For many employees, the middle of the month can be a financially challenging time. Whether it's an unexpected expense or simply a cash flow gap, having access to a salary advance can be a lifesaver. In the past, fintech companies offered quick solutions, allowing employees to borrow a portion of their salary before payday, typically with minimal paperwork and fast approval.

But things are changing. The Reserve Bank of India (RBI) has recently introduced tighter regulations around short-term loans, including salary advances. As a result, some fintech startups, such as Uni Cards and Jupiter, have either paused or reduced their advance salary products.

With these shifts in the financial environment, it's even more important to know how to formally request an advance from your employer.

In this blog, we'll walk you through the process, provide a clear format for your application, and share sample letters to help you make a professional request.

TL;DR (Key Takeaways):

- Clear and concise communication is key in salary advance applications to ensure your request is professional and respectful.

- Provide a detailed repayment plan to reassure your employer that you will manage the repayment without causing disruptions.

- Structure your letter correctly, with a direct subject line, polite salutation, apparent reason for the request, and gratitude for consideration.

- Consider Pocketly for a quick, flexible loan alternative if traditional salary advances aren't suitable for your needs

- Always maintain professionalism, whether requesting an advance or an increment, to ensure a positive and respectful interaction with your employer

What is an Advance Salary?

An advance salary is a portion of an employee's salary that is paid before the official payday, usually to help cover unexpected expenses or financial emergencies. This salary advance is essentially a short-term loan, allowing workers to access funds they would otherwise need to wait for.

In most cases, an employee can request an advance of anywhere from a few thousand rupees up to a specific percentage of their monthly salary. Unlike a traditional loan, advance salaries typically don't require any collateral or lengthy paperwork. The amount borrowed is generally deducted from the employee's upcoming salary, ensuring automatic and hassle-free repayment.

This financial tool can be invaluable in situations where employees require immediate funds for medical emergencies, urgent bills, or family expenses. However, while convenient, it's important to note that most companies only allow advances in certain circumstances, and approval often depends on company policies.

An advance salary can be a helpful tool when you're facing an urgent financial need. However, while accessing this benefit is relatively straightforward, the approach you take to the request can significantly impact the outcome. Just like any formal request in the workplace, how you present your case for an advance salary matters.

Why Should You Write a Formal Application for an Advance Salary?

When you need an advance salary, how you communicate your request can have a significant impact on whether or not it’s approved. A formal application is not only a professional way to approach your employer, but it also ensures that your request is clear, respectful, and aligned with workplace norms. Here's why you should always consider writing a formal application:

1. Professionalism and Respect

A formal application demonstrates respect for both your employer and the company's processes. While informal requests may be effective in some situations, taking the time to draft a formal letter demonstrates your professionalism and understanding of workplace etiquette. It signals that you're serious about the request and value the relationship with your employer.

2. Clarity and Transparency

Writing a formal application allows you to clearly explain why you need the advance, how much you're requesting, and how you plan to repay it. This transparency can help avoid confusion and set expectations for both parties. A written request ensures there's no room for misunderstandings or miscommunications.

3. Creates a Record

A formal request serves as documentation of your application, which can be helpful if there are any follow-up discussions or issues that arise. Having a record of the loan amount, repayment terms, and approval will keep both you and your employer on the same page. This is especially useful if the advance salary is to be deducted from future payments.

4. Increases Chances of Approval

A well-crafted letter that clearly and professionally outlines your situation can increase your chances of approval. By presenting your case in a structured manner, you make it easier for your employer to assess the situation and decide whether to approve your request. A formal approach shows that you've thought through your request carefully.

5. Reinforces Trust and Accountability

By formally stating the amount you need and offering a repayment plan, you demonstrate responsibility and accountability. Employers are more likely to approve salary advances when they see that you are committed to repaying the loan promptly.

In the next section, we'll break down the key elements of an application for an advance salary to ensure you know exactly what to include in your formal request.

Writing a formal application is key to making a positive impression. But if you’re wondering whether your credit score or loan eligibility may affect the process, consider reading Understanding the Debt Restructuring Process and Its Importance to further guide your financial decisions.

