Getting a credit card with no credit history can feel like an uphill battle. Banks and financial institutions rely on past borrowing and repayment patterns to gauge risk. Without any record, they have little way to judge your creditworthiness, making approval for traditional cards difficult. Understanding the options designed for beginners can help you start building credit responsibly and open doors to better financial products.

In this blog, we will explore how to secure credit cards to build credit with no credit history, the types of cards available, and steps to start establishing a strong credit profile.

Key Takeaways

- Secured credit cards and credit builder loans are essential tools for building credit with no history, as they allow you to establish a positive payment record.

- Co-signer or joint credit cards increase approval chances by using someone else’s credit history, but both parties need to be responsible with payments.

- Use eligibility checkers to assess your chances of approval before applying for a credit card, preventing unnecessary hard inquiries on your credit report.

- Timely payments and a low credit utilization are key factors in maintaining a good credit score.

- Start with entry-level cards like student credit cards or retail store cards, which are designed for individuals with no credit history and offer higher approval chances.

What is Credit History?

It is a record of your borrowing and repayment behaviour over time. It tracks loans, credit cards, payment timeliness, defaults, and outstanding balances. Lenders use this history to evaluate how reliably you manage debt, helping them decide whether to approve new credit and under what terms.

Your credit history acts as a financial reputation that reflects your ability to handle borrowed money responsibly.

