6. Gratitude

Always express your thanks for their assistance. A little gratitude goes a long way in maintaining a positive relationship.

Example:

I would like to take this opportunity to thank Fullerton India for your support throughout the tenure of the loan. I look forward to your prompt response.

7. Closing

Conclude the letter politely, providing your contact details if necessary for any follow-up.

Example:

Thank you for your time and assistance. Should you require any further information, please contact me at [Your Contact Information].

Sincerely,

[Your Name]

[Your Address]

[Your Contact Number]

[Your Email Address]

By following this format, you ensure that your loan closure request is formal, professional, and complete. It provides all the necessary details the lender requires to process your closure quickly and efficiently.

Now that you understand the structure of a loan closure letter, it’s crucial to focus on the key elements that must be included to ensure a smooth process.

If you need more insights on how to manage your finances at work, check out this blog on Loans at Work: A Simple Guide to Getting Personal Loans for Employees for a better understanding.

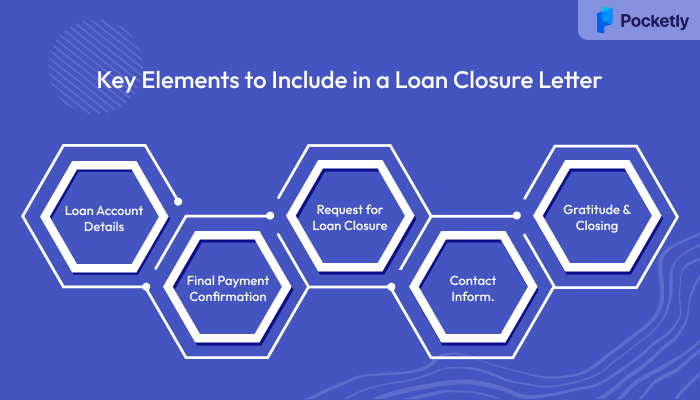

Key Elements to Include in a Loan Closure Letter

When drafting your loan closure letter for Fullerton India, it’s important to ensure that all key elements are included. A clear, concise letter will make the process easier for both you and the lender. Below are the essential components that need to be included:

1. Loan Account Details

Ensure that you provide all relevant loan account information at the beginning of your letter. This helps the lender quickly identify your account and avoid any confusion.

What to Include:

- Loan account number

- Loan type (e.g., personal loan)

- Date of loan disbursement

Example:

Loan Account Number: [Insert Number]

Loan Type: Personal Loan

Date of Disbursement: [Insert Date]

2. Final Payment Confirmation

Mention that you have completed all the repayments for the loan, including the principal and any interest. If applicable, refer to the final payment date and amount.

What to Include:

- The exact date of the final payment

- Total amount paid (principal + interest)

- Any final fees or charges paid

Example:

I confirm that the final payment of ₹[Insert Amount] was made on [Insert Date], and I believe all dues for the loan have been fully settled.

3. Request for Loan Closure

After confirming the repayment, request that the loan be closed and obtain a No Objection Certificate (NOC), which confirms that the lender has no further claim on the loan.

What to Include:

- A polite request for loan closure

- Request for Issuance of NOC

Example:

I request that the loan be officially closed, and a No Objection Certificate (NOC) be issued confirming that there are no outstanding dues.

4. Contact Information

Ensure you provide your current contact details so the lender can reach out to you if any follow-up is needed.

What to Include:

- Your phone number

- Your email address

- Your current residential address (if needed)

Example:

Should you need any further information, feel free to contact me at [Your Phone Number] or [Your Email Address].

5. Gratitude and Closing

Finish the letter with a note of gratitude, thanking the lender for their support throughout the loan period. This will help maintain a positive relationship for future financial dealings.

What to Include:

- A polite thank you note

- A formal closing statement

Example:

Thank you for your assistance during the term of my loan. I appreciate the support provided. I look forward to receiving confirmation of the loan closure.

By including these key elements in your loan closure letter, you ensure a well-structured request that will facilitate a smooth closure process. Now, let's look at a practical example of a Fullerton India loan closure letter, so you can see how to put everything into action.

Looking for more personal finance tips? Explore this blog on Instant Payday Loans for Salaried Employees in Bangalore to learn how to handle emergency finances.

Sample Personal Loan Closure Letter for Fullerton India

Here’s an example of a personal loan closure letter for Fullerton India. This sample incorporates all the necessary elements we've discussed and provides a clear, professional template that you can customize based on your specific loan details.

