With the rising cost of living, unexpected expenses, or the need for immediate cash flow, many of you might be turning to quick and hassle-free online loan options. Paytm is one of India’s leading digital platforms, offering a smooth process to apply for personal loans directly from the app, eliminating the need for lengthy paperwork and approval waiting times.

Whether it’s for an emergency expense or a planned need, understanding how to apply for a Paytm Bank loan can help you get quick access to the funds you need without unnecessary delays. Let’s break down the easy steps to apply and get your loan approved.

Key Takeaways

- Loan Range & Tenure: Paytm offers personal loans from ₹10,000 to ₹5 lakh, with flexible tenures between 12 and 48 months, tailored to the borrower’s profile.

- Eligibility Requirements: Applicants must be between 23-60 years, an Indian resident with a Paytm account, and have completed KYC.

- KYC Verification: KYC is crucial for Paytm's loan disbursal process, ensuring compliance, fraud prevention, and accurate risk-based pricing.

- Pocketly Alternative: For quicker loans with competitive rates and minimal documentation, Pocketly offers loans ranging from ₹1,000 to ₹25,000, with approvals for individuals aged 18-40 years.

Overview: Paytm Personal Bank Loan

Paytm offers personal loans through its platform, providing a fully digital application process. Eligible users can apply for loans ranging from ₹10,000 to ₹5 lakh, with interest rates starting at approximately 1% per month (12% per annum). The loan tenure spans from 12 to 48 months, depending on the lender and the borrower's profile.

Once approved, funds are disbursed directly to the user's bank account. Paytm collaborates with various financial institutions to offer these loans, ensuring a smooth and paperless borrowing experience.

Meeting the right criteria can save you time and increase your chances of approval. The platform has some clear parameters for quick processing times.

Eligibility Criteria for Paytm Bank Loan

To apply for a Paytm personal loan, applicants must meet specific eligibility requirements. Meeting these criteria ensures a smooth loan approval process.

- Age: Applicants must be between 23 and 60 years of age.

- Residency: You need to be a resident of India and have a valid PAN card and Aadhaar card.

- Paytm Account: The applicant must be an active Paytm user who has completed the KYC process.

- Income: Applicants should have a steady source of income, whether salaried or self-employed.

- Credit Score: A higher credit score increases the likelihood of loan approval.

While meeting the eligibility is your first step, having the right documentation ready can further speed up your application.

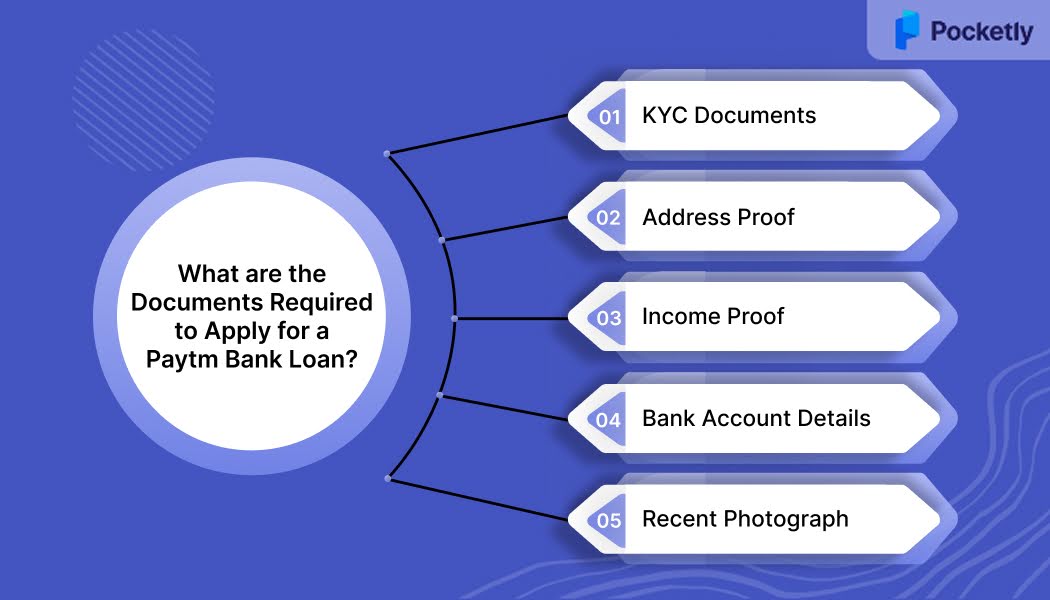

What are the Documents Required to Apply for a Paytm Bank Loan?