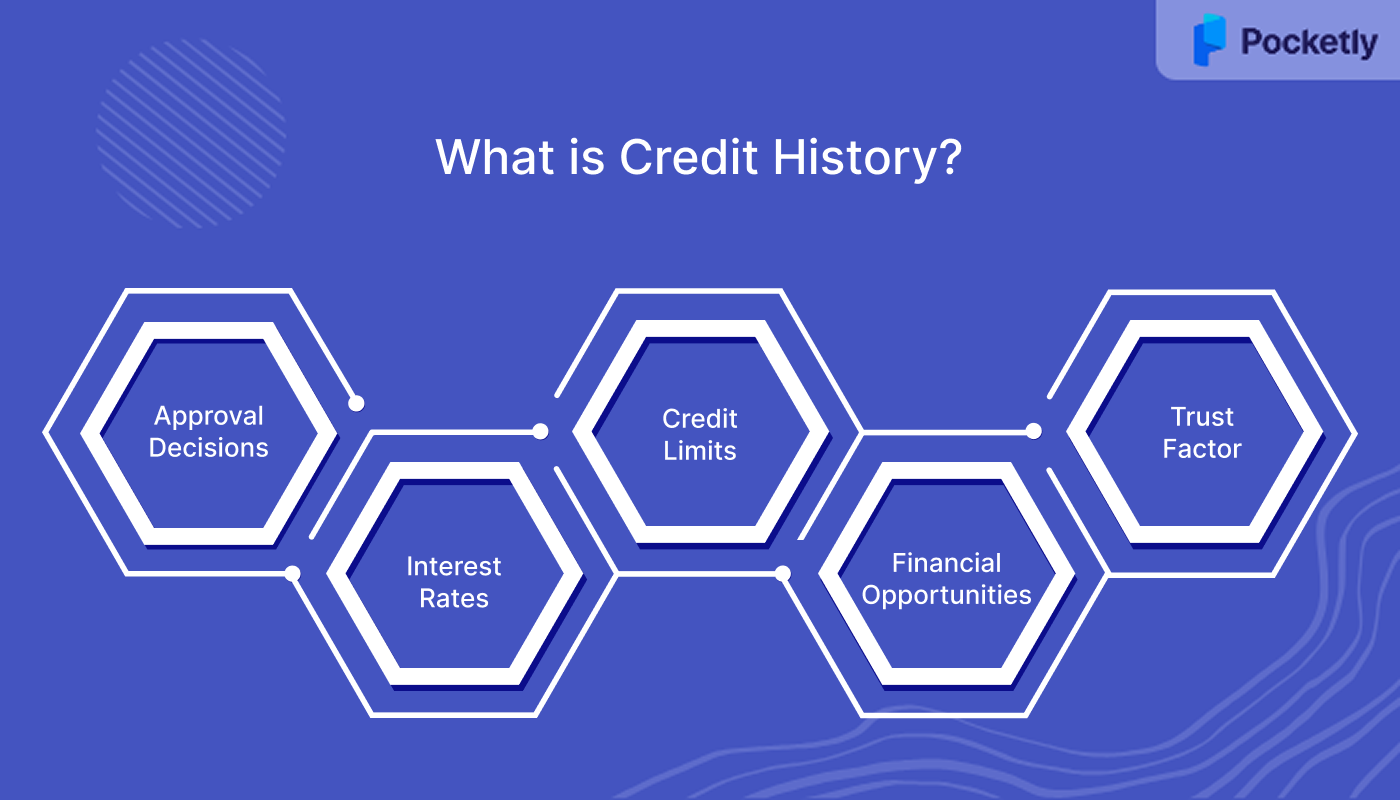

Here are some of the reasons why credit history is Important:

- Approval Decisions: Lenders rely on it to check your eligibility for credit cards, mortgages, and personal loans.

- Interest Rates: Strong credit history can secure lower interest rates and better credit terms.

- Credit Limits: Consistent repayment history often leads to higher borrowing limits.

- Financial Opportunities: A good record unlocks premium credit products, rewards, cashbacks, and financial services.

- Trust Factor: Demonstrates reliability to lenders and increases confidence in lending to you.

