Managing payments for everyday purchases has become more varied, with options like Buy Now Pay Later (BNPL) and credit cards gaining popularity. The global BNPL payment market, which is expected to grow by 13.7% annually and reach US$560.1 billion by 2025, reflects the rising trend of consumers seeking flexible payment solutions.

While both BNPL and credit cards let you spread out spending, they work very differently and come with unique challenges. BNPL offers instalments but includes hidden fees, while credit cards provide rewards and flexibility but carry interest risks if not managed carefully.

In this blog, we will break down the key differences between credit cards, BNPL, and loans, highlight the pros and cons of each, and help you decide which payment method fits your financial habits and goals.

Key Takeaways

- BNPL vs Credit Cards: BNPL is great for short-term, interest-free payments, while credit cards offer rewards but come with higher interest if balances are carried.

- Credit Score Impact: Credit cards directly affect your score, while BNPL only impacts it if payments are missed.

- Pros and Cons: BNPL has no-interest perks but risks late fees, while credit cards offer rewards but can lead to high fees and interest.

- Choosing the Right Option: BNPL is best for short-term needs, and credit cards are ideal for flexibility and credit-building.

Overview of BNPL and Credit Cards

BNPL (Buy Now Pay Later) is a flexible payment method that allows consumers to purchase items and pay for them in instalments without interest, provided they are paid within the agreed period. It offers easy access to goods and services without upfront payments.

Example: If you purchase a ₹5,000 item on Amazon using Amazon Pay Later, you can opt to pay in 3 or 6 monthly instalments. If you pay on time, no interest is charged.

On the Other hand, Credit cards provide a revolving line of credit that allows users to make purchases up to a certain limit. You can repay the amount in full or make minimum payments, but carrying a balance incurs interest, often at higher rates than BNPL schemes.

Credit cards also offer rewards like cashback, points, or miles, making them attractive for frequent users.

Example: With a Credit Card, if you purchase a ₹10,000 item, you can choose to pay it off in full or in monthly instalments. If you choose to pay in instalments, you will incur an interest charge (usually around 18-40% annually).

Key Differences between BNPL and Credit Cards

Both Buy Now, Pay Later (BNPL) and Credit Cards are popular financial tools that offer flexibility in managing purchases, but they differ in their structure, usage, and impact on your financial health. Below is a comparison of key differences between credit cards vs BNPL.

| Aspect | BNPL | Credit Cards |

| Application Process | Quick approval during checkout with minimal paperwork | Requires formal application and thorough verification |

| Approval Requirements | Soft credit checks or no credit verification, accessible for those with limited credit history | Requires meeting specific criteria like income, credit score, and employment verification |

| Credit Score Impact | No impact unless payments are missed or overdue | Regularly impacts credit score through usage and timely payments |

| Interest Charges | Interest-free for short promotional periods; 0-24% if extended | High interest rates, ranging from 18% - 40% annually on outstanding balances |

| Payment Structure | Fixed payments over a set number of instalments (usually 4-12) | Flexible, with the option to pay the minimum balance or carry forward a balance |

| Late Fee Structure | Flat fees per missed payment, which can increase quickly | Percentage-based fees, plus interest on any outstanding amounts |

| Merchant Acceptance | Limited to specific partner merchants and platforms | Accepted globally at millions of merchants |

| Credit Limits | Typically lower, between ₹5,000 - ₹50,000, depending on the purchase | Higher limits, generally ranging from ₹50,000 to ₹10+ lakhs based on creditworthiness |

| Rewards & Benefits | Few rewards, sometimes cashback at partner stores | Comprehensive rewards, including cashback, points, travel benefits, and more |

| Consumer Protection | Fewer protections and limited dispute resolution | Strong legal protections, fraud protection, and chargeback rights |

| Credit Building | Does not build positive credit, only affects the score negatively if missed payments occur | Builds a positive credit history with responsible use and timely payments |

| International Usage | Limited to domestic purchases, with limited international use | Accepted worldwide, with foreign currency exchange options |

| Physical Card | Offers virtual cards only, no physical card | Both physical and virtual cards, along with contactless payment options |

| Repayment Flexibility | Fixed repayment plan with limited flexibility | Multiple repayment options, including minimum payment, partial payment, or full settlement |

| Cost Transparency | Potential for hidden fees, varying terms depending on provider | Clear fee structure with regulated disclosures on charges and terms |

Among all these differences, none is more significant than how each payment method affects your credit score. Your credit profile serves as a financial report card that influences future borrowing opportunities.