To apply for a personal loan through Paytm, it's essential to have the necessary documents ready for verification. Below is a list of required documents to complete your loan application smoothly:

1. KYC Documents

- PAN Card: This is required for identity verification.

- Aadhaar Card: Acts as both identity and address proof. Make sure it is linked with your mobile number for seamless verification.

2. Address Proof: If your Aadhaar does not serve as address proof, you can provide the following:

- Utility Bills: Recent utility bills like electricity, water, or gas (not older than 3 months).

- Bank Statement: A statement showing your address along with your name.

- Passport: If not used as ID proof, it can serve as a valid address proof.

3. Income Proof

- Loan Proof for Salaried Individuals:

- Recent 3–6 months’ salary slips.

- Bank statements showing salary credits.

- Form 16 or Income Tax Returns (if applicable).

- Loan Proof for Self-Employed Individuals:

- Income Tax Returns (ITR) for the last 2 years.

- Proof of business registration.

- Bank statements that reflect regular income.

4. Bank Account Details: Ensure your active bank account is in your name and linked with your mobile number. This is crucial for loan disbursal and EMI repayments

5. Recent Photograph: A passport-sized photo may be required for KYC verification during the application process.

While Paytm offers a smooth loan application process, Pocketly can be an even faster and more flexible option if you're looking for quicker access to funds. Pocketly offers loans ranging from ₹1,000 to ₹25,000 with interest rates starting as low as 2% per month and instant approval with minimal documentation.

Also Read: Getting a Personal Loan with PAN Card and KYC Documents

With your documents organised and eligibility confirmed, let’s take a look at the application process.

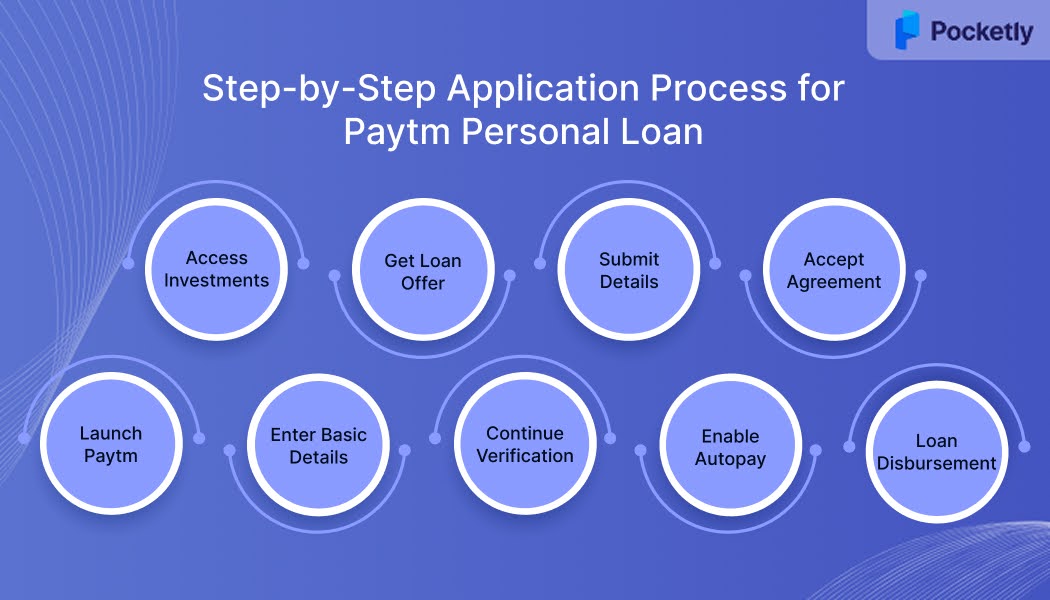

Step-by-Step Application Process for Paytm Personal Loan

With Paytm's digital platform, you can easily apply for a loan with minimum paperwork and quick verification for individuals in need of instant financial assistance. Now, let’s walk through the detailed step-by-step application process.