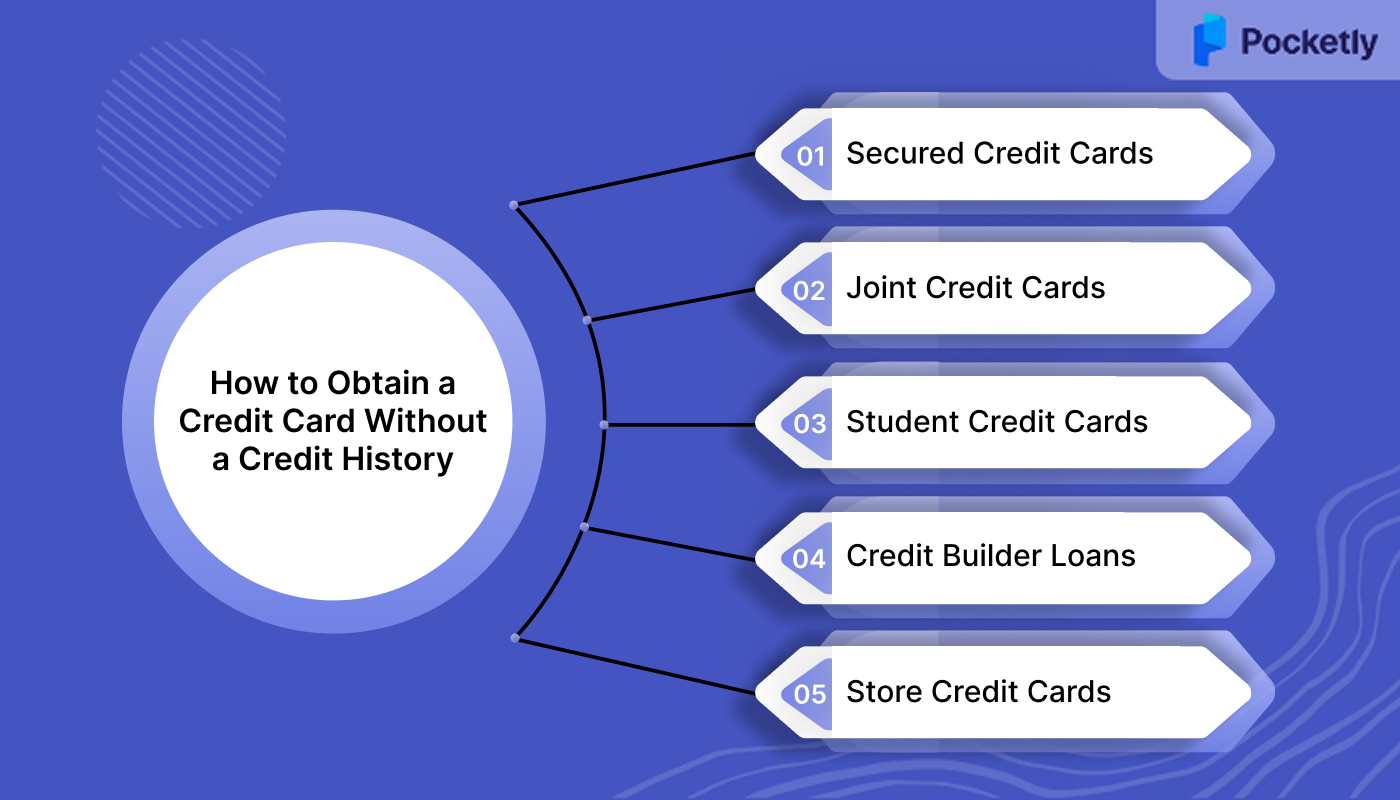

How to Obtain a Credit Card Without a Credit History

If you're new to credit, getting approved for a credit card can seem difficult. However, several options exist that can help you begin building your credit history.

1. Secured Credit Cards

Secured credit cards require you to deposit an amount (typically equal to your credit limit) with the card issuer, which acts as collateral. These credit cards can be easier to get approved for, especially when you have no credit history, and they allow you to build credit as long as you make timely payments.

2. Co-Signer or Joint Credit Cards

With a co-signer or joint credit card, someone with a good credit history (often a parent or trusted friend) agrees to share responsibility for the card. This increases your chances of approval because the lender considers your co-signer’s credit. As you both use the card, your payment history will help build your credit.

3. Student Credit Cards

Student credit cards are for individuals with little or no credit history, such as students. These cards come with lower credit limits and basic features to help students learn how to manage credit.

4. Credit Builder Loans

While not technically a credit card, a credit builder loan can help improve your credit history. You borrow a small amount of money from a financial institution and make regular payments. The lender will notify your payments to the bureaus, further helping you build credit.

5. Retail or Store Credit Cards

Specific retailers issue retail or store credit cards and tend to have more lenient approval processes. While these cards have higher interest rates and are limited to use within the issuing store, they can still help you start building credit. These cards are easier to qualify for and are a good starting point for establishing a credit history.

While these options provide pathways to credit, the application process itself requires strategic preparation. Before diving into applications, understanding your eligibility helps you target the right products and avoid unnecessary rejections.

How Do You Check Your Eligibility for Credit Offers with No Credit History?

Checking your eligibility for credit offers when you don’t have a credit history can feel like a challenging task; however, you can do so easily by following the steps as given below to make the process smoother and more informed. Here's how to assess your eligibility for credit offers:

- Use Eligibility Checkers Without Affecting Your Credit Score: Pre-qualification tools from many lenders allow you to check your eligibility through a soft inquiry, which won’t affect your credit score, saving you from unnecessary hard inquiries.

- Know Which Credit Agency a Lender Uses: Different lenders may check different credit bureaus. Knowing which bureau they use helps you understand their decision-making process and allows you to monitor your credit report from that agency.

- Instant Decision Services for First-Time Applicants: Many issuers offer instant decision services, which give you quick approval or denial based on basic criteria like income and employment status, perfect for first-time applicants.

- Understand Minimum Income and Age Requirements: Be aware of the lender's minimum income and age criteria (typically ₹15,000–₹25,000 monthly income, and 21 years+ age) to focus on cards you’re more likely to qualify for.

- Focus on Credit Cards for Beginners: Cards like secured credit cards, student cards, and entry-level options are designed for individuals with no credit history, offering higher approval chances with fewer requirements.

- Ensure You Meet Documentation Requirements: Lenders may require salary slips, bank statements, or a co-signer. Make sure you have the required documents ready before applying for a card.

Once you've identified your eligibility and selected the right card type, the actual application process becomes your next milestone. A well-prepared application increases your approval chances and sets the stage for a smooth credit-building journey.

