When you need financial support, the first thing most people check is the loan interest rate. Even a small difference in rates can add up to thousands over time, making it harder to manage repayments. Many young borrowers struggle to compare options and often end up paying more than necessary simply because they didn’t know the details.

So, what is the Canara loan interest rate? How does it compare with other banks and lending platforms? And which option is more suitable for your needs? In this blog, we break it down for you with a clear comparison so you can make the right financial decision.

Key Takeaways

- Canara Bank offers competitive interest rates across a variety of loan products, including home loans (7.40%), personal loans (9.95%), and vehicle loans (7.70%).

- Interest rates are influenced by factors such as loan type, borrower creditworthiness, and loan tenure, with secured loans (like home and gold loans) offering lower rates.

- Pocketly offers a faster, more flexible option with interest rates starting at 2% per month, minimal processing fees, and an entirely digital loan application process.

- Canara Bank provides a range of loan products with varying terms and fees, catering to both salaried professionals and self-employed individuals, as well as specific schemes like gold and education loans.

- Borrowers should compare processing fees and loan terms between banks to choose the best loan option, as fees can vary from one institution to another.

What is the Canara Loan Interest Rate?

Canara Bank Loan Interest Rates refer to the rates at which Canara Bank charges borrowers for various loan products, such as home loans, personal loans, education loans, and vehicle loans. These rates are determined based on factors like the type of loan, the borrower’s credit profile, and the loan tenure.

Canara Bank offers competitive interest rates starting from 7.40% p.a. for home loans and going up to 16.00% p.a. for personal loans, with rates subject to change based on RBI guidelines and individual eligibility.

Each loan type serves a unique purpose and comes with its own risk assessment, which directly impacts the interest you'll pay. Here's how Canara Bank structures its rates across various lending products.

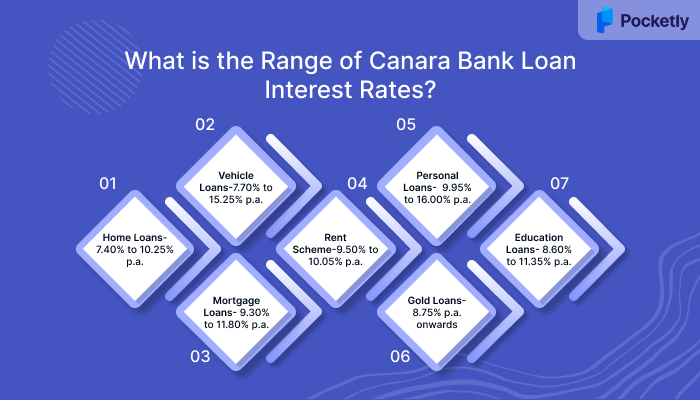

What is the Range of Canara Bank Loan Interest Rates?

Canara Bank provides a variety of loan products like home loans, vehicle loans, and more to meet different financial needs. Each loan category comes with its own eligibility criteria, repayment terms, and interest rate range. Understanding these differences is important for borrowers to select the right product and avoid paying more than necessary.

Below is a breakdown of the main loan categories with their applicable interest rates.

1. Home Loans

Home loans are among the most popular products offered by Canara Bank. They are available for purchasing a new house, constructing a property, or even renovating an existing one.

Interest rates are usually lower compared to unsecured loans because they are backed by collateral. The home loan eligibility varies; however, borrowers with strong credit profiles often get more favourable terms.

- Interest rate range: 7.40% to 10.25% p.a.

- Rate depends on borrower’s credit risk grade and loan amount.

- Longer repayment tenure options available.

2. Vehicle Loans

Vehicle loans cover both two‑wheelers and four‑wheelers, making them accessible to young professionals as well as families. Canara Bank also offers special financing for electric vehicles, reflecting the growing demand in this segment.

The loan is secured against the vehicle, which helps keep the rates lower than many personal loans. However, rates can climb if the vehicle is used or if the applicant’s credit score is weak.

- Interest rate range: 7.70% to 15.25% p.a.

- Higher rates usually apply to used vehicles or borrowers with lower credit scores.

- Flexible repayment terms depending on loan amount and vehicle type.

3. Mortgage Loans

Mortgage loans are chosen by individuals or small business owners who need larger sums for personal or professional purposes. These loans are secured against residential or commercial property, which reduces the bank’s risk and makes them more affordable compared to unsecured borrowing.

Since the loan amount can be high, borrowers must assess their loan repayment methods to avoid long‑term financial strain.

- Interest rate range: 9.30% to 11.80% p.a.

- Suitable for individuals requiring larger loan amounts against collateral.

- Loan tenure can be extended, making EMIs manageable.

4. Canara Rent Scheme

This scheme is relatively unique compared to regular bank loans. It allows property owners to take a loan against the rental income they receive from tenants. The steady cash inflow from rent makes repayment easier for many borrowers. However, eligibility depends on having a valid rental agreement and proof of consistent rental income.

- Interest rate range: 9.50% to 10.05% p.a.

- Designed for property owners earning stable monthly rent.

- EMI flexibility is linked to expected rental receipts.