Step 1: Open the Paytm App

First, ensure that your Paytm app is updated to the latest version. Once updated, open the app and log in using your registered mobile number. If you're not logged in yet, you will need to enter your credentials to proceed.

Step 2: Go to the ‘Get Loan, Invest Money’ Section

On the homepage of the app, scroll down until you find the section labelled "Get Loan, Invest Money." Here, you will need to tap on the "Get Loan" option to proceed with your loan application.

Step 3: Enter Basic Details

After clicking on "Get Loan," tab you will fill in details such as PAN number, email address, date of birth, and gender. This information helps Paytm verify your identity and assess your eligibility for a loan.

Step 4: Get Loan Offer

Once you've submitted your basic details, Paytm will check your eligibility. If you qualify for a loan, you will receive a personalised loan offer, which includes the sanctioned loan amount and the applicable interest rate.

Step 5: Proceed with Verification

After reviewing the loan offer, confirm your details and tap on "Proceed." At this stage, you will need to complete the Know Your Customer (KYC) process, which may involve validating your PAN and Aadhaar details and providing bank information.

Step 6: Provide Bank Account Details

You have to provide your bank details where the loan amount will be disbursed. Ensure that the bank account you enter is active, matches your name, and is linked to your mobile number for seamless transaction processing.

Step 7: Set Up Auto-Repayment

Next, choose your preferred method for EMI repayments. Paytm offers 2 main options: UPI AutoPay (using a UPI handle with OTP authentication) or eNACH Mandate (auto-debit from your bank account). Choose the method that works best for you to automate your monthly payments.

Step 8: Review and Accept the Loan Agreement

Before proceeding, carefully read the terms and conditions of the loan agreement. Once you've reviewed everything, accept the agreement by ticking the required consent boxes. This step finalises your loan application.

Step 9: Loan Disbursement

After completing the verification process and setting up the repayment mandate, your loan will be instantly disbursed to the bank account you provided. You will receive a confirmation notification via SMS and within the app, confirming that the loan amount has been successfully transferred.

Also Read: All About Being a Guarantor in Personal Loans

Throughout this application journey, you'll notice that KYC verification plays an important role. Understanding why this process is so integral to digital lending can help you comprehend its importance for a smooth verification experience.

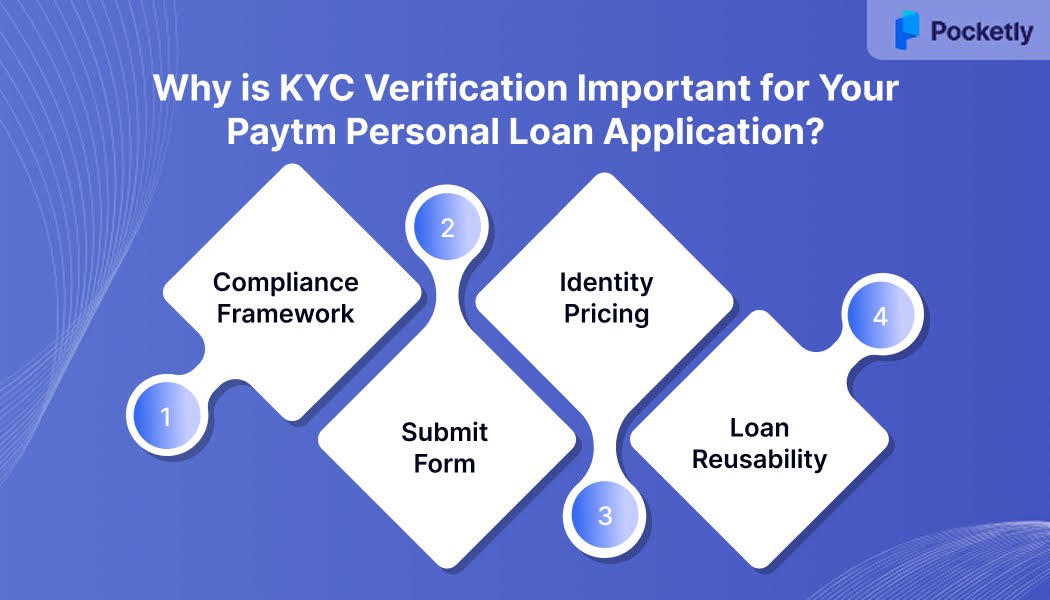

Why is KYC Verification Important for Your Paytm Personal Loan Application?