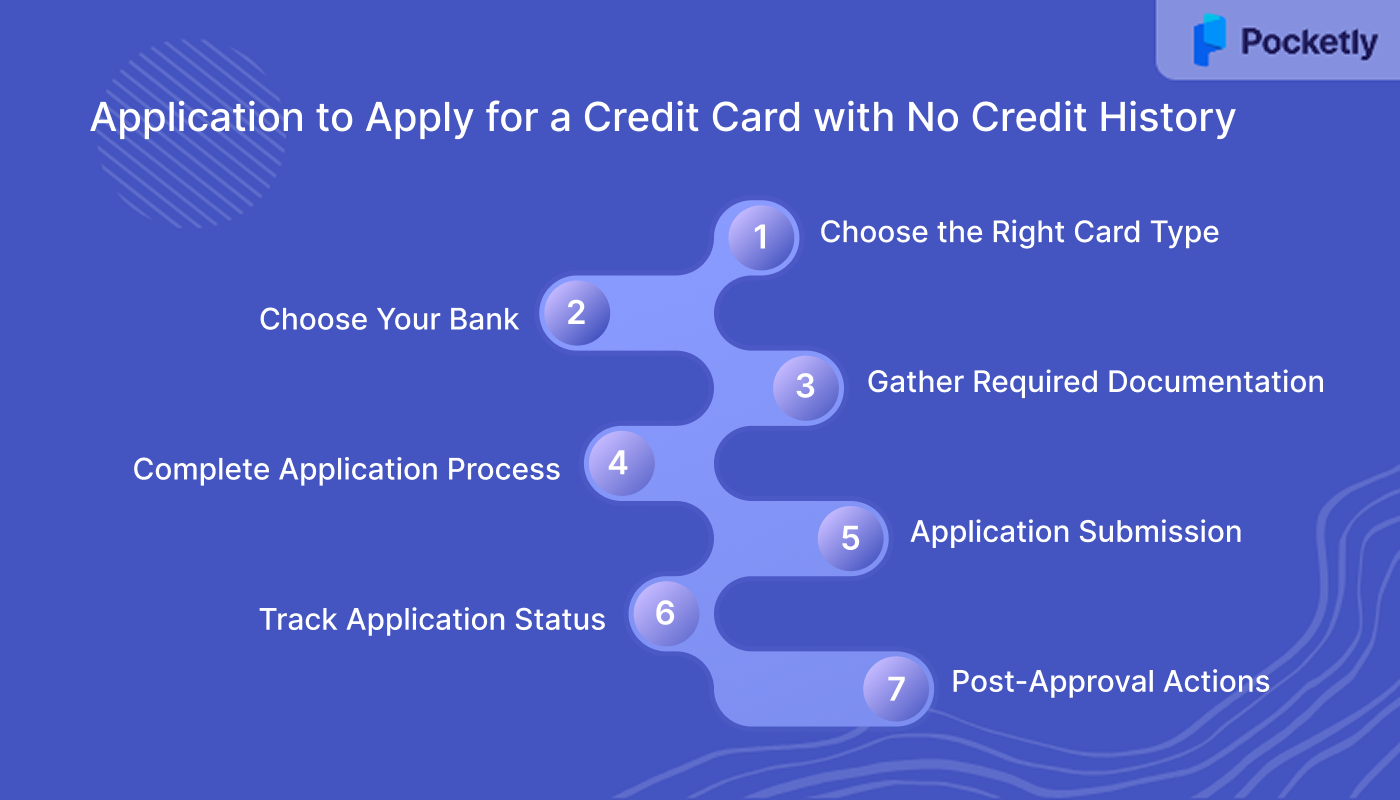

Step-by-Step Application to Apply for a Credit Card with No Credit History

If you want to apply for a credit card despite having no credit history, it can be done easily, but if you follow a structured approach and choose the right products designed for beginners. Here's a step-by-step guide to help you apply for a card with no credit history.

Step 1: Assess Your Financial Situation and Choose the Right Card Type

Consider your monthly income, expenses, and overall financial stability before applying for a credit card. Having a steady cash flow for timely payments is crucial. If you’ve had at least 6 months of consistent income, it improves your chances of approval.

Once you’ve assessed your finances, choose the right type of credit card for your situation, such as secured credit cards, salary account cards, entry-level unsecured cards, or student cards. These options are for individuals with no credit history and offer an accessible entry point to credit.