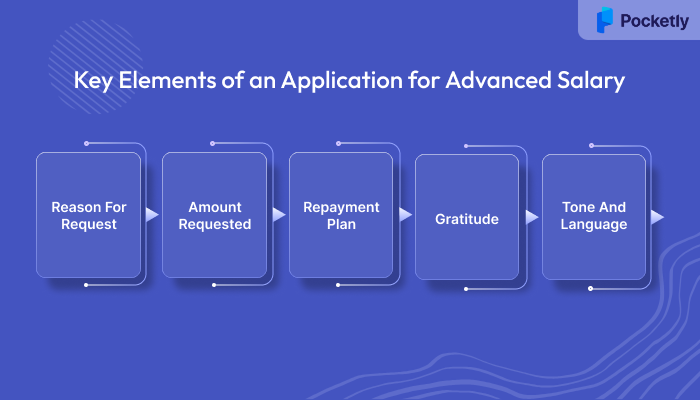

Key Elements of an Application for Advanced Salary

When writing an application for an advance salary, it's crucial to include certain key elements that ensure your request is clear, professional, and well-received. Here's a breakdown of the essential components:

1. Reason for Request

Clearly articulating why you need the advance is one of the most important aspects of your application. Whether it’s a medical emergency, unexpected personal expenses, or an urgent financial situation, being transparent about the reason helps your employer understand the context. Avoid vague or overly detailed explanations; focus on providing enough information to demonstrate that the request is genuine and necessary.

Example:

"I am facing unexpected medical expenses for a family member and require immediate financial assistance to cover the costs."

2. Amount Requested

Be specific about the amount you are requesting. Employers will appreciate the clarity, as it directly impacts their decision-making process. It’s essential to order a sum that's reasonable and justifiable based on your current salary. Asking for too large an amount might raise concerns while asking for too little may not meet your needs.

Example:

"I would like to request an advance of ₹15,000 to help cover these expenses."

3. Repayment Plan

One of the key factors employers will consider is how you plan to repay the advance. Clearly outline the repayment structure, whether it’s deducted from future salaries or repaid through instalments. Mention the duration and frequency of the repayment, ensuring that it’s realistic and manageable. This reassures the employer that you’re committed to returning the advance without complications.

Example:

"I propose that the amount be deducted in equal instalments over the next two months from my salary."

4. Gratitude

While your request is formal, showing appreciation is essential. Expressing gratitude in your application not only reflects professionalism but also leaves a positive impression. A simple thank-you goes a long way in maintaining a respectful and cordial relationship with your employer.

Example:

"I appreciate your consideration of my request, and I assure you that I will fulfill my repayment obligations as agreed."

5. Tone and Language

Maintaining the right tone and language is crucial when writing an application for an advance salary. Your language should be polite, professional, and clear. Avoid using overly casual language or being too demanding. Ensure that the request is framed as a respectful appeal, which reflects your professionalism and seriousness about the matter.

Example:

"I kindly request your support in this matter and would be grateful for your assistance."

By carefully addressing these key elements in your application, you’re not only presenting a clear and professional case but also demonstrating your thoughtfulness and responsibility.

With that in mind, let’s explore the ideal structure for your salary advance request, ensuring that each component is organized effectively to leave a lasting, positive impression on your employer.

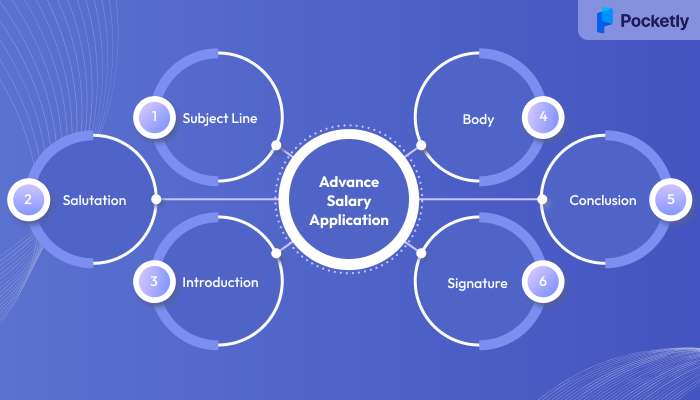

Format of an Application for Advance Salary

A well-structured application is key when requesting an advance salary, as it ensures clarity and professionalism. Below is a detailed format that highlights the essential components of a successful salary advance request, ensuring your communication is both effective and respectful.