Impact on Credit Score: Credit Cards vs BNPL

Your credit score plays a crucial role in determining your financial health and is influenced by how you manage credit. Both Credit Cards and Buy Now, Pay Later (BNPL) services affect your credit score, but in different ways. Here's how each one impacts your credit score:

Impact of Credit Cards on Credit Score

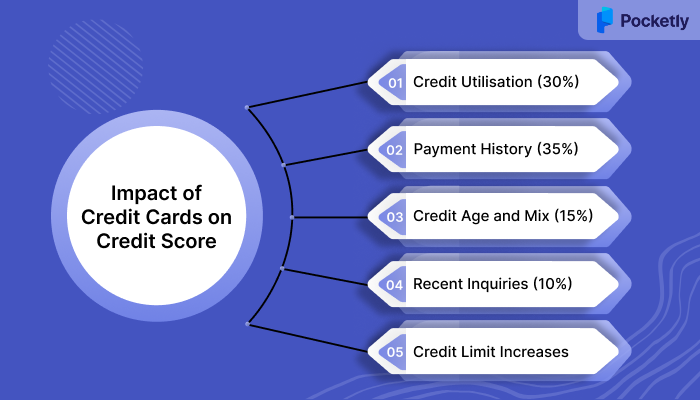

Credit cards have a significant, ongoing impact on your credit score. The way you manage your credit usage is directly linked to your credit profile. Here’s how it affects your score:

- Credit Utilisation (30%): Your credit utilisation ratio, which is the amount of credit you use compared to your available credit, plays a big role in your score.

- Payment History (35%): Timely payments are crucial. On-time payments improve your score, while late payments can severely hurt it and stay on your record for up to 7 years.

- Credit Age and Mix (15%): A longer credit history with a variety of credit types, like loans and credit cards, influences your score. Having a mix shows your ability to handle different types of credit.

- Recent Inquiries (10%): Applying for new credit cards results in hard inquiries. While a few inquiries won’t hurt, too many in a short period can lower your score by signaling financial instability.

- Credit Limit Increases: Increasing your credit limit can lower your credit utilisation ratio, which may boost your score if you maintain responsible spending habits.