Step 2: Choose Your Bank and Card Strategically

When selecting a bank, prioritize those where you already have accounts. Banks have access to your banking history and transaction patterns, which can help compensate for the lack of a credit history. Established banks like SBI, HDFC, ICICI, and Axis often have a preference for their existing customers when approving credit cards.

Step 3: Gather Required Documentation

You’ll need several documents for your credit card application. Standard documentation includes the following:

- Identity proof (Aadhaar, PAN, passport)

- Address proof (Aadhaar, utility bills)

- Income proof (salary slips, ITR, bank statements)

- For self-employed individuals, 2 years of ITR and business continuity proof are needed.

- Students applying for a student card will need their college enrollment proof along with their parents’ income documents.

- For secured credit cards, you’ll need to provide FD receipts and details of the fixed deposit you are using as collateral.

Step 4: Complete the Application Process

A credit card application can be submitted online or offline. If you’re applying online, visit the bank’s official website, select the credit card you want, and fill in the application form. For an offline application, visit the nearest branch, complete the form, and submit the required documents for verification.

Step 5: Application Submission Best Practices

Double-check personal details, employment status, and income figures. Make sure that your contact information is correct so the bank can reach you for any additional verification. It’s also important to apply during weekdays for faster processing. Avoid applying right after changing jobs, and try to show consistent bank account activity with regular income deposits.

Step 6: Follow Up and Track Application Status

Once you’ve submitted your application, keep track of its progress. Many banks offer an online tracking tool where you can monitor the status using your reference number. Respond promptly to any requests for additional documentation or information.

Step 7: Post-Approval Actions

After approval, your card should arrive within 7-10 working days. Once you receive it, activate the card by following the bank’s instructions, either through phone, SMS, or online banking.

Beyond traditional credit cards, there are other alternatives that can accelerate your credit-building journey. These modern tools work alongside conventional methods, often providing faster results.

What are Credit Building Tools and How to Use Them to Enhance Your Credit History

Credit-building tools are financial products to help individuals who have no credit. There are several tools that can help you establish and improve your credit profile over time. These tools range from traditional methods like secured credit cards to modern solutions such as Experian Boost, which can make a big difference.

1. Experian Boost and Similar Services for Adding Payments to Credit History: Experian Boost is a service where you can add your utility, rent, and phone bill payments to your credit history. This is particularly beneficial for individuals who have no credit history.

How to Use:

- Link your account to Experian Boost and allow the service to pull data from utility payments, phone bills, and even rent payments.

- Payments are immediately reflected in your credit history, boosting your credit score within days.

- Payments are immediately reflected in your credit history, boosting your credit score within days.

- It’s free and can be a quick way to start building or improving your credit, especially if you have a consistent payment history on non-traditional credit lines.

2. Credit Builder Loans for Establishment of Payment History: Credit builder loans are helpful if you have little or no credit history. You borrow a small amount, which is placed in your savings account until you repay the loan. Once you make monthly payments, the lender will report your payment history to the credit bureaus.

How to Use:

- Apply for a credit builder loan at a bank or credit union. These loans usually require minimal documentation.

- Once you’ve paid off the loan, the money is released to you, and your credit score will have improved due to the positive payment history.

3. Using Buy Now Pay Later (BNPL) for Entry-level Credit Usage: Buy Now Pay Later services like Klarna, Afterpay, and Affirm allow consumers to make purchases and split payments into manageable installments. While BNPL services don’t always directly report to credit bureaus, some do, allowing you to start building credit by demonstrating responsible use.

How to Use:

- Opt for BNPL services that report to credit bureaus, like Affirm, which reports to Experian.

- Make sure to make all payments on time, or it can damage your score and lead to additional fees.

- Use BNPL for small, essential purchases you can afford to repay quickly and avoid high-interest rates.

4. Authorised User Status: Becoming an authorized user on a family member's or friend’s existing credit card will help you get a positive credit history. As an authorised user, the primary cardholder's on-time payments will reflect on your credit report, helping you build credit without being responsible for the full balance.

How to Use:

- Only ask to be added to a credit card where the primary cardholder has a strong payment history and low credit utilisation.

- The primary cardholder will need to contact their issuer to add you as an authorised user.