5. Personal Loans

Personal loans are unsecured, meaning no collateral is required, which makes them one of the most flexible loan options. Canara Bank offers several schemes under this category, including Canara Budget for salaried individuals and loans for pensioners.

Since there is no security involved, the rates are higher compared to secured loans. The final rate largely depends on the applicant’s income stability and credit score.

- Interest rate range: 9.95% to 16.00% p.a.

- Interest depends on the borrower’s salary tie‑ups and credit risk grading.

- Quick approvals, but documentation requirements vary by scheme.

6. Gold Loans

Canara Bank’s gold loans are secured by pledging gold jewellery or minted coins. Since the loan is backed by physical collateral, the interest rates are lower than those of unsecured personal loans. This makes them ideal for short‑term needs with minimal paperwork and very quick approval.

- Interest rate range: 8.75% p.a. onwards

- The loan amount varies in the range of ₹5,000 to ₹35 lakh, based on the value and purity of gold.

- Repayment plans Include Bullet repayment, monthly interest, or an overdraft facility.

7. Education Loans

Education loans are designed to help students and their families manage tuition fees, living expenses, and other academic costs. Canara Bank provides these loans for students in India and abroad, with flexible repayment terms that often include a moratorium period.

- Interest rate range:

- Concessions are available for girl students and specific professional courses.

- Repayment holiday (moratorium) provided until course completion plus a grace period.

While Canara Bank offers a wide range of loans, the process can be lengthy with multiple checks and higher rates in some cases. If you need urgent funds for rent, travel, or medical expenses, waiting weeks isn’t practical.

That’s where Pocketly helps. A digital lending platform (not an NBFC), Pocketly offers instant short‑term loans from ₹1,000 to ₹25,000 with interest starting at 2% per month.

Having explored Canara Bank's offerings in detail, you might wonder how these rates stack up against the competition. Let’s take a look.

How does Canara Bank's Loan Interest Rate Compare with Other Banks?

When choosing a loan, comparing interest rates across banks helps you find the most affordable option. Canara Bank generally offers competitive rates in line with other public sector banks. However, some private lenders may offer slightly lower or higher rates depending on the product and customer profile.

| Loan Type | Canara Bank (p.a.) | SBI (p.a.) | HDFC Bank (p.a.) | Bank of Baroda (p.a.) |

| Home Loan | 7.40% – 10.25% | 7.50% – 8.70% | 8.55% - 13.0% | 7.45% – 9.20% |

| Personal Loan | 9.95% – 16.00% | starts at 10.30% | 10.90% – 24% | 11.25% to 11.75% |

| Vehicle Loan | 7.70% – 15.25% | 9.00% - 9.95% | Starts at 9.40% | Starts at 8.40% |

| Education Loan | 8.60% – 11.35% | 7.15% - 8.65% | Starts at 10.50% | Starts at 7.10% |

| Gold Loan | Starts at 8.75% | Starts at 9.30% | 9.30% - 17.88% | Starts at 9.40% |

Note: The interest rates mentioned above are indicative and subject to change based on updates from the Reserve Bank of India (RBI) and the borrower’s credit profile, loan amount, and tenure. Actual rates may vary.

Interest rates tell only part of the story when it comes to the total cost of borrowing. Processing fees, often overlooked during initial comparisons, can significantly impact your overall expense.

How does Canara Bank's Personal Loan Processing Fee Compare with Other Banks?

Canara Bank’s personal loan processing fee is 0.50% of the loan amount, with a minimum of ₹1,500 and a maximum of ₹10,000. This fee is competitive when compared to other major banks in India. While it’s at par with some public sector banks like SBI (which charges up to 1.50%) and Bank of Baroda (which charges 0.35% to 2.0%), it tends to be slightly higher than HDFC Bank, which can charge up to 2.50%.

However, borrowers should still be mindful of additional charges, such as documentation fees, inspection charges, or stamp duties that can vary based on the loan size and type of borrower.

Note: Pocketly offers flexible, low-cost loan options with minimal processing fees starting at just 1%. Unlike traditional banks, Pocketly’s entire process is digital, eliminating no documentation for personal loans, no physical paperwork, and additional fees, helping you save more.

Multiple factors work together to determine the final rate you're offered, and understanding these elements puts you in a stronger position to negotiate better terms.

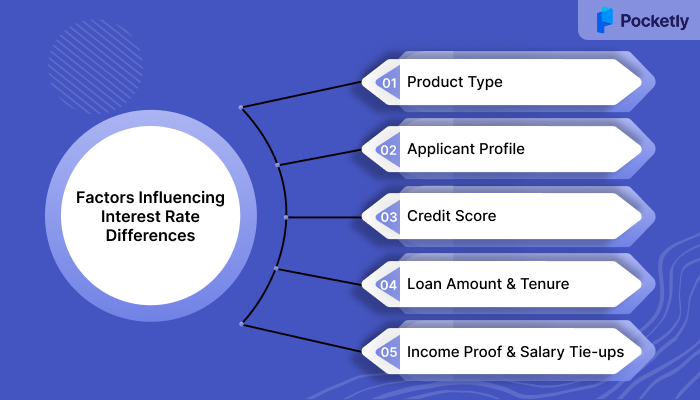

What are the Factors Influencing Interest Rate Differences?