1. Subject Line

The subject line is your first opportunity to make a strong impression. It should be succinct, making it immediately clear why you are writing the application. A clear subject line will help your employer quickly identify and prioritize your request.

Example:

Request for Salary Advance for [Month]

2. Salutation

Start your letter with a formal greeting to maintain a professional tone. The salutation should be respectful and directly address the individual handling your request.

Example:

Dear [Manager’s Name],

3. Introduction

The introduction is your chance to briefly introduce yourself and immediately state the purpose of your application. Be clear and concise about who you are, what position you hold, and why you are requesting the advance salary. This section sets the stage for the detailed body of your letter.

Example:

I am [Your Name], and I have been working as [Your Position] in the [Department Name] for [X years/months]. I am writing to request an advance on my salary for the month of [Month], as I am currently facing an urgent [reason for request].

4. Body

The body of your application is where you provide a detailed explanation for the request. This is where you'll highlight the key elements: the reason for needing the advance, the exact amount requested, and the repayment terms. Ensure that your request is specific, clear, and reasonable. Including details like how the repayment will be handled, whether it will be deducted from future salaries or paid back in instalments, will demonstrate your thoughtfulness and responsibility.

Example:

Due to an unexpected [emergency/personal situation], I find myself in need of immediate financial assistance. I would like to request an advance of ₹[amount] to cover these expenses. I propose that this amount be deducted from my salary over the next [number of months], starting from [date]. This will enable me to repay the advance in a manageable manner without compromising my financial stability.

5. Conclusion

In your conclusion, express appreciation for your employer’s time and consideration. A polite and positive closing helps leave a good impression and reinforces your respect for the process. Be sure to request approval, but in a way that invites further discussion if necessary.

Example:

Thank you for considering my request. I understand the company’s policies regarding salary advances and would appreciate your support during this time. Should you require any further information or clarification, I am happy to discuss it at your convenience. I look forward to your approval.

6. Signature

End your application with a formal closing. Your signature reinforces the professional nature of the communication.

Example:

Kind regards,

[Your Name]

[Your Position]

By adhering to this format, you can ensure that your application is not only professional but also precise, which increases the likelihood of a smooth approval process. Now, let's take a closer look at some practical examples that demonstrate how to customize your request for different situations.

With the format laid out, it's essential to know how this applies to other financial tools you might consider. For instance, if you're still weighing the best loan options for yourself, consider checking out Instant Payday Loans for Salaried Employees in Bangalore to explore quick, hassle-free loan options.

Sample Letters for Advance Salary Application

These examples will help you craft your own application customized to the specific circumstances you’re facing, while maintaining a formal and professional tone. Below are a few sample letters that cater to different scenarios.

Sample 1: For a Medical Emergency

Subject: Request for Advance Salary Due to Medical Emergency

Dear [Manager's Name],

I hope you are doing well. I am [Your Name], working as [Your Job Title] in the [Department Name]. I am writing to request an advance on my salary for the month of [Month] due to an unexpected medical emergency that requires immediate financial attention.

I would like to request an advance of ₹[Amount] to help cover the medical expenses. I propose that this amount be deducted from my upcoming salaries over the next [Number of months] starting from [Date].

I appreciate your understanding and consideration of my request, and I look forward to your approval. If you require any additional information or documents, please do not hesitate to contact us.

Sincerely,

[Your Name]

[Your Position]

Sample 2: For Personal Expenses

Subject: Request for Advance Salary for Personal Expenses

Dear [Manager's Name],

I hope you are doing well. I am [Your Name], and I have been with [Company Name] as [Your Position] for the past [X years/months]. I am writing to request an advance on my salary due to unforeseen personal expenses that have arisen.

I would like to request an advance of ₹[Amount], which I plan to repay in [Number of months] through equal deductions from my future salaries, starting from [Date].

I understand the company's policies and assure you that I will adhere to the repayment schedule as outlined. Thank you for considering my request, and I am happy to provide any additional information if required.

Best regards,

[Your Name]

[Your Position]

Sample 3: For Emergency Family Expenses

Subject: Request for Advance Salary for Family Emergency

Dear [Manager's Name],

I hope you are doing well. I am [Your Name], working in the [Department Name] as [Your Job Title]. I am reaching out to request an advance on my salary for the month of [Month] due to a family emergency that requires immediate financial support.