- This is a passive way to build credit but requires trust and clear communication with the primary cardholder.

5. Regular Credit Monitoring and Reports: Keeping track of your credit progress through regular monitoring can help you understand your credit standing and spot areas that need improvement. Many free services allow you to access your credit score and report, so you can see how your credit-building efforts are affecting your score.

How to Use:

- Sign up for free credit monitoring services available through the major bureaus (Equifax, Experian, TransUnion).

- Regularly check your reports for any errors, fraudulent accounts, or issues that could impact your score negatively.

Sustainable credit health requires developing habits and strategies that protect and enhance your financial reputation over the long term.

Tips for Building and Managing Credit Responsibly

Building and managing credit responsibly requires a mix of disciplined spending, timely payments, and regular monitoring of your credit status. Here’s how to stay on top of your credit management:

- Timely payments are key to a good score. Late or missed payments can have penalties, a higher rate of interest, and harm to your credit score.

- Keep your credit utilization less than 30% of your credit limit for a healthy credit score and show lenders you’re not overly reliant on borrowed money.

- Regularly track your spending to avoid accumulating debt, and set up automatic payments or reminders so that you don’t miss a payment.

- Applying for too many credit products in a short period can impact your score due to multiple hard inquiries.

- Space out your applications for credit cards, loans, or lines of credit to avoid lowering your score from excessive inquiries.

- Only apply for credit products when necessary and when you're confident you meet the eligibility criteria to increase your chances of approval.

- Check your credit report at least once a year for errors or signs of fraud, as you’re entitled to a free report from each of the three major bureaus.

- Dispute inaccuracies immediately to prevent them from affecting your credit score. This includes payment history mistakes or accounts that aren't yours.

While traditional banking products form the backbone of credit building, some platforms provide more accessible entry points and faster processing, particularly beneficial for those taking their first steps in credit building.