Subject: Request for Loan Closure and No Objection Certificate – Loan Account [Your Loan Number]

Date: [Insert Date]

To,

The Manager

Fullerton India Credit Company Limited

[Branch Address]

Dear Sir/Madam,

I hope this letter finds you well. I am writing to inform you that I have successfully completed the repayment of my personal loan, loan account number [Insert Loan Number], which was disbursed on [Insert Date]. I kindly request that you close my loan account and issue a No Objection Certificate (NOC), confirming that all outstanding dues have been settled.

Loan Details:

- Loan Account Number: [Insert Loan Number]

- Date of Disbursement: [Insert Date]

- Final Payment Amount: ₹[Insert Amount]

- Date of Final Payment: [Insert Date]

I would appreciate it if you could provide the NOC at your earliest convenience. If you require any additional information or documentation, please do not hesitate to contact me at [Your Phone Number] or via email at [Your Email Address].

Thank you for your assistance throughout the tenure of this loan. I look forward to your prompt response.

Sincerely,

[Your Full Name]

[Your Address]

[Your Contact Number]

[Your Email Address]

This sample letter serves as a template for your Fullerton India loan closure request. You can modify it by filling in your personal loan details, ensuring a smooth and professional process.

While the sample Fullerton India loan closure letter provides a strong foundation, it’s important to be mindful of some common mistakes that could lead to unnecessary delays or complications in the loan closure process. Let’s explore the typical errors to avoid, so you can ensure a smooth and efficient closure.

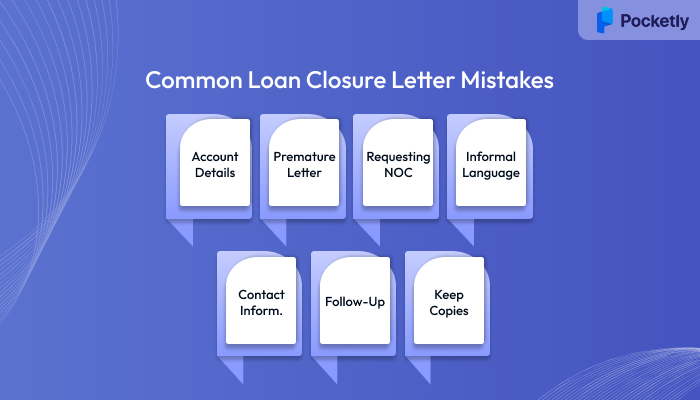

Common Mistakes to Avoid While Writing a Loan Closure Letter

Writing a personal loan closure letter might seem straightforward, but several common mistakes can delay the process or even lead to complications. Understanding these pitfalls ensures that your closure request is handled efficiently and correctly. Here are some of the most frequent mistakes to avoid when writing your Fullerton India loan closure letter:

1. Failing to Include Loan Account Details

One of the biggest mistakes is not providing clear and accurate loan account details in your closure letter. Your loan account number, the amount repaid, and the final payment date are essential pieces of information for the lender to process the closure request.

How to Avoid: Always double-check that you’ve included the correct loan account number, the loan type, and the repayment details before submitting your letter.

2. Writing the Letter Before Full Payment

Sending a loan closure letter before you've fully repaid the loan can cause unnecessary delays. Your lender will need to confirm that all dues have been cleared before proceeding with the closure.

How to Avoid: Ensure that the loan is fully repaid, including all fees and interest, before writing the closure letter. Wait for the final payment to be processed and verified by the lender.

3. Not Requesting a No Objection Certificate (NOC)

The primary purpose of a loan closure letter is to request a No Objection Certificate (NOC), which serves as formal proof that your loan is paid off. Forgetting to ask for this document can leave you without the necessary paperwork for future financial applications.

How to Avoid: Explicitly request the NOC in your letter, as this will be your official confirmation that the loan has been closed and you have no further obligations.

4. Using Informal Language

Although the loan closure letter is a personal communication, it remains a formal request. Using casual language or a friendly tone may undermine the professionalism of your request.

How to Avoid: Keep your letter formal and professional. Use polite and respectful language throughout.

5. Leaving Out Contact Information

If the lender needs to follow up with you for any reason, leaving out your contact information can delay the process. You must provide clear and accurate details so they can get in touch.

How to Avoid: Include your phone number, email address, and any other contact details to ensure easy communication.

6. Not Following Up

Even after sending the loan closure letter, you may not receive immediate confirmation. It’s important to follow up if you don’t receive a response within the expected timeframe.

How to Avoid: Set a reminder to follow up with the lender within a week or two if you haven’t received the NOC or loan closure confirmation.