Impact of BNPL on Credit Score

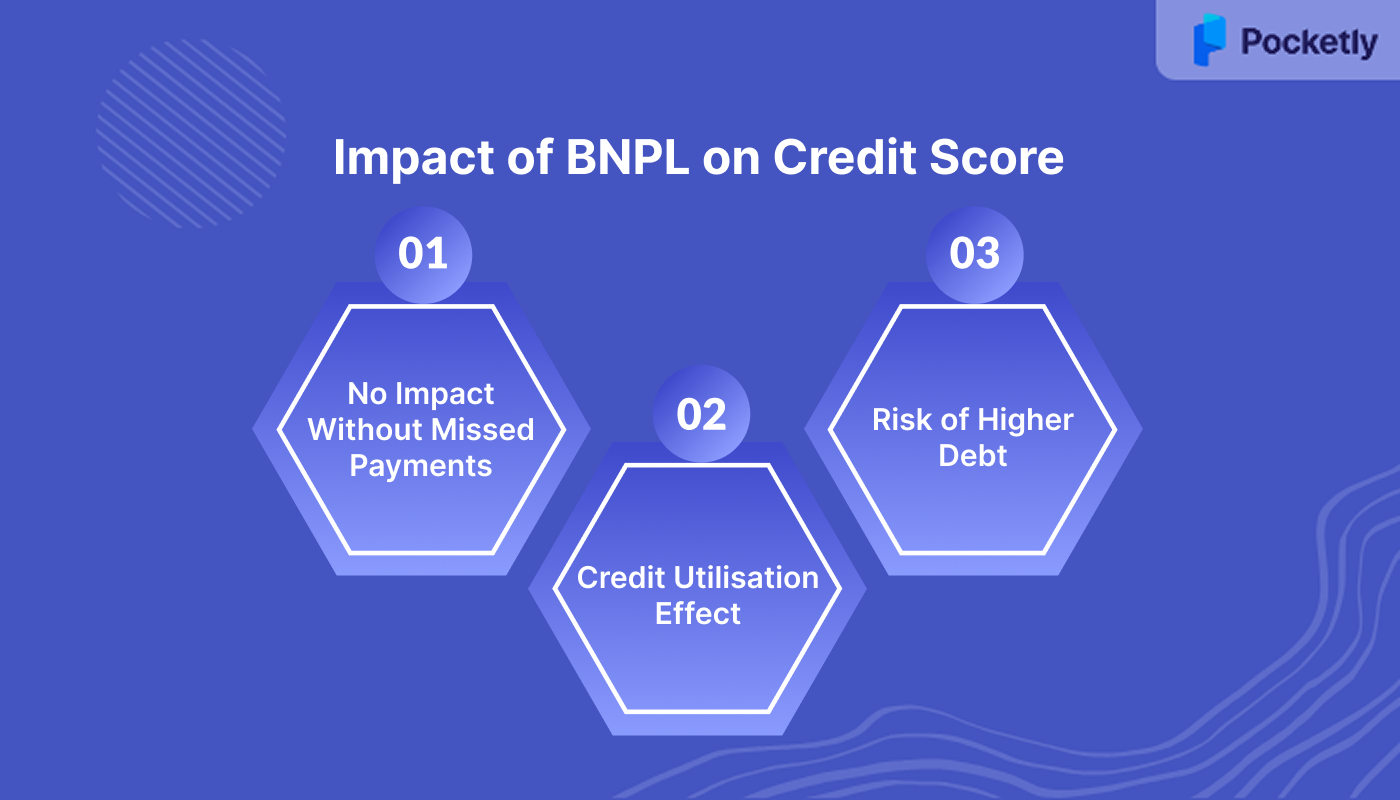

BNPL services, on the other hand, have a more indirect impact on your credit score. While BNPL services like Amazon Pay Later offer easy ways to make purchases and split payments into instalments, they can still affect your credit score in the following ways:

- No Impact Unless Payments Are Missed: BNPL services don’t report positive payment history, but missed payments can affect your credit score, leading to higher interest rates and fees.

- Credit Utilisation Influence: While BNPL doesn't affect your credit utilisation ratio, multiple BNPL accounts or missed payments may signal financial strain to lenders.

- Potential for Increased Debt Load: Frequent use of BNPL services can accumulate debt and could hurt your credit score, leading to penalties.

Understanding these credit score implications provides important context, but making an informed decision requires examining the complete picture of benefits and drawbacks.

Pros and Cons of BNPL

BNPL services offer a convenient way to spread payments for purchases over time and manage cash flow. They can also lead to overspending and missed payments, which can result in fees and impact your credit. Below are the pros and cons of using BNPL.

Pros of Buy Now, Pay Later:

- Split up payments into smaller, manageable amounts, making larger purchases easier to afford.

- 0% interest financing if payments are made on time, offering an interest-free way to manage payments.

- No credit checks are required by some services, making BNPL accessible for those with no credit or poor credit history.

Cons of Buy Now, Pay Later:

- Missed payments can lead to fees, interest charges, and a potential impact on your credit score.

- Automatic payments can result in overdrafts if there are insufficient funds in your bank account.

- It’s easy to overextend your finances, leading to multiple overlapping payments and financial strain.

- You miss out on credit card rewards, benefits, and purchase protection by using BNPL instead of a credit card.

- Returning items bought through BNPL can be complicated, often causing delays and making it harder to manage repayments.

Pros and Cons of Credit Cards

Credit cards, although they help you build your credit score when managed well, their convenience can lead to overspending, high-interest rates, and fees. Below are the pros and cons of using credit cards.

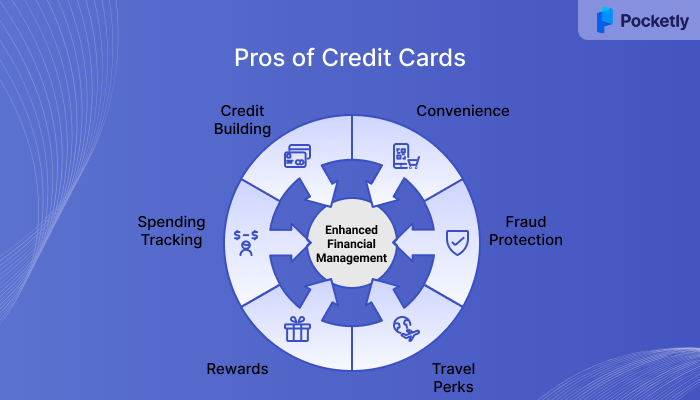

Pros of Credit Cards:

- Convenient for both online and in-person purchases, accepted worldwide.

- Offers protection against unauthorised transactions, ensuring zero liability for fraud.

- Provides travel perks like concierge services, lounge access, and car insurance.

- Earn rewards such as cashback, points, or travel miles on everyday purchases.

- Easy to track spending with detailed transaction history, making budgeting simpler.

- Helps build or improve your credit score when used responsibly.

Cons of Credit Cards:

- The temptation to overspend can lead to accumulating debt, especially with high credit limits.

- Carrying high balances means paying high interest, which makes it harder to pay off debt and can damage your credit score.

- Variable interest rates can increase the cost of borrowing if you carry a balance.