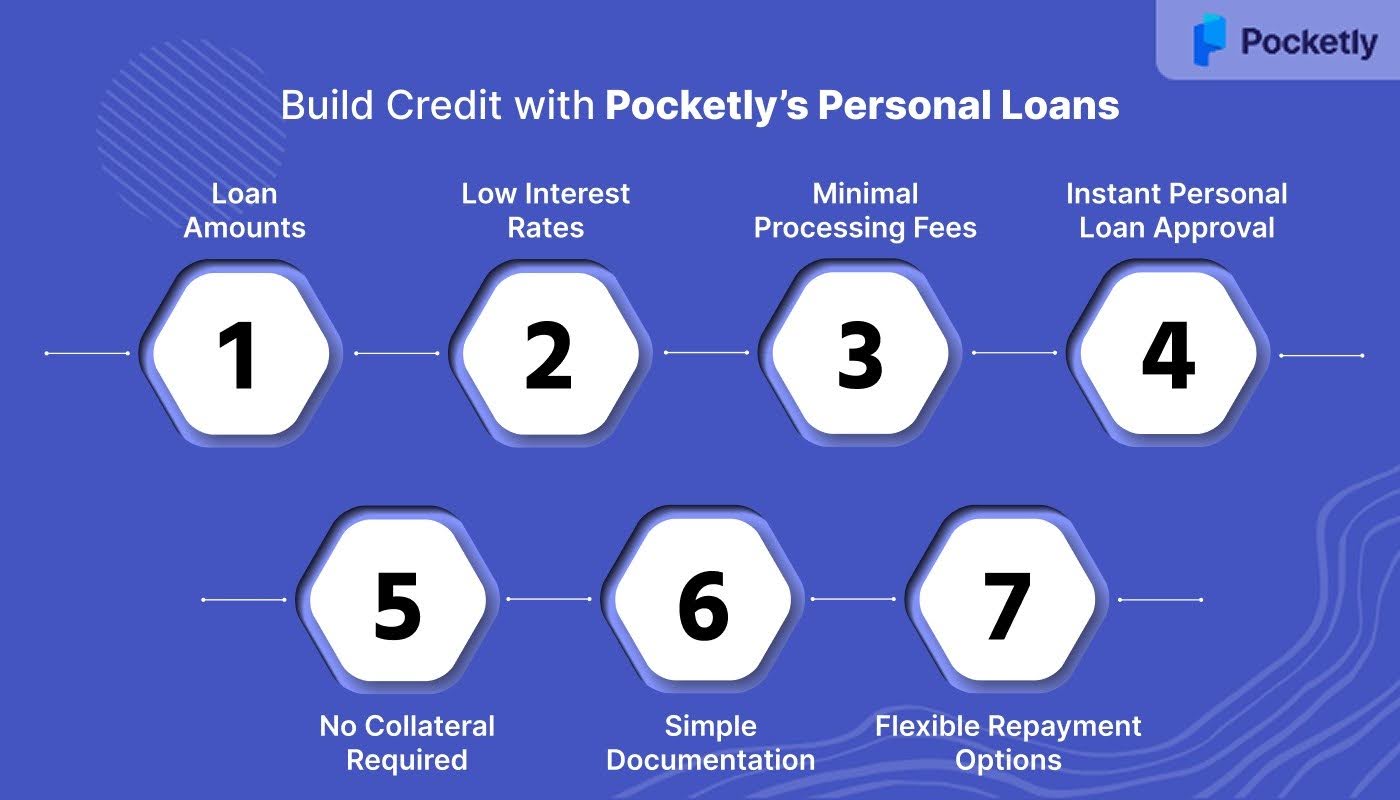

How You Can Build Credit with Pocketly’s Personal Loans

Pocketly’s personal loans offer a straightforward way to start building or improving your credit, whether you're a student, salaried professional, or self-employed. With Pocketly, you can demonstrate responsible borrowing behaviour to the bureaus, which helps in enhancing your credit score.

- Loan Amounts: Pocketly offers personal loans ranging from ₹1,000 to ₹25,000, tailored to meet a variety of financial needs.

- Low Interest Rates: Starting at 2% per month, making borrowing more affordable.

- Minimal Processing Fees: Processing fees are between 1% to 8% of the loan amount, ensuring transparent and cost-effective lending.

- Instant Personal Loan Approval: Fast loan approvals, with funds directly transferred to your bank account, often within minutes.

- No Collateral Required: Unlike traditional loans, Pocketly’s loans don’t require collateral, making it easier for you to access funds.

- Simple Documentation: Apply with minimal documentation, especially for salaried loans and self-employed loans; no physical paperwork required.

- Flexible Repayment Options: Choose from flexible EMI options, allowing you to repay comfortably and build your credit score over time.

Conclusion

Securing a credit card with no credit history is achievable with the right approach. By leveraging credit-building tools like secured credit cards, credit builder loans, and co-signer options, you can begin establishing a strong credit history and improve your chances of getting approved for future credit products. Responsible use of these tools will set the foundation for long-term financial success.

Pocketly is a digital lending platform, partnered with leading NBFCs like Speel, providing fast, easy access to personal loans with flexible terms. Download Pocketly now on iOS or Android to take control of your financial journey!

FAQs

1. Why is Credit History Important?

Credit history is very important because it shows lenders your borrowing behavior and repayment reliability. A strong credit history increases your chances of loan approvals and securing favorable interest rates, while a poor history may limit your access to financial products and result in higher costs.

2. Is it Possible to get a Credit Card with Poor Credit History?

Yes, you can get a credit card despite a poor credit history. Options like secured credit cards, co-signer cards, and credit builder loans are available, allowing you to build or rebuild your credit. These cards often come with lower limits but give you a chance to improve your score over time.

3. What to Do if You're Denied for a Credit Card?

If you’re denied, review the reason provided by the issuer, which may include factors like insufficient income or a high credit utilization ratio. Take steps to address these issues, such as getting a good credit score and lowering your debt. You can also apply for cards designed for individuals with no or poor credit history.

4. What is the Fastest Way to Build Credit?

The fastest way to build credit is to use a secured credit card or to get yourself to be an authorized user on your family member's credit card. Being consistent in actions such as making on-time payments and low credit utilization will lead to gradual improvement in your credit score.

5. What is the Age at which you can Start Building Credit?

You can start building credit once you turn 18. Many credit cards and financial institutions offer options specifically for students or individuals new to credit, allowing you to begin establishing a credit history early on.