Interest rates differ across loan products due to several key factors related to the borrower's profile and the loan specifics:

- Product Type: Secured loans like home loans tend to have lower rates due to reduced risk, whereas unsecured loans (like personal loans) come with higher rates.

- Applicant Profile: Borrowers’ employment status can affect rates. Salaried individuals with strong credit histories may receive lower rates, while loans for self-employed individuals may face slightly higher rates.

- Credit Score: A higher credit score often leads to better rates, as it reduces the lender’s risk.

- Loan Amount & Tenure: Longer loan terms generally have higher rates. However, larger loans may come with better terms due to potential benefits from loan volume.

- Income Proof & Salary Tie-ups: Limited income documentation can lead to higher rates, while tying a salary account to the bank could help secure lower rates, especially for personal loans.

Understanding these factors will help you evaluate your options and make smarter loan choices. By considering your financial profile, you can aim for the best possible rate when applying for loans.

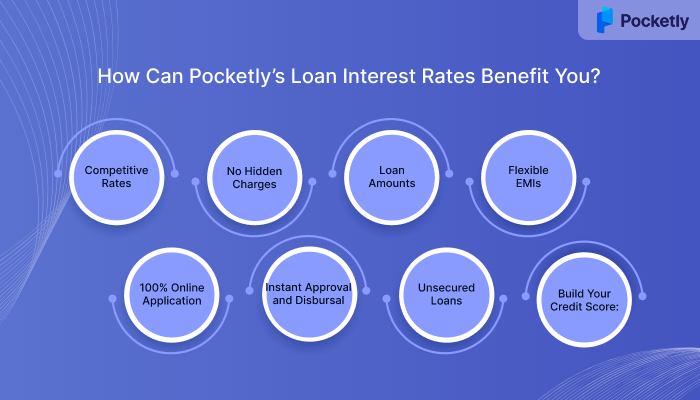

How Can Pocketly’s Loan Interest Rates Benefit You?

Pocketly is a personal lending platform with a fully digital, user-centric approach, designed to meet the needs of young Indians. Unlike traditional lenders, Pocketly offers instant personal loans and flexible loan options with minimal paperwork, making it easier for salaried professionals, students, and entrepreneurs to access funds quickly.

Here's how Pocketly sets itself apart:

- Competitive Rates: Starting at 2% per month and processing fees ranging from 1% to 8% of the loan amount, making borrowing more affordable compared to traditional lenders.

- No Hidden Charges: Pocketly ensures complete transparency with no annual fees, joining fees, or surprise costs.

- Loan Amounts: Borrow amounts from ₹1,000 to ₹25,000, catering to various financial needs.

- Flexible EMIs: Choose repayment tenures that align with your financial situation, with the option to make partial repayments or close the loan early without penalties.

- 100% Online Application: Apply for a loan with a simple 2-minute process, requiring minimal KYC documentation.

- Instant Approval and Disbursal: Get loan approval and funds disbursed directly into your bank account within minutes.

- Unsecured Loans: Pocketly provides unsecured loans, meaning you don't need to risk your property or savings.

- Build Your Credit Score: Timely repayments help you build or improve your credit score, opening doors to better financial opportunities.

Conclusion

Understanding loan interest rates is essential when making financial decisions. Canara Bank offers competitive rates across various loan products, but the process can be lengthy, and fees may add up. Whether you're looking for a home loan, personal loan, or education loan, comparing rates is crucial to finding the best deal. However, if you need quick access to funds without the wait, Pocketly offers a faster, more flexible solution.

Ready to experience a smarter way to borrow? Download Pocketly on Android or iOS today and get started in minutes for a hassle-free borrowing experience.

FAQs

1. What is the Canara Green 1111 Scheme?

The Canara Green 1111 Scheme is a fixed deposit product by Canara Bank aimed at promoting sustainable and eco-friendly initiatives. It offers competitive interest rates for tenures of 1111, 2222, and 3333 days. This scheme is open to individuals, NRIs, and corporates alike, helping them invest while supporting green projects.

2. Is Canara Bank a government bank?

Yes, Canara Bank is a public sector bank owned by the Government of India. It offers a wide range of banking services to individuals and businesses across the country.

3. Is 750 a good CIBIL score?

Yes, a CIBIL score of 750 is considered excellent and indicates strong creditworthiness. It enhances your chances of loan approval and may qualify you for better interest rates.

4. Can I get a ₹2 lakh loan without income proof in Canara Bank?

Canara Bank requires income proof for personal loans. However, certain schemes like the Canara Housing Loan for Customers with Minimal or Nil Income Proof may offer loans up to ₹20 lakh without documented income, provided the applicant has a satisfactory banking history and meets other criteria.

5. Does Canara Bank provide instant personal loans?

Canara Bank Personal Loans are available starting at an interest rate of 9.95% per annum, with loan amounts up to ₹10 lakh and repayment tenures extending up to 7 years. For salary account holders, Canara Bank offers an instant personal loan facility of up to ₹1 lakh, providing quick access to funds for urgent financial needs.