7. Not Keeping Copies of the Letter

In case of any future disputes or confusion, not keeping a copy of your loan closure letter can put you at a disadvantage. Always maintain a copy for your records.

How to Avoid: Keep a personal copy of your loan closure letter and any correspondence related to it for future reference.

Avoiding these common mistakes will help ensure that your loan closure request is processed smoothly and without delays. A well-written and thorough loan closure letter will protect your credit record and ensure that you’re not held liable for any unpaid dues.

As you manage the loan closure process, it's crucial to have reliable support when your finances need a buffer. That's where Pocketly can be a game-changer.

How Pocketly Can Help During Financial Transitions

Whether you're handling a personal loan closure or facing unexpected expenses, Pocketly is here to provide flexible, quick financial support. Pocketly offers small, short-term loans that can help you bridge the gap between financial obligations, without the stress of lengthy approval processes.

Key Benefits of Using Pocketly:

1. Fast and Flexible Loan Options

Pocketly offers instant loans ranging from ₹1,000 to ₹25,000, ensuring that you can get the amount you need without delays. Whether it’s for paying off last-minute bills, handling medical emergencies, or covering small financial gaps, Pocketly gives you the flexibility to borrow what you need, when you need it.

2. Quick Approvals, Minimal Documentation

The application process is simple and fully digital. Pocketly doesn't require stacks of paperwork. You can complete your application and receive approval in minutes, allowing you to get the funds you need right away.

3. Affordable Interest Rates

With interest rates starting at just 2% per month, Pocketly provides a budget-friendly way to manage unexpected costs. Unlike many traditional lenders, Pocketly has no hidden fees or surprise charges, making it a transparent and reliable lending option.

4. No Collateral Required

Pocketly’s loans are unsecured, meaning you don’t need to pledge any assets to access funds. This is particularly helpful if you’re in a tight spot and need financial assistance without additional stress.

5. Credit Score Improvement

Pocketly’s lending practices are designed to help you improve your credit score over time. By making on-time repayments, your behavior is reported to credit bureaus, such as CRIF, which can help boost your creditworthiness for future financial applications.

How to Apply for a Loan with Pocketly:

- Step 1: Download the Pocketly app from the App Store or Google Play Store.

- Step 2: Complete the simple KYC process (no physical documents required).

- Step 3: Select your loan amount and submit your application.

- Step 4: Get instant approval and receive funds directly to your bank account.

Pocketly is designed to support you during moments when your finances need an extra push, making it a reliable partner alongside your financial goals.

Also Read our guide on Understanding Cash Flow: Definition, Types, and Analysis pocket

Conclusion

Closing a personal loan properly by writing a well-crafted closure letter is a crucial step in maintaining a healthy financial profile. A clear and professional loan closure letter not only helps finalize the loan but also ensures that you have the necessary documentation, such as the No Objection Certificate (NOC), for future financial needs. By following the proper steps and avoiding common mistakes, you can ensure that your loan closure process is smooth, efficient, and free from future disputes.

However, managing loans and finances doesn't stop at closure. Financial responsibilities can change rapidly, and having a tool like Pocketly can help you stay prepared for unexpected expenses. Pocketly offers quick, flexible loans to cover urgent needs, and its transparent, hassle-free process is perfect for anyone needing financial support during transitions or emergencies.

Download Pocketly today for Android or IOS and stay on top of your finances, improve your credit score, and move forward confidently in your financial journey.

FAQs

How long does it take to get a No Objection Certificate (NOC) after submitting the closure letter?

The timeline for receiving the NOC varies depending on the lender, but it typically takes anywhere from a few days to a week after your final payment is processed. Always follow up if you haven't received the NOC within the expected timeframe.

Can I still get a loan after closing my previous loan with Fullerton, India?

Yes, once your loan is closed and confirmed, you can apply for new loans. Just ensure that the closure is properly documented in your credit report to avoid any future confusion.

What happens if I don’t receive a NOC after submitting the loan closure letter?

If you don’t receive the NOC within the expected period, contact the lender to inquire about the delay. Keep a record of your communication and request the document to ensure the loan is officially marked as closed in your credit report.

How can I improve my credit score after closing a loan?

After closing a loan, maintain a low credit utilization rate and ensure all your bills are paid on time. You can also apply for smaller loans, like those offered by Pocketly, and repay them on time to continue building your credit history.

Is it possible to reopen a loan after it’s closed?

Once a loan is closed, it cannot be reopened. If you need additional funds, you will have to apply for a new loan. However, if you require a loan extension or modification, you should contact your lender before closing the loan.