- Fees like annual charges, late payment fees, and cash advance fees can add up quickly.

With these comprehensive pros and cons laid out, the decision between BNPL and credit cards ultimately comes down to your individual financial circumstances, spending discipline, and long-term goals.

Choosing Between Credit Cards vs BNPL: Which is Better?

When deciding between Buy Now, Pay Later (BNPL) and a credit card, the right choice depends on your financial situation and discipline. BNPL is appealing for those seeking to spread out payments without interest, but it requires you to make timely payments and have enough funds for automatic deductions.

However, before committing to any loan, it's important to create a personal finance budget for your financial needs and assess whether you can pay down your credit card balance in full or make consistent payments on a BNPL loan.

If you find managing payments challenging, credit cards offer more flexibility, with most cards offering 0% interest for extended periods.

How Pocketly Can Help You Manage Purchases and Build Credit

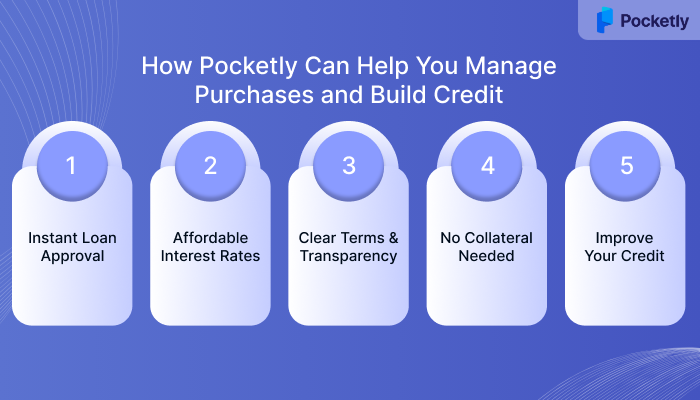

If you're considering financing a purchase or consolidating existing debt, Pocketly, the digital lending platform, provides loans from ₹1000 to ₹25000. Whether you're looking to handle everyday expenses or make a larger purchase, Pocketly offers personal loans, salaried loans, and self-employed loans without collateral.

- Instant Loan Approval: Get fast access to funds with minimal paperwork, allowing you to tackle financial challenges promptly.

- Affordable Interest Rates: With interest rates starting as low as 2% per month, you can manage repayments without putting a strain on your budget.

- Clear Terms and Transparency: Pocketly’s transparent processing fees (1-8% of loan amount) and simple loan structure ensure there are no hidden costs.

- No Collateral Needed: Unlike traditional loans, Pocketly doesn’t require you to risk any personal assets, offering a risk-free way to borrow.

- Improve Your Credit: By repaying your loan, you can gradually build your credit profile, helping you secure better financing options in the future.

Conclusion

In conclusion, both Buy Now Pay Later (BNPL) services and credit cards offer flexible payment options, but they come with distinct advantages and challenges. BNPL is ideal for short-term purchases when you can ensure timely payments, whereas credit cards offer broader financial benefits, including rewards and credit-building potential. Understanding how each works and aligning them with your financial situation will help you make the right choice.

Pocketly offers a great solution with affordable loans and minimal paperwork. Download the app now for Android or iOS to start managing your finances with ease!

FAQs

1. Who is eligible for BNPL?

Eligibility for BNPL typically includes individuals with a stable income and a valid identification proof. Providers often require you to be above 18 years old and have a bank account or a payment method linked to your profile. Some BNPL services may not require a credit check, making them accessible to people with limited or no credit history.

2. What is the contract period of BNPL?

The contract period for BNPL is generally between 1 to 6 months, with some providers offering longer repayment terms depending on the purchase amount and the service's policies. The agreement typically involves fixed monthly instalments during this period.

3. What are the 5 C's of credit?

The 5 C's of credit refer to the key factors lenders evaluate when assessing creditworthiness: Character (reliability of the borrower), Capacity (ability to repay), Capital (financial resources), Collateral (assets for loan security), and Conditions (economic factors affecting repayment).

4. What is the difference between traditional credit and BNPL?

Traditional credit, such as credit cards, involves revolving credit where users can borrow, repay, and borrow again. BNPL, on the other hand, offers a fixed payment schedule over a set period, often with no interest if paid on time. Traditional credit builds a long-term credit history, while BNPL does not report positive payment history to credit bureaus unless missed payments occur.

5. What is the approval rate for BNPL?

BNPL approval rates are generally higher than traditional loans since many services use soft credit checks or no credit checks at all. The approval is often based on basic eligibility criteria like income verification and payment history with the provider, making it more accessible to individuals with less-than-perfect credit.