Given the urgency of the situation, I would like to request an advance of ₹[Amount] to cover the expenses. I propose that this amount be deducted from my salary over the next [Number of months], starting from [Date].

I truly appreciate your time and consideration of my request, and I assure you that I will make the repayment as agreed. Please let me know if you require any additional information.

Sincerely,

[Your Name]

[Your Position]

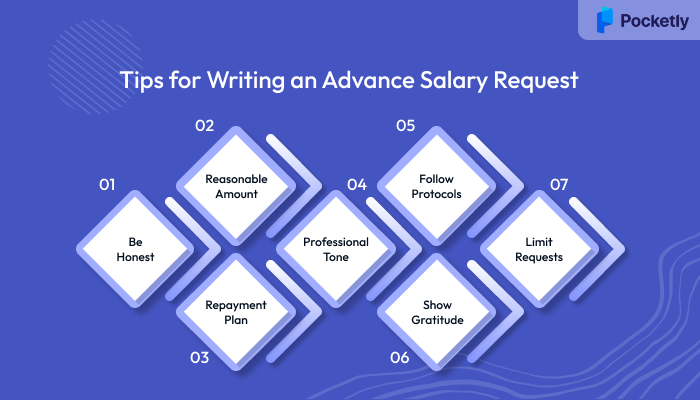

Things to Keep in Mind When Writing an Advance Salary Request

While the format and content of your salary advance application are important, how you approach the request plays a crucial role in its success. Below are a few key things to consider to ensure your request is professional, clear, and well-received by your employer:

1. Be Clear and Honest About the Reason

It’s essential to be straightforward and clear about why you need the advance. Whether it’s for a medical emergency or an unexpected expense, providing a transparent explanation will show your employer that the request is genuine. However, avoid oversharing personal details; focus on giving enough context for the employer to understand the necessity.

2. Keep the Amount Reasonable

Requesting an amount that aligns with your actual needs and your salary is important. Asking for an unreasonably large sum could raise doubts about the legitimacy of your request. Additionally, ensure that the amount you’re requesting aligns with company guidelines, if applicable. A reasonable request reflects your understanding of the company's financial situation and policies.

3. Be Mindful of Repayment Terms

Be clear about how you plan to repay the advance and ensure that the terms are realistic and feasible. Propose a repayment schedule that is manageable for you and acceptable to your employer. Offering flexibility and an understanding of your repayment capability shows that you are responsible and respectful of company policies.

4. Maintain a Professional Tone

While the request may be personal, it’s essential to maintain a professional and respectful tone in your application. Avoid using casual language, being overly informal, or sounding demanding. A polite, concise, and well-structured letter will make a far better impression than one that feels rushed or overly emotional.

5. Follow Company Protocols

If your company has specific procedures for requesting salary advances, make sure you follow them. Some organizations may require additional documentation, such as proof of the financial situation or a more formal process for approval. Being aware of and following these protocols will help ensure your request is processed smoothly.

6. Show Appreciation and Gratitude

Always thank your employer for considering your request. Showing appreciation for their time and understanding goes a long way in maintaining a positive relationship. Even if the answer is not what you hoped for, a polite thank you reflects well on your professionalism.

7. Avoid Frequent Requests

If you frequently need advances, it may raise concerns with your employer. It’s essential to consider long-term financial planning to avoid repeatedly relying on salary advances. If an advance becomes a regular need, it may be a sign that a more sustainable financial solution is required.

By keeping these points in mind, you can ensure your salary advance request is well-received and professionally handled. However, if you're looking for a more flexible and faster solution to meet your financial needs, there are alternatives available that can complement or even replace traditional salary advances.

One such option is Pocketly, a digital lending platform that offers an easy way to access quick funds without the usual complexities. Let's take a closer look at how Pocketly can help you manage financial gaps efficiently and effectively.

As you finalize your salary advance request, understanding your loan eligibility and options is crucial. For those with specific needs, consider reading 'Personal Loan Pre-Closure: Charges and Procedure' to know how pre-closure can affect your loan repayment options.