KYC (Know Your Customer) verification is a critical step in the Paytm personal loan application process, ensuring legality, security, and compliance with regulations. The KYC is important as it protects both the borrower and the lender.

- Regulatory Foundation & Compliance: Under RBI's KYC Master Direction and Digital Lending Guidelines, Paytm’s partners must verify your identity via KYC before disbursing a loan. This ensures compliance and avoids legal penalties.

- Anti-Money Laundering & Fraud Prevention: KYC helps prevent fraud and identity theft by validating Aadhaar and PAN details, protecting both borrowers and lenders from fraudulent activities.

- Accurate Identity & Risk-Based Pricing: A verified KYC allows lenders to assess your creditworthiness accurately, assuring fair loan terms and competitive interest rates. Faulty KYC can lead to higher rates or loan rejection.

- Future Loan Applications & Reusability: Once your KYC is complete, your CKYC number can be reused for future loans, saving time on document submissions for subsequent applications.

Pocketly facilitates a 100% digital KYC process, allowing you to complete this step conveniently from your home. In some cases, you might also be eligible for instant video KYC, which can expedite the approval process.

Why Choose Pocketly for Your Personal Loans?

Pocketly offers a fast, flexible, and completely digital loan experience, designed to meet your short-term financial needs with ease. Whether you're looking for a quick cash infusion or need flexibility in repayment, Pocketly ensures a seamless borrowing process.

Here's why Pocketly could be the perfect loan partner for you:

- Loan Amounts: Access loans ranging from ₹1,000 to ₹25,000, tailored to your financial needs.

- Interest Rates: Competitive rates starting at 2% per month (24% p.a.), ensuring affordability.

- Processing Fees: Transparent charges between 1% and 8% with no hidden fees.

- Flexible Repayments: Choose repayment tenures from 2 to 6 months, with options to prepay or adjust EMIs as needed.

- No Physical Documentation: Experience a 100% digital process with minimal KYC requirements.

- No Annual or Joining Fees: Enjoy financial flexibility without the burden of recurring charges.

- Good Behaviour Perks: Increase your credit limit up to ₹10,000 based on timely repayments.

- Age Eligibility: Available for individuals aged 18 to 40 years, catering to a broad demographic.

Conclusion

The process of applying for a personal loan on Paytm involves understanding the eligibility criteria, submitting necessary documents, and following through with the application and disbursal. While Paytm provides a convenient platform for quick loans, Pocketly offers an even more streamlined and flexible loan experience.

With instant loan disbursal, minimal documentation, and flexible repayment terms, Pocketly makes borrowing quick and hassle-free. Download Pocketly now on Android or iOS and get access to loans with ease!

FAQ’s

1. Can I apply for personal loans without salary slips?

Yes, it's possible to secure a personal loan without salary slips by providing alternative income verification documents. Lenders may accept bank statements, Income Tax Returns (ITRs), Form 16, or business financials as proof of income.

2. What is the debt-to-income ratio, and how does it affect loan approval without documents?

The debt-to-income (DTI) ratio reflects the portion of your monthly income used for repaying debts. A lower DTI ratio suggests better financial stability, potentially improving your chances of loan approval, even if you don't have conventional documentation.

3. Can I get a ₹20,000 instant loan without a CIBIL score?

Yes, some lenders offer instant loans up to ₹20,000 without considering your CIBIL score. For instance, Pocketly provides quick loans with minimal documentation, making it accessible even for those with no credit history.

4. How to build a healthy relationship with my loan provider to increase my chances of getting a loan without documents?

Maintaining timely repayments, transparent communication, and a consistent banking history can strengthen your relationship with lenders. Building trust over time may lead to more favourable loan terms and reduced documentation requirements.