How Pocketly Can Help with Financial Flexibility

For many, traditional salary advances can be a quick fix for financial gaps. However, they often come with limitations, such as the need for employer approval, a rigid repayment schedule, or restrictions on the amount that can be borrowed. That’s where Pocketly offers a more flexible and modern alternative.

Pocketly is a fintech digital lending platform designed to provide short-term personal loans to individuals in need of quick financial assistance. Unlike traditional salary advances, which often require collateral or lengthy approval processes, Pocketly offers a fast and easy solution for managing emergency expenses, medical costs, or any other unexpected financial burden.

Why Choose Pocketly?

- Instant Access to Funds: With Pocketly, you can apply for a loan and receive funds directly in your bank account in a matter of minutes. Whether you need funds for medical emergencies, tuition fees, or personal expenses, Pocketly ensures that you can access the money you need without delays.

- No Collateral Required: Unlike traditional loans, Pocketly doesn’t require you to pledge any collateral. This makes it easier for individuals, especially young professionals or students, to access funds without having to offer personal assets as collateral.

- Flexible Loan Amounts and Terms: Pocketly offers loans ranging from ₹1,000 to ₹25,000, allowing you to borrow only what you need. Repayment terms are equally flexible, with the option to repay through monthly installments or lump sums based on your financial situation.

- Transparent Process: One of the key advantages of using Pocketly is its transparency. There are no hidden fees or surprise charges. The interest rate starts at 2% per month, and you’ll know exactly what you’re paying, making it easier to plan your finances.

- Minimal Documentation: Applying for a loan through Pocketly is straightforward and quick. With just a few documents such as your Aadhaar card, PAN card, and bank details you can complete the application process in minutes. There’s no need for complicated paperwork or lengthy verification processes.

- Repayment Flexibility: Pocketly allows you to repay your loan in easy installments that fit your financial situation. The flexible repayment plan ensures that you won’t be burdened by high monthly repayments, making it easier to manage your finances without additional stress.

How Pocketly Works

- Download the App: Available for both Android and iOS devices, Pocketly can be easily downloaded from the respective app stores.

- Complete KYC: Submit the necessary identification documents (Aadhaar, PAN) to complete a quick and secure Know Your Customer (KYC) process.

- Choose Your Loan Amount: Select the amount you need, ranging from ₹1,000 to ₹25,000, and choose a repayment schedule that suits you.

- Instant Approval: Once your application is reviewed, you’ll receive immediate approval, and the funds will be transferred to your bank account within minutes.

- Repayment: Your loan will be automatically repaid through deductions from your salary or by using your preferred payment method.

Pocketly offers a quick, simple, and efficient way to access the funds you need, eliminating the hassle of traditional bank loans or salary advances.

Ready to take control of your finances? Contact us today and get access to quick, flexible loans whenever you need them.

Conclusion

When you find yourself in need of immediate financial assistance, knowing how to write a clear and formal application for an advance salary can go a long way in ensuring a smooth process. By being clear about your reason for the request, specifying the amount, and offering a practical repayment plan, you demonstrate professionalism and responsibility.

However, if you're looking for a quicker and more flexible solution, Pocketly offers an alternative. With its digital platform, you can access short-term loans quickly and easily, without the need for complicated paperwork or employer approval.

If you want to manage your financial needs with ease and flexibility, Pocketly can provide the support you're looking for. Download the Pocketly app today on Android or iOS to get started.

FAQs

How to write an application letter for a salary advance?

Begin by stating the purpose of your letter clearly. Mention your position, the amount of salary advance needed, the reason for the request, and your preferred repayment plan. Keep it professional and concise.

How to Write a Request Letter for Advance Payment?

In your request letter, outline the need for the advance payment, provide specific details about the amount, the reason for the request, and include a clear repayment plan or terms for repayment.

How to write an application letter for a salary?

Start by addressing the recipient professionally, mention your request for salary payment, and include details about the salary period and any other necessary information, such as bank account details for payment.

How to Write a Letter Requesting Salary Payment?

A polite letter requesting salary payment should include your job title, the due date for payment, and any specific circumstances if payments have been delayed, along with your appreciation for timely action.

How to write an application for an increment of salary?

When requesting a salary increment, emphasize your accomplishments, additional responsibilities, and any positive feedback you’ve received. Present a clear, respectful case for why you deserve an increase, and back it up with relevant examples.